As a swing trader I’m consistently hunting for small caps with good stories and near term catalysts capable of delivering big swings in short time frames. Gevo Inc. (GEVO) is such a company.

Take for example, in the past 52 weeks shares of Gevo swung from $5.32 to $8.86 across 6 days back in October 2011, $5.50 to $11.29 in January across 6 weeks and more recently $4.84 to $9.94 May into June. With a market cap of $144 million it’s no wonder Gevo runs big on catalysts given 43% of the float is betting against the company.

The current price action on Gevo shows it channeling down tight to the bottom trend line at $3.65 with the 20 Moving Average just ahead at $3.80 followed by the 50 at $4.69 and the 200 at $6.93. As a swing trader I look to accumulate support and swing big moves. I’ve started to accumulate a position by scaling in off the trend line here and am looking to buy more in the coming weeks.

How big could the next move be? Well if the analysts are right it’s well over a double from down here. The Wall Street Journal’s analyst ratings show 6 buys, 2 overweight, 0 holds, 0 underweight and 0 sells with the average stock price target $9.36.

But is the time right, could Gevo go on an uptrend from here? Let’s take a closer look at the current potential catalysts.

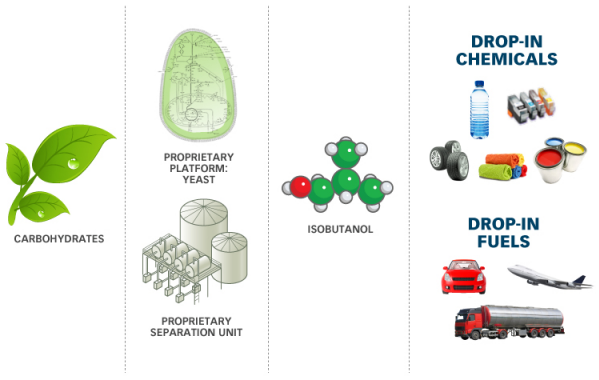

Gevo is a leading renewable chemical and advanced biofuels company that focuses on the production and commercialization of Isobutanol. The key markets for Isobutanol include gasoline blendstock, biojet blendstock, materials, plastics, fibers, solvents, and coatings.

Gevo’s Isobutanol has successfully cleared registration with the U.S. EPA as a fuel additive and is now approved for blending with gasoline. In fact, Gevo recently announced the first successful alcohol to fuel jet flight with the Air Force Research Laboratories. The advent of Isobutanol also provides existing gas, jet, and plastic industries a cost-effective alternative to petroleum-derived solvents (such as ethanol) with lower carbon emissions.

Gevo’s environmental angle has already attracted the attention of one of the world’s largest consumer products companies. Coca Cola’s (KO) various drinks add up to 1.7 billion servings per day. Many come in plastic bottles. Gevo signed an agreement with Coca-Cola last year to produce one ingredient for that bottle from its corn-based isobutanol.

Keep in mind, the chemical industry is largely cyclical and is under intense federal regulation that induces high barriers to entry. Nonetheless, the S&P 500 maintains a positive outlook upon the growth of the chemical industry. In December 2011, the American Chemistry Council forecasted overall US Chemical industry production would rise about 1.6% in 2012 and 2.1% in 2013 citing global demand and the recovery of the manufacturing, construction, and automobile industry.

Net income for specialty chemicals also increased 8% from 2010 to 2011 despite rising raw material costs. In recent years, major companies such as Dow Chemical (DOW), Chevron Phillips Chemical (CVX), and Westlake Chemical Corp. (WLK) have been increasingly breaking into the petrochemical market. Dow Chemical is building and restarting plants that would increase production and delivery by as much as 20% to meet growing demand in North America.

In other chemical markets, the historically fragmented plastic and paint industry have consolidated into a couple of key players. This consolidation is partly attributed to rising material costs. For example, LyondellBassell Industries (LYB) filed for chapter 11 bankruptcy in early 2009 citing softening demand and volatility in material costs.

Over the past six months, Gevo has fallen over 50%. Patent litigation with Butamax combined with missed earnings expectations has hurt the company significantly. Since its ongoing litigation, the U.S. Patent and trademark office affirmed Gevo’s patent on 5/3/12. Moreover, Gevo has continued to win in litigation against Butamax and they are free to sell to anyone anywhere. While Gevo has won ongoing litigation, the patent battle has continued to negatively affect its stock. Gevo asserts that they were the first to patent the key E. coli KARI enzyme and have since continue to advance it in a way that does not interfere with the Butamax patent. Gevo has also filed countersuit citing that Butamax has infringed upon their ‘715 patent’ and is currently seeking declaratory judgment to prove the invalidity of the Butamex patent.

In other news, Gevo recently signed a collaboration agreement with BioFuel energy Corp (BIOF) to explore large-scale production of isobutonal. A recent round of financing has also diluted Gevo’s stock even further. Gevo issued 12.5 million of stock at $4.95 of stock and $40 million of convertible senior notes that diluted the stock even further. More importantly, the financing was to fuel long-term growth. The company plans to utilize the funds from the offering to revamp the 22 MGPY ethanol production facility it acquired in in September 2010. The company also intends to repay $5 million in outstanding long-term debt obligations and may also use a portion of the proceeds to fund working capital and other general corporate purposes.

It’s clear that the potential market for Gevo’s Isobutonal is substantial. Isobutonal could provide a cleaner and cost-effective alternative to existing petrochemicals. The US paint industry alone was valued at $19.3 billion in according to the U.S. Department of Commerce in 2010. Gevo also continues to make advancements through joint ventures, partnerships, and direct investments and in order to achieve full-scale production. It should also be noted that Gevo continues to operate at a loss and analysts project that they won’t operate at a profit till 2014 given that they are able to secure funding from external financing. Furthermore, much of Gevo’s success is dependent on the outcome of their ongoing patent litigation with Butamax. Should Gevo come out on top, we could see it’s stock go back up to $10 per share or an easy double from here.

I am long GEVO.

0 Comments