Last night, Daymond John and I revealed an options strategy to the world — one that gives you an instant advantage in the markets.

Daymond actually uses financial advisors and has many investment strategies… when he told me he traded options, I had a bad feeling.

Why?

When people trade options, they tend to buy them… and let me tell you something, buying options is one of the fastest ways to blow up your trading account.

You see, buying options is actually a LOSING strategy. That’s right.

When I told Daymond to look through his win rate… he found out he was losing 70% of the time.

But the thing is, I don’t blame him for not knowing that because he’s a busy man with multiple business ventures.

I explained to him the value of an option contract is based on several factors… and unlike stocks, options are multidimensional. Typically, when you buy options, you just think the stock needs to go to a specific price to make money…

… but that’s just not the case.

When I told Daymond that you can take the OTHER side of the trade and actually improve your win rate to 70%… he was hooked.

It’s a simple strategy tweak that could take his options trading to another level.

Why are we so confident in my Weekly Windfalls strategy?

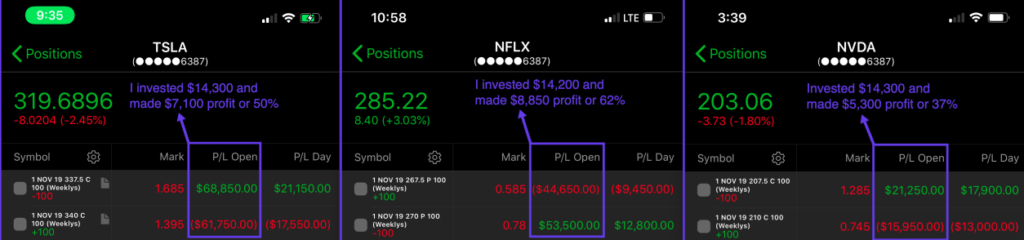

Just this week, I locked in $21K and went 3 for 3.

That said, I want you to walk through the mechanics of this highly profitable strategy.

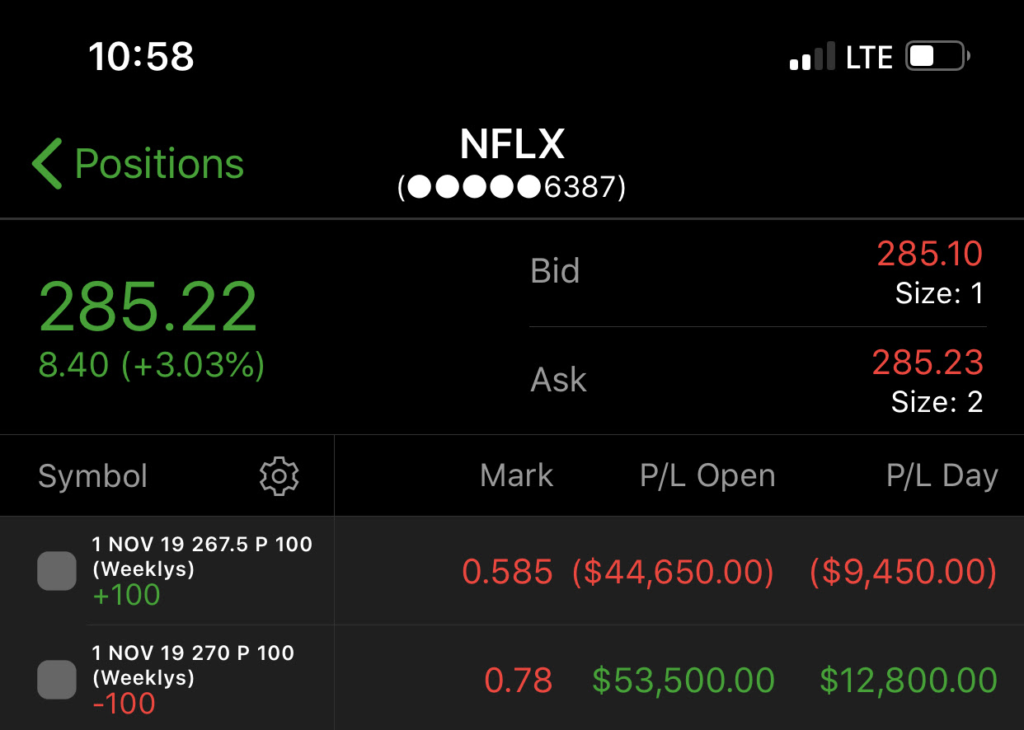

To do that, I will show you a real money case study in my 62% return in Netflix (NFLX) that I just closed out yesterday.

You will probably be kicking yourself after you find out how simple this strategy is and wonder why you haven’t been using this strategy.

If you haven’t been using this strategy… you’ve been leaving profits on the table

You’re probably wondering, What’s Weekly Windfalls and how can I get in on this effective strategy with a mind-boggling win rate?

Let me keep it simple.

Have you ever been to a casino… walk to the craps table, lose money… try your luck out on the blackjack table… lose money… and walk out with your head hanging?

Well, the markets are very similar to the casinos… there are winners and losers… and some have an edge over others.

When traders tap into the options market, they just thinking about buying calls or puts.

However, the math behind options proves that sellers actually have an edge.

But let’s get this straight, I’m not a fan of selling naked calls because your risk can be unlimited. Nor am I fan of selling naked puts because the losses could be massive.

I’ve actually figured out a way to “be the casino” and gain an edge over options seller.

How?

When I sell options, I actually hedge my position, essentially I have an insurance policy in place so I don’t get blown out of the water.

So what’s the exact strategy I’m using?

I’m selling options spreads.

Remember, since I’m selling spreads, I’m essentially the casino.

Like the casino, you know exactly how much you’ll win and lose… and that lets you properly attack the market and rake in profits.

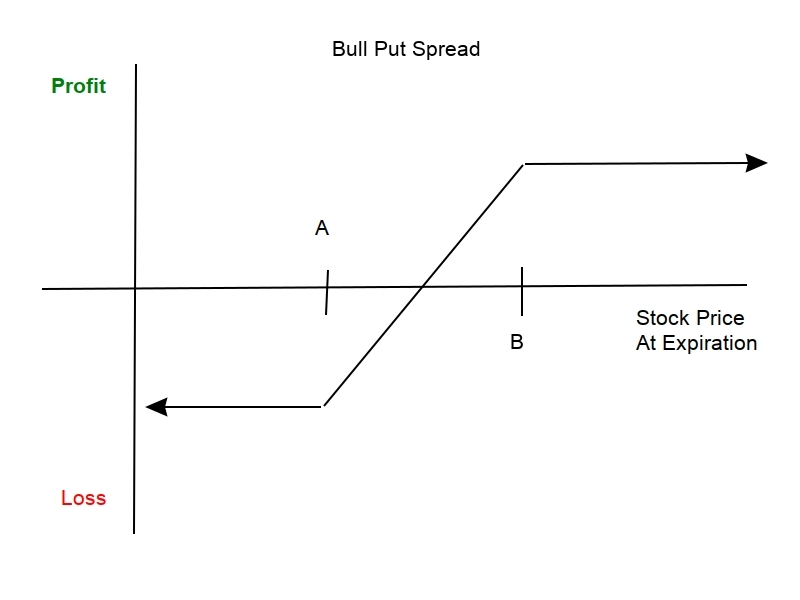

As you can see, your risk is defined with the bull put spread.

So how do you set up the strategy?

Well, you would sell a put at strike price B and buy a put at strike price A. Typically, you want the stock to be trading above strike B.

62% Winner in NFLX

The other day, I actually locked in a 62% winner.

Last week, I spotted a bullish pattern in Netflix (NFLX) and bet it would stay above $270… and on Monday, the stock was trading above $280… it actually closed around $282.

I locked in an $8,850 winner in just about a week.

Here’s how it went:

I spotted a bullish pattern in NFLX. Netflix was rounding out — looking to catch a bounce.

I placed a strategic options bet. At the time, the stock was trading just around $270.

Guess what I did?

I sold the $270 puts for the following Friday and bought the $267.50 puts.

Why?

I figured the stock would stay above $270.

Both selling and buying puts not only reduces my risk… but also allowed me to put me in a position to succeed.

The best part is this:

The strategy is simple to use.

If you’re interested in locking down massive winners like this in a short period in an alarming rate… check out this exclusive replay with Daymond John and me… and earn while you learn.

0 Comments