Stocks are experiencing a taste of volatility today… as all three major indices are pointing lower. The beauty of being a trader is that every day you wake up to opportunities. Some days will be better than others… but if you’re trading a strategy with an edge… over time you’ll have a positive expectancy.

I’ve doubled my trading account (and then some) in 2019…

…basically by trading penny stocks and using three simple chart patterns.

I teach my clients how to trade the same setups but that’s not all I teach. For example, some of my most important lessons are teaching traders how to:

Scan for new trading ideas

Put together a watchlist

Size a trade according to your risk tolerance

How to manage a trade

How to set targets for profit taking (and cutting losses)

In other words, I’ll teach you how to become a proper trader.

You see… if you can learn those skills… you can apply them to other forms of trading too.

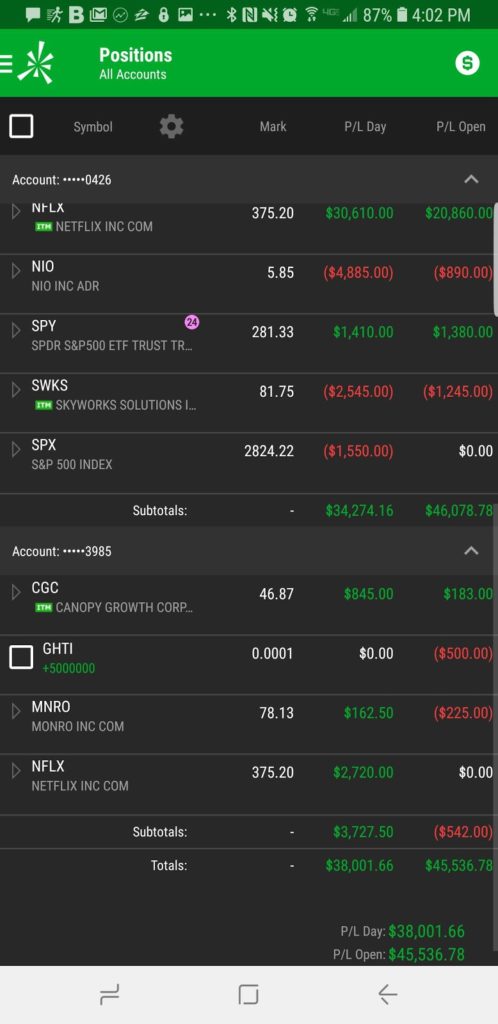

For example, one of my rising star students (also a mentor in Millionaire Roadmap), Nathan Bear, is crushing it this year with over $250K in profits.

Heck, earlier this week he posted some monster gains…

(Nathan Bear is one of the top option traders I know, you can follow him live at Millionaire Roadmap)

The really cool thing about Nathan’s trading is it’s different from mine. In other words, Millionaire Roadmap clients get exposed to another millionaire trader with a winning strategy.

Now, one of Nathan’s favorite trade setups is called the TTM Squeeze. In fact, he credits some of his biggest winners this year to it…

There are two ways to get bigger as a trader 1) increase your trading size 2) add more winning strategies to what you’re currently doing.

That said, if you’d like to learn more about how TTM Squeeze works, read on in his own words.

Momentum Indicators – TTM Squeeze

In Nathan Bear’s own words

There’s one indicator out there that I like to use, and it’s known as the “TTM Squeeze”. Once you understand this indicator, it becomes really easy to use.

Now, don’t worry if you don’t know any of these terms mean… I actually go over them in multiple videos, which Millionaire Roadmap clients have access to.

This indicator allows us to identify periods of consolidation in the market and identify momentum plays. Additionally, it helps to “forecast” the direction of the move. There are three components to this indicator:

1. Bollinger Bands

2. Keltner Channel

3. Zero line

It might sound like a lot… but there’s only one thing we really care about: that’s the zero line and what happens around it. If the indicator goes above the zero line, it indicates a long play… and I’ll look to call options for that. On the other hand, if the indicator goes below the zero line, it indicates negative momentum and the stock might fall.

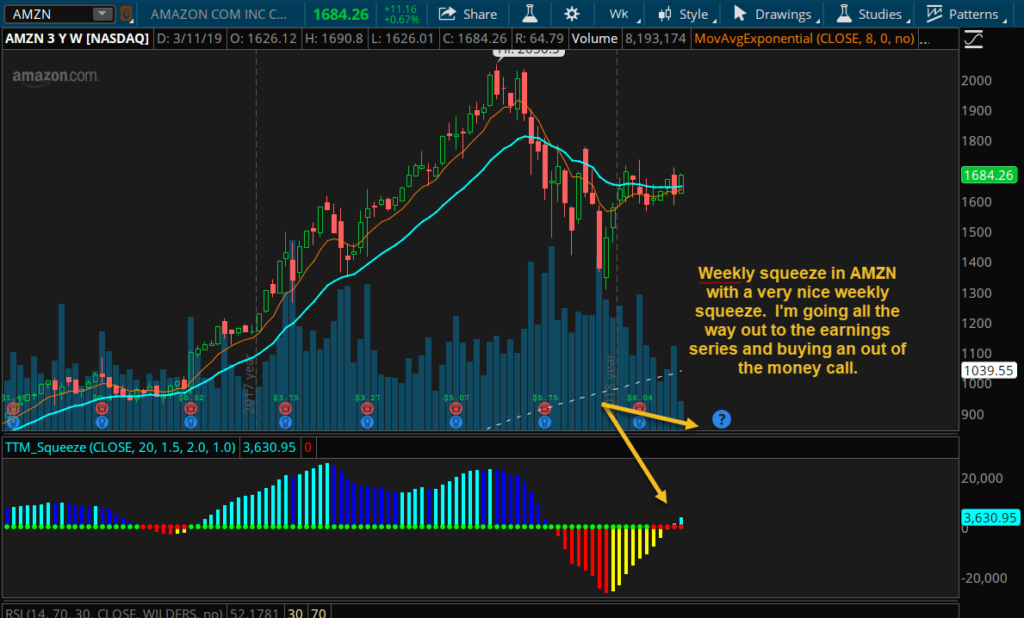

For example, here’s a look at the TTM Squeeze indicator on the weekly chart on Amazon.com (AMZN).

Notice the annotations above. You can see a bar breaking above the zero line. That tells us AMZN could continue higher. Now, I really liked this price action on the weekly chart in AMZN. However, AMZN options are really expensive.

When options are expensive, you need a little bit of creativity. So what I did was go way out of the money, and bought the weekly option series so that we should get a rise in implied volatility. That said, the options premium should hold up well.

Now, just around a week after I got into that trade, those calls were up 250%, as AMZN got a nice move higher and is trading around the $1800 level currently. (The calls I bought expire on April 26 with a strike price of $1900).

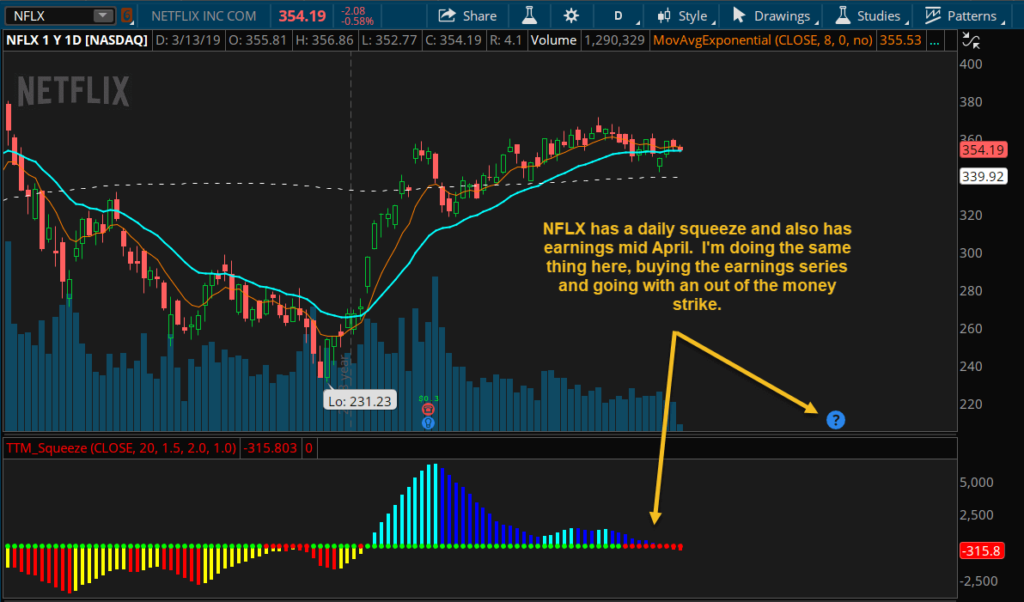

Moving on. Here’s another look at an example of an options trade in Netflix (NFLX) using the TTM Squeeze indicator. Keep in mind, this is a daily chart.

Again, it’s a similar trade with AMZN. However, this time I was anticipating the “squeeze” and a break above the zero line. With the AMZN trade, it actually was above the zero line when I got in.

Basically, I was anticipating for a move above the zero line, which it did… as shown in this daily chart on NFLX.

That’s all for now. If you want to learn more about this indicator and live updates on my positions, and more…

0 Comments