Good morning,

At the close of trading Friday, the DJIA, S&P500 and Nasdaq climbed 0.11%, 0.81% and 1.61%, respectively. Trading reverted back to a more subdued week of backing and filling from the previous week’s extreme volatility, and was contained within a tight 0.67% price range during the week, as in the case of the DJIA. However, a continuation of the risk-on trade was more evident in the smaller-cap space as reflected by the Nasdaq’s 1.61% move higher.

After spiking to readings not seen since June, the VIX once again trades at the 12 handle, closing on Friday at 12.85, which was also the printed low for the week. So, going into Monday morning, traders collectively are relatively unhedged and expect another quiet market open.

For those who rode some or all of this post-election 2,000-point rally in the DJIA, Carl Icahn has some advice for you this week, as he told an audience at this week’s Reuters Global Investment Outlook Summit that after big moves the prudent course for investors is to “scale off a bit.” But Icahn didn’t go so far as to suggest heading for the sidelines. I agree. Big gains should be looked at very carefully as we enter the pre-Thanksgiving trading period.

Prior to the open on Monday, we should get a soundbite from Fed Vice Chairman, Stanley Fischer, who will be speaking at a meeting of the Council on Foreign Relations (CFR) in New York at 8:00 a.m. I don’t expect Fischer to add much to comments made by Fed Chair Janet Yellen of this past week, and neither does the market. Fed fund futures indicate a near-certainty of a 25-basis-point hike to the overnight bank rate when the FOMC convenes in mid-December, especially after the Treasury market has done the work for the Fed by soaring rates.

So, let’s talk about interest rates.

The action in the U.S. Treasury and overseas markets is the real story of the past two weeks, and of the year, besides, of course, the catalyst of the big moves in rates: the emergence of President-elect Donald Trump.

All eyes, including mine, will be watching the bond yields in the Treasury and overseas markets more closely than before. As long-term readers already know, I’m a bond watcher. Why? Because it provides a reliable barometer of medium-term sentient in stocks to compliment short-term sentiment expressed by the VIX.

And what the bond markets across the globe are telling me is that we are nearing a dangerous inflection point. The U.S. Treasury closed to yield 2.34%, up another strong 13 basis points this week to add to the already 36-point move higher following the election, and up a total of 97 basis points from the July low of 1.37%. That is a monstrous move, and spooky.

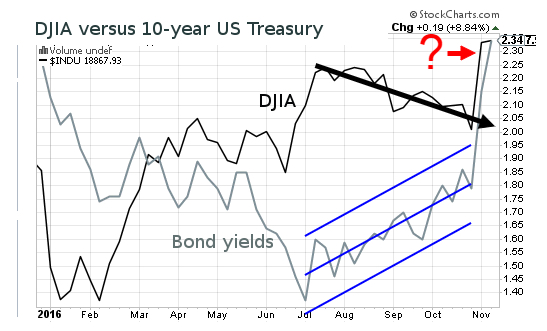

Here’s what I’m watching closely. Below, is a chart of a comparison between the DJIA and 10-year Treasury bond yield. Notice the strong correlation between the 10-year U.S. Treasury and DJIA where the red ‘question mark’ is located on the graph. “That’s what bothers me,” as Lieutenant Columbo was famous for saying to his crime suspects.

Now, follow me on this. Since July, moves higher in 10-year yields have weighed on stocks—as much as my thinking takes me—and makes sense from the standpoint of what we know about global investors and their desperate need to find yield. On average this year, DJIA stocks had yielded annual dividend payout rates as much as approximately 200 basis points more than yields offered from owning 10-year Treasuries, if we only take into consideration the top-half of the highest-yielding stocks of the DJIA composite of 30 stocks into the analysis.

After the 97-point spike in the 10-year Treasury note in the past eight trading days, suddenly there is only a smidgen of difference between the yields from the DJIA and 10-year paper. That sudden spike in rates doesn’t bode well for literally nearly half of the stock market participants who have sought yield from companies with also strong buyback programs (see important chart of this analysis, courtesy of zerohedge.com).

In short, yield-conscious investors have sought out high-yielding stocks backed by company treasuries with pools of money to ameliorate any downside to the price of the security by way of stock buyback programs. So, within this context, Warren Buffett was right when he suggested indirectly that fixed-income securities play a major role in the price of equities. According to the zerohedge chart (linked, above), half of the DJIA buyers relish the idea of high-yield-stock-buyback arrangements. And there are plenty of these arrangements to be found in the Dow 30, for sure.

Okay, so now, with a higher-rate environment upon us, institutional money and high-worth individuals have suddenly found that the rug has been pulled out from under them. Couple the new environment of an erased yield advantage for stocks and a higher cost for company treasuries to buy back stock, the implications to the volume of buyers is rather sobering Why? Because much of the cash available for these buyback programs was raised by leveraging balance sheets through a near-zero cost of borrowing to continue perpetuate buyback programs —a double whammy unwind of carry trades we have seen over and over again in all markets, courtesy of central banks. This expected unwind of this dynamic in the weeks ahead by ways of one of the most significant sources of capital is troubling and likely under-appreciated. Right now, foreign capital into stocks is overwhelming domestic capital. How long can this go on without a break in stocks?

In addition, and as a nice cherry ornamental on top of this poisonous confectionery nightmare scenario I’ve concocted here is the effect rising yields and a stronger dollar has had in overseas trades—a subject woefully under-reported by financial media outside of this analyst’s work and some others like me publishing in the new financial media.

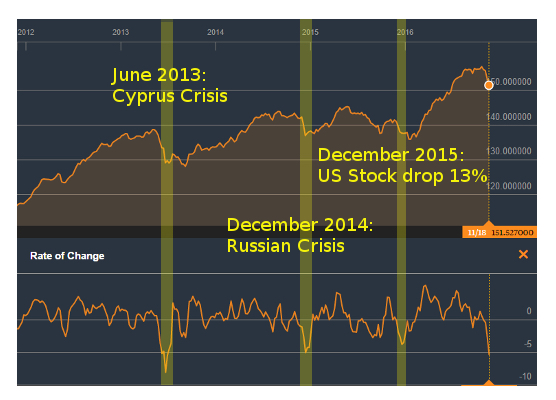

Below, is a chart I gained permission to use from a perceptive colleague of mine, Jeff Williams, who rightfully demonstrates in his analysis the trouble brewing overseas in the emerging market corporate debt market, a market, by the way, that is mostly uncontrolled and uncontrollable by overseas central banks, i.e. ex-Japan, ECB, BOE and SNB.

By looking at the chart, notice the downward rate of change (crash-like) in the price of emerging corporate debt (bottom-right of chart). Compare this most recent rate of change to the rate of change during two major market events and one other event dear to our hearts (the 13% correction in stocks in December/January). These three event are denoted by the yellowish-colored vertical stripes in the chart at June 2013: Cyprus crisis; December 2014: 50% crash of the Russian ruble; and the 13% swoon in the DJIA in December 2015/January 2016 period.

In each of the three events, stocks recovered.

Therefore, from my calculation of the next level of support for the 10-year U.S. Treasury is 122.00, or a 2.40% yield. With a closing price of 125.09 on Friday (yield of 2.34%), the U.S. 10-year Treasury trades at only 2.4% above support at 122.00, which coincidentally calculates to a yield of 2.4%.

Now, do I expect support at 122.00 to fail? No. But I want my subscribers to keep the bond market in mind as we go forward, trading between issues of the LT Report.

And watch to see if the VIX begins to spike if the 10-year Treasury yield breaks 2.4% to the upside (inversely, to the downside in price of 10-year note below 122.00). Don’t be surprised if this issue starts to permeate the notoriously late mainstream media (MSM) this week.

We’ve already witnessed the MSM tell the world that a 90%+ chance of victory for Hillary Clinton on November 8 was indicated by the polls. Well, MSM was terribly wrong.

We also were told by the MSM that ‘Brexit’ had no chance of passing. Wrong again.

Now we’re told that it’s ‘Morning in America’ again, now that Donald Trump will become the 45th President of the U.S. However, as many economist of the alternative media have said, we won’t know the effects on stocks from Trump’s planned infrastructure projects, dollar repatriation incentives, promised repeal of Dodd-Frank, and lowered marginal tax rates until well into 2017 and into the first-half of 2018. But until then, I and my subscribers have to make some ‘dosh’ right now. I don’t think I’m the only sober trader in the room. The euphoria among global traders of a Trump win may not last much longer.

“Scale off a bit,” your long large-cap and index trades, says Icahn. Wise words, I think. We made small fortunes last week. Let’s bank some.

Okay, let’s talk stocks.

This Week’s JBP Stock Ideas

FIREEYE (FEYE)

Dropped from my Watch List.

BALLARD POWER SYSTEMS (BLDP)

As I alerted, I now own 30,000 of BLDP at an average price of $2.16. The thesis, here.

As the chart shows, below, the 200-day moving average is the magnet price level while BLDP traders wait for a break. And again this week, although BLDP closed the week down $0.05, or -2.51%, to close at $1.94 per share, the stock hasn’t strayed far from its 200-week moving average. This tells me that traders are waiting for more good news in addition to the company’s expected growth at the top and bottom line, with revised estimates to now suggest a 20% growth in revenue for the coming fiscal year.

There was no news about the company or sector this week; it was a bit of a ‘yawn’ this week for BLDP.

Stronger oil prices didn’t appear to help the stock much, either. Going forward, the consensus is that President-elect Trump’s campaign promise to champion traditional domestic energy sources may weigh on the stock’s overall participation level. But revenue and earnings, of course, will drive the stock price. I’m holding.

ABOUT BALLARD POWER SYSTEMS (BLDP)

Ballard Power Systems Inc. engages in the development and commercialization of proton exchange membrane fuel cells worldwide. It is primarily involved in the design, development, manufacture, sale, and service of fuel cell stacks, modules, and systems for various applications. The company also develops methanol clean energy backup power systems, as well as provides engineering services for various fuel cell applications. Ballard Power Systems Inc. offers its fuel cell products for various applications, including portable power, material handling, and telecom backup power, as well as power product markets of bus and tram applications. Source: Finviz.com

GLU MOBILE (GLUU)

On October 31, I added Glu Mobile (GLUU) to my watch list. GLUU has now fully retraced its post-earnings selloff, with a hefty 12.24% move higher this week to add to last week’s 7.10% jump.

As I’ve mention in the past two reports, I have been waiting for GLUU to retake $2.00 support that had been breached to the downside following the company’s earnings report two weeks ago. Well, at a $2.20 closing price this Friday, I’ll be reviewing whether I’ll be taking a stake in GLUU, now that investors have indicated a ‘thumbs up’ to my thesis that GLUU trades at a depressed valuation.

I’ll also be watching for any strategic changes that the new CEO, Nick Earl, may embark upon. The former CEO, Niccolo de Masi, has moved to the position of Executive Chairman. I’m not sure why, but the matter of de Masi’s new role may become evident no later than the company’s next earning call expected in early February.

From Zacks, a quick note to recap analysts’ targets for GLUU:

- Piper Jaffray: Confirmed an Overweight rating for GLUU and issued a $3.00 target price for the company’s shares on Nov. 7.

- Cowen and Company: Verified an Outperform rating for GLUU and provided a $3.00 target price for the business’s shares on Nov. 7.

- Canaccord Genuity: Restated a Hold rating for GLUU and gave a $3.00 target price for the company’s shares on Nov. 1.

- Roth Capital: Provided GLUU with a Hold rating and set a $2.00 price objective for the company’s shares on Oct. 30.

- Wedbush: Gave GLUU a Hold rating and established a $2.25 price objective for the company’s shares on Aug. 3.

As noted, Community Financial News reports analysts report an average rating of “hold,” with an average price target of $3.03, a price target that matches my price target for GLUU.

And from Investopedia, who updates activity in institutional holdings. It’s all good.

- Nationwide Fund Advisors: Boosted its stake in GLUU by 3.1 percent and owns 78,811 shares of the business’s stock.

- Rhumbline Advisers: Upped its stake in GLUU by 3.4 percent and holds 152,401 shares of the company’s stock.

- BlackRock Investment Management: Increased its stake in GLUU by 2.2 percent and owns 457,854 shares of the business’s stock.

- Alliance Bernstein: Bolstered its stake in GLUU by 11.6 percent and owns 111,000 shares of the company’s stock.

- Creative Planning: Increased its stake in GLUU by 27.6 percent and holds 62,500 shares of the business’s stock.

ABOUT GLU MOBILE (GLUU)

Glu Mobile Inc. develops, publishes, and markets a portfolio of games for the smartphones and tablet devices users. The company offers free-to-play action, celebrity, sports, and simulation genre mobile games. It creates games based on its own brands, including Contract Killer, Cooking Dash, Deer Hunter, Diner Dash, Eternity Warriors, Frontline Commando, Gun Bros, Heroes of Destiny, Racing Rivals, Tap Sports Baseball, and Tap Sports Football. The company also creates games based on third-party licensed brands, such as Kim Kardashian: Hollywood, Kendall and Kylie, Katy Perry Pop, James Bond: World of Espionage, Mission Impossible: Rogue Nation, and Sniper X With Jason Statham.

LENDINGCLUB (LC)

After two weeks of gains, +9.15% and +19.69%, LC dropped $0.16 per share (-2.61%) this week to close at $5.98. I suspect lots of profit-taking took place this week following two-straight weeks of strong moves higher, driven by an excellent earnings report; a deal announcement regarding National Bank of Canada’s $1.3 billion credit line to LC for loan originations; and a Morgan Stanley upgrade and raised target price of $7.00, on November 3.

And this week, Forbes contributing columnist, Ken Kam, mentioned that fund manager, Tony Mitchell, has added to his position in LC. I don’t know how much Tony Mitchell holds, but I can tell you that 84.4% of the the company’s float is held by institutions, who have increased their collective stakes in LC by a total of 124.89% this year. That’s more than a ‘double down’ stake.

Tony Mitchell, by the way, has a track record that’s among some of the best in the money management industry, with this distinction earned from a recorded 16-year track record of achieving a compounded annual rate of return (ARR) of 16.29%. Folks, these guys in fund management have to move large blocks of money, and achieving an ARR of 16.29% is very hard to do.

ABOUT LENDING CLUB (LC)

LendingClub Corporation, together with its subsidiaries, operates as an online marketplace that connects borrowers and investors in the United States. Its marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, super prime consumer loans, unsecured education and patient finance loans, and unsecured small business loans. The company also offers investors an opportunity to invest in a range of loans based on term and credit characteristics. It serves investors, such as retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, and university endowments.

SPDR S&P NATURAL GAS & EXPLORATION AND PRODUCTION ETF (XOP)

Dropped from my Watch List, but not because of a closed-out trade. Instead, this ETF and all other ETFs will be covered by Jeff Bishop.

TWITTER (TWTR)

On November 5, I alerted a Call position I took in TWTR.

My suggested play is as follows:

You can play this via shares or options: buying shares in multiple tiers is suggested in this play. After opening a position, any price dip would be an opportunity to add to the position. The first price target is approximately the $20 level, followed by $21.50, and ideally a takeover that includes a decent premium, at approximately the $30 level, would make everyone happy.

Via options, the monthly Call, with an expiry of March ’17, and a strike price of $20 can be bought for $1.40 per contract. Buying 10 Calls limits your loss to $1,400. So far, the open interest of the March ‘17 contract is 40.1k, so you certainly won’t be alone on this trade.

Update: This week, the closing price for the March ‘17 Call is $1.71. That’s up $0.31 (+22.1%) for the contract, while the share price has only moved up 3.9%. Open interest has risen to 42.2k, up 2.1k.

To read my rationale for the Twitter Call, follow the link to my report: ‘Twitter Takeover Play’.

FANNIE MAE (FNMA)

I alerted on November 9, the day after the election, that I bought 20,000 shares of FNMA as a long-term hold at $1.73 per share. And the first week’s move of $1.00 higher, or 59.47%, certainly made my week.

This week, more buyers than sellers of FNMA drove the stock and my profit up another $0.44 per share, or 16.14%. In total, the stock has spiked by $1.44 from my purchase price of $1.73, to closing at $3.13. That’s an 82.3% move higher in less than seven days of trading!

Allow me to relive last week’s report and what I wrote about concerning FNMA in a January article I penned, entitled, ‘If Trump Wins, FNMA Soars’.

I began the article:

To my way of thinking, if Donald Trump becomes the Republican candidate in the 2016 presidential election, shares of Fannie Mae (FNMA) rise; if Trump wins the presidency, FNMA soars.

Not much has been written about the connection between billionaire real estate magnate Donald Trump’s bid for the presidency and FNMA, but the growing prospect of a President Trump suggests to me a most fortuitous catalyst to unlock the market value of FNMA common shares.

And concluded with:

Simply put: if Donald Trump becomes President of the United States, the implication is that the Republicans will maintain control of both houses of Congress, handing Trump a mandate by the people to square the “mess,” as bank analyst Dick Bove puts it, and restore property rights to Fannie and Freddie shareholders. In which case, a Constitutional slap-down to the Obama Administration’s attempted hijack of a legacy GSE may unlock as much as a $21 per common share value to investors by 2019, according to Bove (one of the best bank analysts on Wall Street). My estimate calculates to $24. Close enough.

In all, it was another good week for the LT Report. Until next time…

Trade Green!

Jason Bond

0 Comments