I’m constantly on the hunt for solid swing trades like AMR, BWEN, CTIC, CLWR, DHT, EK, FTWR, PPHM, SAPX and TLB. Normally I try to position before the move like I did with HDY recently at $3.06 before it ran about 30% the following day, however, sometimes swimming with the current is an easy way to grab quick profits too. Swing trading, for those of you who are unaware, is a speculative activity where stocks are repeatedly bought or sold at or near the end of up or down price swings caused by price volatility. A swing trading position is typically held longer than a day, but shorter than trend following trades or buy and hold investment strategies that can be held for months or years. In this edition of running with the bulls my filter for the stocks on this list is between $.25 and $3 with 300 trades or more the day before. The following stocks could deliver some decent profits moving forward if they continue so here’s what I’ll be watching for.

AMR Corp. (NYSE:AMR) operates in the airline industry. AMR recently filed for Chapter 11 i.e. bankruptcy. Shares fell from $1.72 to $.20 but have since bounced 250% in just over a week, something day and swing traders are attracted to. Technically, now that the price is working into the gap down it’s anyone’s guess but entry with a stop just below $.65 could be worth the risk if it climbs another quick 20% or more from here. Resistance is definitely at $1.63 and considering the circumstances I’m not sure it’ll test that point again.

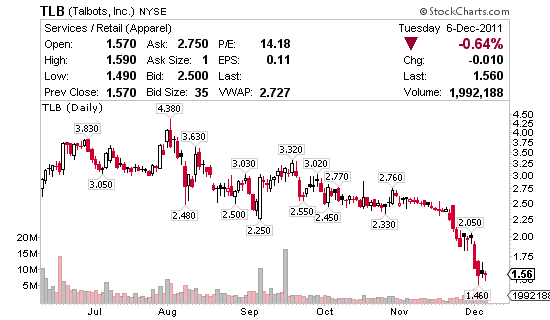

Talbots Inc. (NYSE:TLB) operates as a specialty retailer and direct marketer of women’s apparel, accessories, and shoes in the United States and Canada. Shares where flying Monday on an unsolicited letter from Sycamore Partners proposing to acquire all outstanding common stock for $3.00 per share. I’m looking at the level II which reads $2.50 x $2.75 right now so it’s anyone’s guess from there but if you like running with a bull and the offer is accepted there might just be a $.25 to $.50 cents per share opportunity still on the table. Watch out however if worth comes out that Board isn’t interested because then TLB moves to the short list.

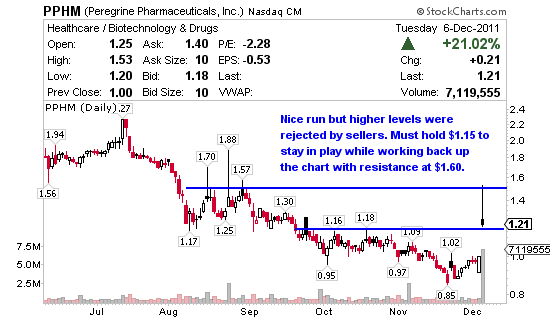

Peregrine Pharmaceuticals (NASDAQ:PPHM) is a clinical stage biopharmaceutical company, engages in the research and development of monoclonal antibodies for the treatment of cancer and viral infections. Shares of Tustin, California-based Peregrine ran over 50% Monday when their experimental lung cancer therapy reduced more tumors than standard treatment in a mid-stage study, a major step forward for a drug that may one day compete with Roche’s top-selling Avastin.

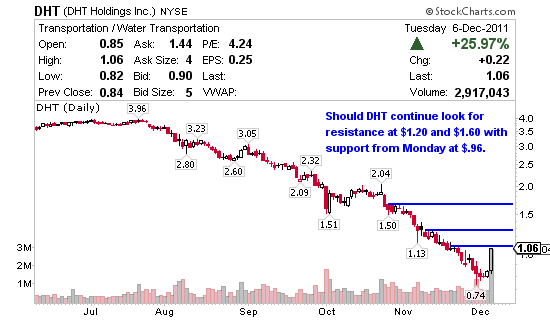

DHT Holdings Inc. (NYSE:DHT) owns and operates a fleet of double-hull crude oil tankers. I didn’t find any news on this one but the volume definitely caught my attention. Short interest is only 5.16 days to cover since the last settlement date on 11/15/2011 and while that may have grown and played a role in this move I don’t think it would have been the underlying cause. Nevertheless it appears resistance would come into play around $1.20 followed by $1.60 so there is still room to move should it continue up this morning.

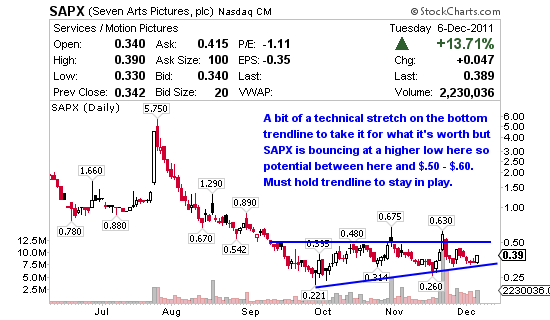

Seven Arts Pictures Plc. (NASDAQ:SAPX) operates as an independent motion picture production and distribution company. I’ve traded SAPX before and this is exactly the type of price action that has led to some solid runs recently.

Clearwire Corp. (NASDAQ:CLWR) provides wireless broadband services. Clearwire got some love from Sprint recently and now it’s trading like a beast again. Pretty good short interest at 7.19 days to cover per the last settlement date 11/15/2011 but I’m pretty sure that’s thinned out a bit during the recent move up.

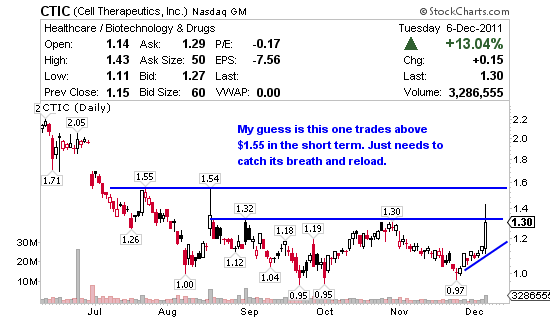

Cell Therapeutics Inc. (NASDAQ:CTIC) is a biopharmaceutical company, engages in the development, acquisition, and commercialization of drugs for the treatment of cancer. FDA sets an April 24, 2012 date as the PDUFA goal for CTIC’s resubmitted Pixantrone new drug application and the runup is on.

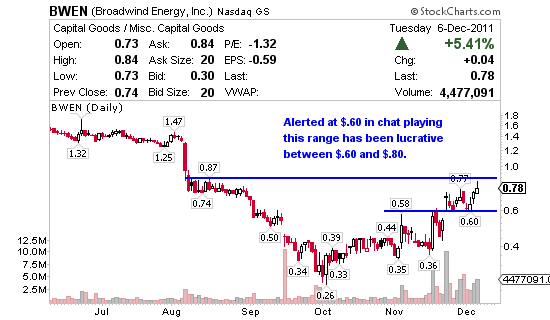

Broadwind Energy Inc. (NASDAQ:BWEN) provides products and services to the energy, mining, and infrastructure sector customers primarily in the United States. A little bit of this, a little bit of that, mix in an article on TheStreet.com and BWEN is off to the races again. This one’s choppy so your entry and exit is key to success swinging it.

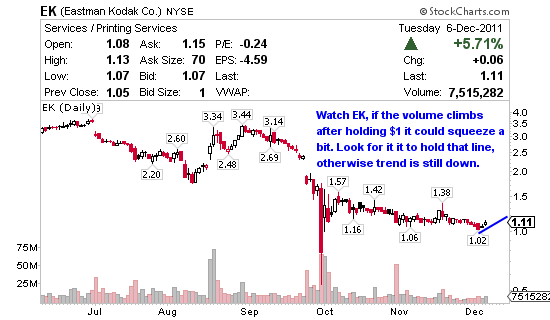

Eastman Kodak Co. (NYSE:EK) provides imaging technology products and services to the photographic and graphic communications markets worldwide. EK has reportedly shuffled its restructuring advisers in its battle to shore up its finances and steer clear of bankruptcy but traders aren’t buying it yet. It is starting to creep off the $1.02 low I like this price action. Swung it recently for a small loss trying to time a potential pop but it continued down. This is a stock that could erupt on good news or fall to $.50 if they announce anything about a bankruptcy so buyer beware there’s volatility in the air in Rochester, N.Y.!!!

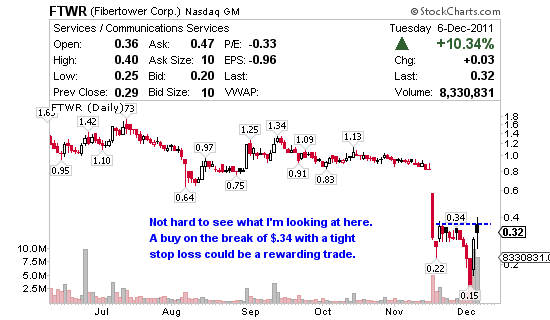

Fibertower Corp. (NASDAQ:FTWR) provides facilities-based backhaul services to wireless carriers in the United States. FTWR took a hit recently when they reported a slew of bad news in the middle of November but shorts overstaying their welcome and dip buyers seem to be driving the price back up here.

hi jason. i am really happy to bump into your site, i just came across it yesterday and you seem really active. I tried out one of these types of sites before at 70$ a month and i was disappointed as it was not active as i expected. Would you allow members to try out on 1 month for a fee of 100$? i think that would be a reasonable trial. or maybe even a 14 day trial for 35$?

Hi Mohamed. Sorry I don’t have any deals and I no longer offer refunds either. What I ask potential subscribers to do is really think about what they are trying to get out of my membership before they sign up. If they aren’t prepared to swing trade for 3 months with me then it’s probably not for them. The way to find out if you’re ready is to come to my free classes every Tuesday night. I teach and you get to know me better. Then through that relationship you can decide. I’m in no rush to get your $295 but when I do I want you to know what you’re getting into so that we can work together for 3 months. I’m not an scam artist and I have nothing to hide. I work my tail off for my subscribers and most will tell you that. I don’t win at all trades and there will be losses. But I do know a lot and I do take the time to make sure I pass what I know to them, if they are willing to learn. So I’ll see you Tuesday night at 9 p.m. EST in chat and we’ll go from there. Thanks for asking, I’m glad you are interested.

Hi Jason, I am a soldier, currently deployed to afghanistan. I am new to the markets but I don’t have alot of time for them. I am playing with the lower end penny stocks but I am losing ALOT of money trying to learn how to do this stuff. Any suggestions would be appreciated. Thanks

Hi David. First of all, thank you for serving our country. Second, the lower the price the harder they are to trade…but the low price usually attracts the inexperienced which generally give people a bad impression of penny stocks. My advice would be stop trading and come to Tuesday night classes if you can. I try to teach a few lessons every week, 1 for free subscribers Tuesday and 1 for paid subscribers Wednesday. Feel free to email me as well, jason@jasonbondpicks.com

Thanks for your reply Jason. I was not able to check out the tuesday class last week but i sent a mass email to a bunch of my buddies. One who attended took notes and we are on a really high learning curve. He will be attending tuesday again and I’m going to make sure im free on tuesday. We really appreciate you doing a free service- i think this proves to us that you are no scam and have something real to offer.

See you then.

Appreciate the mass email traffic Mohamed. No problem on the free classes, I’ve found it’s the best way to build my premium service teaching people before they jump in with me. Cheers, Jason.