For years, many Wall Street traders were all over this strategy, and it’s not one I implement whatsoever…

It’s one some still use to this day.

It’s no secret strategy, heck, when people first start out to trade or if they talk to their financial advisor or broker — it’s one of the strategies people are taught not to use at all.

It’s known as the short volatility trade, and it’s ruined firms and people’s lives… and that’s why I want to bring it to your attention, and show you why it’s such a dangerous strategy.

Some will fight you tooth and nail on why it’s such a good strategy…

Rather than getting into a heated argument with someone about it, I think a perfect answer to get out of that is to just say, “It only works, until it doesn’t.”

That said, let me tell you about this strategy and why I don’t want to use it, and why there are better options trading strategies out there, in my opinion.

Why This May Be A Riskiest Strategy On The Street

If you don’t already know, there are asset classes based around volatility. Now, there are some traders out there who will bet against volatility. In other words, it’s a bet there will not be wild price swings.

The specific short volatility trade I’m referring to here has to do with the CBOE Volatility Index, which measures the market’s view of expected price fluctuations in the S&P 500 over a 30-day period.

Of course, those expectations move very quickly, and theoretically, no one knows where volatility can run to.

I already know what you’re already thinking…

Who in their right mind would short volatility if they don’t know where it can go to?

If you think that way, that’s great in my opinion, because that means you understand risk management a bit.

So if you think back to February – March 2020, what was going on with the market?

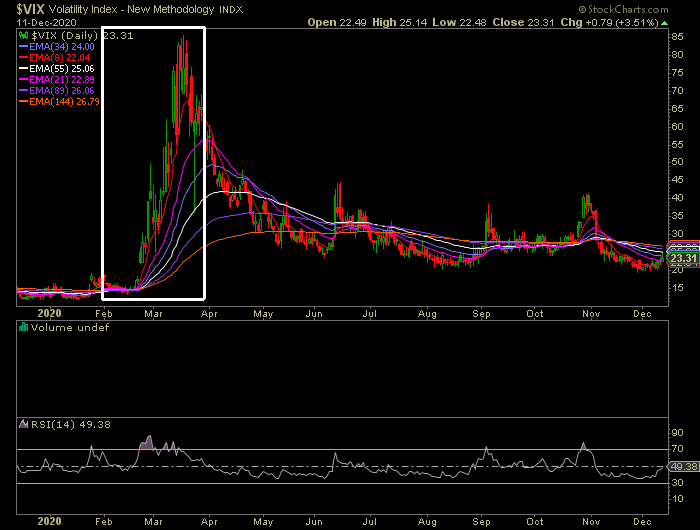

If you guessed heightened volatility, then I think you’re right… but you look at the change in the CBOE Volatility Index ($VIX), the white rectangular area below.

No joke, there were traders actually betting against volatility during that period, and that’s why I mentioned it’s a strategy that works until it doesn’t.

Prior to that point, the strategy could have been successful, if those implementing it knew what they were doing.

However, given the nature of this strategy, it’s very easy to blow up.

I mean think about it like this, there are funds who trade with a lot of margin. In other words, they borrow money from the banks to implement these trades. A lot of these players will actually “naked” short volatility.

What that means is they don’t have a hedge and aren’t managing their downside risk.

So let’s say they throw down and sell calls against a volatility ETN or $VIX.

Think about what happens if $VIX skyrockets and goes from $20 to $60 in a matter a few weeks, and a trader is in a short volatility trade?

Well, that means they would lose much more than expected, and that’s one strategy that can not only ruin a trading account, but potentially a trader’s livelihood.

That’s why it’s one strategy people are taught NOT to utilize. If you do still decide to bet against volatility after everything I told you, I just want you to know I think it’s important to paper trade, and speak to your broker or financial advisor before you put real money behind the trades.

Thanks Jason, a good explanation of a dangerous strategy

Thank you, Jason. Clear as always!