Good morning.

Just 2 days left to take advantage of my Halloween special and save 30% off Long Term Trading and 33% off Swing Trading annual upgrades.

I’ve made +156% +$146,285 in 2015 swing trading.

U.S. futures are up early, should be a good day in chat.

Let’s take a look at the open trades in the portfolio which has BAS and OHGI in it.

Thursday I took 6,000 of my 16,000 BAS off into the $3.90’s spike +$.21 +$1,260, still holding 10,000 shares looking for $4’s. Crude is up early which could trigger a squeeze at some point today if that keeps up.

OHGI was the perfect afternoon entry of the retracement curl and is likely to gap up this morning or open strong and get into the $1.50’s. Up 15% $3,000 there I opted to let it ride overnight for the potential of a bigger score since it closed strong.

Here’s the scan.

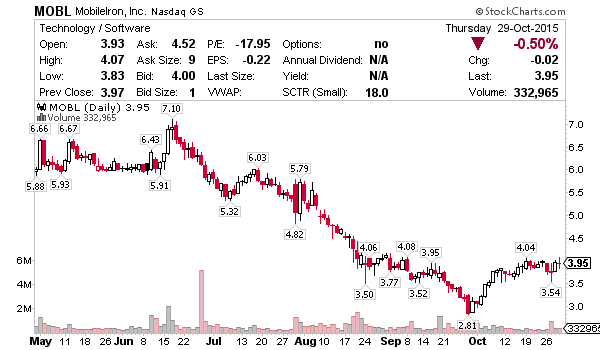

MOBL – Earnings winner Thursday after the close. Key break above $4 could trigger a move to $4.50’s+ Friday. Beat by $.02 and beat on revs, should have momentum today.

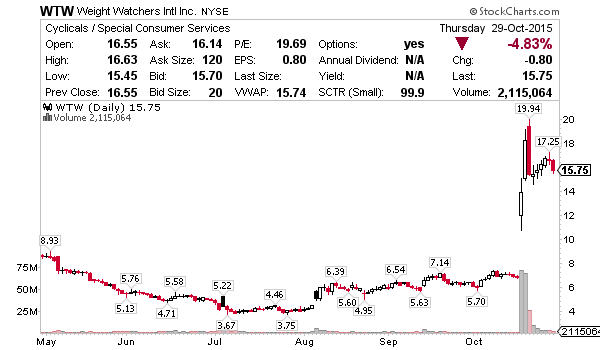

WTW – Missed my short entry in the $16.50’s 2x Thursday at a doctors appointment and didn’t want to chase it down at $16 once I arrived home. Classic pattern right out of my video lessons, I sure hope you watched them. Still in play to fall further, maybe $13’s but it’s not coming down easy due to short interest. This means we’ll watch $15.50 and the intraday today, if it’s bullish, it could squeeze right back to $16.50’s for a nice trade.

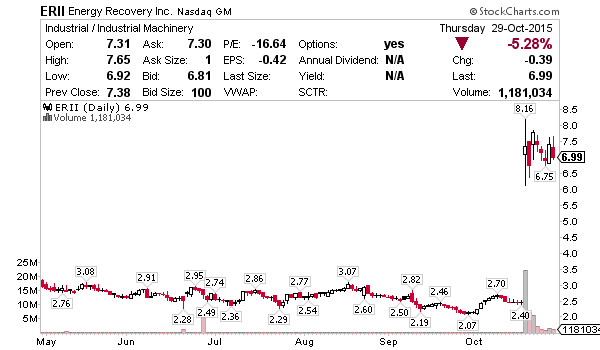

ERII – Up early Thursday, testing $7.70’s resistance but sellers took control and busted support through the open and a new low of day into the close. Short biased here into spikes are $7.50, stop out on a fresh breakout, shares easy to borrow at E*TRADE. I have no problem switching my tune here if it’s strong, similar to what I mentioned above with WTW.

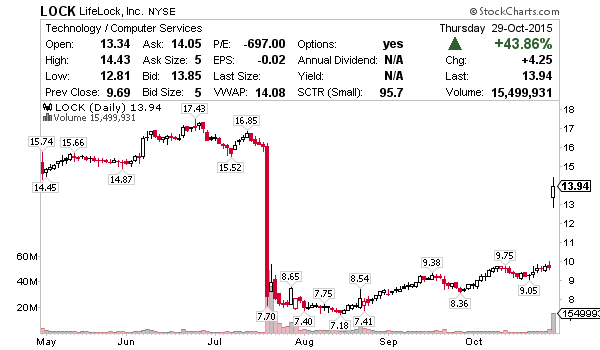

LOCK – Strong 3rd quarter results as well as good news sent shares screaming higher Thursday. Very good chance this trends to $16 so if it’s above Thursday’s close of $13.94 I’m watching for momentum.

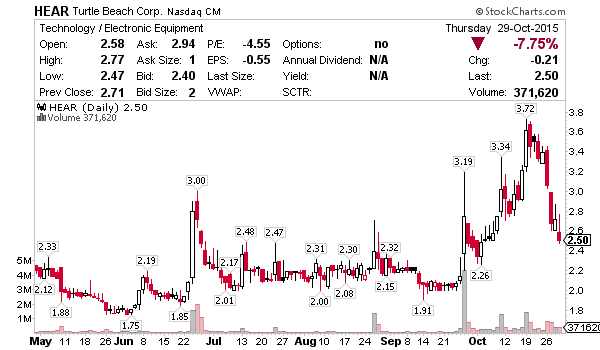

HEAR – Collected shorts and is at support around $2.50. I’m not sure I want to step in and catch a falling knife but if it looks like sellers dried up and are looking to cover for profit, I might step in for the reversal to $3.

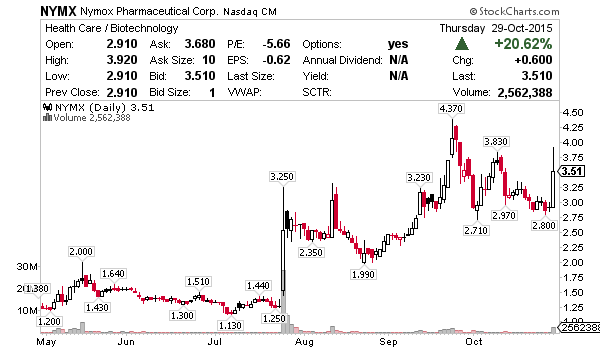

NYMX – Good news for the Pharma Thursday sparked a five mover from $2.90’s to $3.90’s. I believe there’s a good chance it continues today and am looking for a move from the $3.50’s to $4.50’s for profit.

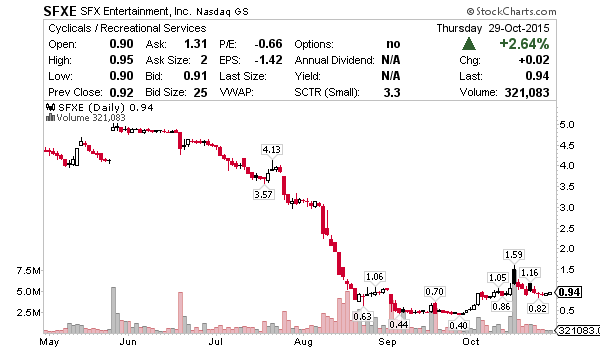

SFXE – Last but not least, the lotto ticket / ticking time bomb. Shares are rounding out above $.90 which might make this an opportune time to watch for a short squeeze, before the weekend. If Sillerman’s deal at $3.25 doesn’t go through, like his last at $5.25 didn’t go through, this stock could be toast, hence the ticking time bomb. Probably no more than $5,000 in this one for me due to overall risk.

Trade green!

Jason Bond

0 Comments