Hard to believe, but yes… the U.S. stock-market futures are up Wednesday, in the wake of the prior day’s rally, after a European Central Bank funding operation for the region’s banks showed a higher level of lending than expected. Lend, lend, lend… Dave Ramsey is cringing this morning.

On the economic calendar for Wednesday, existing-home sales for November will be released at 10 a.m. The data will draw attention after the prior day showed construction of new homes in the month at the highest annual rate since April 2010.

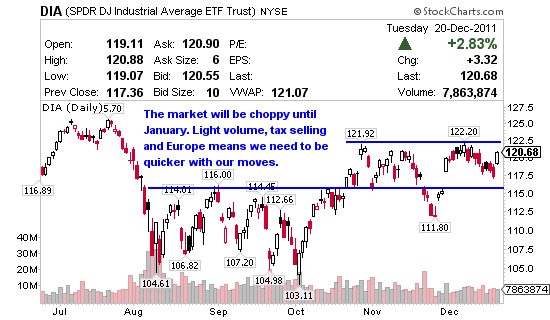

Personally I don’t trust it! Why should I, we’ve seen 4/5 green opens close red. Call me the Grinch if you like but I’m green in 2011 and I plan to close it that way if I can. Especially considering volume is light and the major indices are coming up on MAJOR resistance once again. We might get another push early on but in general I don’t think it’s the multi-day uptrend I’m looking for. Personally I think our time is better used scouting out great stocks that are beaten back and will run in 2012 – that’s where real money will be made and made very quickly if you get the right positions.

That’s not to say I won’t be swing trading but the setup has to be one I trust for two days or more. I took my last alert THQI for a small profit and I hope to do the same with BPAX and just repeat those ‘buy today’ and ‘sell tomorrow’ trades as that is what I believe is the safest way to manage my money before Christmas. If you’d like some day trade ideas, jump in chat and I’ll toss out some extra picks.

Video on HKN coming today – made $7,000 back this week just by demonstrating patience. Luck yes, but some skill too – because it’s hard to look at -$7,000 daily and not just want to dump. Anyway, I stuck to my plan and a short seller bailed me out even. Lots and lots of lessons here which I’ll address in the video.

Still liking USAT and hope to score that stock big in 2012 but I don’t expect to see a run in December. Yes this is a swing trade newsletter and yes I’ve had it for a month, maybe more. But I’m still sending 3-5 new swing trades every week so understand I won’t just sell a position if I still think I can make money on it just like I did with HKN yesterday after a month of waiting.

Other than that I have a small piece of FAZ left which was a scalp that went wrong. For those who are new, a scalp is when you take a big position with the hope of making a few thousand dollars the same day. Problem is you can lose a few thousand dollars the same day if you’re wrong. I’m down a nice chunk on that trade so far but it wasn’t a swing alert (Day trade) so that shouldn’t effect you. However you can learn from my mistake I hope. Where did I go wrong, well I bet against the market Monday into Tuesday and you know the rest given the market Tuesday. I still think there are plenty of sellers out there which is why I held.

BPAX goal is $.50 and if the market turns down and so does the stock I’m out. This is not a 1-10 hold like normal but rather a trade very similar to THQI. In and out for 5% – 10% if you are lucky and move on, timing is everything. Don’t get me wrong, if it runs like ABAT did and starts to squeeze shorts I’ll milk it for every ounce I can get but I’m positive there are big sellers still waiting to unload, especially with January just ahead and tax selling at it’s height. Anyway, if the market stays green then there’s a chance this one catches on with the day traders and if that happens we’re in luck. Best case scenario we get a double up to $.80 before Friday, worst case we stop out below $.40 somewhere. Tiny position for me to protect against giant lurking bears in the stock. This is not a trade to take lightly as it could dump 20% at a moments notice i.e. EK.

PZZI not alert yet but I was able to pick up 500 on the bid Tuesday. This was on my watch list and I told you guys I was bidding the stock. I will continue to bid this stock in December until I have roughly 10,000 shares. Right now 500 at $5.22 is a start but I won’t chase it up the chart. The idea here, if you weren’t in last night’s class is to accumulate PZZI around $5, RENN around $3, USAT around $1 and QPSA around $2.70 with a sprinkle of LQMT in there for fun – kinda like a stock stuffer ha.

0 Comments