Just looking at Zynga (ZNGA) with an estimated $1.50 in net cash on books and a $2.43 stock price it’s hard to believe the market says this company is essentially worth less than a buck a share.

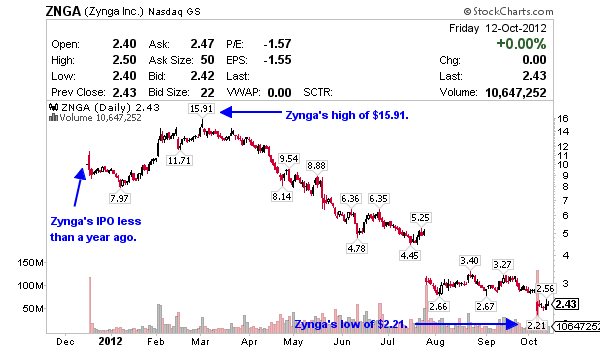

Especially hard to believe if you’ve owned ZNGA since it went public earlier this year at much loftier prices.

A quick look at the ugly stock chart illustrates just how beat up the shares are. It appears the market is simply not giving them too much hope to survive.

ZNGA is an innovative company with a very creative pool of talent working for them. I bet they’ll find a way to slash costs and turn the ship around. They still have many excellent franchises to build from.

In my opinion, Zynga gets treated worse than it should on Wall Street. Yes, I know they lost $404 million in 2011 and $85 million in the first quarter this year and $22 million in the second quarter this year.

I think it is safe to bet that mobile-monetization game is not going away, so it’s safe to say there’s value in Zynga down here. They are still the goliath in this sector… at least for now.

As far as a turnaround goes, one option would be to lay off staff and cut costs to make the company profitable, even if it meant lowering the amount of revenue they have. Bottom line, they need to stem losses and not eat up the $1.2 billion they have in the bank.

Another option, Pincus takes Zynga private. He controls 50.15 percent of Zynga’s voting rights and after his Twitter comments the other day regarding a suggestion he should consider such a move, rumors are starting to heat up.

Another option, Pincus takes Zynga private. He controls 50.15 percent of Zynga’s voting rights and after his Twitter comments the other day regarding a suggestion he should consider such a move, rumors are starting to heat up.

I also think a Facebook (FB) buyout makes a lot of sense. Facebook’s Zuckerberg clearly wants to control everything in his path so why not just pay off Pincus and really control the future of social gaming? Buying Zynga would mean not having to share the ad revenue. They really only need to fork over about $2 billion right now to acquire Zynga (Net of the $1 billion plus Zynga already has). And considering how quick they dropped $1 billion for Instagram earlier this year, this purchase sounds very reasonable for them.

Further, Zynga is generating real revenue and about 600 million of Facebook’s one billion-plus users now access the site each month from a mobile device.

As a matter of fact, at these prices I could imagine a lot of big players are interested in the social gaming companies that are beat up. Those games are not going away, it’s just the valuations that were out of control, now things look a lot better.

Back to Facebook buying Zynga and why it makes sense for Zuckerberg to pony up. It’s clear as day looking at the charts each time Zynga guides lower Facebook takes a hit losing billions in market share repeatedly. Zynga is a steal at these levels so eliminating that connection could stabilize Facebook’s stock price. Zynga will likely do much better under Facebook’s roof too and the acquisition could cut costs for both companies.

So open your wallet Zuckerberg, it simply makes sense to pay Pincus.

Disclaimer: I have no positions in any stocks mentioned, but may initiate a long position in ZNGA, FB over the next 72 hours

0 Comments