Good morning!

Stocks closed lower this week. Despite large moves higher in the stock prices of Chevron (CVX) and General Electric (GE), the DJIA closed nearly unchanged.

In the broader market, the S&P500 and NASDAQ dropped 0.69% and 1.28%, respectively, as initial gains from a better-than-expected rise in Q3 GDP of 2.9% was erased following the announcement by the FBI at 1 p.m. that it is reopening the investigation into Hillary Clinton’s use of a private email server while she was U.S. Secretary of State. By 1:40 p.m., the DJIA dropped by more than 70 points, while the VIX soared to as high as 17.35 before settling at 16.19, up 2.85 points for the week.

The VIX closed Friday at a ‘neutral’ reading and slightly above its 200-day moving average.

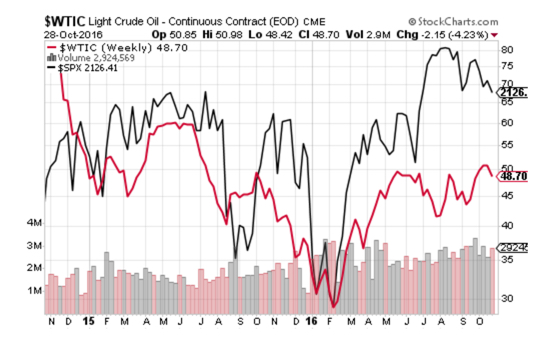

After five-straight weeks of higher closes, the price of West Texas Intermediate Crude (WTIC) fell $2.15 per barrel to close below $50 for the first time in two weeks amid reports that Iran and Iraq haven’t come to agreement on production curbs.

Rig counts declined by three this week to 934, breaking a 17-week run of higher counts, according to Baker Hughes, and below last year’s count (y-o-y) of 1,140.

Note the chart, below, of the price of WTIC and the S&P500. The chart demonstrates the relatively high positive correlation between oil prices and stock prices. So, in addition to reading transcripts of oil industry conference calls to gauge sentiment, reviewing the Baker Hughes rig count is how I assess how the oil industry recovery is shaping up.

Now to the interesting development: interest rates.

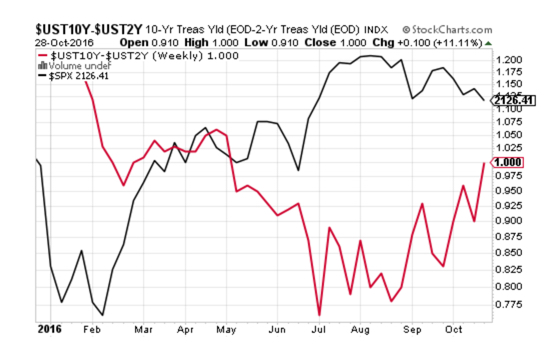

Interest rates rose this week, with the U.S. Treasury 10-year note spiking 12 basis points to 1.86%, while the two-year bill inched higher by two basis points to close at 86 basis points. Both the 10-year and two-year Treasuries trade above their respective 52-week highs, as the global trend toward higher interest rates continues, led by the Bank of Japan Governor Kuroda, who noted Thursday that it “would not be strange for longer-term rates to rise a bit” and added that “excessive flattening is not a good thing.”

The spread between the two maturities move significantly higher this week to 100 basis points, or just shy of of its 52-week moving average.

As interest rates rise, downward pressure on stocks also rises. The chart, below, demonstrates the negative correlation between a steepening yield curve (wider spread between 10-year and two-year U.S. Treasury interest rates) and stock prices.

From a fundamental point of view, rising debt yields lower ‘fair value’ of dividend-paying stocks. In many cases, institutional investors, mutual funds and sovereign funds allocate portfolios based upon a formula weighing yield versus risk. On the margin, as nearly-risk-free U.S. Treasury yields rise, higher-risk dividend-yielding stocks may fall to reflect a higher yield to maintain an adequate spread between the two asset classes. So, keeping an eye on interest rates is also part of my routine to gauge market sentiment in stocks on any given day.

The next chart shows the yield of the U.S. Treasury 10-year note. Notice the breakout in rates above the 1.70% level. Although central banks allegedly seek to steepen the yield curve, rates are rising to reflect higher consumer price inflation expected from rising oil and other commodities prices, in my opinion.

Essentially, I think central bankers are getting ahead of a situation that they cannot effectively manage in the longer term. In other words, if central banks attempt to drive interest rates down against the trend desired by the marketplace (which is a much bigger force than central banks), the bond market will eventually snap, thereby ruin the credibility of central banks to ‘manage’ rates. Then, all hell breaks loose.

So, instead, the story line at the BOJ and the Fed must jibe with market fundamentals to some extent. I think Fed Chair Janet Yellen’s speech in Boston two Friday’s ago was made to prepare the market for higher inflation accompanied by only marginal increases in interest rates. The result will be a continuation of a global market trading in a negative real interest rate environment, which is generally supportive of stock prices in the long run.

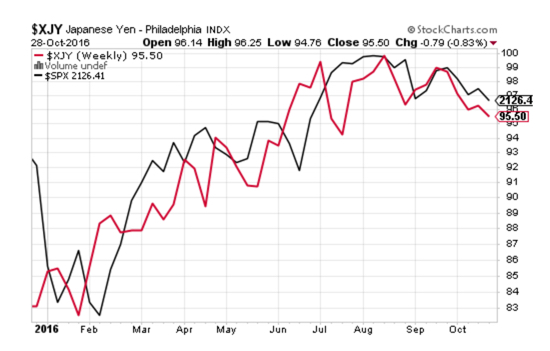

And finally, a look at the yen and its influence upon U.S. stocks. If the following chart doesn’t tell the story of what’s primarily driving U.S. stocks, nothing else will.

In the not-so-distant past, a weak yen aided U.S. stocks in a trade referred to as the ‘yen carry trade’. Since the start of the year, the reverse, a stronger yen, has carried stocks higher.

Why?

Image yourself a ‘global’ trader confronted with a weak Nikkei (off more than 17% from its August 2015 high), negative nominal yields for Japanese sovereign debt, and a U.S. Treasury market that at one point had a 10-year U.S. Treasury yielding 1.36%. Where will you find yield for your savings? U.S. stocks. What other major stock market of the world is still on the rise?

Remember, the yen is a global financing currency, while the hedging currency of global traders is the U.S. dollar.

As Japanese asset prices began to fall, dollar hedges began to be removed, as investors believed further downside risk in Japanese assets progressively abated as asset prices fell. This phenomenon is demonstrated by reviewing commercial traders hedging statistics in the gold market that can be found in the Commitment of Trader (COT) report published each week at the CFTC. History tells us that lower gold prices typically encourage more unhedging by commercial traders. So in my discussion of Japanese asset prices, the unwinding of dollar-denominated hedges from Japanese accounts are converted back to yen, lifting the currency’s demand in the Forex against, primarily, the U.S. dollar.

Now review the dividend yields of the 30 stocks which make up the DJIA, here. From the list, I can see two blue-chip stocks yielding more than 4.0%, Verizon (4.82%) and Chevron (4.16). The next 12 stocks yield more than 3.0%. The average yield is 2.87%, which includes six stocks yielding less than 2.0%.

If I were a global-minded retiree, a wealthy investor, hedge fund, endowment or institution in Japan, I’d buy U.S. stocks, too, keeping in mind that studies have shown that bond prices are, in fact, more volatile than stock prices. So, some of that dollar-denominated unhedging in Japan is converted back into dollars once again to buy U.S. stocks that offer a higher yield.

How long this phenomenon will hold is difficult to know, but it looks like the upward trend in the yen has stalled, beginning in late September, as the head of the BOJ, Haruhiko Kuroda, has indicated he wants rising rates in Japan.

Okay, that’s the market wrap up for this week.

Now I need to make an apology to a subscriber who felt I was morphing last week’s Long Term Weekly report into a political campaign forum for Republican presidential nominee, Donald Trump.

It doesn’t matter what is in my heart regarding the sensitivity my readers feel for the candidates on the presidential ballot this November; I offended a subscriber, and maybe a few more who refrained from emailing me. To this subscriber and others who felt offended by last week’s market wrap, as this one subscriber felt, I’m truly sorry for the intrusion.

I assure you, the intent was to dispel rumors about Mr. Trump and the effect he may have on our portfolios if he should win in November, and nothing more; but I apparently didn’t handle the commentary very well in that regard. Maybe that’s why I stick with stock trading. Right?

Okay, let’s talk stocks.

This Week’s JBP Stock Ideas

LIQUIDMETALS (LQMT)

Thursday was the big announcement I was waiting for. Liquidmetals announced it has finalized the additional closing of a stock deal with Hong Kong company owned by Professor Lugee Li.

I was almost positive this was going to happen, but I’ll admit I had a slight tinge of a doubt when the due date for the deal had come and gone. But since the company made no mention of the deal in its 10Q, I suspected it was still in discussion, as not disclosing material information of this nature would border on in violation of SEC rules, something I don’t count on as a usual occurrence.

Liquidmetals issued and sold to Professor Li 300 million shares of company’s common stock for a purchase price of $55 million, comprising of 200 million shares at $0.15 per share and 100 million shares at $0.25 per share. The amount raised by the company totaled $63.4 million.

And pop goes the weasel. LQMT soared to as high as $0.2121 before succumbing to profit-taking. But I wasn’t one of the profit-takers. I still own 100,000 of LQMT at a price of $0.137 per share, with a paper profit of $4,800.

ABOUT LIQUIDMETALS (LQMT)

Liquidmetal® Technologies researches, developments and commercializes amorphous metals. The company’s revolutionary class of patented alloys and processes form the basis of high performance materials in a broad range of medical, military, consumer, industrial, and sporting goods products. Discovered by researchers at the California Institute of Technology, Liquidmetal alloys’ unique atomic structure enables applications to achieve performance and accuracy levels that have not been possible before. As the company controls the intellectual property rights with more than 70 U.S. patents, these high performance materials are dramatically changing the way companies develop new products.

Source: Liquidmetals Technologies

FIREEYE (FEYE)

Shares of FireEye (FEYE) dropped $1.11, or -8.78%, following a downgrade on Monday from First Analysis Securities, who recommended an ‘underweight’ from its previous ‘equal-weight’ rating. FEYE went downhill all week following the downgrade.

The stock now trades deep into my ‘buy zone’; but the trend is still down, so I’ll hold off from considering a stake in FEYE until the downward trend stops. Let’s see what the earning report looks like on Thursday (after the bell). I’m starting to get itchy about this stock, either to buy it or move on.

ABOUT FIREEYE (FEYE)

FireEye, Inc. provides cybersecurity solutions for detecting, preventing, analyzing, and resolving cyber-attacks. The company offers vector-specific appliance solutions that provide threat protection from network to endpoint for inbound and outbound network traffic that may contain sensitive information.

Source: Finviz.com

LIVE VENTURES (LIVE)

Another good score this week with my sale of LIVE at $1.98 on Tuesday, as alerted. For a one month holding period, my profit was $2,200. We all should have made some good cash on this trade, because following my alert on LIVE, the stock took off immediately and didn’t look back.

ABOUT LIVE VENTURES (LIVE)

Live Ventures Incorporated is a diversified holding company with several wholly-owned subsidiaries and provides, among other businesses, marketing solutions that boost customer awareness and merchant visibility on the Internet. They operate a deal engine LiveDeal.com, which is a service that connects merchants and consumers via an innovative platform that uses geo-location, enabling businesses to communicate real-time and instant offers to nearby consumers. In addition, they maintain, through their subsidiary, ModernEveryday, an online consumer products retailer and, through their subsidiary, Marquis Industries, a specialty, high-performance yarns manufacturer, hard-surfaces re-seller, which is a top-10 high-end residential carpet manufacturer in the United States.

BALLARD POWER SYSTEMS (BLDP)

I alerted on October 7 that I bought 10,000 shares of BLDP at $2.39. I’m underwater on this stock at the moment. As the chart shows, below, the stock price tested and failed at the 50-day moving average this week, following Tuesday’s disappointing earning release and weak oil prices.

The company reported a loss of $4.2 million in its third quarter, or a loss of $0.03 per share, from revenue of $20.6 million, nearly $1.0 million less than expected. Impairments to assets contributed $0.01 to the company’s per share loss.

The stock managed to trade above its 50-day moving average following the report.

However, as the oil price (WTIC) looked like it would fail to close above $50 per barrel on Thursday, the stock finally succumbed to the pressure exerted by sellers trading the energy and alternative energy complexes.

Now, I’m looking at $2.00 as support.

I’m still anticipating a bump in the stock from an announcement of more details to the signed joint-venture Memorandum of Understanding (MOU) with Guangdong Nation Synergy Hydrogen Power Technology, wherein the two companies tentatively agreed to produce fuel cell stacks in China.

ABOUT BALLARD POWER SYSTEMS (BLDP)

Ballard Power Systems Inc. engages in the development and commercialization of proton exchange membrane fuel cells worldwide. It is primarily involved in the design, development, manufacture, sale, and service of fuel cell stacks, modules, and systems for various applications. The company also develops methanol clean energy backup power systems, as well as provides engineering services for various fuel cell applications. Ballard Power Systems Inc. offers its fuel cell products for various applications, including portable power, material handling, and telecom backup power, as well as power product markets of bus and tram applications. Source: Finviz.com

GLU MOBILE (GLUU)

Glu Mobile is once again on my radar screen. Since the disappointing guidance that came with the company’s earnings report, released May 4 and, again, on August 9, the stock has traded between $2.50 and $2.00, except a brief shot high to $3.00 in July.

With support at $2.00 now being tested and earnings scheduled to be released on Thursday, November 3, I’ll be eyeing GLUU for a trade, maybe before earnings or following the release. I’ll let you know in an alert.

I’m looking for two things in GLUU. First, I’d like to see how the Taylor Swift game does in the first couple of weeks of its debut. As we know, Glu Mobile has had a lot of misses since its blockbuster Kim Kardashian series, so I’m looking for a break in the streak of mediocre releases. Will Taylor Swift breakout as a hit? We’ll see.

Second, I want to listen to the conference call about any further information from the purchase of Poke Radar. Poke Radar is a community app, built by Pokémon Go fans.

I’ve had a fondness for GLUU because of its very low valuation when compared with competitors, Zynga (ZNGA) and Electronic Arts Inc. (EA). At a Price-to-Sales (P/S) of 3.42 and 5.38, respectively, GLUU’s P/S of 1.15 seems awfully low to me.

Since my last look at the trio, ZNGA and EA have risen in valuation against sales (approximately 10% in the case of ZNGA), but GLUU has dropped approximately 20%. And in the valuation metric, measured by Price-to-Book, EA at 6.43 and ZNGA at 1.48 outpace GLUU at 0.91. GLUU trades below Book Value and 1.64-times the company’s cash in the bank! Wow.

Glu Mobile is a cash cow; all it needs is one big hit to soar this stock. The upside potential is a good 50% from $2.00, with $3.00 at a minimum upside from a nice showing from Taylor Swift, especially when taking into account the large 16% of the stock’s float held short (nearly 12 days of GLUU’s average daily volume) that may need to quickly cover.

Therefore, I’m watching GLUU closely and will update you in future communiques, or maybe an email alert of a position I’ve taken.

ABOUT GLU MOBILE (GLUU)

Glu Mobile Inc. develops, publishes, and markets a portfolio of games for the smartphones and tablet devices users. The company offers free-to-play action, celebrity, sports, and simulation genre mobile games. It creates games based on its own brands, including Contract Killer, Cooking Dash, Deer Hunter, Diner Dash, Eternity Warriors, Frontline Commando, Gun Bros, Heroes of Destiny, Racing Rivals, Tap Sports Baseball, and Tap Sports Football. The company also creates games based on third-party licensed brands, such as Kim Kardashian: Hollywood, Kendall and Kylie, Katy Perry Pop, James Bond: World of Espionage, Mission Impossible: Rogue Nation, and Sniper X With Jason Statham.

LENDING CLUB (LC)

Lending Club is new addition to my picks this week. The company has been in a turnaround phase following revelations in May that Lending Club CEO, Renaud Leplanche, had sold $22 million of loans to a investment bank, Jefferies, that did not match the client’s requirements, i.e., fraud.

More trouble followed. On May 16, the U.S. Department of Justice served a subpoena for records involving the company’s deal with Jefferies.

In all, LC had lost nearly 57% of market capitalization from the scandal, but has since recovered some of the initial drop.

RECENT NEWS

On Tuesday, Lending Club is adding auto loan refinancing to its portfolio, according to the company. Initially, the company said it will fund these loans with its substantial cash reserves of approximately $570 million. Lending Club’s first target market and beta for the new auto loan offering is California, where, if successful will then bundle the loans for sale to institutional investors.

Lending Club has been tackling three principal challenges since May: patching its reputation with regulators; downsizing operation expenses to coincide with revenue; and repairing relations with institutional clients.

On the operations front, the company announced it has eliminated 179 employees in Origination/Servicing, and has estimated $2.6 million in costs related to the reduction in headcount.

Sales and Marketing has declined substantially between the Q1 and Q2. I expect that trend to continue on a percentage of revenue basis.

On the General/Administrative side of expenses, I expect legal fees and additional auditing expenses related to the company’s legal snafu with regulators and lawsuits to continue through to the end of the year.

Lending Club has guided no growth in originations from the second quarter. The company also guided a $15-$30 million loss on revenues of between $95 million and $105 million, translating to an EPS loss of $0.035 to $0.077. Analysts’ consensus EPS estimate is a loss of $0.07.

Third-quarter earnings is expected to be released before the bell on Monday, November 7. I’ll be hoping for a miss and a market overreaction, but am also watching for signs of an aggressive response to the company’s expense lines and anything positive regarding its relationships with its institutional clients in its conference call.

LC, below a price of $4.00, would look mighty tempting, with a target price near $5.00 as my escape and profit. I’ll let you know.

ABOUT LENDING CLUB (LC)

LendingClub Corporation, together with its subsidiaries, operates as an online marketplace that connects borrowers and investors in the United States. Its marketplace facilitates various types of loan products for consumers and small businesses, including unsecured personal loans, super prime consumer loans, unsecured education and patient finance loans, and unsecured small business loans. The company also offers investors an opportunity to invest in a range of loans based on term and credit characteristics. It serves investors, such as retail investors, high-net-worth individuals and family offices, banks and finance companies, insurance companies, hedge funds, foundations, pension plans, and university endowments.

B/E AEROSPACE (BEAV)

In closing of this week’s LT Weekly report, I want to report on B/E Aerospace (BEAV), a stock featured in my August 15 report. I’m not adding the stock to my watch list, but instead want to make sure my readers heard the news on Monday of the company’s sale to Rockwell Collins (COL). BEAV jumped $10 on the news.

On August 15, I wrote:

The business fundamentals look good and, as I stated, guidance is also good. The company’s total backlog of orders (slide 2) is currently $8.9 billion. This is a huge amount, considering Q2 revenue was $755M. This backlog is worth nearly three years of revenue, less cancellations, of course.

Well, I must say: I knew the stock was plump as a fundamental value, but I had no idea that, while I was scheming to make a play on the stock’s option, the board of directors of Rockwell Collins were scheming to buy the company!

By adding BEAV to this report as a ‘mention’, I just wanted to demonstrate to my readers that my nose is still sensitive and tuned-in to good plays. Really, I’m just gloating.

Trade Green!

Jason Bond

0 Comments