September 24, 2018 11:05 a.m. ET. A correction that impacts two reports I’ve issued regarding Liquidmetal’s association to Chaohu Yi’an Yunhai Technology Co., Ltd. (“CYYT syndicate”) is of a material nature and warrants a published correction to the text associated with the reports entitled, Big Deals Made Right Under Our Noses and LQMT CEO Professor Li Scores BIG! But You’re Not Supposed to Know—Yet.

In these reports I have indicated the stockholder ownership structure of the CYYT syndicate at 40%, 35% and 25%, held by Eontec, Shenzhen Anke and Liquidmetal Technologies, respectively. Instead, regulatory documents provided by Eontec regarding the ownership structure of the CYYT syndicate delineate the ownership at 60% and 40%, held by Eontec and Nanjing Yunhai, respectively.

The distinction is important in that, Liquidmetal Technologies is not required to report on SEC Form 8K the material impact the CYYT might have upon shareholders of LQMT. Instead, the impact upon LQMT investors may necessitate a SEC Form 8K at a later time due to affiliate agreements held between Eontec and Liquidmetal regarding revenue generated and ascribed to Eontec under the CYYT syndicate, or any other instance.

Agreements held between Eontec and Liquidmetal grant shareholders a basic framework as to how revenue shall be ascribed to both entities via the CYYT syndicate or any other entity conducting business with Eontec. Although the determination of how revenue, expenses and profits shall ultimately be ascribed to Liquimetal Technologies shall presumably become dependent upon agreements held between sales personnel of the two entities and their respective employers.

I) Introduction

II) Darn Good Explanations For Professor Li’s Silence

III) Did You Know Liquidmetal Has Already Lifted Off?

IV) ‘Smoking Gun’ Proof of Undisclosed Liquidmetal Plant In Production

V) Final Thoughts

VI) Disclosure

Introduction

It’s been two months since I updated my analysis of Liquidmetal Technologies (ticker: LQMT). Since I began issuing reports, as far back as early-2017, about the progress made by the company, each report has expounded upon the last one with a purpose of clarifying why a Hong Kong businessman would enter the United States in December 2016 with $64 million of his own money and buy a controlling stake in Liquidmetal, a failed 23-year-old OTC company with a retained earnings deficit of approximately $250 million.

With a boatload of exotic intellectual property as Liquidmetal’s only promising assets, speculation of big production deals imminent with Apple Computer followed the iPhone maker’s purchase of Liquidmetal’s amorphous metals patents in 2010. Then Tesla’s modest production runs contracted with the very-same Hong Kong businessman’s China-base production facility (Eontec) entered into the speculative frenzy about Liquidmetal’s promising future prospects with the marquee name.

Other than these two narratives of good things that might come to Liquidmetal’s spanking-new production facility in Lake Forest, California, speculation of Liquidmetal’s entrance into the medical equipment maker industry has since filled the growing void of enthusiasm for holding LQMT.

What did this Hong Kong businessman, Professor Lugee Li, have in mind leading up to his seizure of Liquidmetal, a month following the presidential election of Donald Trump? Surely Li had at least a Memorandum of Understanding in his pocket from one of the blue-chip makers of electronic devices, vehicles or medical equipment, the three industries touted as likely markets Liquidmetal would profit the most.

With prototypes and introductions of new products, made in part with amorphous metals, creeping into the consumer and commercial marketing literature, most investors of LQMT have drawn the conclusion about the stock as a long-term play.

When the media asked of Li’s plans, the professor of material sciences is quoted that the company will pursue business with several companies in the medical equipment market, but will also include asking for business with the “fruit company,” referring to Apple Computer. And mere months later, Li announced plans for a new manufacturing facility in Lake Forest, California, that was quickly built, followed by a well-attended Open House, and a hopeful vision by the new CEO of turning around Liquidmetal into a vibrant supplier to the world’s multinationals.

These events during the first-half of the year 2017 only fueled speculation of an announced deal with a ‘whale’ was imminent, including the huge publicity that would follow, and a soaring stock. If no deals were imminent, why else would Li quickly build a state-of-the-art manufacturing facility? And that question posed was at that time a good point until it occurred to attentive shareholders that Li’s 41k sq./ft. facility is inadequate for a production run of 100 million iPhone casings, production runs for Tesla’s needs, or similar tasks required by other global behemoths upon whom LQMT investors have embraced their hopes.

After more than a year of Li’s arrival, the erection of a new facility, and the grand-opening hype surrounding the facility, nothing has changed at Liquidmetal. Zilch. The company appears no closer to landing a big contract than it was prior to the arrival of Li. Earnings reports so far have yielded nothing more than disclosures of a couple of prototypes shipped and the same miserable financial metrics.

Maybe Li had underestimated the difficulties William Johnson, co-founder and CEO before him, faced, and will now resort to a backup plan. The mood of selling Liquidmetal’s patents to a multinational corporation of Apple’s vintage as a means of Li bailing out of his $64 million stake hasn’t arrived among faithful stockholders yet, but I suspect a collective throwing up of hands will come soon unless a spark is generated to assess whether more fuel has reached the ignition chamber of this dead engine.

Well, read on, because I don’t have a mere spark for you, but I do have a surprise: a well-tuned running engine already running at an undisclosed plant overseas! But first, investors are perplexed at Li’s silence at the Lake Forest location. And why wouldn’t Li brag about his deals and shipped parts? Are we all used to that, especially coming from CEO’s of micro-cap companies?

Darn Good Explanations For Professor Li’s Silence

In this report, I demonstrate that Li is no Captain Ahab in an unrealistic haul of the trillion-dollar ‘whale’ of the likes of Apple Computer or Tesla, though he might have contracts at the undisclosed plant overseas that I haven’t sleauthed yet. Instead, I demonstrate that Li is a brilliant, aggressive, connected and cunning global operator of the first order, who already had his ducks aligned meticulously well before his dramatic acquisition of Liquidmetal in December 2016. After uncovering evidence of his real operation in July, and of the 1,000-ton whaler he had built in China, it occurred to me that the likes of a Captain Lugee Li don’t come around very often, yet he is continually trashed on stock message boards as a neglectful buffoon. Clarification of his modus operandi is now in order.

Forgive them Professor Li, for they know not what they do. I’ve read many postings on stock message boards. I cringe in response to many of the comments posted there.

The truth is, not only is this man a master of the art of corporate counter-corporate espionage, nation-state affiliations and cooperation, and academic and industry networking, Li knows how to make money. And I have the concrete proof revealed in this report that I know will drop the naysayers’ heads in utter shame, but please indulge me for a moment so that the motives behind Li’s secrecy, perceived inaction, maybe even perceived failure, and overall neglect of investors are rooted in an overarching need to work ‘at night’ and ‘under the radar’ for reasons of preserving his options—on his timetable.

I cannot definitively prove that Li already secured firm assurances of contracts from global enterprises prior to his abrupt entrance into our financial lives in December 2016, but the bold and unflinching actions taken by a man with a long, squeaky-clean track record of making a good buck within an industry, whose science has been the focus of his entire professional life (Li is 57-years old) indicated to me an impressive demonstration of someone who knows how to make things happen, irrespective of not letting you know about his every move. He doesn’t give sh*t about your need of him to hold your hand.

And then, in July of this year, following my discovery of an amazing labyrinth of partnerships, financial arrangements, private-placements, and positioning within Beijing’s strategic economic sphere of clout, I was quickly led to the conclusion that Li’s purchase of LQMT and subsequent building of manufacturing facility at Lake Forest arguably must have been a premeditated quasi-decoy, as part of a master plan of taking his roadshow to China, where the global juggernaut behind the $8 trillion ‘Silk Road 2.0’, officially called the “One Belt, One Road” megaproject in Asia begins, and where the money will be made for all stockholders of LQMT.

Read:

MAPPED: China’s most ambitious megaproject — the new Silk Road.

The Yangtze River Delta Integration Plan

China Launches $15.6B Fund To Support Yangtze River Delta Economic Zone

Shanghai factories move as Yangtze River Delta accelerates (video)

Beijing’s high hopes for the Yangtze Delta

Although a deal with Apple Computer would be a great development, but, essentially, Li doesn’t need Apple to make LQMT investors rich. Li has his eyes set on much bigger plans than cow-towing to a penny-pinching and controlling colonial-like master of the West. Sounds harsh? Li must have plenty of colleagues who’ve told him all about the life of an Apple supplier, and I don’t think he’ll pursue Apple as he said he will. I think he’ll wait for Apple to come to him.

Read: The blessing and curse of being an Apple supplier

Beijing’s One Belt, One Road initiative, which now includes the Yangtze River Delta, is China’s response to a stifling U.S. economic and political hegemonic global trade infrastructure, and Li has taken sides in the growing trade war—his side, where he believes he can make money instead of becoming a casualty of tariffs salvoed from the U.S. and China.

True businessmen have no political allegiance unless that allegiance treats them with ‘kid gloves’ and puts money in their pockets. And one of the two top complaints waged against China, expressed by Peter Navarro, President Trump’s chief trade adviser, is China’s “theft” of intellectual property. In this interview with Fox News, Navarro begins the discussion about the trade war with China’s theft of intellectual property (video here time: 7:45).

The situation between Washington and Beijing is quite serious. Li must have had a heads-up about Trump’s intentions regarding trade relations with China from sources within the intelligentsia of Chinese political power. How do I know? Because I found reports from Chinese institutions (similar to our institutional ‘think tanks’), written in the Mandarin language for the Chinese reader, about the coming trade war between the U.S. and China—and published prior to the election of Trump. The reports conclude that Trump was an “uncertainty” within China’s business and political class, and that presidential candidate Hillary Clinton would be more “politically pliable” on trade, if she was elected U.S. president. The well-connected Professor Li must have known all of this analysis before he set foot into the U.S. to buy Liquidmetal.

Therefore, from a political point of view and from a viewpoint of limiting corporate espionage, Li’s opaque nature toward investors shields him from answering sensitive questions about his strategic plans. Search with Google and read about how Apple computer treats its suppliers regarding breaches of corporate secrets. The provisions and penalties imposed upon all suppliers who sign Apple supplier agreements read like a conscription into the French Foreign Legion.

In other words, Apple has been at the forefront of counter-corporate espionage for a long time, and it is Washington that’s finally coming around to Apple’s sense of urgency. I think Li feels much more comfortable in China, where cooperation between manufacturers and suppliers are endemic to Chinese strict business culture and Beijing’s oversight, as long as you are apart of the inner circle, of course.

Contrast the legal environment in the United States and Europe with the lax legal environment involving cross-nation violations of intellectual property laws in China, explained in a publication by Singapore Management University, then ask yourself: what would I do if I was in Li’s shoes? Now, I’m going to layout what Li has done to pave a way around these business-unfriendly obstacles. And from the beginning, it’s all happened right under our noses!

Did You Know Liquidmetal Has Already Lifted Off?

For newcomers to LQMT, either you can read my previous report of July 17, entitled, Big Deals Made Right Under Our Noses, or you can continue reading the summary I proved here:

Up until the early-July, my strong hunch that something big was rumbling at Liquidmetal under our collective noses quickly morphed into compelling evidence that something indeed was the cause of my hunch. In mid-July, following my uncovering of Li’s real operation, I knew then that my next logical step is to find the evidence of production, revenue and back orders—the ‘smoking gun’ — that definitively demonstrates that Professor Lugee Li is no Captain Ahab, but instead a man who is slated to make shareholders of LQMT very happy indeed in the months to come.

Yup,I found the smoking gun!

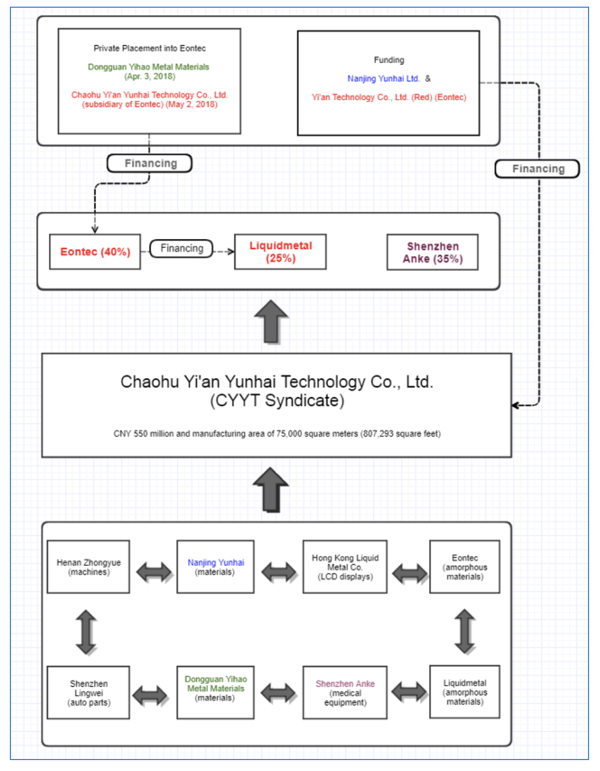

In my report of July 17, I outlined my discovery of a privately-held Chinese syndicate of nearly a dozen China-based companies, furiously formed into existence before Li’s purchase of Liquidmetal in December 2016. Got that? Before Li purchased LiquidmetaI! I coined the syndicate, “CYYT,” which is short for Chaohu Yi’an Yunhai Technology Co., Ltd., a private company controlled by two publicly-held entities and one privately-held entity, of which Li controls two of the entities (publicly-held) as well as control of the syndicate with his 65% majority share. No doubt about it; Li is the ringleader of the entire enterprise.

The three entities of the CYYT are as follows:

1) Eontec (ticker: 300328:SZ): Professor Li’s company in China, founded in 1993, with a market capitalization of US$430 million. Eontec holds 40% of the CYYT syndicate.

2) Shenzhen Anke: A privately-held company in China, founded in 1986, and began as a joint venture with Analogic Corporation (ticker: ALOG), a $1.05 billion market capitalization company. Analogic Corp. was purchased by investors of Altaris Capital Partners, LLC, and taken private on June 22. The ticker, ALOG, no longer trades on the Nasdaq as of June 23. Shenzhen Anke manufactures medical equipment and devices, and holds 35% of the CYYT syndicate.

3) Liquidmetal Technologies (ticker: LQMT): Professor Li’s US-based operation, the target stock of this report. Liquidmetal holds 25% of the CYYT syndicate.

I originally estimated the financial muscle of the syndicate at approximately US$500 million, including initial capital, value of tangible assets, equipment, and credit lines pooled by all participants contractually obligated to the CYYT. In all, I’ve identified more than 10 substantially-sized (some huge in size) companies involved with the CYYT syndicate.

At the best of my ability at this time, I present an organizational chart of the CYYT syndicate, below (Exhibit A)

Copyright: Jason Bond Picks

Regarding the CYYT, an excerpt of my July 17 report included the citation of the existence of the CYYT, as follows:

On Jan. 3, 2017, Foundry World (the only journal about China’s foundry industry to an English-speaking audience) provided me with the lead I needed to launch some investigative journalism of the Liquidmetal matter.

Foundry World stated:

On November 16, the light alloy precision die-casting project (Phase I) constructed by Chaohu Yi’an Yunhai Technology Co., Ltd. was completed and put into production. The main products are new energy automotive components, 5G product components and laptop shells. Chaohu Yi’an Yunhai Technology Co., Ltd. is a joint venture funded by Dongguan Yi’an Technology Co., Ltd. [Eontec] and Nanjing Yunhai Special Metals Co., Ltd., with a total investment of CNY 550 million and a building area of 75,000 square meters. The project is to construct a magnesium and aluminum alloys die-casting production base to meet the requirements of energy-saving and industrialization of new energy vehicles in China, and to vigorously develop lightweight automobile components. The main products are precision die-castings for automobile, rail transportation and consumer electronics. The project can annually produce 50,000 tons magnesium and aluminum alloy die-castings once put into production.

With this vital citation as proof of Li’s China operation, this Foundry World article introduced to me another ‘big wheel’ in the CYYT syndicate: Nanjing Yunhai Specialty Metals (ticker: 002182:SZ), the second-half of the principal financing partner to the CYYT syndicate, along with the first-half of the financing partnership, Eontec, Li’s 25-year old company in China. And as it turned out, my investigation into the Nanjing Yunhai only cemented my thesis (now, proof) that Li is ‘swinging for the fence’ to seize market share of a multibillion industry. Li stated he had a two-year window of time before competition was able to catch up with his commanding lead in the amorphous metals industry, so he’s acting fast, as you, too, will soon conclude of his speed to market.

Below, find Nanjing Yunhai’s profile, per the company’s website:

RSM [Nanjing Yunhai] was founded in 1993, in 2007 listed on the Shenzhen stock exchange. After more than 20 years of development, the company has grown into a high-tech enterprise integrating mining and non-ferrous metal smelting and processing. The group has more than ten subsidiaries in Jiangsu, Shanxi, Anhui, Guangdong, Hubei and Inner Mongolia. It is based on the leading advantages of magnesium, aluminum, strontium and other raw materials, and actively develops into the downstream processing field. The products are widely used in transportation, 3C electronics and aerospace industries. [emphasis add].

According to Chinese industry sources, Nanjing Yunhai is often referred to as the world’s largest producer of magnesium. And the term, “3C electronics” contained in the last sentence of the company profile stands for “computer, communications, and consumer electronics.” And without adding to an already intricate puzzle of the Liquidmetal mystery, I’ll just state for now that Nanjing Yunhai has just closed a financing arrangement to build another facility, in a deal worth US$380 million, all of which means the company (market capitalization of $450 million) expects a backbreaking growth trajectory of magnesium sales.

With $380 million in hand, Nanjing Yunhai’s future facility is expected to reach a size of 3.01 million square feet! That amount of square footage reaches more than half the size of the world’s largest manufacturing plant: Tesla’s Gigafactory, which spans 5.5 million square feet. Are my readers beginning to catch this drift? And then when I discovered that the CYYT syndicate is the second-most funded joint venture of Nanjing Yunhai, I now know where to look for more information about the CYYT — Nanjing Yunhai’s earnings reports, for starters.

As much as I would like to speculate in this report, I cannot delve deeper into the significance of the involvement of Nanjing Yunhai with Li and the CYYT syndicate, at this time. I’m able to only share the implications of the company’s 3.01 million square feet facility and the serious involvement Nanjing Yunhai most likely has with Li’s CYYT syndicate.

I cannot share concrete proof of any of this with you—yet. But I’ll leave you with this thought: after I read the CYYT capacity limits included 50,000 tons of magnesium alloy die-castings per year — as indicated in the last sentence for the Foundry World citation, above — I don’t think I’m going out on a limb to suggest the largest producer of magnesium of the world, who has also meaningfully partnered with the CYYT on the debt side of the CYYT balance sheet, would ship its tons of magnesium to a CYYT competitor and not the CYYT syndicate. Fair enough?

And I think when the facts of the CYYT facility’s capacity of 50,000 tons per year of magnesium alloy; produced in the CYYT syndicate’s 807,293 sq./ft. facility; significantly financed in part by the world’s largest magnesium producer (Nanjing Yuhnai) are put all together, it indicates to me approved plans for massive production and contractual obligations between Nanjing Yunhai and the CYYT syndicate must exist.

And my personal gratitude to Nanjing Yunhai for publishing the smoking gun of financial data I need to bring to my readers is indescribable at the moment.

‘Smoking Gun’ Proof of Undisclosed Liquidmetal Plant In Production

Well…in early September I found the ‘smoking gun’ of Li’s real and running factory. Nanjing Yunhai published its earning report on Aug. 29, where I found Li’s LQMT production—the smoking gun! Bingo! After years of waiting to hear about contracts and production, LQMT investors finally have the news we’ve all waited for.

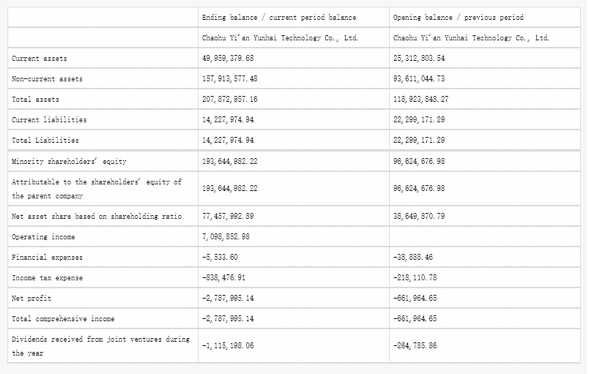

Nanjing Yunhai’s online 159-page earning report is linked here, and PDF here (pg. 138). In the report, the financial data ascribed to the CYYT (Chaohu Yi’an Yunhai Technology Company) is located on page 138, below.

Source: Nanjing Yunhai Specialty Metals semi-annual report

Hello?! Li is in business! And I bet he never thought we would find him so early.

So far, the first quarter results show an operating profit of 7,098,852 yuan (US$1.04 million) and 193,644,982 yuan (US$28.3 million) of Book Value. And these two metrics were reached only after the first quarter of the CYYT syndicate’s brief two-quarter history. And what do you think the financial metrics of the CYYT syndicate will look like at this time next year?

An operating profit of US$1.04 million for the company’s first operating quarter suggests revenue of $2.06 – $5.02 million for the quarter, if a medical equipment parts industry operating margin average of 50.5% is used to estimate revenue, or an auto parts equipment industry operating margin average of 20.7% is used, respectively.

Just from this trace of data, I can infer that, as the law of ‘economies of scale’ kick in on the CYYT syndicate P/L, net margin should soar quickly to profitability and open Li’s options to either take the company public, and merge Eontec and Liquidmetal before the CYYT syndicate merges with both of Li’s enterprises, or keep the CYYT private (a good choice, in my opinion) and book profits away from taxation in the U.S. via Liquidmetal’s whopping capital deficit of $250 million, as you can see reported on Liquidmetal’s balance sheet.

And for those who read my last report, you’ll remember the inclusion of a price target assessed to LQMT of US$1.45 by 2019, issued by Beijing-based broker/dealer firm, Founder Securities (ticker: 601901:CH; market cap US$8.23 billion). Since my July 17 report, LQMT investors were wondering upon what this seemingly incredulous price target was predicated. Well, now you know. Founder Securities knew all about the CYYT, a long time ago.

Final Thoughts

It might be true that Professor Li and the CYYT did know it had a major intelligence leak via its strategic financing partner and, most likely, working partner: Nanjing Yunhai, but this sensitive financial information was buried quite well. He probably assumed the U.S. press, or a motivate trader like me, would not find the time to look into tiny Liquidmetal. Wrong.

Finding the data contained within a 159-page earning report tested my patience and resolve, because I had serious doubts whether Nanjing Yunhai would go the extra mile to delineate, in detail, the financial data of its joint ventures. Admittedly, I was endowed with some luck this time. Nanjing Yunhai did report all the data I needed for this round of reporting to my subscribers. Enjoy.

Folks, as a final thought: I think the CYYT will end up as a magnificent privately-held gravy-train subsidiary of Liquidmetal, with Liquidmetal serving as a de facto shell company (for now) for the purposes of reducing corporate income tax liabilities in the U.S. while leveraging Li’s capital wealth (and our wealth) via the most active and powerful equities markets on the planet: Wall Street.

And the day Li decides to, not hope to, become listed on Nasdaq, that’s the day when the long-awaited bumper harvest is reaped. The move in the share price of LQMT might be akin to a successful launch of an IPO. I hope this report helps you decide whether you want to play LQMT along with me, or not.

Disclosure

In the spirit of full disclosure, as of this report date in September 2018, I own 1,175,000 shares in LQMT $.231 or $271,588, am planning to add 325,000 more shares, with a goal of selling above $.40 for profit, or taking a loss.

Trade Green…

Jason Bond

Editor, Jason Bond Picks

Very impressive work, Jason.

Nice

Hello Jason, I just joined your service and I’m very impressed. Thanks! I was wondering, what is your stop order on this stock?

Excellent information! Thank you for sharing.

Sei Incredibile! You’re amazing!

Very nicely done, Jason! Thanks for sharing. As you know from our discussions when I first joined your service years ago, LQMT has been a long hold of mine for several years, and it appears that many things are coming together to allow them to expand in accordance with the disruptive nature of what they are producing. It reminds me of “Reardon Steel” from Ayn Rand’s, “Atlas Shrugged”. Lugee Li may indeed be John Galt.

don’t forget about the 1/100 reverse split that will be sure to come

Based on all of the evidence in this report…. and based also on your more than impressive track record…. and based also on the fact that you are a man who has a history of doing most of his trades over the course of days and mostly NOT doing long term investments (that we are aware of)….I do NOT believe that you have spent this much money buying THIS much stock…. of this company and holding it THIS much time… hoping for only about 40 cents….. Boys and girls I do believe our teacher is looking at very likely.. a LOT more profit . I do believe I am seriously looking forward to the results of this one folks 😉 (deal me in for 10k+ shares of LQMT )

Hi jason, thankyou so much for all of your hard work and time spent gathering, writing, and most of all, sharing it with us .Glad to be a part of the MRM. LQMT is an added bonus. Great job!

WOW! All for 299.00 a Quarter! I feel guilty (not Really) Thanks Jason

Cheers, it’s always fun when they go like CEI. But truthfully the real money is made with the base hits over the long run.

someone spell it out for me…so buy some and hold ’til when,..2019??

Thoughts on earnings?

Any updates on Liquidmetal? It’s way down, extremely cheap right now for those who want to buy, too low for those who own it. When will you be sending out some updated information on this stock? Do you still own 1 million shares of it?

No updates from me on LQMT, I’ve been adding to my position around $.14 into this dip and have a big position I’m holding long-term for. I’ll update everyone if something material changes that requires an update.

Let’s all hope this rumor is true…

https://rumormurmursbuzz.blogspot.com/2018/12/new-whaleliquidmetal-technologies-lqmt.html

There was also an article saying that Apple was making some casings for the new iphones. Maybe, just maybe, it’s LQMT…

https://9to5mac.com/2018/12/06/icon-found-on-watchos-beta-shows-battery-case-for-this-years-iphones/

Just curious, any chance they could be supplying parts to SpaceX?