Good morning!

A week of incredible drama and volatility in markets and the political arena ended with massive gains to those subscribers willing to faith in my price targets for the market bottom following the results of the presidential election.

As I split my attention to the vote count and stock futures, stocks began to drop into the toilet when it became clear that the underdog of the presidential race, Donald Trump, appeared to be on the verge of winning the state of Florida, Ohio, & North Carolina. The win in Ohio implied a win in Pennsylvania, and maybe, just maybe, Michigan. And when I looked at New Hampshire, Dow futures showed more than 600 points in the red. Minutes later, 900+ points in the red.

After I woke up the next morning to discover that Dow futures were trading closer to 300 points down, I reviewed the overnight action during the time I was asleep and noted the lows in stocks.

At 11:05 CST, the DJIA, S&P500 and Nasdaq futures printed the lows of the evening at 17,464, 2,028 and 4,858, respectively.

Here’s what I wrote in the Long-Term Weekly report, two days prior to Election Day.

Target trading ranges for the DJIA of 17,500 – 17,400; 2,030 – 2,050 for the S&P500; and 4,820 – 4,850 for the Nasdaq may not be unreasonable until significant buying comes back into the market.

- DJIA Target: 17,500 – 17,400; Actual: 17,464 – ‘bulls eye’

- S&P500 Target: 2,050 – 2,030; Actual: 2,028 – near ‘bulls eye’

- Nasdaq Target: 4,850 – 4,820; Actual: 4,858 – another near ‘bulls eye’

Folks, did I get it right? That’s an ‘A- or a full A’ in my book. Being two points off the predicted range following a 111-point decline in the S&P is very, very close. Same with the Nasdaq, which had been down by as much as 335 points. I was off by a measly eight points!

So, then, I wrote:

That’s the bad news. The good new is, the possibility of lower price levels I anticipate in stocks may result in better bargains in those stocks already suffering from a deficit of buyers. Watch for some good prices in your favorite trading stocks during the volatility this coming week.

Bingo! That’s when I went big into FNMA, as alerted. I’ll get into that trade at in the second-half of this week’s report. The trade, so far, has been “yuuuge” for my subscriber, and has satisfied me of my quest to provide the utmost value that I can for you. So, when I miss the target next time, resulting, maybe, in a puny loss, call your bank or landlord and get an update on how far in advance your payments/rents have been paid. Okay? 😉

I’m gloating again. But no one seems to mind much when he/she is in the trade with me.

Now, for the two-step lesson learned from this week’s action.

We’ve all just witness a significant and vital lesson about how the media work and how the public is culled at times by the media to one side of a trade, ‘en masse’. With media chanting “Armageddon” for stocks following a Trump win becoming the groupthink trade, I knew there was opportunity here; I just didn’t have a handle on the odds of the event coming to fruition.

I asked myself, “If Trump upsets and everyone (mom-and-pop traders) sells, who will be left to sell?” Answer: no one; all of the selling took place within hours, not weeks or months. The stages that lead to total despair and panic happen within minutes of each other. It’s beautiful, really.

Okay, onto the second step of the lesson.

When analyzing target ranges, place yourself in the shoes of the other potential buyers and not the shoes that necessarily make you most comfortable. Where will professional and ‘smart’ money buy what you perceive is a bargain?

In this case, the target ranges for the three major averages were the levels reached during the ‘Brexit’ vote in June, in my well-informed opinion. Oh, it was Armageddon for the ECB and Eurozone if Britain left the contractual confines of the common market. Right? The euro would collapse, and the next Lehman event would come out of Deutsche Bank; and how ironic that a German bank would be after several years of German pressure exerted onto Greece and Cyprus during their crises. That’s what the media told us, and it was nice touch.

Oh, and lest not forget that the pound was expected to drop to parity with the dollar overnight, they said, as if the ECB would allow too much damage and fulfill its own prophecy, I thought. And by the, while all currencies tanked against the U.S. dollar last week, it was the pound that rallied against the dollar, and partial unwind to the risk-off trade since April.

So, the June lows of the trading range in the U.S. major averages at the ‘Brexit’ lows became my target range. Simple, really; the ranges coincided with longer-term support, and a Trump win didn’t, therefore, suggest another replay of a 1930’s-style Smoot-Hawley Tariff Act becoming law the day after the election. That’s was the media line to mom and pop.

Don’t just take my word this. Did anyone notice how happy Warren Buffett was after the big moves in stocks? He now says Trump is good for stocks, too—after the event; after mom and pop got stopped out and missed the rally. Hmmmm.

“The stock market will be higher 10, 20 and 30 years from now, and it would have been with Hillary [Clinton] and it will be with Trump,” Warren Buffett told CBS Market Watch, who also said that market pundits were “silly” for suggesting a Trump win was bad for stocks.

Why didn’t Buffett say this before the election? Hmmmm again. I guess you get what you pay for—candid talk and after the fact is expensive, not free.

So, after a nearly 2,000-point swing in the Dow, the impact of stock on interest rates was even more stunning.

Talk about Armageddon? This week, the U.S. Treasury market lost more than $1.1 trillion in value, an amount lost not seen since the aftermath of the debt crisis in Cyprus in the early summer months of 2013. Instead of Europe as the epicenter of the rout in the global bond market, this time the quake came from this side of the Atlantic.

At the close of Friday’s trade, the yield on the bellwether 10-year Treasury spiked a massive 36 basis points to close at 2.15%. The two-year U.S. Treasury price got slammed as well, closing higher by 12 basis points to 92 basis points (yields drop inversely to price). The spread between the 10-year and two-year soared 24 basis points to close at 123 basis points, taking out the 52-week with ease.

Folks, there’s been a change in sentiment in the markets! Market participants are now expecting more consumer price inflation and higher interest rates to stick. Stanley Druckenmiller may have been right. Rates have bottom, and may explain Fed Chair Janet Yellen’s speech in Boston on October 14, when she suggested the Fed may want to let the U.S, economy to “run hot.” The Fed is preparing to respond to the market by following interest rates higher.

President-elect Donald Trump has campaigned with a promise of embarking on infrastructure projects, and these projects will be expensive. So, where is the money going to come from? Answer: the issuance of more debt, resulting in pressure toward larger budget deficits and higher interest rates.

More evidence that of a change in sentiment can be gleaned from the dismal performance of the FANG stocks, Facebook (FB), Amazon (AMZN), Netflix (NFLX) and Google (GOOGL). FB down -1.43; AMZN down -2.12%; NFLX down -5.94; and GOOGL down -1.20%. Measure those performances with the DJIA, which spiked 959 points (+5.36%) this week. Defense and basic materials may be catching a bid going forward, while consumer products may not.

And lastly, a quick note about the gold and silver market. Both metals were pounded badly from the risk-off trade. I anticipate a big rebound this week and into the remainder of the year. Word has it that the wholesale market isn’t budging from $1,250, therefore I expect a good rebound in both metals very soon. If I’m right, junior mining stocks may spike higher.

Will the markets continue as they did this coming week? Well, I’m waiting for the extreme market euphoria to wear off soon. We’ll see.

Okay, let’s talk stocks.

This Week’s JBP Stock Ideas

FIREEYE (FEYE)

Shares of FireEye (FEYE) popped again this week, a nice $2.06, or 16.69%. Since the company’s Q3 earnings report on November 3, the share price of FEYE has returned 22%, driven by what appears to me the company’s upbeat guidance. Management increased bottom-line guidance for the year, but decreased guidance for billings and revenue.

I have to admit I was surprised by the magnitude of the guidance, and so was everyone, it appears. When a stock trades very poorly going into earnings, as FEYE did, it’s usually a sign that there is too much trepidation about the results, especially when the stock closes smack on its base of support within hours of the release. Well, FEYE defied the odds. No harm done.

ABOUT FIREEYE (FEYE)

FireEye, Inc. provides cybersecurity solutions for detecting, preventing, analyzing, and resolving cyber-attacks. The company offers vector-specific appliance solutions that provide threat protection from network to endpoint for inbound and outbound network traffic that may contain sensitive information.

Source: Finviz.com

BALLARD POWER SYSTEMS (BLDP)

I added 20,000 BLDP at $2.03. I now own 30,000 at at an average price of $2.16. The thesis, here.

As the chart shows, below, the 200-day moving average is the magnet as BLDP traders wait for a break, including me, of course.

Again, I’m please with the resilience of this stock. Traders come in with force each time the stock drops significantly below its 200-week moving average. And they did again this week. When/if the oil price begins to rally once again, I expect BLDP to follow.

Allow me to remind subscribers of Zacks’ report on Ballard Power because, aside from the stock’s high correlation to the oil price (the price of which dropped $0.66 this week), the fundamentals within the space are strengthening. Zacks writes:

One stock that might be an intriguing choice for investors right now is Ballard Power Systems Inc. BLDP. This is because this security in the Electronic-Miscellaneous Components space is seeing solid earnings estimate revision activity, and is in great company from a Zacks Industry Rank perspective.

This is important because, often times, a rising tide will lift all boats in an industry, as there can be broad trends taking place in a segment that are boosting securities across the board. This is arguably taking place in the Electronic-Miscellaneous Components space as it currently has a Zacks Industry Rank of 68 out of more than 250 industries, suggesting it is well-positioned from this perspective, especially when compared to other segments out there.

Meanwhile Ballard Power is actually looking pretty good on its own too. The firm has seen solid earnings estimate revision activity over the past month, suggesting analysts are becoming a bit more bullish on the firm’s prospects in both the short and long term.

Source: Zack’s Equity Research

There was no news about the company or sector this week; it was a yawn of a week for BLDP among all the action throughout the exchanges.

The weak oil price did nothing for the stock. Let’s see if my hunch is correct about reversals in all markets as the post-election enthusiasm wears off.

ABOUT BALLARD POWER SYSTEMS (BLDP)

Ballard Power Systems Inc. engages in the development and commercialization of proton exchange membrane fuel cells worldwide. It is primarily involved in the design, development, manufacture, sale, and service of fuel cell stacks, modules, and systems for various applications. The company also develops methanol clean energy backup power systems, as well as provides engineering services for various fuel cell applications. Ballard Power Systems Inc. offers its fuel cell products for various applications, including portable power, material handling, and telecom backup power, as well as power product markets of bus and tram applications. Source: Finviz.com

GLU MOBILE (GLUU)

On October 31, I added Glu Mobile (GLUU) to my watch list. GLUU has retraced nearly all of its post-earnings declines, with a nice $0.13 move (+7.10%) this week to break a five-week losing streak.

A worse-than-expected earnings report trashed the stock by -8.04% following the release, and has since broken below key support at $2.00. So far, traders aren’t enthusiastic enough to break GLUU above $2.00, yet. See chart, below. However, on a relative basis, GLUU performed well against both Entertainment Arts (EA), which dropped 3.45% this week, and Zynga (ZNGA), which move higher by 5.86%.

As a reminder of what was said during the earnings conference call, the company announced that Niccolo de Masi is stepping down as CEO and moving to Executive Chairman of the company. Nick Earl, a former-executive at Electronic Arts, will serve as Glu’s new CEO.

Glu also announced it has taken a controlling interest in California-based Crowdstar, the maker of “Covert Fashion,” the game for “the shopping obsessed.”

As I mentioned in the initial discussion of GLUU at the time I add the stock to my Watch List, I’d like to see how the Taylor Swift game does in the first couple of weeks of its debut. As we know, Glu Mobile has had a lot of misses since its blockbuster Kim Kardashian series, so I’m looking for a break in the streak of mediocre releases.

The upside potential is an easy 50% from today’s price, with $3.00, at a minimum, upside attainable from a nice showing from Taylor Swift, especially when taking into account the stock’s short position, which didn’t change from the 16% reported last week, which represents more than 13 days of GLUU’s average daily volume. As I see it, these short are vulnerable.

I’m watching GLUU closely as it approached $2.00, and will notify you of any trade I make in the stock.

ABOUT GLU MOBILE (GLUU)

Glu Mobile Inc. develops, publishes, and markets a portfolio of games for the smartphones and tablet devices users. The company offers free-to-play action, celebrity, sports, and simulation genre mobile games. It creates games based on its own brands, including Contract Killer, Cooking Dash, Deer Hunter, Diner Dash, Eternity Warriors, Frontline Commando, Gun Bros, Heroes of Destiny, Racing Rivals, Tap Sports Baseball, and Tap Sports Football. The company also creates games based on third-party licensed brands, such as Kim Kardashian: Hollywood, Kendall and Kylie, Katy Perry Pop, James Bond: World of Espionage, Mission Impossible: Rogue Nation, and Sniper X With Jason Statham.

LENDINGCLUB (LC)

Shares of LendingClub (LC) rose sharply again this week, following a $0.48 move higher (+9.15%) the week prior. At the close Friday, LC soared $1.01, or +19.69%, on better-than-expected earnings and an announcement of a deal struck with the National Bank of Canada (BOC). The BOC has agreed to be added as a source of capital to LendingClub in the amount of $1.3 billion.

“We dedicated a lot of resources this quarter to supporting banks, as they worked through their complex diligence and regulatory requirements,” LendingClub CEO Scott Sanborn said in the company’s conference call.

Apparently, LendingClub is adding some performance to the talk, though the percent of capital coming from banks to recapitalize the company has dropped to 13% of the aggregate from 26% during the same time period last year.

“While we’ve made incredible progress, there is still work to be done. In the months ahead we are focused on increasing the diversity and resiliency of our funding mix, realigning our resources, and regaining our operating rhythm,” Sandborn said. “Today’s results, along with our new executive team, and the return of banks to our platform, give me confidence as we begin our planning for 2017.”

This comes on the heels of an upgrade from Morgan Stanley on November 3, who upgraded the stock to an “overweight” from “equalweight.” Morgan Stanley also issued a target price of $7.00 for the stock.

I noticed $7.00 happens to also be a huge level of resistance for LC (see chart, below) and the price point from where the stock last traded before the scandal at the company broke.

Lending Club was added to my Watch List last week. The company has been in a turnaround phase following revelations in May that Lending Club CEO, Renaud Leplanche, had sold $22 million of loans to a investment bank, Jefferies, that “did not match the client’s requirements.”

More trouble followed. On May 16, the U.S. Department of Justice served a subpoena for records involving the company’s deal with Jefferies.

In all, LC had lost nearly 12.3% of market capitalization following the scandal, but appears to be recovering nicely from the original loss of market capitalization of approximately 48%.

According to Morgan Stanley, the company told them that competition in the lending business space is weak at a time of robust loan demand, and added that the company’s securitization volumes are presently strong.

In addition, LendingClub has raised interest rates and lending standards to match a rising interest rate market environment and rising default risks during the late stages of the current lending cycle.

ABOUT LENDING CLUB (LC)

LendingClub Corporation, together with its subsidiaries, operates as an online marketplace that connects borrowers and investors in the United States. Its marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, super prime consumer loans, unsecured education and patient finance loans, and unsecured small business loans. The company also offers investors an opportunity to invest in a range of loans based on term and credit characteristics. It serves investors, such as retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, and university endowments.

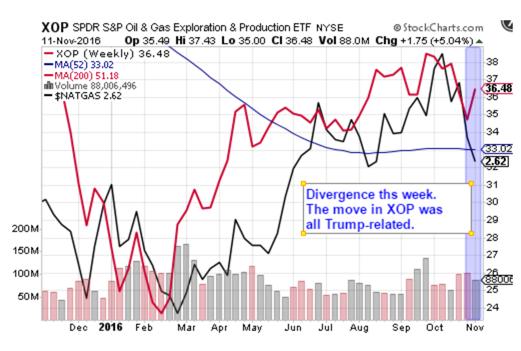

SPDR S&P NATURAL GAS & EXPLORATION AND PRODUCTION ETF (XOP)

As I noted in my alert on November 1, I filled 200 shares at $35.45, and will be looking for $33.00, or a little better, take add to my position. Well, although I would have liked to add to my position at the $33.00 handle following the election, the stock spiked instead, and is quite alright with me.

With a gain of $1.75 (+5.04%) this week, I’m up $1.03 (+2.9%) on the trade, or a couple of hundred bucks. That will pay for my champagne I consumed this weekend while celebrating the nice profits and ‘green’ positions I made this week. Right?

Well, why did XOP drive higher this week? Market Realist explains:

The performances of these ETFs corresponded with Trump’s policy on the energy sector. His policies would firstly mean higher drilling activity in the United States. This would mean more business for oilfield equipment and services (or OFS) companies. The OIH holds OFS companies. It was the top performer among our energy ETFs between November 3 and November 10, 2016.

Higher drilling activity will likely lead to a rise in production, which could drive the revenues of US-based oil and gas companies higher. That’s why XOP also did well this week. Moreover, the recent rally in the broader market also contributed to the upside in the energy sector despite a lack of support from crude oil and natural gas prices.

You know, although Warren Buffett was late with his ‘Trump is good for stocks’ interview on CNBC this week, he was certainly right, in my opinion. During the campaign, Trump was adamant about changing domestic energy policy in the U.S., and traders didn’t miss the opportunity in XOP this week as a result of his win. But I got in the ETF before the crowd this week, fairing a little better.

TWITTER (TWTR)

On November 5, I alert a Call position I took in TWTR.

The ‘play’ at that time (and still) is, as follows:

Technicals are supporting a long position: during the 10 trading sessions prior to the presidential election, when the market continuously sold off, the price level of $17.30 acted as support, at the 200-day moving average. The next level of support is found at $16.75. The daily RSI is in ‘oversold’ territory, and the MACD shows a bullish crossover!

You can play this via shares or options: buying shares in multiple tiers is suggested in this play. After opening a position, any price dip would be an opportunity to add to the position. The first price target is approximately the $20 level, followed by $21.50, and ideally a takeover that includes a decent premium, at approximately the $30 level, would make everyone happy.

Via options, the monthly Call, with an expiry of March ’17, and a strike price of $20 can be bought for $1.40 per contract. Buying 10 Calls limits your loss to $1,400. So far, the open interest of the March ‘17 contract is 40.1k, so you certainly won’t be alone on this trade.

Due to the length of, and detail involved in the report, subscribers may read my entire rational for this play by visiting my website. The title of the report is, ‘Twitter Takeover Play’.

FANNIE MAE (FNMA)

I alerted on November 9, the day after the election, that I bought 20,000 shares of FNMA as a long-term hold at $1.73 per share. Ha…and before I knew what hit me, the stock moonshots $1.00, or 59.47%, for the week.

Why the big move? Well, my faithful long-term subscribers saw this move coming in January, when I wrote an article to the gang about FNMA and what the stock would likely do if Trump became president of the U.S., entitled, ‘If Trump Wins The White House, FNMA Soars’. No equivocation there, folks. Trump wins; FNMA soars. Period.

I began the article:

To my way of thinking, if Donald Trump becomes the Republican candidate in the 2016 presidential election, shares of Fannie Mae (FNMA) rise; if Trump wins the presidency, FNMA soars.

Not much has been written about the connection between billionaire real estate magnate Donald Trump’s bid for the presidency and FNMA, but the growing prospect of a President Trump suggests to me a most fortuitous catalyst to unlock the market value of FNMA common shares.

And concluded with:

Simply put: if Donald Trump becomes President of the United States, the implication is that the Republicans will maintain control of both houses of Congress, handing Trump a mandate by the people to square the “mess,” as bank analyst Dick Bove puts it, and restore property rights to Fannie and Freddie shareholders. In which case, a Constitutional slap-down to the Obama Administration’s attempted hijack of a legacy GSE may unlock as much as a $21 per common share value to investors by 2019, according to Bove (one of the best bank analysts on Wall Street). My estimate calculates to $24. Close enough.

Read the article in its entirety, here.

With my accurate predictions of support for the DJIA, S&P500 and Nasdaq during the post-election volatility and the FNMA trade, I earned my pay this week and for the remainder of the year, the full year, in fact! No?

In all, this was a ‘yuuuge’ week for me and my subscribers. Many of us made some serious ‘dosh’ this week—serious dosh. Okay, so we missed out on LC and FEYE, but this business is akin to baseball; you bat .300, and you get to play in the major leagues. And we’re doing much better than that.

Trade Green!

Jason Bond

0 Comments