On November 6, Americans re-elected Barack Obama as President. A day later investors turned their focus to the impending fiscal cliff. All three major indexes fell more than 2% a day after the Presidential election as worries over the fiscal cliff mounted.

Between November 7 and November 13, the Dow Jones has fallen 2.57% and is now well below the 13,000. The sell-off has been exacerbated by uncertainty in the euro zone. Some of the biggest losers in the last five trading sessions have been Apple Inc. (AAPL), which is down nearly 7%, Caterpillar Inc. (CAT), which is down nearly 5.5%, and Bank of America Corp. (BAC), which is down more than 6%.

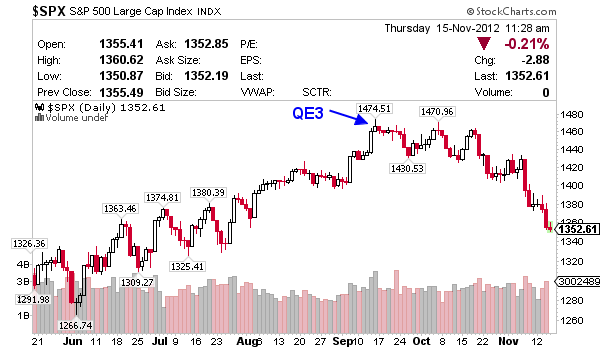

S&P 500 Tumbles on Fiscal Cliff Worries

The Fiscal Cliff

While the fiscal cliff issue has been at the back of investors’ mind for over a year now, focus completely turned to the impending threat following the U.S. Presidential election on November 6.

The fiscal cliff refers to the implementation of automatic spending cuts and tax increases worth nearly $600 billion that will take effect on January 1, 2013 if lawmakers in Washington D.C. fail to reach an agreement on reducing the U.S. fiscal deficit.

The fiscal cliff issue is largely self-inflicted as Democrats and Republicans have failed to reach an agreement on how to reduce the U.S. fiscal deficit. While Republicans do not accept tax increases, Democrats loathe spending cuts. A robust long-term deficit reduction plan requires a bit of both, however, partisanship has taken over common sense in Washington D.C. these days. Unfortunately, this has put the U.S. economy at risk of slipping into yet another recession.

The fiscal cliff issue if unresolved would lead to a number of provisions going into effect on January 1, 2013, including the expiration of Bush era tax cuts, which were extended by President Obama in 2010, spending cuts to majority of discretionary programs as directed by the Budget Control Act of 2011, and expiration of 2% Social Security payroll tax cut, among others.

What would be the impact of these spending cuts and tax hikes? The Congressional Budget Office (CBO), in a report, last week, estimated that the U.S. GDP will drop by 0.5% in 2013 (measured by the change from the fourth quarter of 2012 to the fourth quarter of 2013) if the economy falls over the fiscal cliff. The CBO also said that the contraction of the economy would lead to a rise in unemployment rate to 9.1%.

Recent U.S. economic data, especially from the labor and housing markets, has been encouraging. However, the nascent recovery will be derailed if lawmakers fail to act before the year-end deadline to avert the fiscal cliff.

Recession Not Just Painful for American Citizens But Also for Global Economy

The U.S. economy cannot afford another recession. Unlike the recession that followed the financial crisis of 2008, a recession now will be hard to fight. The U.S. government announced massive spending programs during the last recession to stimulate the economy; however that option won’t be available this time. There is very little that can be done on the monetary policy side, given the Federal Reserve has already implemented a third round of quantitative easing and interest rates are at record low. So a recession in 2013 would be probably be longer and more painful then the previous one.

However, it is not just the Americans that will suffer if there is a recession next year, the global economy will suffer too. Remember, the global economy is in a fragile state. The euro zone debt crisis is far from resolved. China is seeing a slowdown and is undergoing a once-in-a-decade leadership change and Japan recently reported a very disappointing GDP data for the third quarter.

Given all these factors, it is imperative that lawmakers find a solution to the fiscal cliff issue.

The Worst Outcome is Likely to be Avoided but Deficit Issue Has to be Addressed

Considering the damage that will be done to the U.S. economy if the fiscal cliff issue is unresolved, it is likely that lawmakers will reach some sort of deal before the deadline. Bipartisanship is the need of the hour. However, Congress’ recent record doesn’t inspire a great deal of confidence. Back in July 2011, a deal on raising the debt ceiling was sealed only a day before the deadline. The political bickering back then caused a huge sell-off in equity markets and eventually led a downgrade of U.S. triple A credit rating by Standard & Poor’s, the first ever downgrade in the country’s history.

Hopefully, lawmakers have taken some lessons from the debt ceiling issue and show a little more sanity this time. Negotiations over the fiscal cliff issue will begin on Friday, when President Obama sits down with Republican and Democrat leaders of Congress.

As I said before, a deal of some kind will be reached very likely; however, kicking the can down the road will not help. The U.S. has massive fiscal deficit and public debt and needs a robust long-term deficit and debt-reduction plan. While doing it the European way, i.e. implementing harsh austerity measures at the front-end, will not work, spending cuts and tax increases in the medium term is the way to go.

Market to Remain Volatile

As lawmakers begin negotiations this week, market will remain volatile until there is a sign of some sort of deal before the deadline. However, the market volatility may throw up some attractive opportunities. Investors should look to capitalize on those. Remember, the U.S. economy has shown signs of improvement. If the fiscal cliff issue is addressed in time, a more robust recovery will be seen in 2013.

mmmmmmmmmmmmmmmmmmmmmmJason: If O takes us ofer the fiscal cliff for raises on taxing the wealthy. This is just the easiest to start with to break the nation. Obama care will break the insurance companies bringing it to the govt socializing the program. The wealthy will pull businesses out of the country, causing unheard of unemployment which will bring banks down and back ending up going to the govt. Probably devaluing the dollar which will break insurance companies. Guess what the O has us check mated and can take over. This has been his plan since coming into office. He and his wife hate capitalism, they don’t like the class system. Govt with him dictating can keep us all working and better off then we are now. All in the same class. Thats the bottom rung of the latter.

This is so scary to think that the American people can’t beleive they don’t need govt. It will be our down fall just as it has been throughout history.

Joe Lillis