Good morning,

After nine-straight days of losses in the DJIA, S&P500 and Nasdaq, the major indexes have approached their respective 200-day moving averages, as recent changes in polling data in the U.S. presidential race suggest a closer race than the one of only two weeks ago. For the week, the DJIA, S&P500 and Nasdaq lost another 1.5%, 1.94% and 2.77%, respectively.

I anticipate further pressure on stocks with two full days of campaigning left until the results of the November 8 vote are in. With polls showing a neck-and-neck race, markets dislike uncertainty; and this uncertainty typically leads to further hedging and liquidations. Target trading ranges for the DJIA of 17,500 – 17,400; 2,030 – 2,050 for the S&P500; and 4,820 – 4,850 for the Nasdaq may not be unreasonable until significant buying comes back into the market. The VIX may once again spike to more than 30 this week as last-minute hedges are taken.

That’s the bad news. The good new is, the possibility of lower price levels I anticipate in stocks may result in better bargains in those stocks already suffering from a deficit of buyers. Watch for some good prices in your favorite trading stocks during the volatility this coming week.

Also underlying the stock market woes this week was the weakness in the oil market. The price of a barrel of West Texas Intermediate Crude (WTIC) plunged $4.63 (-9.51%) to close at $44.07, amid a report by Reuters that a Saudi official threatened to flood the oil market with additional crude above the tentatively-agree-upon OPEC quotas. Later, Bloomberg News reported the Saudis denied the Reuters report, but the oil price continued to slide.

Applying additional pressure in the oil market came from reports of increased production levels from the North Sea (which reveal a 10% consistent y-o-y output rate) and a huge inventory build in the latest U.S. inventory report.

While the supply/demand dynamics in the oil market suggest weak pricing, I have to caution my readers that the unit of measurement, the U.S. dollar, may be reaching a cycle high. If I’m correct, all commodities priced in U.S. dollars should attract buyers as a hedge to a declining currency. Sentiment in the U.S. dollar is quite high, and as a contrarian by nature I am not a ‘dollar bull’ in terms of commodities pricing.

I should also note the unusual change in the negative correlation between the oil price and U.S. dollar this week. As the dollar declined sharply against its major rivals, down 1.25 points in the USDX, the oil price declined concurrently. Though this phenomenon has happened many times before, the positive correlation between the two markets reverts back to a negative one because of the nature of the petrodollar system. Therefore, either oil prices rise again in the near future, or the U.S. dollar strengthens in the coming weeks.

This week in the precious metals market made sense, for once. As the dollar weakened, the price of gold and silver shot higher, much higher in the case of the silver price. At the close of trading Friday at the Comex, gold rallied 2.17% higher, while the silver price soared 3.23% in active trading.

Gold closed at $1,304.50 per ounce, settling above its 52-week average, while the silver price fell short by $0.60 of its 52-week moving average, closing on Friday at a price of $18.37 per ounce.

If gold continues to rally from here, traders of silver may be in for a pleasant surprise. As traders of silver see the gold price trade strongly above its 52-week moving average for a while longer, silver buyers will most likely be jumping in massively to close the gold/silver ratio back to its 52-week moving average of 68.47, suggesting a price of silver slightly north of $19.00 at gold’s present price level.

Bank stocks were also losers this week. After approaching the interim high of 77.14 in the KBW banking index, the KBW basket of banks retreated $1.18 (-1.59%) to close at $73.36 for the week.

I smell a recent high has been printed in most banking stocks, and expect further weakness in sector. And Deutsche Bank’s (DB) plunge of -8.00% this week, following its recent five-week rally and sudden breach of its 50-day moving average to the downside, adds to my bearish sentiment of the sector. So what happened to poor Deutsche Bank? Following Moody’s downgrade of the bank the previous week, Fitch piled on this week with a downgrade of DB to a “negative watch.”

After rising relentlessly off the early-July low of 1.37%, the rally in the U.S. 10-year Treasury note declined back below its 52-week moving average to close at 1.79% from last week’s close of 1.84%.

The spread between the 10-year Treasury note and two-year bill dropped a basis point to close Friday at 99 basis points, settling two points below its 52-week moving average of 101 basis points. Odds are, rates may stabilize here and may provide a reason for some traders to buy selected stocks in the coming days, a factor the stock market desperately needs this week.

And now let’s review the action in the currency markets.

As I mentioned, the U.S. dollar this week was weak against its major rivals, the euro, yen, pound and Swiss franc. After a British High Court ruling this week that the Brexit vote must be ratified in Parliament, the pound soared to close up 3.28 cents (2.69%) against the U.S. dollar. The euro, yen and franc followed, leading the USDX down by 1.25 points (-1.28%).

So, after weeks of rising oil prices and weaker exchange rates for the pound against the U.S. dollar and euro, the British were the big winners this week. This reversal in the oil market, priced in pounds, is a great lesson for my readers. That is to say, as negative (or positive, for that matter) sentiment grows deeper and deep against an asset, watch for a huge snap-back to hit traders in the face who’ve been riding a profitable trade for too long. In this case, when the oil/pound trade began to reverse, the trade snapped back by a whopping 12% this week!

As I sip my morning coffee and reflect about this week, I sense we are moving into a fundamental shift in all markets. The banking and FANG stocks may have peaked, and the commodities, precious metals and out-of-favor stocks may be ready for a big move higher in the coming weeks and months.

I’m confident the Fed will mitigate substantial declines in the big name stocks, and may even have to back off from its warned rate hike if stocks falter to badly, even though the bond market has pressured the Fed to allow rates to rise. As far as he Fed’s primary objective is concerned, you can count on all stops to maintain capital flows into U.S. stocks! I just think returns for the major averages will look quite anemic when compared with out-of-favor, lower-cap stocks.

I also believe foreign capital may continue to view the U.S. stock market as the only game in town as a means of capturing a decent yield. This anticipated capital flow should provide a lift to the U.S. dollar against its rivals and U.S. stocks, but, in terms of precious metals, the U.S. dollar may decline.

I’m not contradicting myself, here, from my previous sentiments about the U.S. dollar. Dollar strength against the euro, yen and pound doesn’t mean the U.S. dollar is strong; it just means the U.S. dollar is the best of a bunch of other currencies in terms of which one loses the least in purchasing power of dollar-hedging commodities.

Well, that’s my sense of how the market feels to me at this stage. And, by the way, after I read the recent sentiments of Eclectica’s famed hedge fund manager, Hugh Hendry, he appears to see the markets the way I see them, though he doesn’t discuss the precious metals piece of my thesis.

Okay, let’s talk stocks.

This Week’s JBP Stock Ideas

LIQUIDMETALS (LQMT)

As I alerted Tuesday, I sold my remaining 100,000-shares stake of LQMT for a $4,300 profit, taking my overall profit to $10,000 profit during a two-month holding period. That’s a great score, and provides me some comfort from a stock I’m struggling with: BLDP. I’ll get to BLDP in a moment.

FIREEYE (FEYE)

Shares of FireEye (FEYE) popped $1.33, or 12.08% on Friday, following a smaller-than-expected loss reported for the company’s third quarter. The company cited a surge in cloud-based offerings for the slimmer loss. FEYE added $0.81 per share this week to close at $12.24, a 7.03% gain for the week.

Instead of an expected loss of $0.30 per share, FireEye lost only $0.18 per share, which is an excellent report for this stage in the company’s turnaround, in my opinion. Although revenue was up 13% y-o-y, the $184.6 million revenue reported for the quarter fell short of analysts’ average estimate of $195.7 million.

Management increased bottom-line guidance for the year, but decreased guidance for billings and revenue.

Okay, I anticipated FireEye’s earnings ro come in better-than-expected , but not as good as I imagined. At this point, I’ll be watching the stock for firmness and an expected amount of backing and filling in the share price that may offer me a hint of whether a bottom had been reached on Thursday. I’ll let you know.

ABOUT FIREEYE (FEYE)

FireEye, Inc. provides cybersecurity solutions for detecting, preventing, analyzing, and resolving cyber-attacks. The company offers vector-specific appliance solutions that provide threat protection from network to endpoint for inbound and outbound network traffic that may contain sensitive information.

Source: Finviz.com

BALLARD POWER SYSTEMS (BLDP)

I alerted on October 7 that I bought 10,000 shares of BLDP at $2.39. I’m ‘in the red’ so far on this stock. As the chart shows, below, the stock price tested and failed at the 50-day moving average last week and failed support at $2.00 this week, trading unenthusiastically during the present beating taken in the oil pits.

As I noted in my email alert on Tuesday, notifying subscribers of my sale of LQMT, I also mentioned I’ll be looking to average-down my purchase price of BLDP.

The next level of support is $1.80, and will be looking at that price level ($1.80 to $1.86) to trigger a decision whether to lower my average purchase price with another long position at the range.

I don’t like being in this position with BLDP, but after reading Zacks on Thursday, it appears others may being seeing what I see in BLDP.

One stock that might be an intriguing choice for investors right now is Ballard Power Systems Inc. BLDP. This is because this security in the Electronic-Miscellaneous Components space is seeing solid earnings estimate revision activity, and is in great company from a Zacks Industry Rank perspective.

This is important because, often times, a rising tide will lift all boats in an industry, as there can be broad trends taking place in a segment that are boosting securities across the board. This is arguably taking place in the Electronic-Miscellaneous Components space as it currently has a Zacks Industry Rank of 68 out of more than 250 industries, suggesting it is well-positioned from this perspective, especially when compared to other segments out there.

Meanwhile Ballard Power is actually looking pretty good on its own too. The firm has seen solid earnings estimate revision activity over the past month, suggesting analysts are becoming a bit more bullish on the firm’s prospects in both the short and long term.

Source: Zack’s Equity Research

In addition, I’m still anticipating a bump in the stock from an announcement of more details to the signed joint-venture Memorandum of Understanding (MOU) with Guangdong Nation Synergy Hydrogen Power Technology, wherein the two companies tentatively agreed to produce fuel cell stacks in China.

ABOUT BALLARD POWER SYSTEMS (BLDP)

Ballard Power Systems Inc. engages in the development and commercialization of proton exchange membrane fuel cells worldwide. It is primarily involved in the design, development, manufacture, sale, and service of fuel cell stacks, modules, and systems for various applications. The company also develops methanol clean energy backup power systems, as well as provides engineering services for various fuel cell applications. Ballard Power Systems Inc. offers its fuel cell products for various applications, including portable power, material handling, and telecom backup power, as well as power product markets of bus and tram applications. Source: Finviz.com

GLU MOBILE (GLUU)

Last week, I added Glu Mobile (GLUU) to my watch list.

This week, GLUU broke support at $2.00 to close at $1.83 per share. A worse-than-expected earnings report trashed the stock by -8.04% this week at an important time when the stock needed some good news. But that’s all the better for me, as a lower stock price really drops the already-good financial metrics of the company to levels that astounds me.

This week, we had some developments at the company, including an earning report, as I mentioned.

Glu Mobile reported a worse-than-expected quarterly loss of $0.33 per share. That’s a far cry from a $0.11-per-share loss that I expected. Revenue dropped 18.8%, y-o-y, which I thought was a bit steep. The company needs a decent hit game in the coming quarters; and, if one comes along, watch the stock ping higher from some really depressed metrics when compared to Electronic Arts (EA) and Zynga, Inc. (ZNGA). This stock may easily double on a decent hit game.

During the conference call, the company announced that Niccolo de Masi is stepping down as CEO and moving to Executive Chairman of the company. Nick Earl, a former-executive at Electronic Arts, will serve as Glu’s new CEO.

Glu also announced it has taken a controlling interest in California-based Crowdstar, the maker of “Covert Fashion,” the game for “the shopping obsessed.”

As I mentioned last week, I’d like to see how the Taylor Swift game does in the first couple of weeks of its debut. As we know, Glu Mobile has had a lot of misses since its blockbuster Kim Kardashian series, so I’m looking for a break in the streak of mediocre releases.

As many of my long-term subscribers know, I’ve had a fondness for GLUU because of its very low valuation when compared with competitors, Zynga (ZNGA) and Electronic Arts Inc. (EA). At a Price-to-Sales (P/S) of 3.19 and 5.31, respectively, GLUU’s P/S of 1.04, reflects a very depressed stock price, indeed.

Essentially, Glu Mobile is a cash cow; all it needs is one big hit to soar this stock. The upside potential is an easy 50% today’s price, with $3.00, at a minimum, upside attainable from a nice showing from Taylor Swift, especially when taking into account the large 16% of the stock’s float held short (more than 13 days of GLUU’s average daily volume) that may need to quickly cover.

I’m watching GLUU closely, and will notify you of any trade I make in the stock.

ABOUT GLU MOBILE (GLUU)

Glu Mobile Inc. develops, publishes, and markets a portfolio of games for the smartphones and tablet devices users. The company offers free-to-play action, celebrity, sports, and simulation genre mobile games. It creates games based on its own brands, including Contract Killer, Cooking Dash, Deer Hunter, Diner Dash, Eternity Warriors, Frontline Commando, Gun Bros, Heroes of Destiny, Racing Rivals, Tap Sports Baseball, and Tap Sports Football. The company also creates games based on third-party licensed brands, such as Kim Kardashian: Hollywood, Kendall and Kylie, Katy Perry Pop, James Bond: World of Espionage, Mission Impossible: Rogue Nation, and Sniper X With Jason Statham.

LENDINGCLUB (LC)

Shares of LendingClub (LC) rose sharply by $0.48 (+9.15%) this week to close at $5.13 per share on relatively heavy trading volume, following an an announcement of an upgrade from Morgan Stanley on Thursday to “overweight” from “equalweight.” Morgan Stanley also issued a target price of $7.00 for the stock.

I noticed $7.00 happens to also be a huge level of resistance for LC (see chart, below) and the price point from where the stock last traded before the scandal at the company broke.

Lending Club was added to my watch list last week. The company has been in a turnaround phase following revelations in May that Lending Club CEO, Renaud Leplanche, had sold $22 million of loans to a investment bank, Jefferies, that “did not match the client’s requirements.”

More trouble followed. On May 16, the U.S. Department of Justice served a subpoena for records involving the company’s deal with Jefferies.

In all, LC had lost nearly 48% of market capitalization from the scandal, but appears to be recovering.

According to Morgan Stanley, the company told them that competition in the lending business space is weak at a time of robust loan demand, and added that the company’s securitization volumes are presently strong.

In addition, LendingClub has raised interest rates and lending standards to match a rising interest rate market environment and rising default risks during the late stages of the current lending cycle.

Lending Club has guided no growth in originations from the second quarter. The company also guided a $15-$30 million loss on revenues of between $95 million and $105 million, translating to an EPS loss of $0.035 to $0.077. Analysts’ consensus EPS estimate is a loss of $0.07.

Third-quarter earnings is expected to be released before the bell on Monday, November 7.

ABOUT LENDING CLUB (LC)

LendingClub Corporation, together with its subsidiaries, operates as an online marketplace that connects borrowers and investors in the United States. Its marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, super prime consumer loans, unsecured education and patient finance loans, and unsecured small business loans. The company also offers investors an opportunity to invest in a range of loans based on term and credit characteristics. It serves investors, such as retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, and university endowments.

SPDR S&P NATURAL GAS & EXPLORATION AND PRODUCTION ETF (XOP)

As I noted in my alert on Tuesday, I have been watching XOP for several weeks now and it’s come into my price target range in the past couple of sessions. I’m going to take a half-position and wait until after the election to decide whether or not to add to my 200-share position.

I filled 200 shares at $35.45, and will be looking for $33.00, or a little better, following the U.S. election.

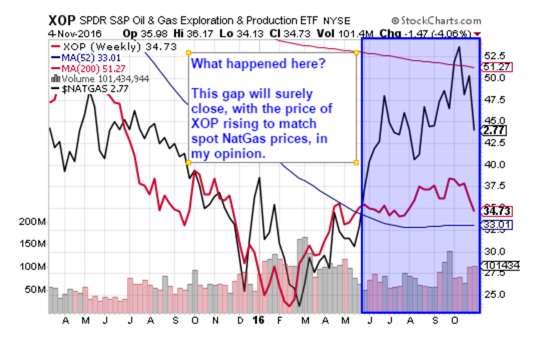

Below, I’ve included a chart demonstrating the gap between spot natural gas prices and XOP. Notice the lag in the XOP against the NatGas spot price, starting in May. XOP’s 52-week moving average suggests $33.00 may be the magnet price for ETF in the coming days.

Momentum in the energy sector has been to the downside, to say the least, so I wouldn’t be surprised to see XOP test at $33.00. But at XOP’s, at any price under $36.00, is a good entry price, in my opinion.

Keep in mind the incentive for Washington to maintain elevated energy prices (to some extent) as a means of protecting the banking sector from more than $1.1 trillion of loans to the sector and derivatives sold within the banking industry to hedge this massive position taken by banks, especially our friends at Deutsche Bank (DB).

That’s it for this week. I’ll be more looking forward to a post-election environment and more breathing room that period will aid in my analysis. As a trader, I, too, don’t like political uncertainty.

Trade Green!

Jason Bond

0 Comments