U.S. stock-index futures edged higher in choppy trade Tuesday, a day after Standard & Poor’s Ratings Service put the ratings of 15 euro-zone countries on negative watch amid worries over the region’s debt crisis. Meanwhile, investors will pay close attention to developments surrounding a summit meeting of European Union leaders Thursday and Friday in Brussels. Equities had initially received a boost Monday after French President Nicolas Sarkozy and German Chancellor Angela Merkel outlined a call for a new treaty to enshrine budget rules and impose sanctions on countries that violate deficit limits.

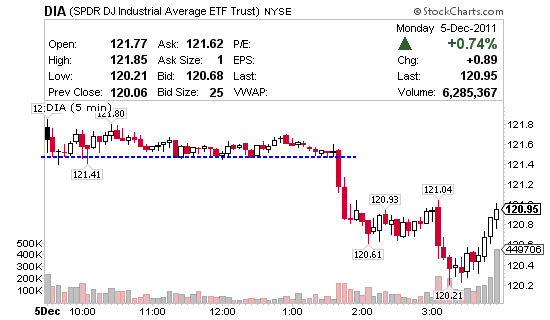

You can see how the market was holding gains and trading sideways but then fell off just before 2 p.m. EST which is why I didn’t pick up any additional swing trades. Swing trading in choppy markets isn’t easy i.e. November, so sometimes the best move is no move at all. This is an ETF that represents the Dow Jones Industrial Average 5 minute 1 day from Monday. So anyway I’m not fearful of trading here, just cautious is all.

Regarding the portfolio…

LOCM – took 1/2 my position off the table yesterday when it didn’t hold $2.40 which is the pivot point. Here is a video I just did on LOCM this morning. Goal is still $2.70 – $3.00 but I won’t let my profit slip away either if it can’t break $2.40 this week.

THQI – solid 1-day 5% but I’d like 10% and hope to get at least $1.90’s before selling. Chart is still in play so I’m feeling good here but if the market rolls THQI will give up ground so I’ll look to lock it in. Remember, stocks move with direct and indirect forces and you must respect both. $1,000 in the pocket in 1-day is good money if you ask me.

HKN – big spread but it’s still holding it’s range so I stick with the trade. $2.60 is my mental stop and $3 – $4 is my price target. Ledbed stopping touting it which doesn’t help but I still think he will come back to it once shorts load up. We’ll see if I’m right.

USAT – finally, FINALLY moved up off support Monday on news they confirmed their CEO. This stock can flat out fly if volume hits it so I was very happy to see it move Monday. With a new CEO in place don’t be shocked to see some positive press coming out of the company soon which could take me green on the trade. Goal is $1.60 here with a stop below $1.00.

Newsletter updates – as I said months ago, the goal with JasonBondPicks was to offer 3 newletters in 1 – long, swing and day trading.

Phase 1, the swing trading newsletter is in place and going great.

Phase 2 is the day trading newsletter which will be offered as a separate product and a higher price point. If you like day trading (5-10 big position trades a day) and want to hang in a chat only for subscribers then this will be for you. This system will not have Skype, text or email alerts. Just big positions in chat in which I’ll be putting portfolio money in the trades with subscribers. An example of how I’d trade this system would be shorting 20,000 BAC at $5.77 when bad news on banks hits the wires with a goal of $.05 – $.10 per share profit in 10 minutes or $1,000 – $2,000 etc. It’ll be buy and short focused. Essentially it’s large position momentum trading using market forces and technical analysis to make quick and big gains.

Hi Jason,

I am a new subscriber to your service, with high hopes! I just opened an E*Trade account and downloaded Pro-Elite platform, because I know that’s what you use in your classes, and I want to learn it. Could you send me an idea of how your screen is set up? I have a big new screen that should be perfect. I’m coming from Schwab Street Smart Edge. Thanks for any help you can give me! Blue Skies, Mary

Hi Mary. High hopes are good and I have them daily myself so you’re in the right place. Some days are better than others but so long as we win more than we lose we’ll get there. Etrade Pro is a must, good job! I used to have Street Smart Pro way back in 2004-2006 if my memory serves me correct, you’ll like Etrade much, much better. Regarding setup, can you make it to class and I can show you? If not I’ll do a video on it, just let me know. Thanks again… Jason.