See time stamp above – POSTED Friday 12/13/13 – I’m ashamed, such a scam!

With 2-weeks to go in 2013 the portfolio is +72% +$230,370 compared to the S&P 500 +24%. Going into the end of the year I’m preparing for the January Effect.

January 2013 the portfolio was +8.3%, much of which came from a report just like the one you see below. If you’d like my real-time trade alerts on the stocks JOIN NOW.

I’ve identified 7 stocks under $10 that are beaten up at the end of this year for the January Effect. We’ve hit some home runs in January off this list and you don’t want to miss it. I’ll end up buying and alerting many of the stocks no later than the last week of December.

Definition of ‘January Effect’ – A general increase in stock prices during the month of January. This rally is generally attributed to an increase in buying, which follows the drop in price that typically happens in December when investors, seeking to create tax losses to offset capital gains, prompt a sell-off.

Jason Bond’s definition of ‘January Effect’ – The GOOD small caps will get bought by funds in January… let me emphasize this is only for the GOOD small caps. The bad ones suck and no funds will be buying them! People think every small cap will be a winner… fact is that if it is a crappy one, no one will be buying it anytime of the year. Here’s my list right now for 2014 and make sure you understand this is a flexible game plan likely to change slightly in the month of December.

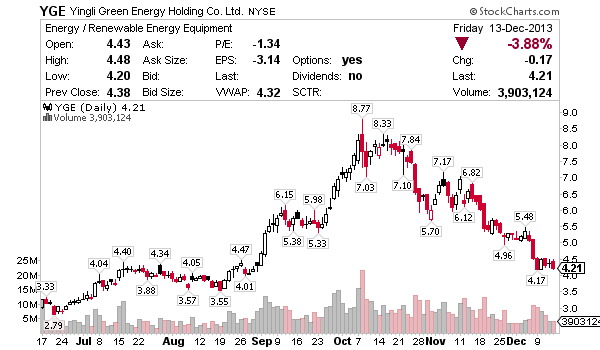

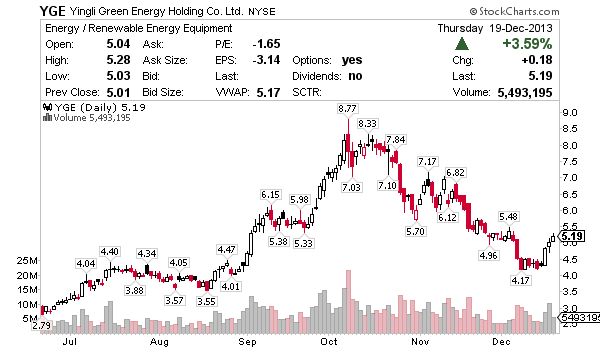

Yingli Green Energy Holding (NYSE: YGE)

- Jan. 2, 2013 – $2.47

- Dec. 12, 2013 – $4.38

- YTD: +77.3%

- Float: 104.22 million shares

- Institutional holdings: 17.60%

- Short Sales (% of float): 21%

Reports of projected year-over-year declines for 2014 in solar modules orders in the People’s Republic of China triggered selling of the stock during the fourth quarter. But, many investors overlook the fact of Yingli Green’s already-existing pipeline of 500MW scheduled for completion, in part, during 2014. Moreover, earlier this year, the company signed a 3GW solar project development agreement with Yunnan province (slated as one the largest deals ever for the industry), which, if completed, will most likely increase operating margins radically as the benefit of economies of scale works its way to the bottom line. Overall, YGE’s 51% drop in share price since Oct. 8 appears headline driven (and a healthy dose of overreaction and negative speculation), resulting in knee-jerk wholesale selling of anything in the solar space irrespective of the particularities of the solar companies targeted by short sellers.

Disclosure: I am long YGE

BEFORE

AFTER +23%

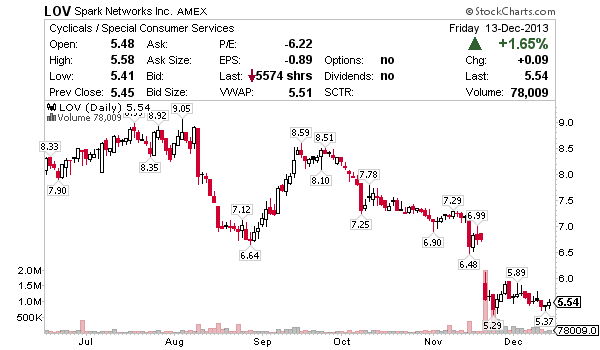

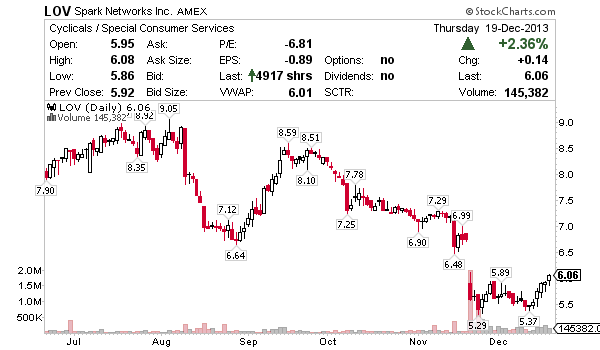

Spark Networks (NYSE: LOV)

- Jan. 2, 2013 – $7.77

- Dec. 12, 2013 – $5.45

- YTD: -29.8%

- Float: 14.0 million shares

- Institutional holdings: 30.2%

- Short Sales (% of float): 5.6%

A $2.6 million GAAP loss in Q3 reported on Nov. 13 disappointed investors, sending LOV to a six-day rout of 24.1% (to a share price of $5.39 from $7.10 a week earlier). Underlying the 9% year-over-year revenue growth was the company’s Christian Networks (faith-based Internet dating service) segment, which posted a revenue increase of 19% year-over-year and expanded its subscriber base by 27% year-over-year. As the segment with a better potential than its much smaller Jewish dating segment, the company plans to boost its market presence of its website ChristianMingle.com to capitalize on its leadership within the sector. Contribution margins from subscribers exceed 85%, and should expand as it scales its subscriber base and benefits from a growing awareness from a untapped and mostly unchallenged marketplace.

BEFORE

AFTER +9%

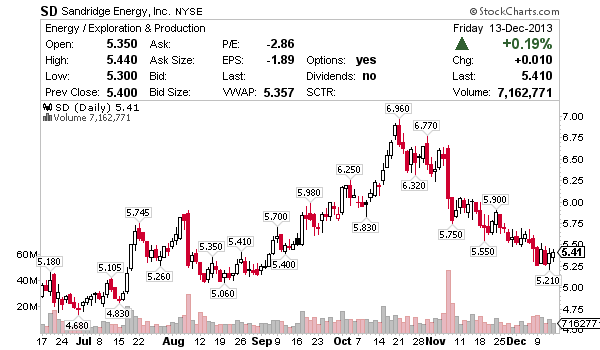

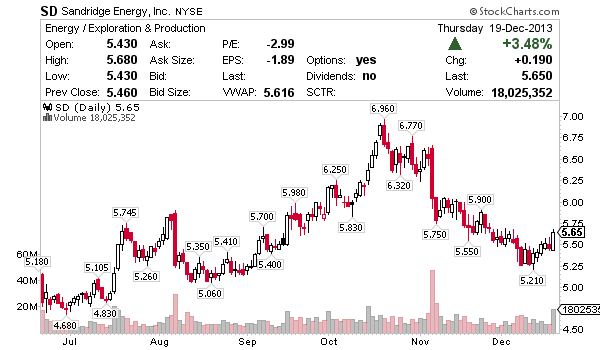

SandRidge Energy (NYSE: SD)

- Jan. 2, 2013 – $6.48

- Dec. 12, 2013 – $5.40

- YTD: -16.6%

- Float: 311.5 million shares

- Institutional holdings: 61.3%

- Short Sales (% of float): 15.9%

A lavishly spending CEO with a poor operating performance weighed heavily on the shares of SandRidge throughout the first half of 2013. As the big oil and gas player in the Mississippian Lime (Kansas), SandRidge did not convert its success and revenue to the bottom line. The result was: SD shares sank, from the $7 level at the start of 2013, to south of $5, before the company’s board of directors had had enough of the squandered opportunity to greatly enhance shareholder value. In June, founder and CEO Tom Ward was fired and replaced with James Bennett as the new CEO. Within one quarter, general administrative costs dropped by 28%, a $56 million run rate, or 11.6 cents per share (against a $5.50 share price)., which serves an an example of the poorly-run operation. Under Bennett, additional cost-cutting and revenue enhancing measures are clearly in the works, and should provide investors with more upside in the share price. SD could be a 2014 short-covering sleeper catalyzed by a dramatic change in culture and performance at the company.

Disclosure: I am long SD

BEFORE

AFTER +5%

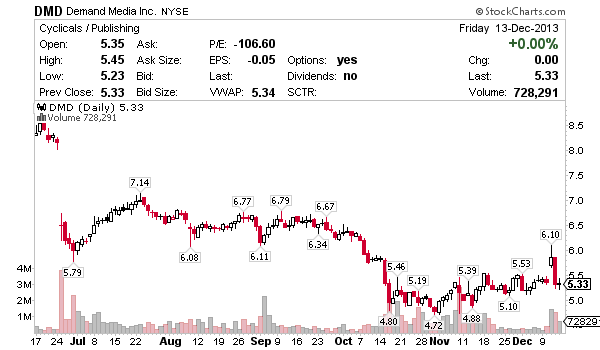

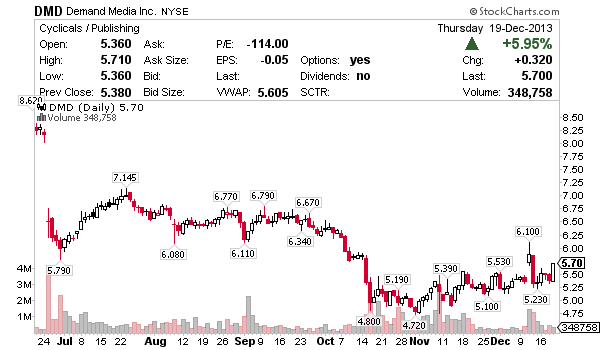

Demand Media (NYSE: DMD)

- Jan. 2, 2013 – $9.72

- Dec. 12, 2013 – $5.33

- YTD: -45.2%

- Float: 42.2 million shares

- Institutional holdings: 40.4%

- Short Sales (% of float): 3.8%

Demand Media’s problems stem primarily from Google’s changed search engine algorithm, creating a shortfall in advertising revenue and a rise in cost of deriving that revenue. As a result, Wall Street punished the stock to the $5 – 6$ trading range, from the $8 – $9 range level reached in June. The company has responded quickly by splitting the company into two operating entities, ‘Demand Media’, to run the ecommerce and digital content, and ‘Rightside’, to sell domain services. In addition, DMD recently acquired ‘Society6’, an artist-driven ecommerce business. These two development are expected to put revenue and gross margin back on track in 2014.

BEFORE

AFTER +7%

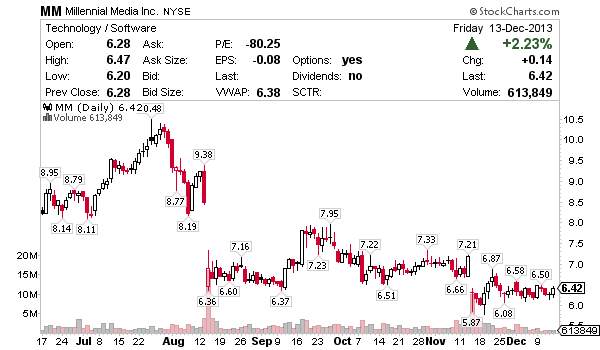

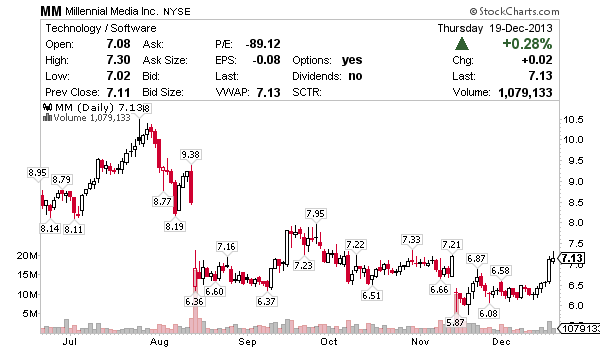

Millennial Media (NYSE: MM)

- Jan. 2, 2013 – $13.04

- Dec. 12, 2013 – $6.28

- YTD: -51.8%

- Float: 32.7 million shares

- Institutional holdings: 78.1%

- Short Sales (% of float): 29.3%

With the ad tech business simultaneously attracting heavy competition along with an ongoing paradigm shift in the sector toward mobile and programmatic-based advertising, Millennial was caught temporarily asleep in the shuffle. Revenue stagnated; it’s bottom line still negative for the third-straight quarter despite a 77.3% revenue growth for the sector. Google (GOOG), Apple (AAPL), Facebook (FB) and Twitter (TWTR) compete to attract developers and brand advertisers within the ad tech space. However, with the merger of Jumptap in November, the potential for developing the premier programmatic-based buying platform for mobile has turned Millennial from a slow-poke to world-class contender. The combined market share of both companies in the 3rd-party mobile market now rivals Google’s share, giving Millennial both a good start in market share, visibility and execution with its state-of-the-art platform. Additionally, in the works for Millennial includes the capability of offering services that reach a potential 50 million users of smartphones, tablets and desktops. At $6 per share, investors haven’t realized yet that the new Millennial offers a much better shareholder value than the $8.50 share price of June.

BEFORE

AFTER +11%

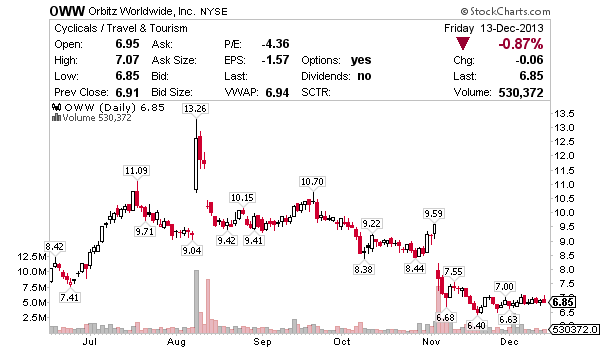

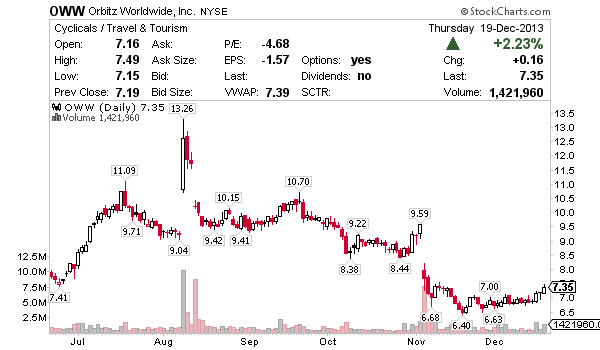

Orbitz Worldwide (NYSE: OWW)

- Jan. 2, 2013 – $2.88

- Dec. 12, 2013 – $6.91

- YTD: 140.0%

- Float: 90.0 million shares

- Institutional holdings: 43.4%

- Short Sales (% of float): 17.8%

On Nov. 5, after reporting a miss of 2 cents per share earnings for the third quarter, shares of Orbitz were slammed 19.7% to $7.69 per share in active trading. Since then, the stock has continued to languish, not recovering much from the low of $6.40 during the subsequent six-week sell off. The company cited lower booking for flights and depressed margins from its new ‘Orbucks’ loyalty rewards program for both flight and hotel bookings. Moreover, fourth-quarter guidance included a full-year revenue forecast of $840 million. Analysts expected $849.4 million. The upside is management’s expectation for a positive impact on longer-term revenue growth rates as customers learn of the Orbucks reward program. If Orbucks succeeds as management expects, the stock could easily retrace its loses, as management demonstrates its ability to respond to a chink in its previous stellar performance.

BEFORE

AFTER +8%

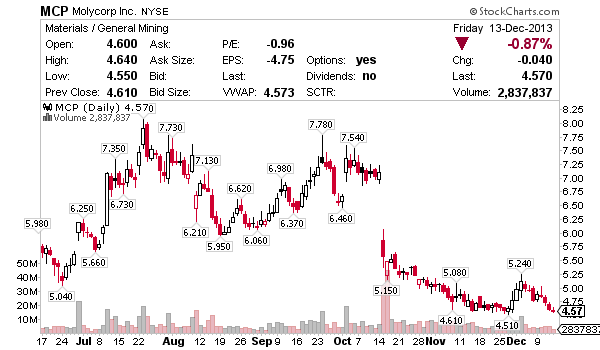

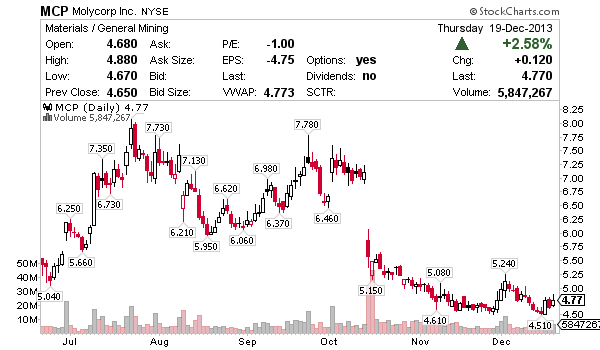

Molycorp (NYSE: MCP)

- Jan. 2, 2013 – $10.39

- Dec. 12, 2013 – $4.61

- YTD: -55.6%

- Float: 186.0 million shares

- Institutional holdings: 45.0%

- Short Sales (% of float): 39.4%

Molycorp has suffered from a raft of exogenous difficulties to achieve profitability, including declining materials prices, inventory builds, illegal production and export activity in China, as well as questionable future inventories. However, as I explained in my article, “Molycorp Multi-Bagger Potential In 18 Months”, posted on SeekingAlpha.com on Nov. 15, management expects rare earth elements prices to stabilize. With the company slashing operating costs at its Mountain Pass facility to bare bones and increasing volumes to replenish worked-off global inventories expected during fiscal 2014 and 2015, Moly’s stock price hasn’t responded yet to the company’s guidance (though there was an initial 9.6% rally at the end of November). Moreover, China’s announcement of its plan to reduce smuggling appears credible according to the Beijing ‘tea leaves reading’ folks at the Journal of Strategic Security. Therefore, running the numbers from company-projected fiscal 2015 metrics, I expect Moly could achieve earnings of between $250 to $300 million, or a stock price north of $25. Moly holds potential to explode in price as the massive short players scramble to cover a once-again profitable enterprise.

BEFORE

AFTER +4%

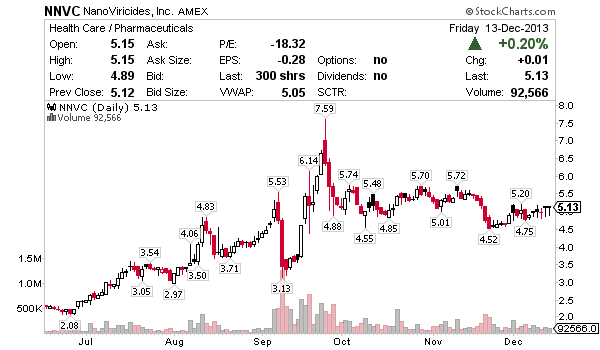

BONUS IDEA – from last year’s January Effect report and +210% in 2013

NanoViricides (NYSE: NNVC)

- Jan. 2, 2013 – $1.65

- Dec. 12, 2013 – $5.12

- YTD: 210%

- Float: 36.6 million shares

- Institutional holdings: 0.3%

- Short Sales (% of float): 0.9%

NanoViricides is one of those biotechs companies which imparts impassioned intrigue among those following the stock. The thought of capitalizing upon successfully-launched vaccinations or drug therapies to cure or ameliorate the effects the influenza, dengue, HIV and herpes viruses must surely rival the gold fever in California of the 19th century. NanoViricides just completed a trail at the University of California, Berkeley for its DengueCide™ program, resulting in “an unprecedented 50% survival rate in a special mouse model that mimics the most severe dengue disease in humans,” according to a company news release in mid-November. The market for an anti-dengue elixir, alone, is mind-boggling in size, as just this single solution to one of the world’s deadly diseases could reap countless financial returns for investors. This stock is a must watch, a bonus to the research and work presented in this special report.

Best wishes for the holiday season! Thanks for your service and your passionate commitment to your clients. Relax and have a good weekend we will get them next week. Mike

Your information on Spark Networks is incorrect. The price dropped due to a secondary offering priced for $6 per share rather than the earnings report. Mind you, the earnings results were expected and pitiful — I believe that’s a loss for 10 quarters in a row due to the fact that they can’t get Christian Mingle to be profitable. Additionally, I’d focus on the fact that Christian Mingle quarter over quarter only picked up 822 members in spite of $11.7 million in advertising. Finally, Q4 has always been the worst quarter for the company in terms of membership, so if anything Q4 numbers should be expected to be WORSE not better than Q3 numbers.

All great picks JB every single one was a winner.