Good morning,

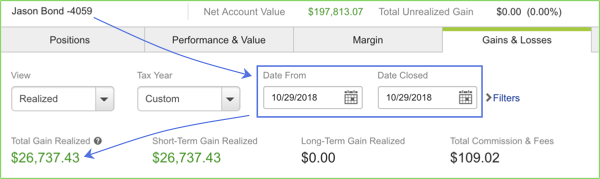

Friday’s decision to go with 6 swings into Monday worked perfectly. Not only was the overall market up a lot early Monday morning, but I caught good news on APRN, which was my biggest holding. I closed 4 of the 6 swing trades for wins and +$26,737.43 in realized gains.

If you are new, let’s talk about heightened probability. I almost always load a basket of swings on Friday because small cap companies often announce good news to start the week and APRN was the perfect example of that. Once I hit 3 news winners Monday morning using this simple strategy. But I only get aggressive if I think the market is likely to be green Monday morning, since most small caps will not advance in the face of red futures.

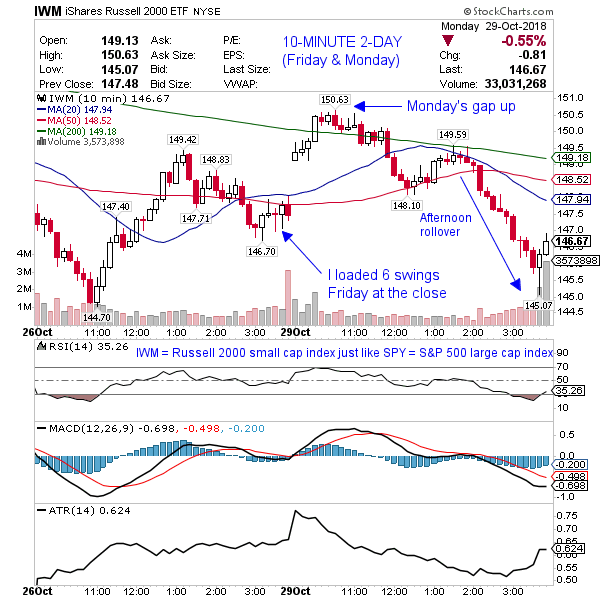

Here’s a 2-day chart of the IWM (Russell 2000 small cap index) which shows you where the market was when I loaded the 6 swings and where it was Monday morning before it rolled over in the afternoon. Do you see the oversold price action in the overall small cap market? Do you see candle over candle? Now you know why I loaded up Friday anticipating a green open Monday morning.

All of this is taught in my video lessons The Basics of Swing Trading & How To Trade Like A Pro, took my 5-10 minutes to execute Friday and Monday to make that $26,737.43.

Are you finding it difficult to learn from the video lessons? Want hands on mentoring like this daily? SAVE 40% when you upgrade to the Millionaire Roadmap.

Deal expires Wednesday at midnight. Click here to join & apply Promo Code: save40percent

The diary of a real $ trader,

Jason Bond

Nice post!