Earnings are out. On a year-over-year basis, overall and same-store sales are up smartly in the latest quarter ending May 3; gross margin expanded significantly; operating expenses shrank; and losses were cut nearly in half. With only a little more than one year back at JC Penney (JCP), CEO Mike Ullman has inspired a growing legion of vocal bulls who now strongly believe that the 112-year-old retailer is out of the woods.

With more than $1.1B in the bank, a larger credit facility, and important metrics turning up, meaningfully, the $345M cash burn from operations during the latest and historically slowest reporting period of the year implies JCP has approximately another few quarters before investors could see a small profit. What once was a strong candidate for bankruptcy, JCP appears to have weathered the most difficult maneuver of the turnaround trick – regaining confidence among customers and investors.

With the share price up as much as a double from the Feb. 2014 low of $4.90, the consensus among investors indicates that JC Penney’s nose is now up – with some feet to spare if a reasonable follow-through of recent quarters will materialize.

Essentially, a crash-and-burn scenario for JC Penney has been averted. So, now where to for the iconic retailer?

First Quarter of 2014 Results Show Marked Improvement

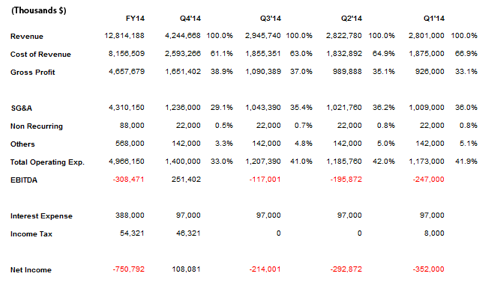

Excluding the disastrous Ron Johnson period of Nov. 2011 through Apr. 2013, gross margin has averaged approximately 39%, since 2006. Under Johnson, gross margin averages 32%, with the last four quarters averaging a meager 29.6%.

However, under Ullman, the latest quarter showed a strong year-over-year 230-basis-points improvement to gross margin of 33.1% (66.9% COGS), and that’s on top of a 6.2% increase in same-store sales, as well as a 25.7% spike in revenue from its online presence.

Operating expenses dropped significantly, as well. JC Penney reported a drop of 960 basis points in operating expenses, which, combined with growing sales and higher gross margin, cut its loss for the quarter by nearly in half from Q1 of 2013. With a continuation of the improved metrics for the remainder of the fiscal year, JC Penney could surprise skeptical investors with a small profit by the fourth quarter.

Fiscal Projection for Remainder of Fiscal 2014

Assumptions made to the fiscal 2014 forecast include a reversion back to pre-Johnson financial metrics of a gross margin of 39% and operating expenses of 33% by the fourth quarter of fiscal 2014. In the projection, below, SG&A comes in at approximately 29%. A year-over-year sales growth of 6% is assumed, considering that the new merchandise strategy at JC Penney has performed better than expected during the first quarter. And there is no compelling reason to suggest a meaningful change in the increased rate of once-loyal customers returning is forthcoming during the remaining three quarters.

Sales growth is assumed to continue at an average rate of 6%, year-over-year, while SG&A is assumed to grow at an average rate of 3% for the remainder of the fiscal year. Gross margin, one of the remaining keys to Ullman’s turnaround strategy, is projected to incrementally reach the historical average of 39% in time for the most important and final quarter of fiscal 2014.

The nearly $900M cap ex spending and restructuring charges taken as the result of the cap ex and inventory unwind from the failed Johnson makeover has been phased out of operating expenses for fiscal 2014. Under Ullman, cap ex and other charges are expected to reach approximately $420M, spent primarily to remake 505 JC Penney stores is assumed for fiscal 2014.

Moreover, all assumptions are made under the consideration of a flat to slightly growing US economy, as well as forecasts issued by most US broker/dealers of a stable (though still low levels) or slightly improving US employment participation rate.

According to the projection, above, JC Penney will end the year with a small profit during the fourth quarter, with cash and cash equivalent equaling approximately $700M ($1.1B – $400M).

Note: JC Penney reported cash/cash equivalents of $1.1B at the end of the first quarter of fiscal 2014.

Conclusion

Though any turnaround comes with multiple variables of implied risk, JC Penney’s performance thus far has earned a modicum of credibility. CEO Ullman’s decision to discontinue providing interim sales figures, margins and other updates throughout the quarter only heightens the insecurity investors and traders experience leading up to 10-Q reports. If next quarter’s results reasonably match the first quarter’s, investor sentiment may change to excitement from today’s modest skepticism. Investors should watch closely for changes in year-over-year sales revenue, gross margin and SG&A for hints of JC Penney’s effectiveness amid, not only endogenous factors to the company’s model, but exogenous factors as well, such as any deterioration to an already unusually tough retail environment of the middle-class consumer market. Sentiment among JC Penney investors can assuredly be gleaned as decisively bullish by the stock’s price action surpassing the $10 level. The chart suggests strong technical resistance at the $10 level, with two previous attempts thwarted already. A sustained break above $10 suggests JCP could assault the $14 mark, the next significant level of resistance.

Jason, I am only going to have $500 USD to trade with. Is this good enough? And do you alert when you BUY ans SELL?

Hi. I alert when I buy / sell. $500 is fine depending on what your goals are. If you’re here to learn, get Think or Swim’s paperMoney and learn with that instead.