Everywhere I look in the market, I just see opportunity. I mean it doesn’t matter if it’s small-caps, mid-caps, or large-caps… there are money makers out there.

Of course, you’re probably wondering, “Jason, more trades don’t always equal more profits.”

I know that, and that’s why I narrow my focus every single day.

How?

By scanning different areas of the market and drilling down until I get my number one trade idea for the day.

I know what you’re already thinking… “How can you possibly make money and grow an account with just one trade idea a day?”

I can tell you, but I’d rather show you.

Why NAKD Was My #1 Trade Idea On Friday

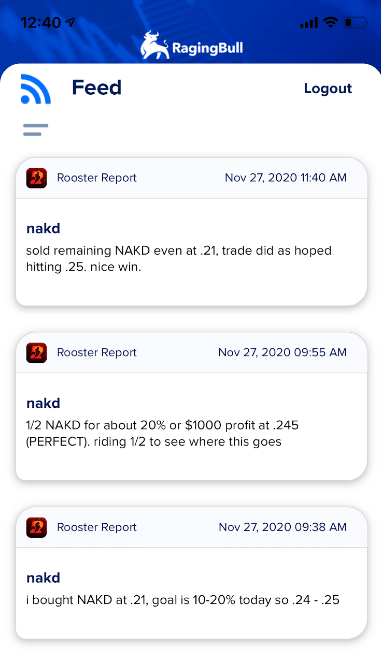

On Friday at 9:21 AM ET, here’s what I sent out to subscribers…

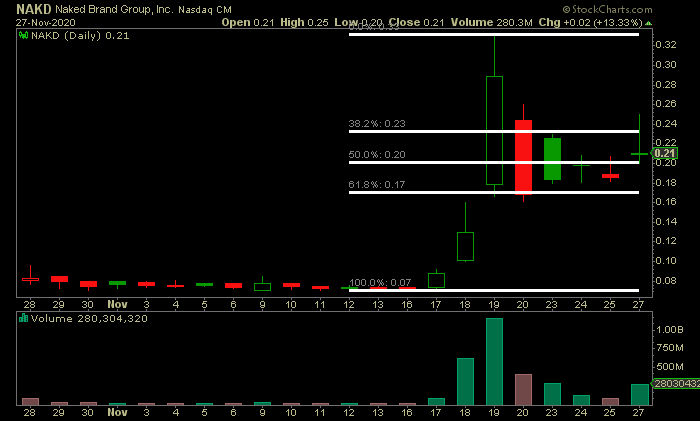

Today’s trade idea is a fibonacci retracement play that caught fire about a week ago, rested and is now getting frisky Friday morning.

In play above $.19, don’t want to see it test $.18, goal is $.27 if this works. Trade range is $.20 – $.24 looks like, maybe tests $.26’s and if things really heat up, the recent high is in the low $.30’s for the ‘rest and retest’ pattern.

It’s already traded $5M+ in the premarket so it’s active today so far.

Goal on this is 10-20% today. Market closes at 1 p.m. ET so hopefully this hits by noon.

The reason why NAKD was my number one trade idea yesterday was the fact it’s a tiny company that pulled into a key level. Given the shortened-trading day, I figured this stock would help me achieve my goal in a relatively short period.

So just as the stock was breaking back above the 50% Fibonacci retracement level, I pounced on the position. Spoiler alert: you’ll find out how I traded it once you look at the screenshot below.

Now, NAKD didn’t get to the level I wanted to, but I did lock in half of my position for a 20% win.* The rest of the position, I sold it for break-even.

You see, that was the right move to make in my opinion. I was going for a base hit, but it makes sense to hold onto a stock when it’s running higher.

However, I wasn’t going to turn a winner into a loser. So all in all, I locked in 10% on the trade.*

These base hits add up, and that’s how one can grow their account with just one trade idea a day. Of course, with my trade ideas, they’re not always day trades. Sometimes, I’ll swing trade them.

Jason, Hi this is Duren Boyce, I am a Monday Mover and Sniper Report subscriber.

Between the two NAKD charts the volume bar for Nov. 27th, is different. I like your strategy of lower profit more often. That takes discipline for sure.