What a wacky morning it’s been already. Over the weekend, OPEC and other major oil-producing countries finally reached a deal to cut production. Right now, many traders are still trying to figure out the true impact of the coronavirus.

With earnings season coming up, I think stocks can make even more wild moves.

In order to focus on my best setups, it’s important for me to establish a daily trading routine. Basically, there are steps that I go through in order to hunt down momentum stocks poised to run higher.

Today, I want to provide you with actionable tips and reveal to you what I do on a daily basis to spot some of the hottest stocks in the market.

How I Prepare For The Trading Day

By the time I get to my trading desk and have my cup of coffee, I know exactly what I need to do before the opening bell… I’m not surfing the web or trying to kill time before the opening bell.

I’m catching up on news, finding out what’s going on with the overall market, scanning for stocks to potentially trade, and looking at charts.

In order to help you better understand my approach to hunting down momentum stocks, I want to show you what a day in the life is like.

For example, this morning, oil and gas trades were on my radar after the historic deal. Not only that, but I was long Valaris PLC (VAL) from Thursday. Of course, I check up on any positions I’m in once I get up in the mornings.

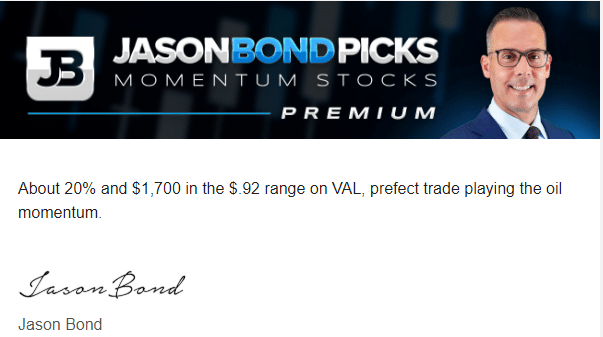

Here’s what I sent out to Jason Bond Picks clients at 8:39 AM ET:

|

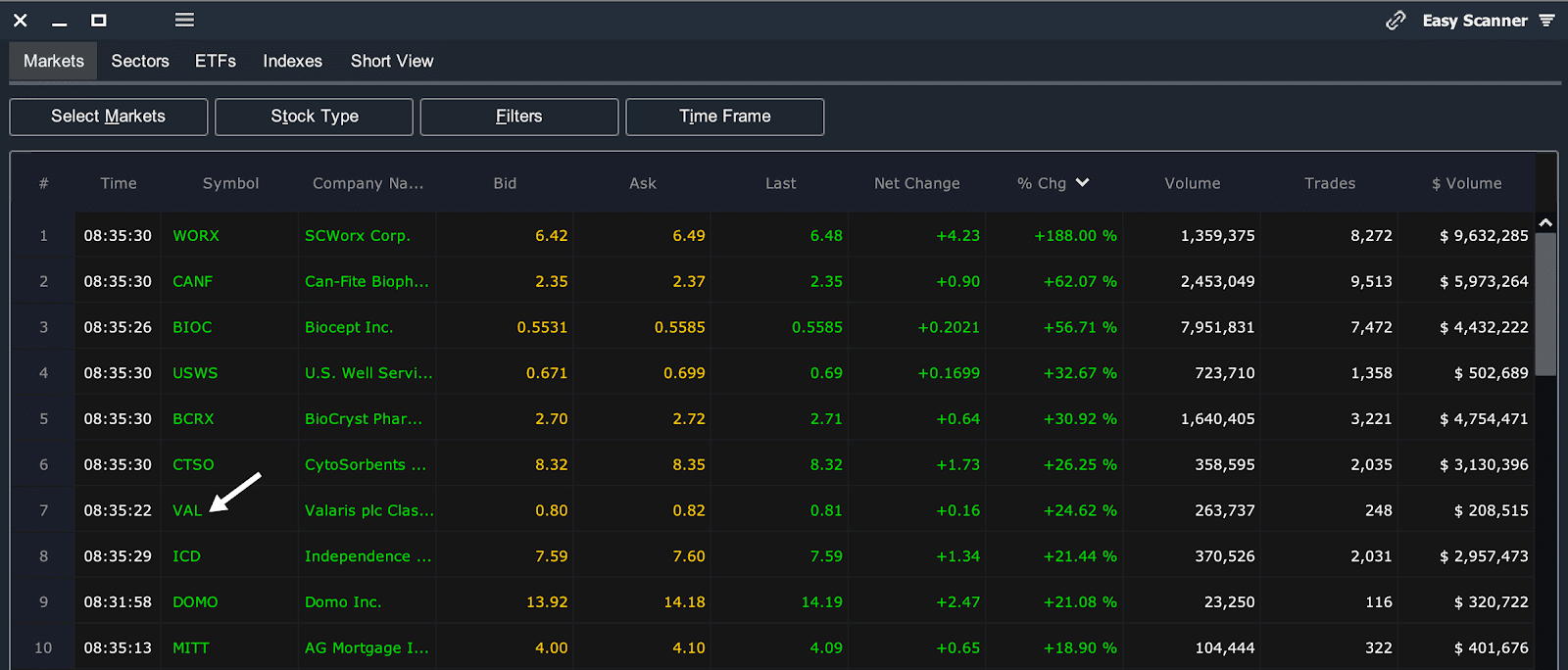

So far so good with VAL, currently trading in the low $.80’s. I’ll look for 10-20% on that today from my $.74 entry. Oil and gas trades might be in play this week after the historic deal but right now I’m questioning the price action. Always good to be in the top 10 premarket.

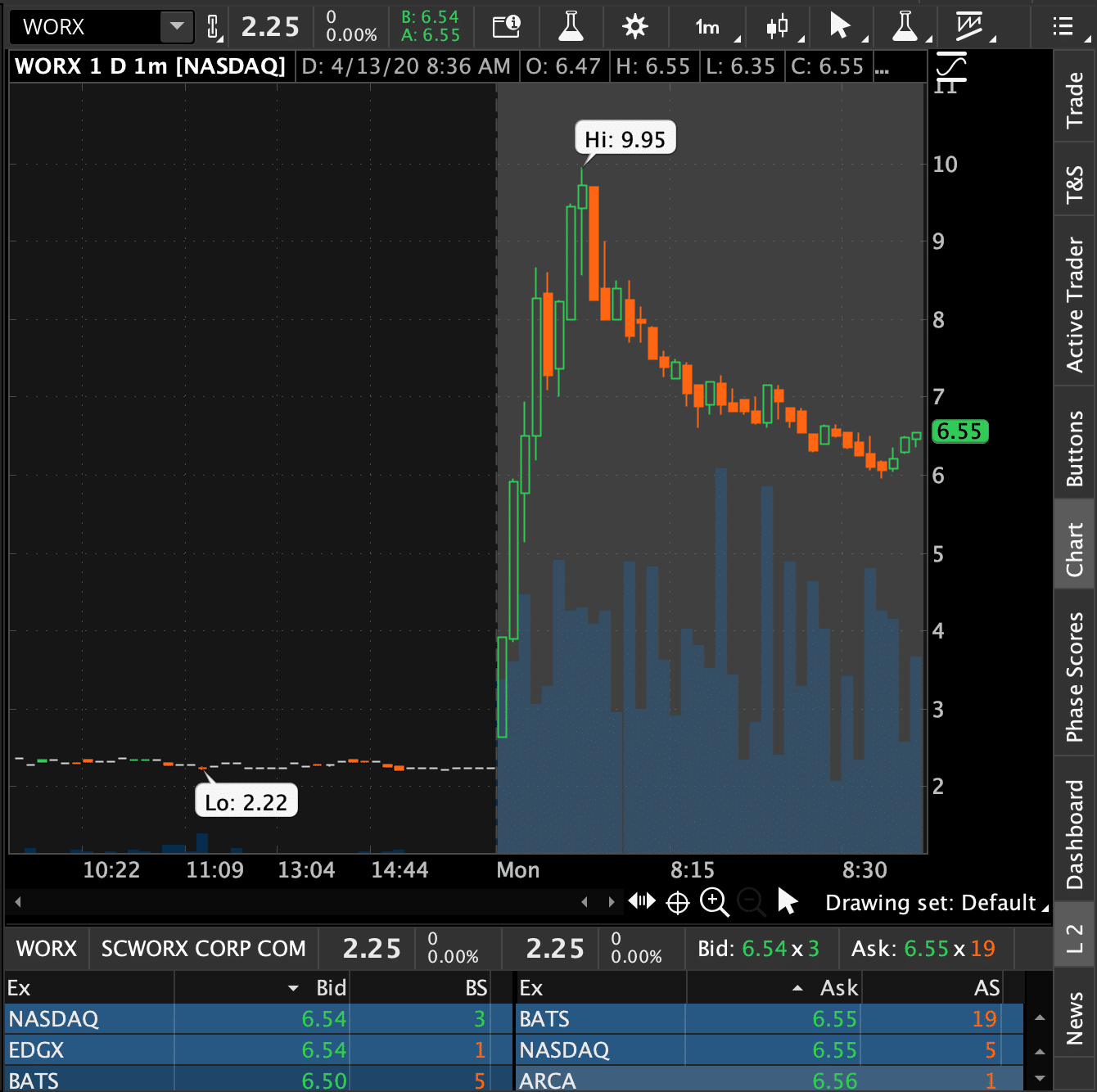

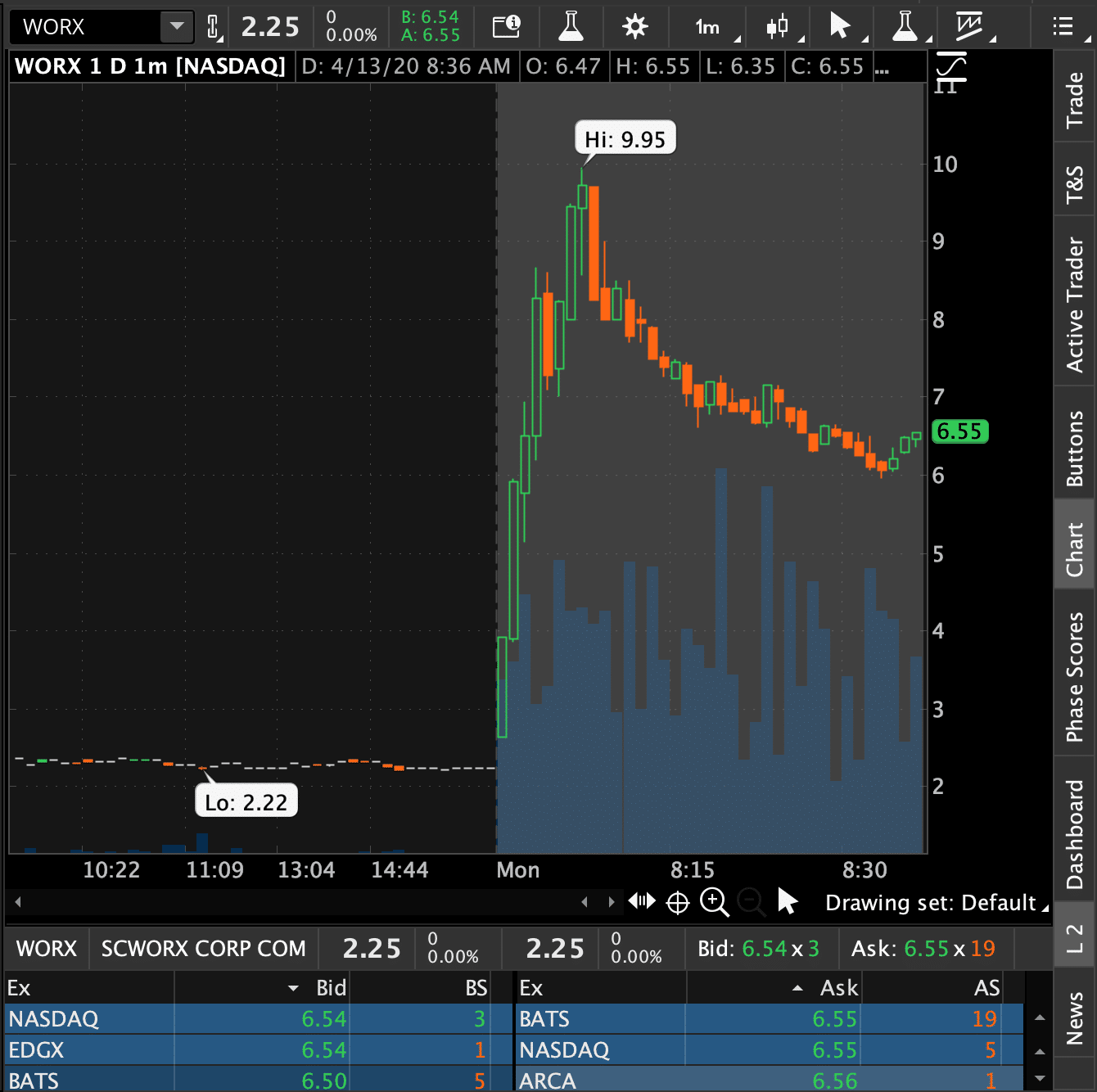

Source: Scanz Technologies

U.S. stock futures are lower, which I projected, but not anything concerning so depending on how this morning plays out, I’ll be taking trades by lunch. Markets made a big move last week so I’m still hesitant to get aggressive, especially as banks kick off earnings season. WORX is on my radar early. Good news, volume and price action so far. But I don’t trade these early in the session because of how volatile they are. Instead, I wait for patterns to emerge around midday and target the bull flag/pennant setup if it develops. Right now the first support it’s making on a pullback is around $6 but again, for me, way too early to trust that.

Source: thinkorswim |

If you want to receive my watchlist and alerts in real time, click here to join Jason Bond Picks.

Of course, with VAL set to gap higher… I kept an eye on it, and by the time the market opened — I locked in about $1,700 in VAL (or about 20%).

I know what you’re probably thinking, “Jason, how do you find these stocks to potentially trade?”

My Method To Uncover Momentum Stocks To Trade

In the mornings, I look for stocks that have some trading activity. More specifically, in the pre-market, I look for stocks with at least $200K in dollar volume. In other words, at least $200K worth of the stock must have been traded before the opening bell. Thereafter, I’ll sort by percentage gain on the day (or percentage loss, depending on what pattern I want to use).

This allows me to get an idea of what stocks to potentially trade.

Now, after the opening bell, I’ll increase the filter to at least $2M in dollar volume, and look for the top movers that day. This allows me to find out what stocks are hot, and which ones aren’t. The thing is, I don’t just buy the stocks on the filter — I look for my bread-and-butter patterns.

For example, today I noticed WORX on my radar this morning…

There was a catalyst in the stock, and it looked like my “rest and retest” pattern was forming in the stock. However, it was too early to tell, so I would leave it on my watchlist and maybe look back at the chart later.

I’ll also do this in the afternoon to try to find other trading opportunities. In this market environment, I think it’s important to have a routine in order to stay focused on potentially high-probability setups.

Jason,

Thanks for the insight, I’ve just joined your service as a lifetime member. It only took two days of reviewing your material and communications to know you are the real deal. Thank you for providing such in depth instruction. I’m hoping, and have a good feeling, that I’ll be able to start seeing some profit in trading using your education material and alerts.

Cheers

Mike