Well, we’re back in that spot where good news is bad news… and bad news is good news.

I don’t know about you… but I’m not going to get faked out and even try to figure out where the market is going to move off these headlines.

So what am I doing instead?

Focusing on specific stocks and key levels.

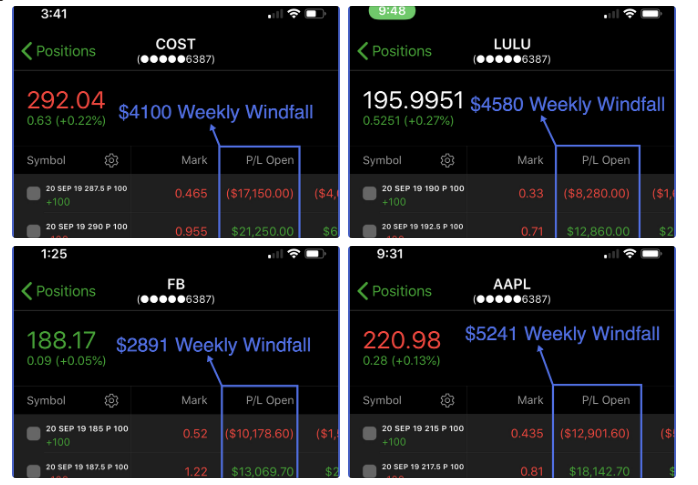

Keeping it simple — using my Weekly Windfalls strategy to pull in returns like these…

I’ve mastered a way to profit off directional moves in stocks — using an options strategy that increases my odds of success right from the start.

All I’m doing is looking for a key level — with high odds that the stock will stay above (or below) — and placing a strategic short-term options trade around that area… then sit back and watch the money pile up.

How does it all work?

Stocks All Over the Place? Just Find A Key Level

The beauty of using options to trade is the fact that you don’t necessarily have to be right on the direction.

With stocks, when you buy… you make money if the stock goes up… and lose money if it goes down.

On the other hand, options are a little different — especially when you start combining different positions.

But don’t worry, we’re not going to be talking about complex options strategies that will require extensive knowledge… all you really need to do is understand what a vertical spread is… this is where I come in… it’s not complicated

With Weekly Windfalls… I’m strictly focused on collecting premiums by selling spreads.

Simplest Way to Trade Options

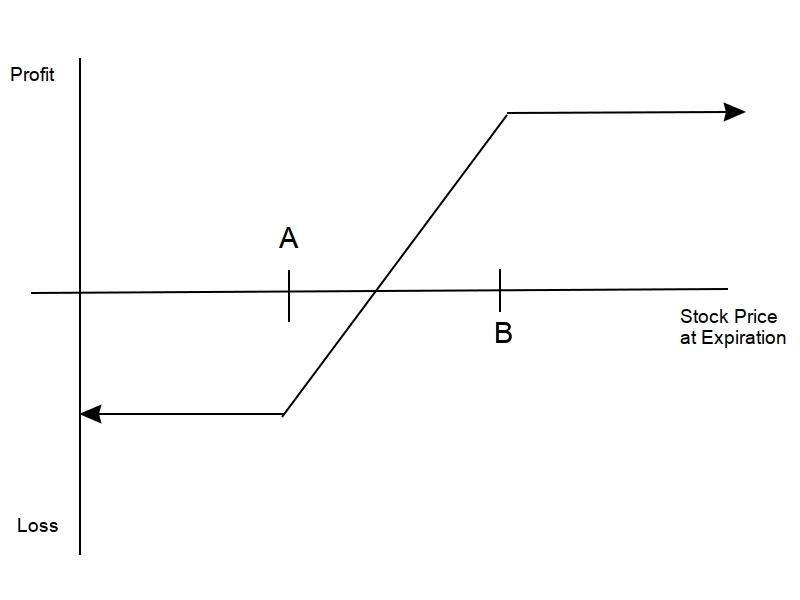

What I mean by that is I’m placing strategic bets around key levels… and I can profit one of three ways — let’s talk about selling put spreads (a bullish trade):

- If the stock rises significantly — I make money

- If the stock trades in a tight range — I can profit

- If the stock drops by a little… but stays above a specific level — I stand to generate high returns.

The best part is that this strategy has defined risk… and you know your maximum profit and loss right off the bat — allowing you to properly manage your positions.

Here’s a look at the profit and loss (PnL) diagram of a bull put spread.

Let me show you how I actually use this strategy.

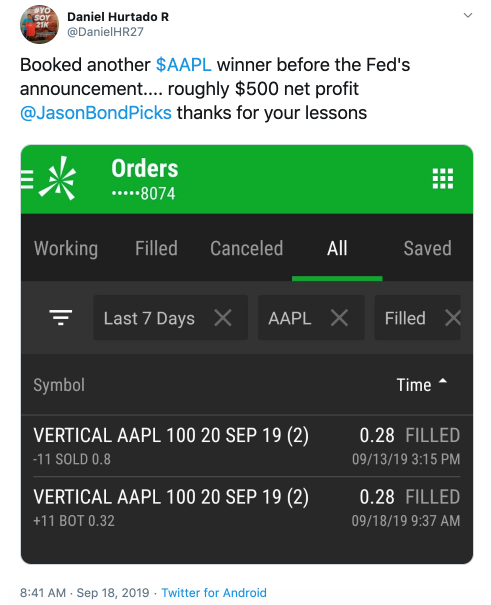

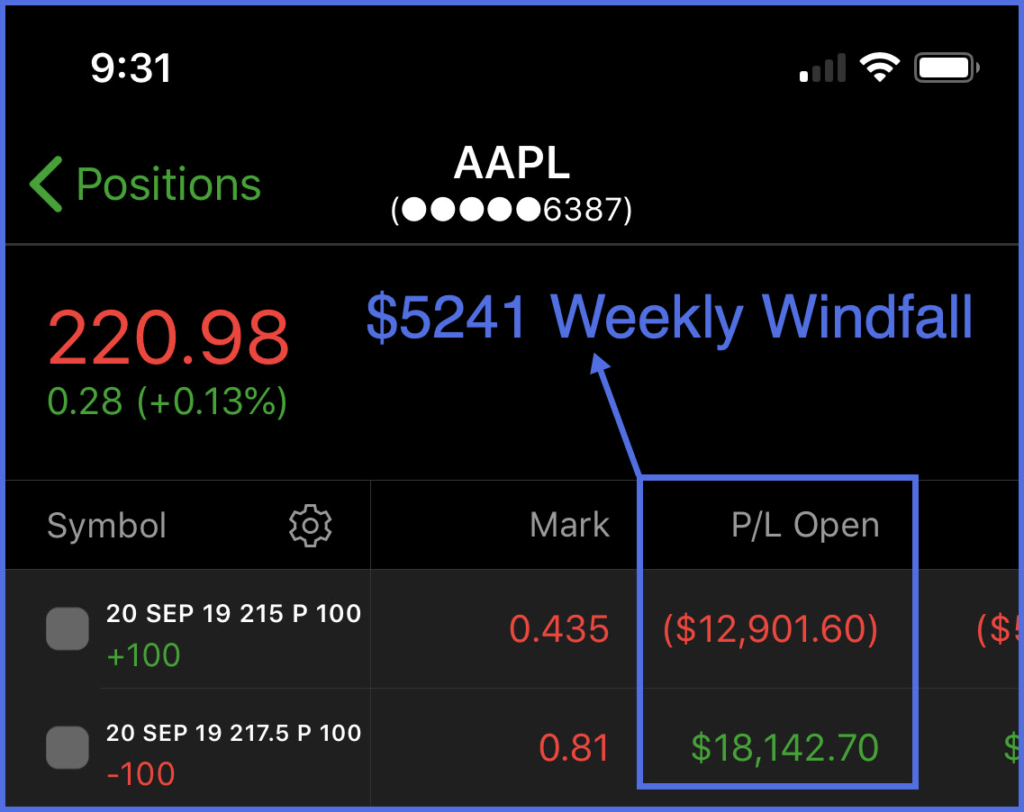

Apple had been on an absolute tear… and I was betting that AAPL would stay above $215 and reclaim its recent highs.

So what did I do?

I sold the $217.50 puts at $2.63… and I bought the $215 puts at $1.72.

So I received a credit for placing the trade. All I needed AAPL to do was stay at or above $217.50, at the expiration date… and I would collect the premium.

But the thing is… you’re not locked into the trade once you place it… and you can take profits whenever you see fit.

For example, with this AAPL trade… it actually caught some momentum and ran up to $220 (what I expected)… and since I was sitting on a 50% winner — I decided to take my profits and move on.

Let me hit you with another example of how this strategy works.

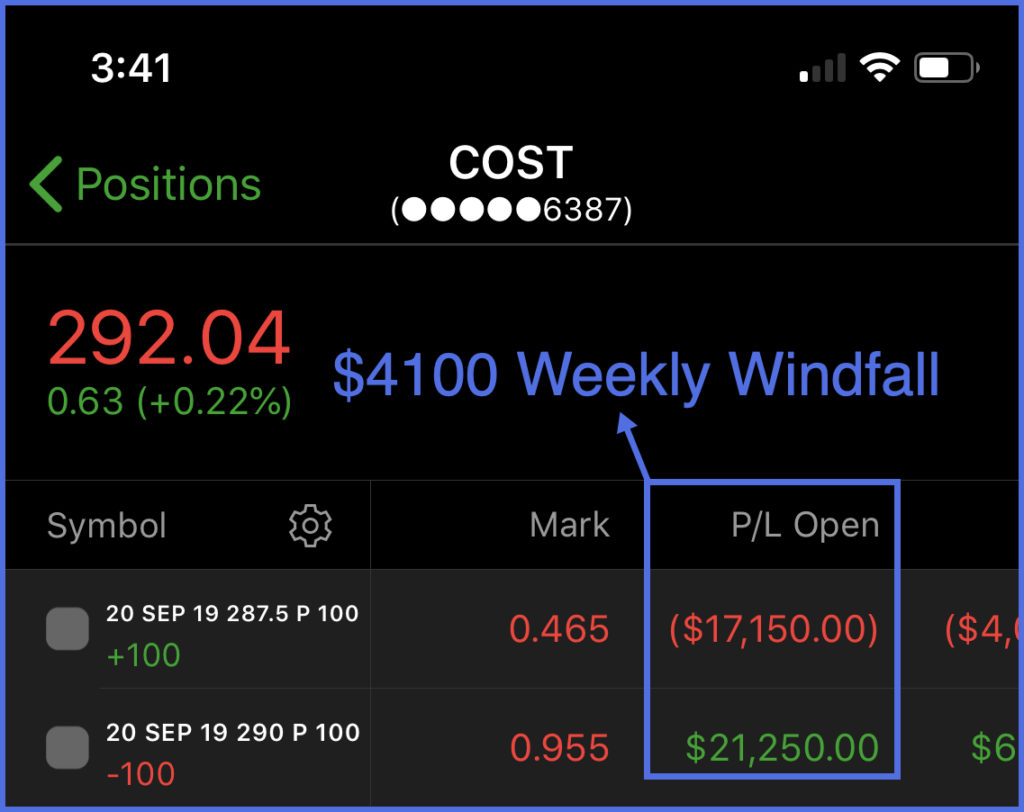

The stock has been on an absolute tear… and it was right at a key psychological level around $290.

There was a high chance that the level would hold and COST was primed to continue higher… so I decided to sell the $290 puts and buy the $287.50 puts.

However, if you recall, I could’ve profited multiple ways:

- If COST ripped higher, I would’ve been at my max profit very quickly.

- If COST chopped around and stayed around $290… I would still sit in some profits.

- If the stock dropped a little but stayed above $290, I could still collect premiums.

So what happened?

COST actually was trading above $290… and I was sitting in a ~40% winner… and since those options were expiring today — I decided to take my profits the other day, and just move onto the next trade setup.

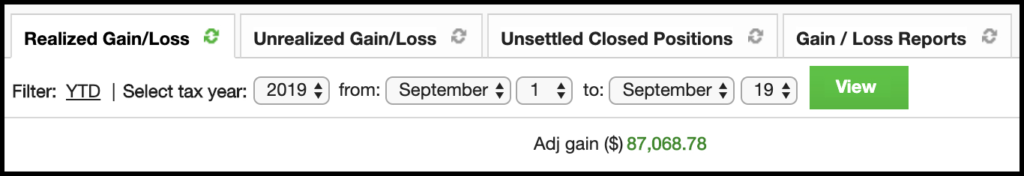

By far, this has been one of my best strategies ever… and it’s been one of the main reasons I was able to lock in $87K in just a few weeks…

But the thing is… I’m not the only one making money off Weekly Windfalls… in fact, many of my clients have been crushing it as well.

L.C. : Closed 4 ww for 3k. Thanks Jason!!!

M.C. : trading tiny closed WW four positions for $2400!!

With Weekly Windfalls… so many people are improving their odds of success in an area of the market that is often too complex to understand…

The reason?

I’ve simplified options trading and developed a unique strategy that doesn’t require any prior knowledge of options…

… and I’ll even walk you through every step of the way and show you EXACTLY how to spot these Weekly Windfalls consistently.

Join my community:

0 Comments