Man, has it been a wild market… the S&P 500 ETF (SPY) finished Monday higher by nearly 7%, and today, stocks are looking to extend those gains.

It seems as if the coronavirus cases may be starting to peak, and traders may be thinking everything returns to normalcy very soon. Who knows what’ll happen…

If you missed out on this rebound, don’t beat yourself up because this is a tough market environment even for seasoned veterans. However, I believe there are some ways to improve my trading performance, such as focusing on what’s working right now.

For the most part, I’ve stuck with momentum trades, and options play with my Weekly Windfalls strategy — and it’s worked out for me, as I locked in about $14K in profits so far this week across all my services.

At these levels, I believe there will be more momentum trading opportunities for me to hunt down, as well as options trades for me to take advantage of.

In order to help as many people as I possibly can, I wanted to provide a teachable moment in a momentum trade in Penn National Gaming (PENN) — something I only send to my subscribers (typically).

So how did I spot the move higher in PENN and lock in $3,050 in profits?

[Revealed] How I Uncovered A $3,050 Winner In PENN

On a morning when the Nasdaq was up about 3%, it’s easy to think every stock must be up. Of course, it’s easy to think that the base hit win on PENN is no big deal… and many traders probably wondered, “What stock isn’t up 5-10% this morning?”

But that’s not reality and here are some facts to back me up.

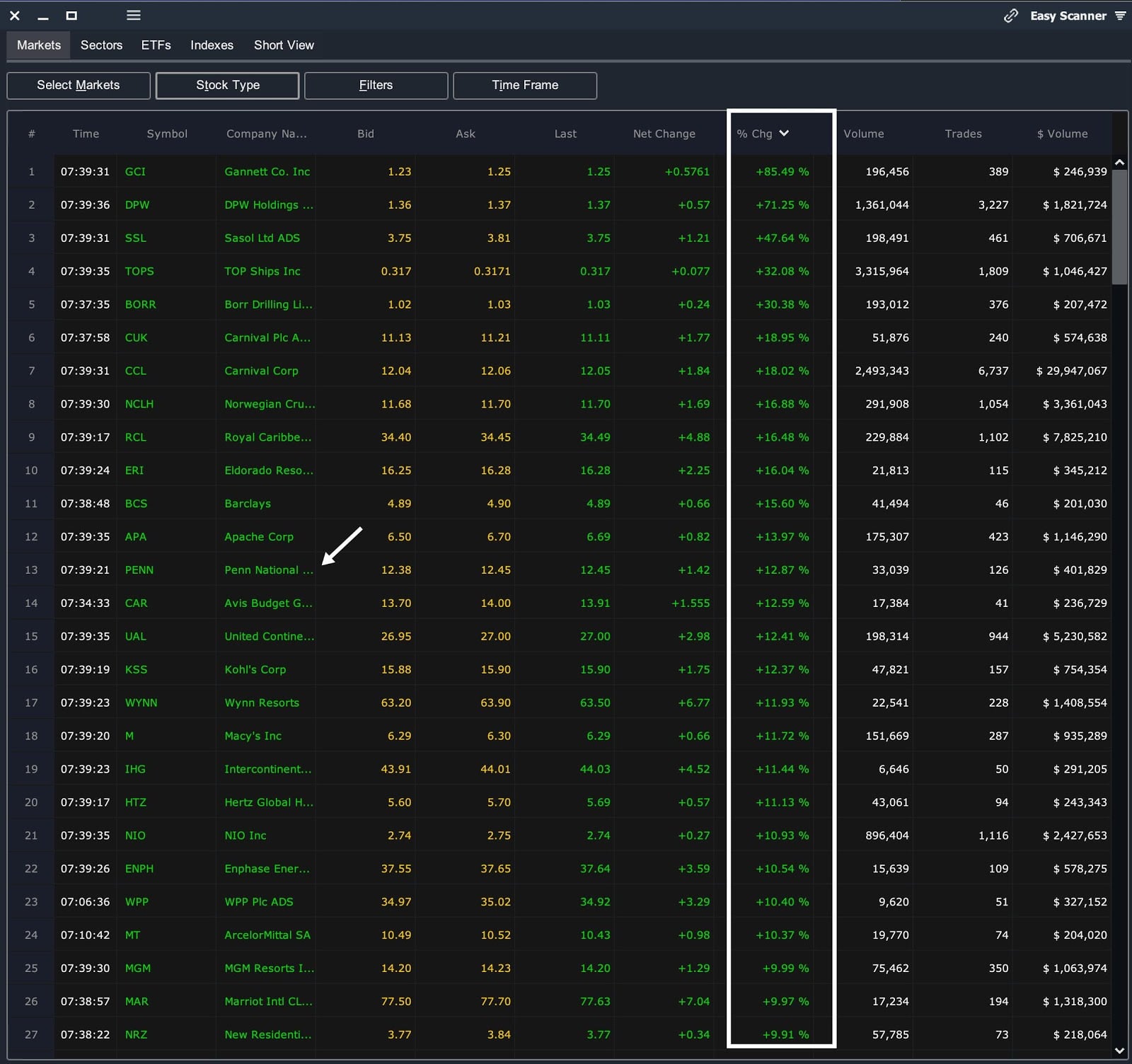

The screenshot of the scanner below and more importantly, in this case, my master watch list, as that’s where the PENN idea came from, illustrates my point.

This morning at 7:33 a.m. ET, there were about 206 stocks with a minimum of $200,000 in liquidity. PENN, as you can see, was #13 on all of Wall Street.

Source: Scanz Technologies Inc.

Yesterday, when I bought shares of PENN, the liquidity scanner was set to $2,000,000 minimum and there were over 3,100 stocks to choose from.

And it’s not uncommon for my ideas to be in the top 10.

You see by using the scanner and my patterns fish hook and rockets, I’m able to track which stock has the juiciest average true range (ATR), highest Beta and volatility.

Thereafter, if my patterns hold true, they tend to deliver. I’m not trying to be a hero and pull in monster winners, I’m really just focused on base hits. There are some mornings when I get lucky and I’m at the top of the board, but most of the time it’s 5%, 10% or 20% wins.

The lesson illustrates how I narrow down possibilities to increase the probability, after all, isn’t that what a strategy is, having an edge in the market?

I want to break this down into the four steps I took to spot this winner.

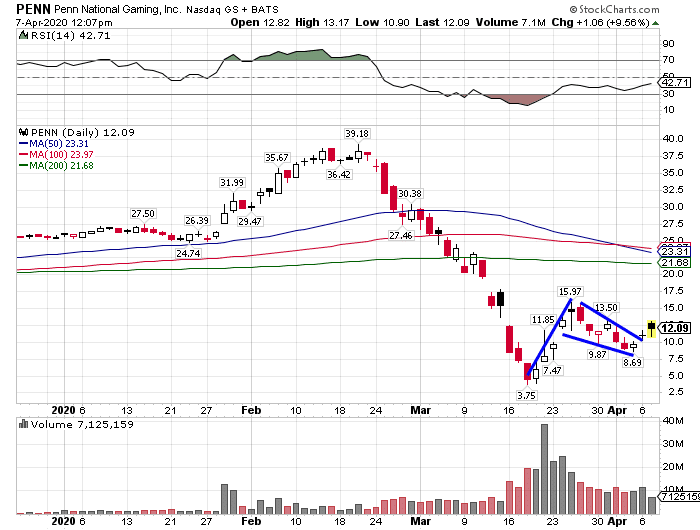

Step 1. Find PENN on scanner 3-weeks ago

Step 2. Add it to master watch list since the stock dropped from about the $40 area to $3 range

Step 3. Monitor for fish hook and trade it

Step 4. Monitor for continuation pattern and trade it

Prior to PENN crashing from $40 to $3’s I don’t think I’ve ever traded it. But once I do trade stocks I’ve never traded before and made money in them, they stay in my wheelhouse until my patterns are no longer relevant.

The pattern that got me into PENN was the one you see below, the bull flag/bull pennant.

This is how I consistently narrow down a field of stocks from 5,000-6,000 down (overall market) to 3,000 (>$2M liquidity) down to 100 (sorted by % gain) down to a watch list (fish hooks or rockets) down to actual trades.

If you want to learn more about my strategy and how I hunt down momentum, then you’ll want to take advantage of this exclusive offer.

Also, for a limited time only, I’m providing my brand new eBook Wall St. Bookie absolutely FREE. Find out how I’m stacking the odds to my favor in this market environment!

0 Comments