Man has it been a wild three months. The Dow notched its worst first quarter in history, while the S&P 500 had its worst quarterly performance since 2008. Many traders and investors have been battered by this volatility mess… and that’s okay because this market is a different beast.

However, that doesn’t mean you try to do the same thing over and over again, especially if it’s not working — I learned that the hard way. In this market environment, I’ve refocused my attention to hunting down momentum stocks.

Why?

Simply because my method has proven to work even during violent selloffs… and I want to show you exactly how I locate stocks set to pop.

You see, there are pockets of money-making opportunities out there, and all you have to do is figure out where they’re hidden and have the right strategy in place.

How To Uncover “Hidden” Momentum Trading Opportunities

I believe location is key in this market environment. Basically, I want to look out for where the hottest stocks are and capitalize on them, if my bread-and-butter setups pop up.

I know what you’re probably thinking, “Jason, there are thousands of stocks out there, how in the world do you filter that down to just a handful of names to trade?”

It’s simple… I use my scans to find momentum stocks — and I want to show you how exactly I do that. Typically this type of lesson is only accessible to Jason Bond Picks premium clients, but in these trying times… I want to help as many people out as possible.

So where does it all start?

First understanding where to locate these momentum stocks. For the most part, I want to look for stocks trading under $30 that are liquid and active.

I’m simply looking for a stock that’s already on the move and short-term upside potential.

When I use my scanner, I want to locate stocks that are moving but still have meat on the bones — stocks that could give me around a 10% to 20% profit fairly quick.

Pretty simple, right?

Now… to the fun part.

How to Scan For Momentum Stocks

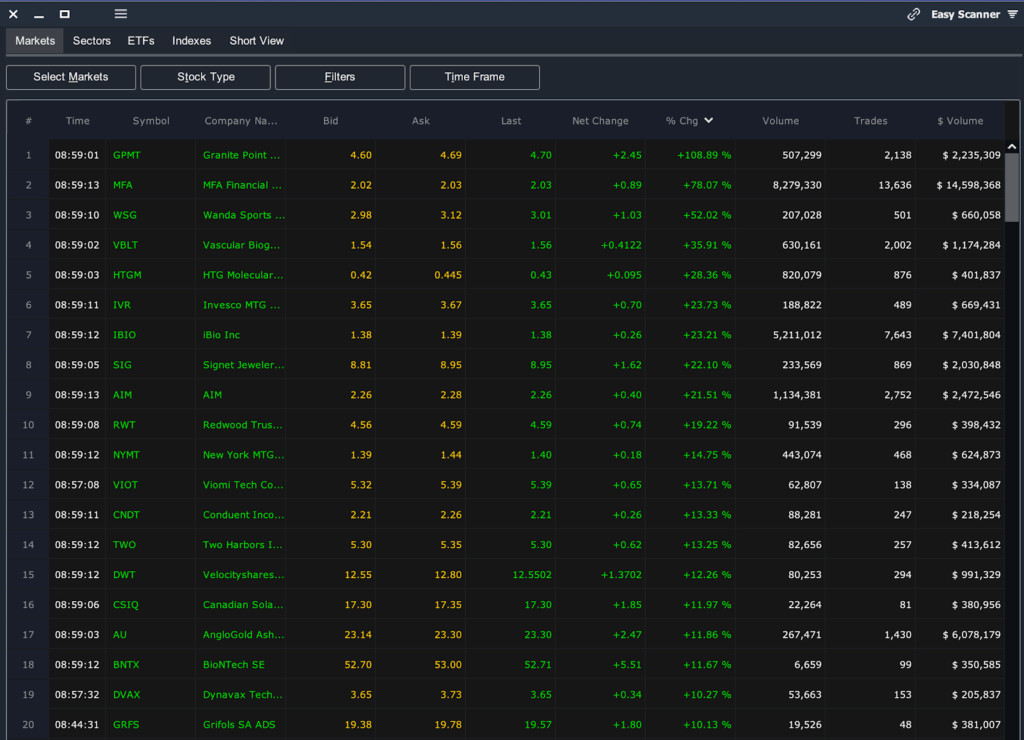

I use Scanz (formerly Equity Feed) for my scanner. Yes, it costs money for the subscription, but I like it because it allows me to use some filters that I haven’t seen anywhere else plus I’m comfortable with it. Old habits die hard…

There are plenty of free scanners out there, try to find the one that works best for you and get comfortable with it.

Moving along, here’s my process:

Filter for Current $ Volume Of At Least $2M

I want to see DOLLAR volume (not share volume) because it weeds out the stocks that don’t have enough liquidity. Think about it like this, you can have a stock trading for a quarter trade 1M shares, and that doesn’t mean it’s very liquid.

Stocks with enough liquidity allow traders to get in and out of a trade quickly. That being said, stocks with high dollar volume are obviously being traded fast & furious that day, and with lots of money flowing in and out. In other words, the chances of getting “stuck” in a stock is relatively small.

Sort by Percentage (%) Change

I’m looking for volatility — and typically, stocks that have already made big GAINS.

And you might ask — “Jason, can a stock already up 50% in a day still move more?”

The short answer? Absolutely, we simply don’t know where a stock could go.

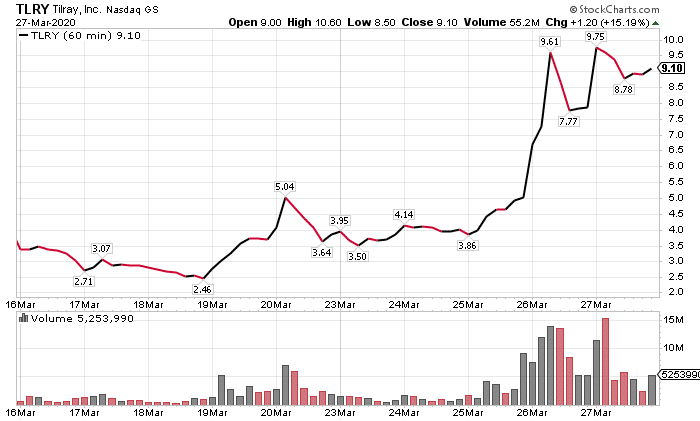

Just take a look at Tilray (TLRY) last week…

The stock EXPLODED… and I was kicking myself for not making money on it then.

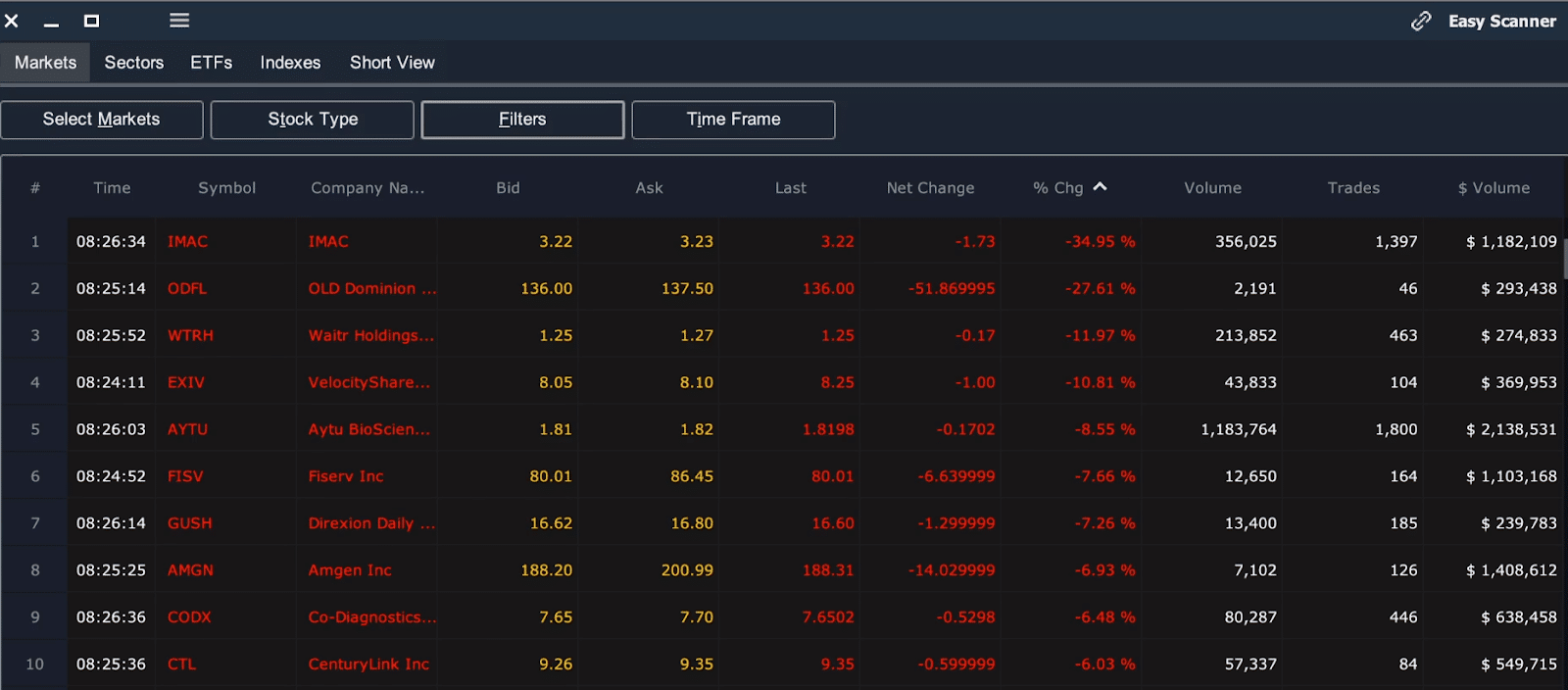

Now, there are times when I sort by % losers.

Why?

Well, think about it like this… when a stock has a massive move one day, chances are traders are going to take profits (pushing the stock price down). If you think about it, it makes sense that a stock retraces before it explodes higher… and that’s when I use my “rest and retest” pattern.

There are also times when I want to locate oversold stocks set to bounce — that’s when my fish hook pattern comes into play.

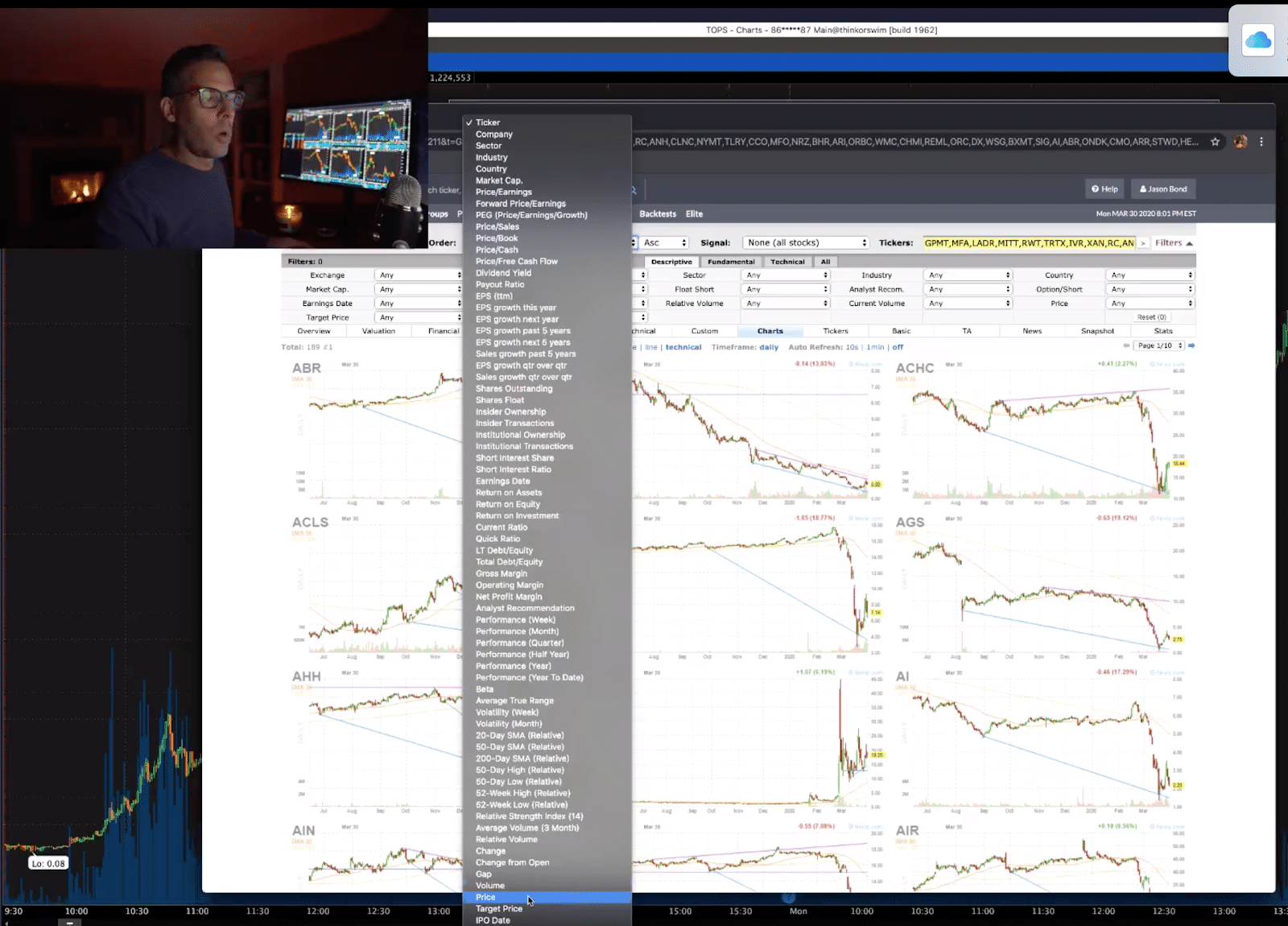

Once I’ve uncovered a basket of momentum stocks to potentially trade, I load them up on Finviz. That way, I can look at the chart view and search for my favorite patterns.

I know what you’re thinking, “Jason, does this actually work?”

Yes, it does… and you can check out how I locked down winners in SIEN and CHEF recently. If you’re struggling to find trading opportunities in this environment, let me teach you how to hunt down momentum stocks and provide you with “access” to the scanner I use.

0 Comments