If you want to be an effective trader who consistently rakes in profits… the best way to go about that is by keeping your strategy simple.

I know, I know… it’s a little backward when you see the so-called quants and algorithms trading hundreds of times a day.

The thing is, when we’ve got so many variables, it actually gets hard for the everyday trader to filter out the noise and find the “perfect” setups.

For me, I like to focus on a handful of setups.

For example, my small-cap momentum trading strategy only focuses on 3 patterns… but I’ve actually taken it a step further and turned to the options market — solely focusing on the “casino strategy”.

You see, by just focusing on my Weekly Windfalls strategy, I can relax and not be concerned with wild swings… and best of all, I don’t have to dissect what the overall market is doing.

Not only that, but the strategy increases my odds of success and allows me to assess my risk-reward so I know how to properly size my bets — I’m equipped with the ability to “set it and forget it”.

So how can you keep your trading simple with Weekly Windfalls, while improving your win rate and minimizing your losses?

This Simple Yet Powerful Strategy Improves Your Success Rate

If you think trading options is difficult… you’re seriously mistaken.

Sure, you could combine different options and create some pretty complex strategies… but I’ve actually uncovered a way that simplifies options trading, and best of all you don’t really need to do much.

All you really have to do is place the trade… and it just takes a few minutes a day.

So what’s this strategy?

Well, it involves selling options to collect premium.

If you know anything about options trading, I know what you’re thinking…

Jason, isn’t selling options extremely risky?

Yes, and no.

Of course, if you sell naked options (just selling calls or puts), your trading account could get damaged.

I’m actually selling options spreads.

Basically, this allows me to have an insurance policy in place, in case things get sour. However, since most options expire worthless, this strategy is often referred to as the “casino strategy” because it’s got such a high win rate.

All I really look for is a key level and look at the overall trend… if I see a specific setup, I’ll either look to bet the stock will stay below (or above) a specific price.

The Bulletproof Options Trading Strategy

Let me show you how easy it is to use my Weekly Windfalls strategy.

Take a look at the daily chart in Netflix Inc. (NFLX).

If you look at the daily chart above, it’s pretty difficult to buy the stock.

NFLX is pretty volatile and it’s got a wide bid-ask spread… and a small move could get you stopped out.

Not only that, but buying or shorting shares of NFLX will require a massive capital outlay.

Just think if you were to buy 500 shares of NFLX… that would cost you more than $150K.

The solution: trade options.

More specifically, sell options spreads.

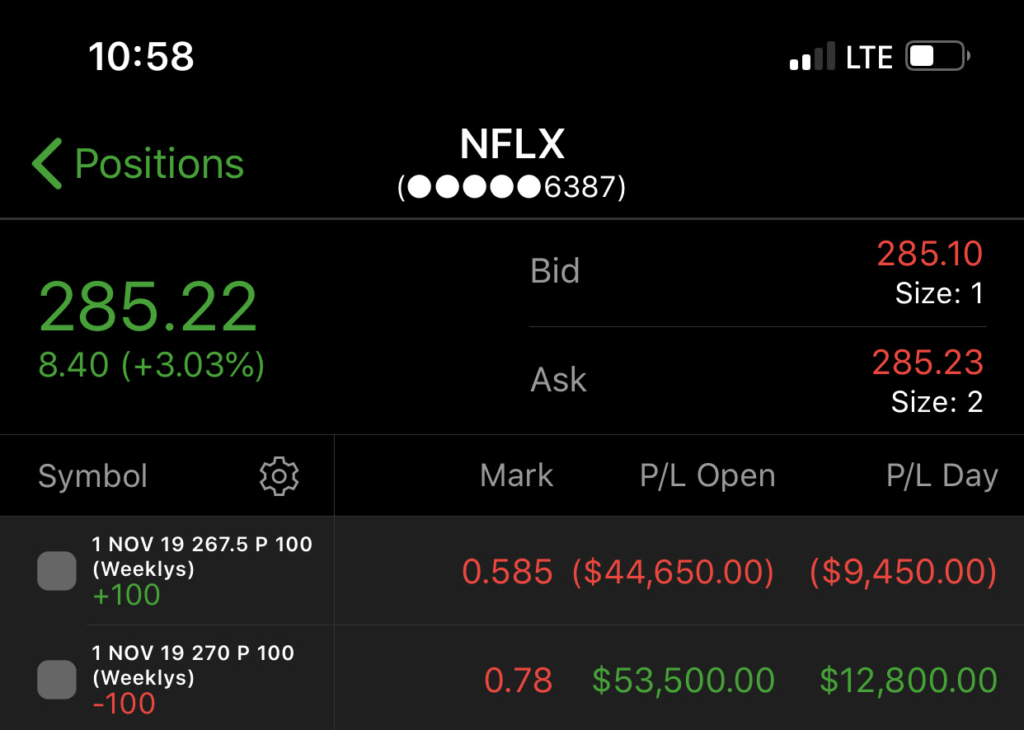

For example, I was actually bullish on NFLX — it had a nice rounding bottom, and I figured it could stay above $270… so I decided to sell put spreads.

That meant whoever was buying from me was actually bearish on the momentum stock… and I was bullish on it.

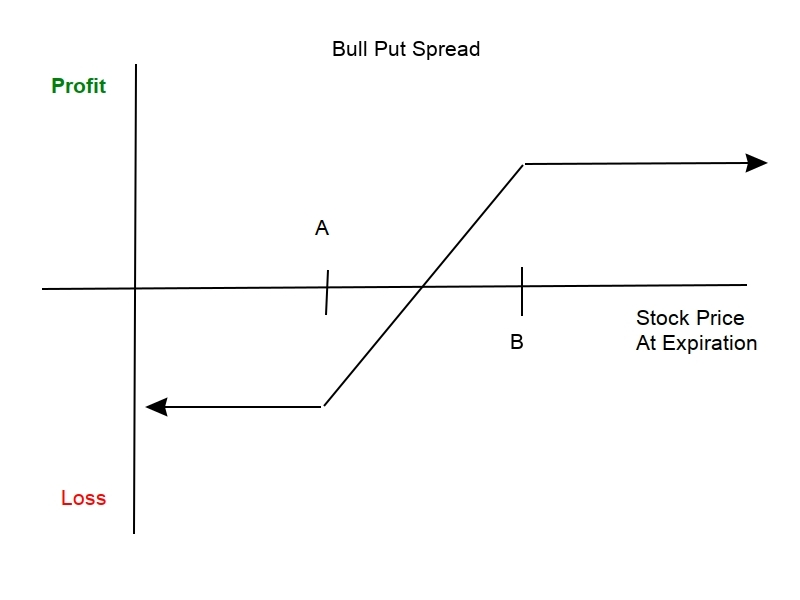

If you look at the profit and loss (PnL) diagram of the short put spread strategy… you’ll notice your risk and profits are defined — no real surprises.

That way, if you’re comfortable with your risk-reward, you could potentially place the trade and go about your everyday schedule.

Here’s how I would make money in the trade:

- If NFLX explodes, I’d get to my maximum profit very fast.

- If the stock drops slightly… I could still make money.

- If NFLX trades between a tight range, I could still collect a bulk of the options premium.

When you enter a bull put spread, all you need the stock to do is stay above the price at which you sold the options (in my case it’s $270).

I figured NFLX would grind higher and stay above that level… and boy was I right…

You’re probably wondering, Jason is this hard to learn?

Not at all!

In fact, a Marine Corps. Reserve Officer changed his luck after he switched from buying options to selling options premium… just like me.

“Buying options did not work for me, so I got away from trading for a little while…” ~ Elijah Gonzalez

But he found Weekly Windfalls, and made some simple tweaks… he was able to achieve a 95.65% win rate in a short period… and had a nice little streak going.

If you need a little bit of Monday morning inspiration, check out this short clip Elijah was so kind to make with his busy schedule… and see how he simplified his trading turned it all around.

0 Comments