While analysis, opinions and Internet chit chat focused upon Groupon Inc.’s (GRPN) less-than-inspiring earnings release, Tuesday (after the close), the stock’s price action Wednesday offered up a clue to a price target, where the longs decided to pull out checkbooks.

Instead of a steady wave of lower lows throughout a deteriorating trend, buyers of GRPN came in full force to snap up shares on weakness in the share price of the Chicago-based marketplace maker of discounted products and services.

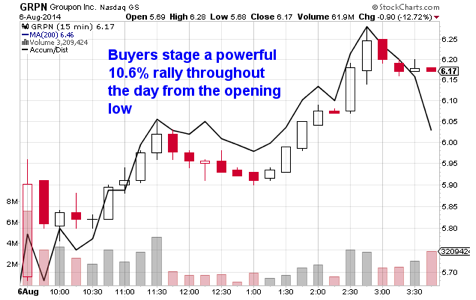

The chart, below, shows three strong rallies during Wednesday’s trading hours.

Source: StockCharts.com

From the low of $5.68 during the first 15 minutes of trading, GRPN soared as much as 60 cents, or 10.6%, which suggests to us that the previous low of $5.17 on May 17 could turnout to be the ultimate low for GRPN.

Higher lows – along with an Accumulation/Distribution index that clearly reveals a rapid net accumulation of GRPN when it moves down to the bottom of the 3-month trading-range (see below) – are exactly the action we like to see before considering a stake in GRPN.

Source: StockCharts.com

Why Jason Bond Believes We’ve Hit the Low in GRPN?

The price action Wednesday and rapidly rising accumulation statistic left a distinctive signature of institution and hedge fund buying. In other words, professional money appears to be seizing the opportunity to enter large sums of client funds against retail selling. In the case of GRPN, approximately $350 million changed hands Wednesday during the course of the 10-plus percent rise in the stock. It appears that small retail sellers capitulated to professional buyers.

“Wednesday’s action gave me the same feel when I see commercials taking the other side from the ‘specs’ (speculators) in the commodities pits,” stated Jason Bond of Jason Bond Picks (JBP). “The net accumulation has been huge on both up days and down days this week. That smells of institutions taking advantage of fickle, weak-handed specs offering what the pros think is a bargain. We agree with the longs, here.”

Though Groupon posted after the bell Tuesday a loss of $22.9 million (three cents per share) against last year’s $7.6 million (one cent per share), revenue spiked 24% to $751.6 million from $608.7 million posted for the equivalent quarter a year ago.

Overall gross billing grew year-over-year by 29%, which suggests that the faster rise in the billing rate over the revenue rate (24%) translates to falling commission rates during the quarter.

We believe stiff competition from Amazon (AMZN) puts pressure on Groupon to maintain its revenue growth by way of sacrificing commission rates.

“The guts of the quarterly report spooked investors. Groupon reported smaller commissions, a new credit line and disappointing guidance,” stated Steven Russolillo of the Wall Street Journal.

However, average spending per customer, number of deals, and total active customers rose during the quarter, all of which appears consistent with the transition of the company’s new business model of reducing its dependency on daily-deals emails and simultaneously growing sales of goods and repeat discounts through its online marketplace and mobile phone marketing.

In addition to the change in the way the company interfaces with customers, Groupon has launched Gnome, a cash-register system, to compete directly with PayPal and Square.

“Investors will be looking for signs of improvement on three key metrics; revenue growth in local, improvement in goods gross margins and, progress in international operations,” said Sterne Agee analyst Arvind Bhatia, in a note to investors.

“Changing operating models mid-steam as Groupon is doing right now takes time,” said JBP’s Jason Bond. “We’re afraid sometimes the hype coming from the chat room bulls rarely matches the results. We agree with the Journal, but we also believe Groupon will surprise with better metrics in all categories over time.

“In fact, long-term JBP subscribers have seen this turnaround story play out many times with our other picks – like the ones we’ve highlighted over the years – such as Sirius XM, Plug, GM and FNMA,” he added. “We expect nothing yet to seriously eat away at the foundation of Groupon to believe the company won’t offer traders the big returns on turnaround strategies we’ve already seen with the stocks we cover each day in our chat room.”

Lost in the somber headlines Tuesday and Wednesday was Groupon’s North American billing and revenue, which both grew 12%, and indicates commission rates were stable in the Americas during Q2. The company also billing and revenue growth in Europe, Middle East and Asia (EMEA) rose 0.2% and 42%, respectively.

Excluding the acquisition of TMON, billing for the ‘rest of the world’ climbed 17%, suggesting to us that Groupon is poised to generate operating income as early as Q4 of 2014.

Total active users grew 22% to 53 million, led by North America’s 43% and followed by a hike of 30% for the ‘rest of the world’.

Though company guidance included a lowering of the revenue range expected for Q3, Groupon CEO Eric Lefkofsky told the Wall Street Journal, “We’re a business in transformation. We’re still in investment mode. We believe we can accelerate our business.”

The Jason Bond Takeaway

Deal volume is up, but Groupon has more to do at the local level. An acceleration in grow to the top and bottom lines could come from its travel business, which presently books hefty gross margins. We expect progress in that area.

Overall, we understand that turnarounds of this size take time. Investors expecting instant results; and when those results don’t come quick enough, the short-term speculators dump shares and move on. In the case of Groupon, like SIRI, PLUG, et cetera before, the big price moves come from dislocations between investor sentiment and the tangible, meaningful progress made toward the company’s objectives.

If Groupon succeeds, the reward could be rather large, as the company now trades at 1.45-times sales, compared with Priceline’s (PCLN) 9.41-times sales.

Looking for another big stock idea like GRPN?

To get a heads-up on other stocks we feel may better your rate of profit, start by joining our mailing list (top of the page). Or, take the next bold step now by joining Jason’s community of dynamic and active traders with your subscription to Jason Bond Picks.

Click here for 2013 Performance Record +77%

0 Comments