Good morning.

Stocks closed slightly down this week after a 200-point rally on Wednesday fizzled to a 41-point drop. Subsequent rallies on Thursday and Friday were also stymied. The action looked ominous this week. But after eight-years of rising stock prices, apparently the ‘algos’ on Wall Street need a strong unexpected ‘convincer’ in the face before a significant correction has a chance of developing.

At the close of Friday’s trade, the DJIA fell 0.03%, the S&P 500 dropped 0.30%, the NASDAQ dropped 0.57%, and the DJTA closed nearly unchanged at -0.13%. The standout and weak sister in this week’s trade was the Russell 2000, which closed down 1.54%. In all, traders probably felt the week may have been worse after Friday’s surprise bombing run in Syria, weak jobs report and FOMC minutes showing some members of the FOMC fear stock prices have overshot.

In the banking sector, the BKX fell 1.24%, led by a goodly-size drop of 4.08% in shares of Deutsche Bank (DB). The BKX has been down four of the past five weeks. And has anyone noticed the 31% drop in DB from the February high of $20.71 in the past six weeks? I have. And it appears DB will eventually need to be bailed out by the Germans. There’s clearly no hope for the bank and the counterparties to the bank’s $47 trillion derivative book without more money printing in Europe.

The VIX was all over the place this week. After hitting 13.59 on Monday, the index crashed as low as 10.90 by Wednesday during the 200-point rally of the DJIA. After the release of the FOMC minutes for the March meeting on Wednesday, the VIX traded much higher and continued to do so for the remainder of the week, closing at 12.87 on Friday, a reading just below its 52-week moving average.

And the McClellan Oscillator (measure of market breadth) dropped to a reading of 43.02, down from last week’s 107 print.

So what happened on Wednesday that plunged the DJIA by almost 250 points? It was the Fed minutes. The text in the Fed minutes of the March FOMC that spooked Wall Street is as follows:

A few participants attributed the recent equity price appreciation to expectations for corporate tax cuts or to increased risk tolerance among investors rather than to expectations of stronger economic growth. Some participants viewed equity prices as quite high relative to standard valuation measures. Some measures of valuations, such as price-to-earnings ratios, rose further above historical norms.

Can anyone remember a time when the Fed discussed stock prices? But then again, and more broadly asked, when did central banks ever buy stocks or non-sovereign debt (aside from Hong Kong’s central bank in 1997-8), as we see today in Japan, EU, Switzerland and the US? Now the Fed talks about stock prices during its meetings, and obviously didn’t remove that part of the discussion. Intentional?

And the observation of the Fed that Wall Street may be bidding up prices with the expectation of coming tax cuts proposed in the new federal budget is also a concern, in that I strongly believe President Trump may experience difficulties achieving tax cuts without more cuts to his present budget proposal demanded by his opposition. The only meaningful cuts that can be made, of course, include entitlement programs and military, the latter of which Trump wants to increase by another $51 billion. And the ‘third rail’ of politics, entitlement programs are not likely to be cut meaningfully without the wrath of voters and an already-hostile Democrat party and anti-Trump Republicans coming down hard.

According to former-budget director for the Reagan administration, David Stockman, and others, due to the extreme divisiveness between the two parties (including factions within his own party) Trump has no chance of getting tax reform passed Congress without commensurate cuts to ‘pay for’ his proposed tax cuts. According to Stockman, Trump has not had, and will not have, a ‘honeymoon’ period during his administration.

What would a failed White House do to the tax-cut rally?

The SKEW closed the week at 132.70, and now trends slightly below its upward-sloping channel that began in early December. This means more traders have removed their hedges when compared with the four-month trend.

And there’s more. Read this article from ZeroHedge.com, entitled, Why Traders Are Now Selling Insurance To Protect Against Volatility: A “Feedback Loop” Theory, and ask yourself: if this strategy spreads, why isn’t this insanity any different from the overexposure in the off-balance sheet derivatives market? In other words, banks are taking one-way bets all over again, anticipating that the central banks won’t ever allow stocks to enter a bear market. It’s insanity, and we’re living it.

How useful is the VIX, now? Let’s stick with the SKEW for any hope of measuring market sentiment from now on.

The Atlanta Fed revised down Q1 GDP to 0.6%. Ouch. With the Fed telling us it’s data-dependent, will this downward revision put a stop to rate rises? Let’s keep an ear glued to the Fed’s comments more intently.

Couple the GDP revision and hard economic data that looks ‘toppy’ to me, I cannot imagine the Fed following through on three more rate hikes this year, unless, of course, then Fed intends to sacrifice the stock market for better handle on its balance sheet. Remember, the Fed lies, so three more rate hikes are definitely not a shoe-in. And, like a cornered animal, who knows how a desperate Fed is likely to maneuver from its impossible position.

The US dollar closed strongly higher this week by 0.90%, with a gain of 0.59% against the euro leading the rise in the USDX. The USDX closed at 101.12, the second-straight weekly gain for the dollar after its successful bounce and rally from the 99 level of two weeks ago. Most of the drop in the euro took place on Friday, as traders skittish about the news of the US military strike on a Syrian airstrip rushed holders of the euro into US dollars.

Remember, it’s the EU who does a lot of business with Russia, not with the US. I’m not sure Brussels is too pleased about this airstrike launched the White House. I feel Trump’s complaint about NATO not holding up its share of military spending included a good reason now, at his hands! Trump may be establishing a good reason for traders to not dump the US dollar hard while he attempts a dollar-negative strategy of ballooning the fiscal budget deficit. It’s an interesting theory of mine.

Speaking of which, while the US dollar rallied against its major rivals this week, gold rallied against the dollar. The dollar-gold price finished the week up 0.49%, while the dollar-silver price dropped a modest $0.10 for the week.

On Friday, the swing in the silver price was quite vicious. After reaching as high as $18.49 at the peak of the Syrian-bombing rally, the price dropped markedly to as low as $17.86 before rallying back above its 200-day moving average to $18.15.

Keep in mind, the net number of short contracts held by commercial traders has reach a record high. So, we either get a downdraft in the silver price as we approach mid-May, or we witness a near-epic short squeeze in the silver pits. Which will it be? Odds favor a ‘no short squeeze’, in my opinion. But, the way silver rallied from the $17.86 low by the close of trading Friday, I’m never too sure when the silver market will break from the bullion bank naked shorting.

The gold price spiked to as high of $1,273.30 following the news of the US strike in Syria on Thursday evening (EST). I thought, maybe, the $1,260 resistance price was cleared for good. However, when NY opened, the precious metal was hit by the bullion banks in the futures market, so I hear (from a good source). But the metal is still knocking at the $1,260 door, closing $6.10 higher for the week at $1,257.30, settling just below its 200-day MA.

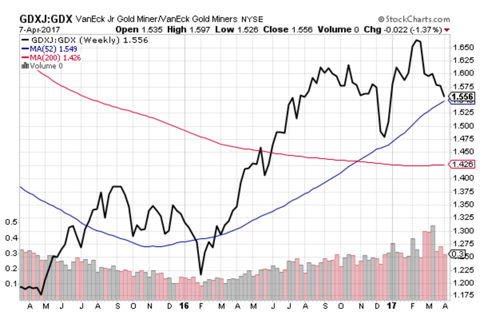

For those precious metals traders among my subscribers, here’s a chart you may want to save and keep updated. The chart, below, is a ratio of the GDXJ (junior gold miners) and the GDX (major gold miners).

I use the GDXJ:GDX ratio as an indicator of sentiment among more sophisticated, risk-taking investors of the precious metals market. As the rate of the GDXJ outpaces the GDX, sentiment is good.

In the oil market, reports this week of Iran planning to increase its oil output by 600,000 barrels per day; oil rig counts rising for the twelfth-straight week; oil production rising in the US; and record stockpiles bloating storage facilities don’t bode well for higher oil prices. But the WTIC price rose this week anyway by another $1.64 per barrel (+3.24%).

Of course, any time there’s military action in the Middle East, oil gets a bid. But, unless tension increase in the region between the US, Russia and Iran from here, oil is a sell. Let’s wait to see if Russia intends to respond (discounting the anticipated media hype) before I buy into this rally.

Some say the missile attack in Syria on Friday was just a political distraction to deflect alleged turmoil in the White House between chief of staff, Stephen Bannon, and 36-year-old Trump son-in-law, Jared Kushner. If the missile attack was not intended to confront Russia, directly, the oil price has little chance of remaining above the $50 level with so much supply stored, being produced and not being consumed rapidly.

My call on an expanding spread in gold and copper is working out, as well as my long call on the US Treasury 10-year (lower rate). Let’s see if the trend continues, as I see the reflation trade struggling for its breath. Watch the copper price for clues to how well the reflation trade is shaping up, or not.

Bottom line is: Dow Theory says to stay long stocks, but also hold negatively correlated assets, or hedge with out-of-the-money puts. Click here for more on this important subject of hedging strategies in the options market for retail investors.

Okay, let’s move on.

My current portfolio: LQMT, CROX, LC, ANGI and GRPN

This Week’s JBP Stock Ideas

There were no trades this week, but I want to devote this section of the report to providing more detail to my thinking about Liquidmetal Technologies (LQMT).

LQMT: My large stake of 100,000 shares of LQMT was inspired by footprints made by this company and to where these footprints are likely to lead. Hint: Liquidmetal new chairman and CEO, Professor Lugee Li (56), has embarked on a new venture and market that’s much bigger and profitable than the present commercial materials market his $661 million company, Dongguan Eontec Co., Ltd., now services. I also hold a position in the Day & Swing newsletter.

The key to understanding the truly massive potential of LQMT must be gleaned by way of following the the company’s footprints. The driving force behind Liquidmetals Technologies is Professor Lugee Li. Essentially, Professor Li is the company, so allow me to tell you what I know about Li.

First, Professor Li spent his college years studying materials engineering, and achieved a Masters degree in the field. He, then, began teaching at colleges and universities throughout China, more than seven, in all.

At the young age of 33-years old, Li founded Dongguan Eontec Co., Ltd., an advanced materials company listed on the Hong Kong stock market as a $661 million enterprise. Since the founding of Dongguan Eontec Co., Ltd. in 1993, Li has sat on at least six boards of directors of companies involved in advanced materials for various commercial markets, primarily the medical devices industry.

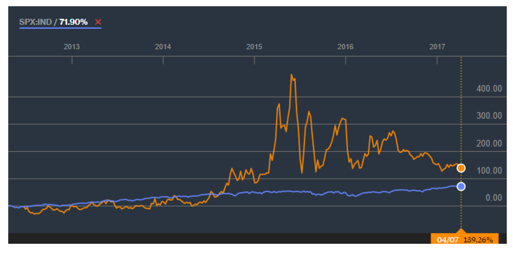

Below, is a chart of the performance comparison between Dongguan Eontec and the S&P 500. The orange line is the stock performance of Dongguan Eontec, and the blue line is the performance of the S&P 500.

From the stock performance of Dongguan Eontec, I surmise that Professor Li is not only an expert on advanced materials, he’s a good businessman, as well, the latter of which is of the most importance to investors of LQMT, of course. At last look, Dongguan Eontec is expect to earn a triple-digit increase in profits this year.

In December of last year, Li gained control of Liquidmetals with a majority stake that cost him approximately $41 million. He raised that cash from liquidating nearly 5% of his holdings of Dongguan Eontec in July 2016. So, it appears that the modus operandi of Professor Li is to take complete control of each of his companies within his budding empire and grow them rapidly.

The major players in the new field of ‘liquid metal’ alloys number only three:

1) Eontech (Liquidmetals): Liquidmetals is a spin-off in 2003 from California Institute of Technology (Caltech) and holder of numerous patents in the field of liquid metals. Essentially, Liquidmetals holds much of the legal power of this technology.

Since the company’s inception in the 1990s, Liquidmetals has sought to commercialize these leading-edge metal alloys, but has been unsuccessful in the past for the principal reason of the high entry price for entering the market. Liquidmetals needed big capital, and Li has now provided it and taken control of the company as part of his Dongguan Eontech business in China.

2) ENGEL, a privately-held Austrian company, founded in 1945, makes specialized manufacturing equipment for the production of advanced materials. At $1.6 billion of annual revenue, this company is the premier maker of industrial machines in the global advanced materials market. But ENGEL is not a direct competitor of Li’s.

3) Materion (MTRN), a publicly-traded company base in Ohio, is in the business of producing specialized materials, a US competitor of Li’s. At a market cap of $702 million, Materion is approximately the same size as Dongguan Eontech, and is a Certified Partner of Liquidmetals’.

Since Professor Li took control of Liquidmetals in December, he hasn’t wasted time positioning the company to service awaiting makers of consumer products and medical equipment. By March 2017, Li bought a manufacturing facility and machinery to begin production of liquid metals components. But the mystery is: who is/will be his customers?

I’ll first begin with the possibility that Li is angling to service the medical device industry, either initially and/or as a longer-term strategy. The number of applications in the medical devices industry for liquid metals is too numerous to address in this small space. And needles to say, the market size is billions of dollars per year of revenue. But I’m not convinced that Li’s fast-moving steps of taking control of Liquidmetals, buying a manufacturing facility and ushering in production machinery within a span of only three months points to a ready customer in the slow-moving medical devices industry.

Which leads me to a much more likely customer: Apple Computer (AAPL). There’s been a lot of speculation as to Liquidmetals’ connection with Apple Computer, and for good reason. Apple is famous for bringing leading-edge consumer products to market first, including products known for their ease of function and beautiful design.

For a good synopsis of the facts that suggest Apple is primed to incorporate liquid metals technologies into its iPhone series, read this well-written and informative article of March 31 on PatentlyApple.com, entitled, Apple Patent Describes using Liquid Metal (Metallic Glass) for the Backside of an iPhone, wherein the author restates the ‘smoking gun’ section of Apple’s application at the US Patent & Trademark Office to register a new patented design of its iPhone, which includes liquid metals as the material of the backside of the device.

The relevant text contained within Apple’s application is as follows:

In some embodiments, the metal substrate may be a metallic glass substrate. In some embodiments, a metallic glass coating is deposited on a metallic glass substrate to form a coated metallic glass. Pulsed radiation is applied to the coated metallic glass to form a metallic glass with altered chemical composition.

Okay, Apple’s iPhone 8 (iPhone X) is anticipated by many analysts to be released no earlier than September of this year. It’s been suggested that the iPhone 8 will feature wireless charging, have no physical buttons, and sport an all-new design. For now, these suggestion are mere speculation, of course. But consider the effectiveness of wireless charging technology is greatly enhanced by removing interference caused by the material used in the device being charged, the urgency to incorporate liquid metals into the iPhone becomes crystal clear to me.

After the information gleaned from Apple’s most recent patent application, the issue of the features slated for future models of the iPhone (after the iPhone 7) may now also include the composition of the backside of the iPhone. Will the backside material of the iPhone 8 include liquid metals? If not, the odds of the next iPhone (after the iPhone 8) featuring these new composite materials for the sake of being able to remotely charge the device soar.

Here’s my bottom line to my thinking behind LQMT. Apple is on the cusp of incorporating liquid metals into its iPhones series. Taking a stake in LQMT now may even be a better buy for traders than waiting to buy some shares after developments surface at Apple and/or Liquidmetals at a later time.

But one thing I know, Apple and Swatch (VTX: UHR) have licensing agreements with Liquidmetals. Apple’s agreement includes exclusive rights to all patents for the consumer electronics markets through February 5, 2016.

Does the picture now become more clear? Apple has aligned its ducks with Liquidmetals as far back as 2010, as to establish and protect competitive advantages that Apple has always enjoyed in the mobile device and other markets.

If traders wait too long, LQMT may become merely a good play (or bad play), not a potential ‘jackpot’ play. I’m holding now for the distinct possibility of a jackpot play of at least 10-times my investment, not just hoping for the possibility of a two-bagger play. Just the speculation and hype surrounding the latest revelation that Apple plans to use liquid metals, alone, is worth the price of admission.

MY WATCH LIST

Fannie Mae (FNMA)

After the Trump victory in November, shares of Fannie Mae (FNMA) soared to as high as $5.00, from $1.65, an amazing move for only 16 days of trading. At that time, Trump was viewed as a pro-investor president, likely to nominate a treasury secretary who would take sides with investors.

Optimism and profit-taking held FNMA within a large trading range of $3.50 and $4.50, until February 21, the date the U.S. Court of Appeals ruled that investors have no standing to sue the Federal Housing Financing Agency (FHFA). On the news, the stock plunged to $2.71, from the opening price on February 21 of $4.18 per share.

So, what now?

Well, according to Height Securities analyst Edwin Groshans, further appeals are the only course left for investors, unless FNMA investors would like to wait as much as an estimated 11 years, according to Groshans, to recoup Fannie Mae’s value through earnings.

However, if suitors take their case against the FHFA, a successful ruling for the plaintiffs would realize “instant value,” according Groshans.

“It is our view that despite the string of court losses, legal action is the path that has the best chance of monetizing GSE preferred shareholder investments,” Groshans told Benzinga.

I agree with Groshians’ assessment. What else can investors do? The court system is the only way to go, as I see it.

I’ve add FNMA to my Watch List because of the risk/reward profile of the stock. Famed investor, Bill Ackman, of Pershing Square Capital Management estimates FNMA to be worth as much as $47 per share, if the plaintiffs prevail in the courts.

I have no problems with Ackman’s estimate. All I know is: FNMA is a clear double-digit stock price, when/if the value is released to investors and not retained by the FHFA.

Until next time…

Trade Wise and Green!

Jason Bond

0 Comments