Good morning!

Over the last 3-months I’ve made +$34,564 in the Long-Term Trading service winning 10 out of 12 trades.

All trades, with the exception of LIVE, were easy to follow, which is the most important part of this service.

Not bad when you consider this tiny fee, right? I assured everyone I’d do my best to make this Long-Term Trading an awesome newsletter and couldn’t be more proud of the direction it’s going.

I’m not bragging here, I’m just proud to deliver my best in every service I offer. Moving right along.

Another week of rising US dollar exchange rates catapulted stocks to record highs. At the close of Friday’s trade, the DJIA settled at 19,152.14, a record. The S&P 500 and Nasdaq gained another 1.44% to 2,213.35, and 1.45% to 5,398.92, respectively, both records.

And the Russell 2000, the index of small-cap stocks, outperformed the large-caps this week, closing up a hefty 2.40% to close at 1,347.20, a record.

The VIX, once again, trades at the 12 handle. Life is good says the hedgers, but keep your good eye on your stops, says me.

Keep in mind, too, among all the giddiness, champagne-popping and rosy headlines of record highs, the Transportation Index has not followed the major indexes to record highs. For me to become less wary of this post-election bull move, I’d like to see the Transportation Index make record highs, as well. Another 2.9% move will do it.

Another issue is the US dollar, which has driven this eye-popping rally since the presidential election. After reaching a 13-year high, the US dollar appears overextended to me, but my sentiment doesn’t mean it won’t go still higher in the longer-term as we enter a period of uncertainty in Europe and the negative impact on the euro stemming from Trump-like candidates fairing well in the polls there.

Mario Camara, Saxo Bank head in Dubai, told The National that he sees his clients moving into the US dollar as a ‘fear trade’.

“People are getting out of any asset that they don’t think will conserve its value,” said Camara. “Markets hate uncertainty and the safe asset is the dollar.”

When I think through to the cause of this three-week rally, I can certainly imagine what the big boys must be thinking in Europe. For example, in France, it’s now likely that former prime minister François Fillon, a social conservative, will take on populist candidate, Marine Le Pen, for the presidency. Francoise Holland’s 7% approval rating certainly narrows the choice between the social conservative, Fillon, and Le Pen, the latter of whom is likened to the ‘Donald Trump’ of France.

If Le Pen maintains her lead in the polls against her rivals as we approach the first round of voting on April 23, the fear trade in the US dollar may accelerate. And if no candidate reaches a majority after the first round, May 7 becomes the nail-biting day in France because, if Le Pen wins, all hell may break loose in Europe.

A successful ‘Brexit’ vote smashed the British pound against the dollar by nearly 21% from the day’s high of June 23 to the low of October 11. Ouch. A Le Pen win may soar the dollar to heights we cannot now imagine, taking stocks with it.

France and Germany are the pillars of the European Union. A Le Pen win would cement the notion of a nationalism wave sweeping the West—no doubt about that. Speculation of a nationalist movement in Germany prevailing in October 2017 would compound the fear-based trade into the US dollar that much more. With both the people of France and Germany rejecting centralized government out of Brussels, I don’t see how the European experiment can survive in its present form.

I believe this Brexit-Trump juggernaut may still be in its infancy, and may provide a strong updraft into the US dollar as the principal safe-haven trade. The potential move of the dollar in the coming months may resemble the currency mismatch in Europe (and Japan) against the dollar during the huge rally in the dollar following president Ronald Reagan’s victory that culminated in the Plaza Accord of 1985.

Okay, my bottom line about the prospects of US stocks in the coming months is: although the task of righting the fiscal and economic problems in the US are quite daunting, Europe and Japan face greater problems. So, on a relative basis, the dollar and US stocks may look enticing as we move into 2017—for now. Let’s see how the polls in France go when we approach early Spring.

In the short-term, the rise in US stocks has been mighty steep since November 8. I expect at some point between now and the December 13, 14 FOMC meeting a pullback or consolidation of the major averages, as the discounting of the potential implications of a Trump presidency become less forward-looking. But, I’ll discuss the potential impact of the FOMC meeting may have on stocks in later issues of this report.

Let’s talk about another important market impacting stocks: the US Treasury market. As I noted in my previous report, the US 10-year Treasury yield has risen to the very important and meaningful 2.4% – 2.5% price band. After being slapped down from the intraday high of 2.41% on Wednesday and, again, at 2.41% on Friday, traders settled the note at 2.36%.

So, what’s all the brouhaha about in the bond market?

Consumer-price inflation is expected. Although oil prices got slammed pretty good on Friday, the price of West Texas Intermediate Crude (WTIC) approached $50 per barrel once again. The rally from the February low of $26 per barrel concerns inflation watchers (and me), who expect higher energy prices to seep into operating costs and, therefore, consumer prices of both goods and services in the coming months.

In addition to what has already been baked into the cake, if OPEC was to get its act together and agree upon cutting production by as much as a million barrels per day, I’m confident we’ll see $60 oil in a short-term time horizon. These factors have already been discounted into the Treasury market, in my opinion, but it’s getting crazy out there on the political front between Western-leaning and foes who make up OPEC.

So, for this week, let’s keep an eye on the 10-year US Treasury, the yen and oil prices as they relate to the VIX. I’ll be looking for any growing anomaly between the three markets against the VIX, and will cover the reason for watching the yen more closely in my next report. Hint: I think the yen carry trade may be ‘operative’ once again, leading me to reassess the help/obstacle for US stocks may receive from the BoJ, going forward.

Keep your stops in check and I’ll report back to you next week, barring an emergency note from me during the week in addition to my alerts.

Okay, let’s talk stocks.

This Week’s JBP Stock Ideas

BALLARD POWER SYSTEMS (BLDP)

As alerted, I’ve averaged purchases to now owning 30,000 of BLDP, at an average price of $2.16. The thesis, here.

BLDP closed the week up $0.01 to $1.95.

Another quiet week for BLDP, although Wednesday’s opening price of $2.16 got me search for the cause. What news was released? There was no news from Ballard; it was Zacks who issued a news release that the research firm upgraded the stock to “strong buy” from “hold.”

The latest Zacks upgrade comes after the number of analysts recommending the stock, with the recommendation among analysts averaging ‘2’, or a ‘buy’ recommendation. Recommendations are based on a scale of 1 to 5, with ‘1’ denoting a ‘strong buy’ and ‘5’ a ‘strong sell.’

In addition to the ‘strong by’ recommendation, Zacks issued a price target of $2.25, not a particularly bold price target, in my opinion. But I’ll take it.

“Ballard Power Systems focuses on developing and bringing to market PEM fuel cell systems for transportation, stationary, and portable applications,” stated Zacks. “Ballard now offers key subsystems and components that are based on technology developed in support of Ballard fuel cell products. Their focus is on further enhancing product performance, reducing costs, designing market-viable products, developing additional volume-manufacturing capabilities, and continuing to build customer and supplier relationships.”

Other information about this year’s activity in BLDP from institutional and large investor filings reveal the following:

Renaissance Technologies LLC raised its stake in Ballard Power by 30,470 shares during Q1, and now owns 326,300 shares.

Bank of Montreal raised its stake in Ballard Power by 24,597 shares during Q3, and now owns 55,074 shares of the company’s stock.

And Royal Bank of Canada bought an additional 57,634 shares during Q2, and now owns 98,923 shares.

In total, institutions hold approximately 16.4% of Ballard Power’s total outstanding shares.

ABOUT BALLARD POWER SYSTEMS (BLDP)

Ballard Power Systems Inc. engages in the development and commercialization of proton exchange membrane fuel cells worldwide. It is primarily involved in the design, development, manufacture, sale, and service of fuel cell stacks, modules, and systems for various applications. The company also develops methanol clean energy backup power systems, as well as provides engineering services for various fuel cell applications. Ballard Power Systems Inc. offers its fuel cell products for various applications, including portable power, material handling, and telecom backup power, as well as power product markets of bus and tram applications. Source: Finviz.com

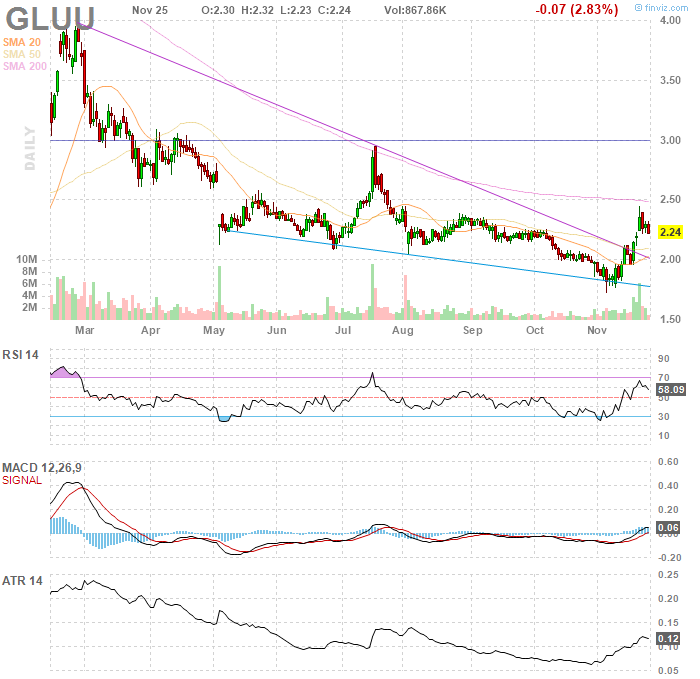

GLU MOBILE (GLUU)

Glu Mobile (GLUU) has been on my Watch List since October 31, when the stock reached a low of $1.86 leading up to the company’s earnings report of November 3. The report was less than inspiring, dropping the stock to as low as $1.73.

Since the post-earnings low of $1.73, GLUU rebounded by 28.9% to close Friday’s trade at $2.23 per share, up $0.03 (1.36%) for the week. After trading within $0.06 of the stock’s 52-week moving average of $2.51, aggressive selling overwhelmed buyers. That tells me traders need some really good news to get the market for the stock rolling.

However, a bit of fireworks reached traders of GLUU following a Cerbat Gem report on Monday revealing that executive chairman, Niccolo de Masi purchased an additional 20,000 of stock at an average price of $2.07. He now owns 675,936 shares of GLUU common stock.

Cerbat Gem also reported that new Glu CEO, Nick Earl, bought an additional 100,000 shares at an average price of $2.09. Earl now owns 184,368 shares of GLUU common stock.

Although Earl receives stock options to go with his position as Glu’s new CEO, I really like to see a CEO buy shares in the open market as a signal of confidence in the company’s future. At a purchase of 100,000 shares, the amount exceeds a token gesture of enthusiasm I see from time to time from other C-class executives.

As I’ve stated each time I add GLUU to my Watch List, the company has been doing well with its releases, including Tap Sports, Cooking Dash and Deer Hunter, but I and, apparently, the market are expecting another hit from Glu, akin to the company’s big hit, Kim Kardashian: Hollywood.

But I like Glu for its very strong balance sheet, which gives them opportunities to acquire franchises, such as the recent acquisition of Crowdstar.

As a reminder from last week’s report about GLUU, Zacks issued a quick note to recap analysts’ targets for the stock. These include:

- Piper Jaffray: Confirmed an Overweight rating for GLUU and issued a $3.00 target price for the company’s shares on Nov. 7.

- Cowen and Company: Verified an Outperform rating for GLUU and provided a $3.00 target price for the business’s shares on Nov. 7.

- Canaccord Genuity: Restated a Hold rating for GLUU and gave a $3.00 target price for the company’s shares on Nov. 1.

- Roth Capital: Provided GLUU with a Hold rating and set a $2.00 price objective for the company’s shares on Oct. 30.

- Wedbush: Gave GLUU a Hold rating and established a $2.25 price objective for the company’s shares on Aug. 3.

As noted in my last report, Community Financial News reports analysts report an average rating of “hold,” with an average price target of $3.03, a price target that matches my price target for GLUU.

And from Investopedia, who updates activity in institutional holdings from time to time, notes:

- Nationwide Fund Advisors: Boosted its stake in GLUU by 3.1 percent and owns 78,811 shares of the business’s stock.

- Rhumbline Advisers: Upped its stake in GLUU by 3.4 percent and holds 152,401 shares of the company’s stock.

- BlackRock Investment Management: Increased its stake in GLUU by 2.2 percent and owns 457,854 shares of the business’s stock.

- Alliance Bernstein: Bolstered its stake in GLUU by 11.6 percent and owns 111,000 shares of the company’s stock.

- Creative Planning: Increased its stake in GLUU by 27.6 percent and holds 62,500 shares of the business’s stock.

ABOUT GLU MOBILE (GLUU)

Glu Mobile Inc. develops, publishes, and markets a portfolio of games for the smartphones and tablet devices users. The company offers free-to-play action, celebrity, sports, and simulation genre mobile games. It creates games based on its own brands, including Contract Killer, Cooking Dash, Deer Hunter, Diner Dash, Eternity Warriors, Frontline Commando, Gun Bros, Heroes of Destiny, Racing Rivals, Tap Sports Baseball, and Tap Sports Football. The company also creates games based on third-party licensed brands, such as Kim Kardashian: Hollywood, Kendall and Kylie, Katy Perry Pop, James Bond: World of Espionage, Mission Impossible: Rogue Nation, and Sniper X With Jason Statham.

LENDINGCLUB (LC)

After two weeks of gains, +9.15% and +19.69%, LC then dropped $0.16 per share (-2.61%) at the close of the following week, then dropped $0.04 this week to close at $5.94 per share.

The big moves of +9.15% and +19.69% followed an excellent earning report and an announcement by the company that National Bank of Canada’s $1.3 billion extended a credit line to LC for loan originations. In addition, on November 3, to that good news, Morgan Stanley upgraded the stock and raised the target price of LC to $7.00.

And for my new subscribers of the Long Term Report, I found an article penned by Forbes contributing columnist, Ken Kam, who mentioned that fund manager, Tony Mitchell, has added to his position in LC.

I stated in my November 21 report about Tony Mitchell:

I don’t know how much Tony Mitchell holds, but I can tell you that 84.4% of the the company’s float is held by institutions, who have increased their collective stakes in LC by a total of 124.89% this year. That’s more than a ‘double down’ stake.

Tony Mitchell, by the way, has a track record that’s among some of the best in the money management industry, with this distinction earned from a recorded 16-year track record of achieving a compounded annual rate of return (ARR) of 16.29%. Folks, these guys in fund management have to move large blocks of money, and achieving an ARR of 16.29% is very hard to do.

So, for now, I’m watching how LC performs as it nears its 52-week average at $6.80, but I won’t get excited about purchasing the stock until we get a broad-based sell off and consolidation period in the major averages following the massive Trump-euphoria rally. My tentative target is $7, which won’t allow me much profit at today’s price when compare with the risk to the downside of the stock during a broad-based sell off.

That scenario may not happen, but I’m laying 50/50 odds that a consolidation period will commence by, or immediately following, the time of the FOMC meeting on December 13, 14. I’ll be watching for opportunities in LC and other stocks at that time.

ABOUT LENDING CLUB (LC)

LendingClub Corporation, together with its subsidiaries, operates as an online marketplace that connects borrowers and investors in the United States. Its marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, super prime consumer loans, unsecured education and patient finance loans, and unsecured small business loans. The company also offers investors an opportunity to invest in a range of loans based on term and credit characteristics. It serves investors, such as retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, and university endowments.

TWITTER (TWTR)

On November 5, I alerted a Call position I took in TWTR.

My suggested play is as follows:

You can play this via shares or options: buying shares in multiple tiers is suggested in this play. After opening a position, any price dip would be an opportunity to add to the position. The first price target is approximately the $20 level, followed by $21.50, and ideally a takeover that includes a decent premium, at approximately the $30 level, would make everyone happy.

Via options, the monthly Call, with an expiry of March ’17, and a strike price of $20 can be bought for $1.40 per contract. Buying 10 Calls limits your loss to $1,400. So far, the open interest of the March ‘17 contract is 43.06k, an active and popular strike price.

To read my rationale for the Twitter Call, follow the link to my report: ‘Twitter Takeover Play’.

My bet with a Call option includes the possibility a suitor who can fix Twitter’s sluggish attempt to monetize the company better will strike by the expiration of my March 2017 Call.

ABOUT TWITTER (TWTR)

Twitter, Inc. operates as a global platform for public self-expression and conversation in real time. The company offers various products and services, including Twitter that allows users to create, distribute, and discover content; and Periscope and Vine, a mobile application that enables user to broadcast and watch video live. It also provides promoted products and services, such as promoted tweets, promoted accounts, and promoted trends that enable its advertisers to promote their brands, products, and services; and subscription access to its data feed for data partners.

FANNIE MAE (FNMA)

Woohoo! I love to report a huge win; I really do. After holding FNMA approximately two weeks, I sold the remaining 10,000 shares at $3.00. At a purchase price of $1.72, the post-election pop scored me a huge 74.4% win from FNMA! That’s a $12,800 profit!

Although I’ve stated on many occasions of FNMA’s excellent chance of moving much higher in price—and I mean much higher—I took the easy profit and now look for the stock price to retreat back to the $2.40 handle in the coming weeks.

ABOUT FANNIE MAE (FNMA)

Federal National Mortgage Association (Fannie Mae) is a government-sponsored enterprise chartered by the Congress. The Company supports liquidity and stability in the secondary mortgage market where mortgage related assets are purchased and sold. It securitizes mortgage loans originated by lenders into Fannie Mae mortgage backed securities (Fannie Mae MBS) and purchasing mortgage loans and mortgage-related securities, primarily for securitization and sale later. Fannie Mae operates in three business segments: Single-Family Credit Guaranty, Multifamily and Capital Markets.

Source: Google Finance

In all, it was yet another good week for the LT Report. Until next time…

Trade Green!

Jason Bond

Jason, many of the same names maintained in this list, and no newsletter last week. there’s been great movement up in a number of financial stocks since the election. 20% in a month. Seems like some good opportunities for this type of long term service. What do you think?

It’s very hard to chase these names now though, wouldn’t you agree?

Yes agree