Fear is rampant in the market… and stocks may just have entered into crisis mode. The coronavirus sparked concerns of a potential recession, causing many to flock to save havens.

The economic fallout of the coronavirus pushed U.S. Treasury yields to record lows on Friday… and that action could lead to a volatility frenzy. If you’ve had trouble finding winners in this environment, don’t beat yourself up. As a trader, I find it helps to grind through and figure out what you’re doing right and what you’re doing wrong.

That’s what I’ve found to be beneficial to my trading. Despite all the wacky price action earlier last week, I was happy we locked down a quick winner in NantHealth (NH) on Tuesday.

Today, I want to walk you through how I hunt down unique plays in the market and put myself in a position to win… and lessons I learned from this trade.

How I Locked In A Quick Overnight Winner When The Market Whipsawed

On Monday, I was on the hunt for my highest conviction trade idea. In this market environment, it’s so easy to get caught up in the noise and just throw down random bets. What I found to be helpful is to develop a clear-cut plan and reasons for being in a trade.

That’s allowed me to lock in my fourth straight winner in my Jackpot Trades, at the time of this writing. As a former school teacher, I find the simplest way to learn is through examples. So let me show you a real-money case study in my most recent Jackpot Trade idea.

The Setup In NantHealth (NH)

Here’s what I sent out to Jackpot Trades clients on Monday.

I bought 10k shares at $2.02. This is a technical trade with earnings just behind it. The continuation pattern from my lessons leads me to believe it could test $2.50’s soon. My goal is 5-20% in 1-4 days on this trade.

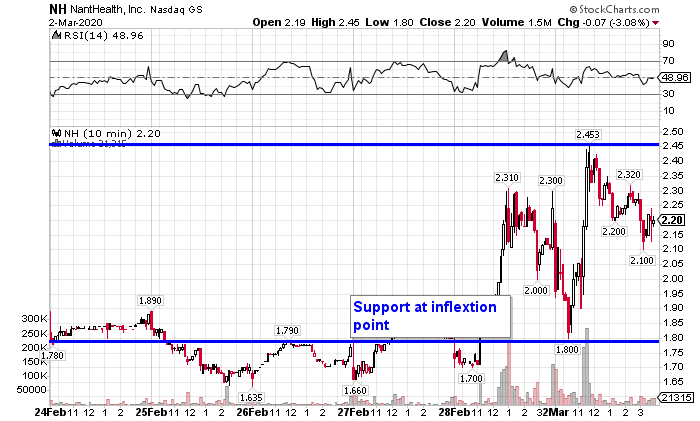

$2 is an established base of support I’m referencing. Resistance is clear in the $2.30’s defined by the trendline.”

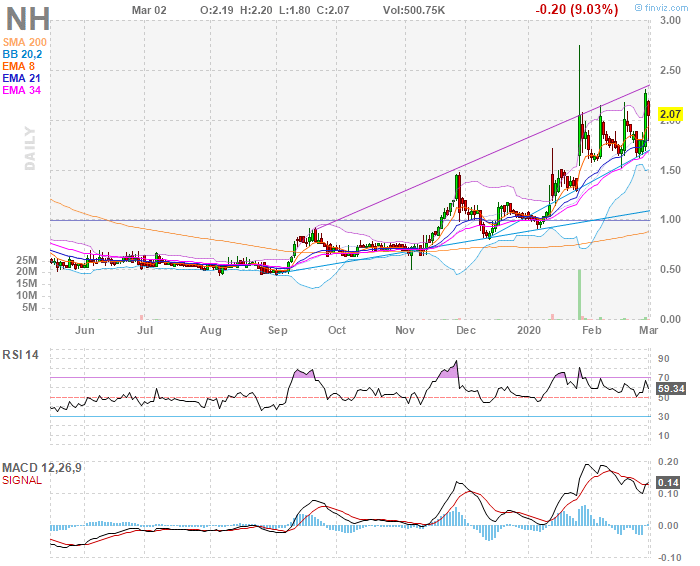

There was a supply line, the purple trendline in the chart above and that was one technical indicator I had on my radar. Typically, if a stock breaks above the supply line, in my experience, I’ve witnessed a rush of demand flood into the stock.

The real crux of the reason why I got into the trade was the fact markets have been weak and NH has been strong, which was an indication short sellers didn’t want to short it at these levels.

It Helps To Look For Stocks Stronger Than The Overall Market

While volatility has been rampant and the overall market in a definable short-term downtrend, this stock was popping… maybe it was due to the fact biotech stocks have been hot lately. I saw so many stocks skyrocket as companies race to find a cure for the coronavirus.

One of my favorite plays in wacky market environments is looking for divergence. In other words, I want to find stocks that move in the opposite direction of the overall market — the S&P 500, Dow, Nasdaq, or Russell 2000.

So I purchased 10,000 shares at $2.02… and figured NH had a high probability of breaking out above the supply line.

On Monday, the stock actually got as high as $2.45… that was good for more than 20% in just a few hours. However, at the time, I decided to hold onto shares because I thought NH could explode. Of course, it was the right move in my eyes, and I just played the hand I was dealt.

So I actually decided to hold onto NH overnight.

Yet again, NH broke above that supply line you saw earlier on the daily chart… but I still didn’t take profits. With the market getting rowdy and NH whipsawing, I decided to put a profit stop at $2.20. That would allow me to protect my profits.

The one thing I could have done better was taking off a portion of my position when it hit my target. That’s about the only thing I would change about the next time I see a similar setup.

0 Comments