Well, we ended the first week of 2020 on a low note as political tensions are rising between the U.S. and Iran.

As traders, we can’t hark on all the little details of what’s going on… but the only thing we can do is put our best foot forward and look for different ways to profit in this environment.

Finding winners in this market is a heck of a lot easier for some traders than others.

The beauty of stock trading is that there are plenty of strategies to lean on to make money.

There are large caps, which I love to trade via the options market using my Weekly Windfalls strategy… then there small-cap momentum stocks in which I use my fish hook and rocket patterns.

When stocks start to get volatile, that’s when it’s time to find plays that aren’t susceptible to shocks in the market.

For the most part, penny stocks are where it’s at when things get dicey.

You see, while everyone and their brother are trying to figure out exactly where we go next… some try to hedge their portfolios… there are other traders out there raking in profits from trading penny stocks—oblivious to what the overall market is doing.

When it comes to penny stocks, they move to the beat of their own drum and the factors that drive them are chart patterns and company-specific catalysts.

Let me show you why you might want to be trading penny stocks if you haven’t been doing so already.

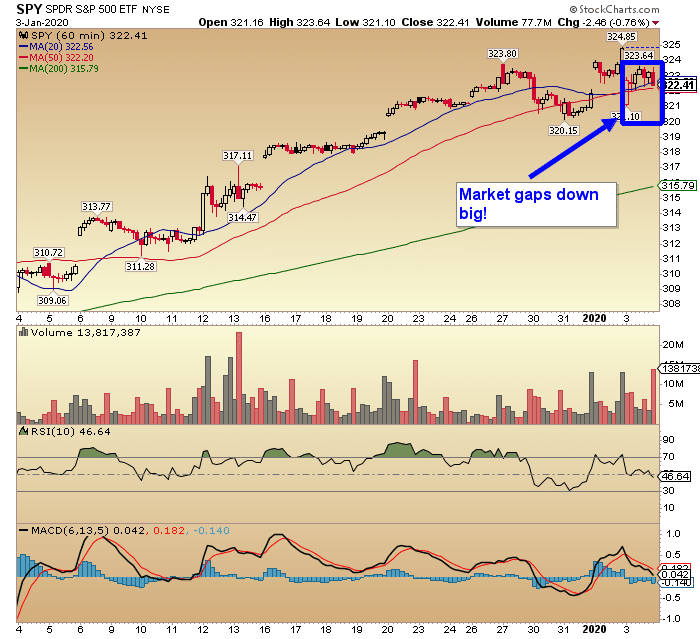

Check out the hourly chart in the SPDR S&P 500 ETF (SPY).

When you look at the price action, you’re probably wondering… Who in their right mind would be buying stocks with all these potentially negative catalysts on the table?

Sure, buying mid-, large-, and mega-caps wouldn’t have been an amazing idea, but when you look to penny stocks — there were plenty of juicy setups.

You Don’t Need To Trade The Overall Market To Make Money

Take my good friend Jeff Williams for example. When the market was dumping, he probably didn’t know what was going on! He was just focused on finding the best penny plays out there. The best part — all he had to do was look to the charts.

On Friday, as everyone panicked in the pre-market… Jeff was actually sitting in profits and locking them in.

You’re probably wondering how he did that. Let me break it down for you.

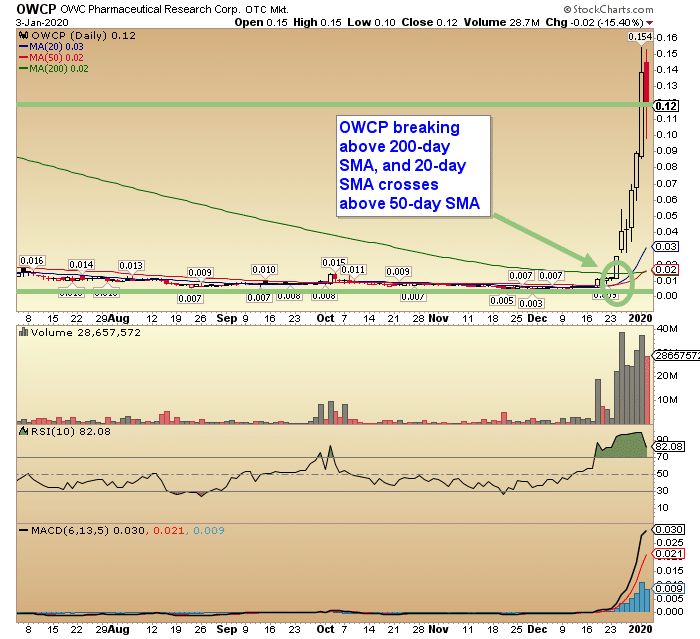

The trade was in OWC Pharmaceutical Research Corp. (OWCP), and all Jeff spotted was volume and momentum picking up, as well as a key level.

If you look at the daily chart, OWCP broke above its 200-day simple moving average (SMA)… and the 20-day SMA was crossing above the 50-day SMA. Those are bullish signals indicating the stock could run higher.

However, since that all went down during the holidays… Jeff waited until the New Year to hop in because things could get choppy then.

When Jeff was conducting his scans and ready to fire off trades to kick off 2020, he noticed OWCP had a strong volume day on New Year’s Eve… and spotted a key level the stock could break above.

He was looking at the $0.1189 resistance level, which dated back to January 2019. Basically, with volume picking up and OWCP gaining momentum, there was a high probability OWCP would break above that level.

So what did Jeff decide to do?

He waited for the perfect entry and bought shares just above $0.1189.

Buying shares at that level actually minimized his risk, because he had clear support levels to stop out below, just in case the trade didn’t work.

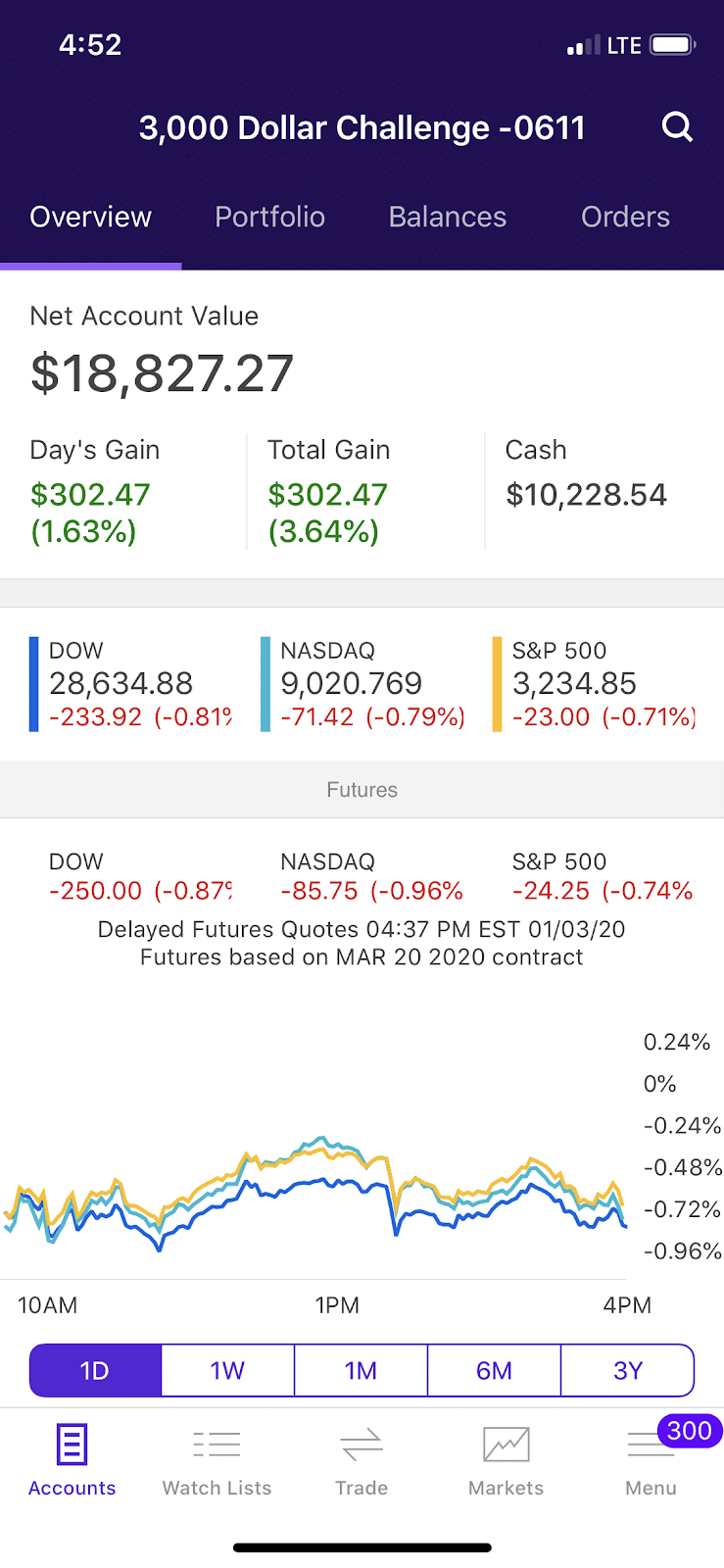

However, the following day, OWCP gapped up massively… and Jeff was locking in a 22% winner — bringing his small account to more than $18K…

… all while the market was selling off.

Now’s the best time to learn how to trade penny stocks, especially in this market environment.

What are you waiting for?

Click here to learn how Jeff Williams multiplies is small accounts.

0 Comments