Man was this morning wild… futures were up in the pre-market but by the time of the opening bell, stocks opened up… shortly after, the market whipsawed after the Fed cut rates to combat the coronavirus.

With all this back and forth action, there was money to be made this morning… especially in the pre-market. Heck, you could’ve made your day and avoided this volatility mess if you knew which patterns to trade.

You’ve probably heard that old adage, “The early bird gets the worm”… and I actually live by that — because it pays to be up bright and early when you’re a momentum trader.

If you’re not a morning person after you check out how I locked in a 15% winner overnight this morning… you’ll probably want to set your alarm clock earlier than usual.

[Revealed] How I Locked In A 15% Winner Overnight

As a momentum trader, I find it’s helpful to have scalable and repeatable patterns in my arsenal. You see, when it comes to fast-moving stocks, technical patterns can be self-fulfilling prophecies. In other words, if everyone is looking at the same chart… and they play for the breakout, it tends to happen.

A lot of the times, I notice these breakout moves happen in the pre-market… and if you’re not up before the opening bell, you could be leaving profits on the table. Before you go out and start trading the pre-market, there are a few factors you need to consider:

- Volume tends to be light in the early morning sessions and is typically made up of pros.

- The bid-ask spreads could be wide, so make sure you know which order types to use.

- Have a plan in place. If you want to take profits, make sure to leverage the power of limit orders, rather than market orders.

- The last thing you want to happen is send a market order and there’s no bid or ask… and you end up selling or buying at a significantly different price than you expect.

With momentum trades, a lot of the time we see these stocks gap up… and that’s what happened with one of my trades.

Let me show you with a trade example in Zosano Pharma Corp. (ZSAN).

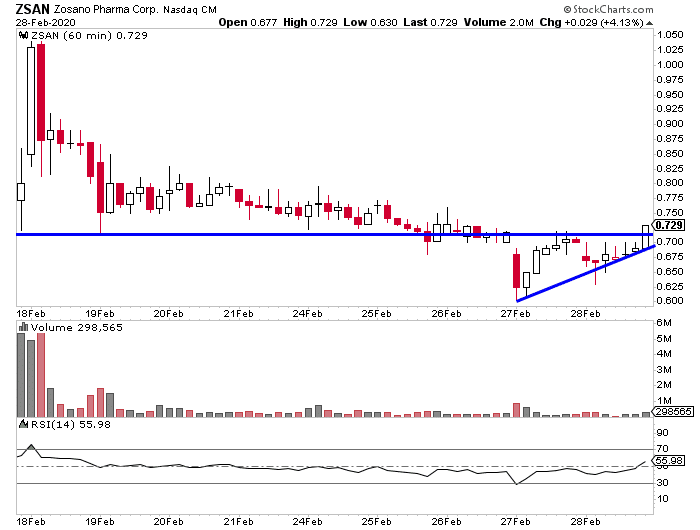

The stock formed an ascending triangle pattern on the hourly chart last week… and broke above a key level (the blue horizontal line) in the chart below.

Now, once it broke above that key resistance level… ZSAN gained momentum and continued higher, and I was waiting to get in.

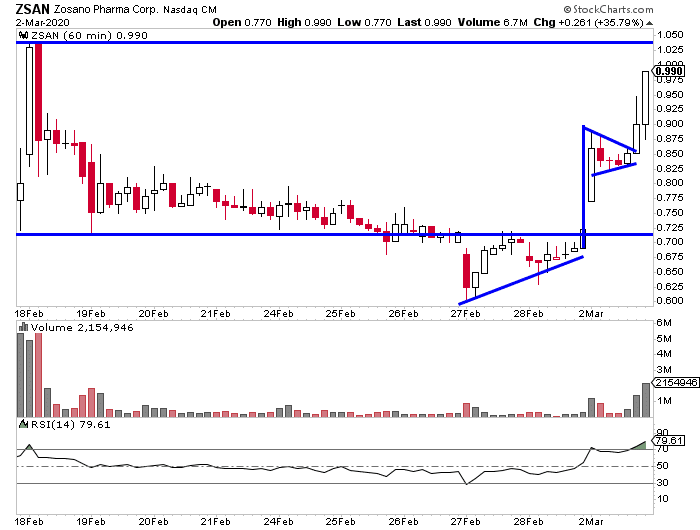

If you look at the updated chart, ZSAN formed a bull flag pattern on the hourly and ramped higher into the close. Once I saw an area of value at $0.91… I decided to jump in, and looked for the stock to continue higher and potentially break above $1.

Mar 2, 2020 at 3:08 PM – Jason Bond:

JBP: bought 20k ZSAN at $.91, goal is $1+ on a gap tomorrow, continuation pattern

Guess what happened?

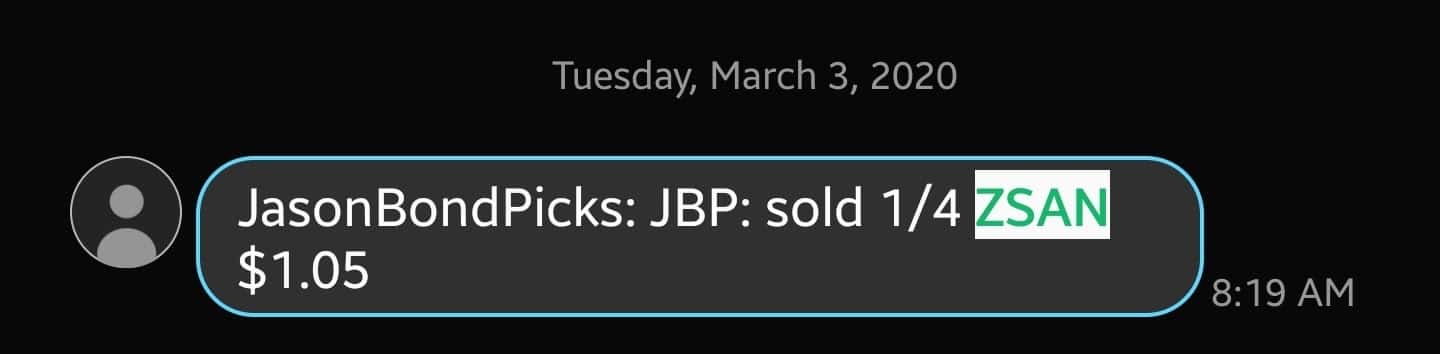

In the pre-market I was able to take a portion of my profits off the table for a 15% winner overnight!

If you want to learn how to trade momentum stocks and gain an edge like no other in the markets… click here to watch this exclusive training session and learn about my scalable and repeatable patterns.

Disclaimer: At the time of this writing, I am still long ZSAN.

0 Comments