With Germany’s announcement of Tuesday to award FuelCell Energy Inc. (FCEL) $6.6 million for research, the stock soared 11.7% on a whopping 42.5 million shares. After rising for most of the day in sympathy with FCEL, shares of Plug Power (PLUG) suddenly began to weaken, dropping 3.8% on equally-strong volume of nearly 80 million shares.

That abrupt reversal suggest to us that an opportunity to arbitrage the two stocks could be in the offing.

But, the window of this opportunity won’t stay open for too long. When traders assess what has happened to the share prices of these companies following recent news of FCEL’s $6.6 million research grant and PLUG’s analyst upgrade at FBR Capital Markets of Jul. 15, the trade will be most likely go lost.

Jason’s Analysis of the Trade

Executive Summary – Jason believes traders may simultaneously short PLUG and buy FCEL in coming days to close the gap between the relative performances of the two stocks.

Technical Anomaly

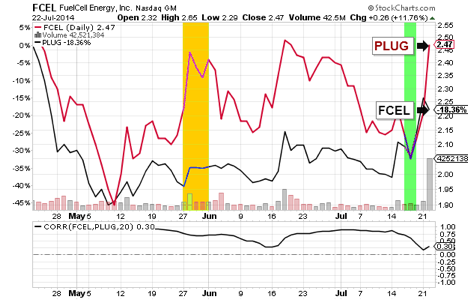

Review the chart (below) and commentary, and make-up your own mind about what appears to be a limited-risk trade against a potentially decent score from arbitraging PLUG and FCEL.

Though the chart’s historical data show that the gap may widen still further, the data show that technical traders of FCEL and PLUG, individually, have dominated the trade thus far this week, creating the potentially profitable arbitrage trade.

From the bottom of the chart, also notice the Correlation Coefficient between FCEL and PLUG. Since July 14, the correlation between FCEL and PLUG has tumbled markedly; however, we expect the misconception among retail traders that PLUG and FCEL share the same technologies and compete directly, the Correlation Coefficient may rise again to the 0.80+ level, thereby reflecting the return to a ‘normal’ relationship between the two stock’s past performances.

In addition, the chart, below, confirms that both stocks have not recently traded quite in tandem. According to the Slow STO, FCEL has just achieved a ‘bull cross’, while PLUG shows signs of technical ‘toppiness’. Both stocks, too, show the significant intraday pullbacks to Tuesday’s strong early rallies.

Fundamental Anomaly Consistent With Technical Anomaly

Anomalies found in the above technical data for FCEL and PLUG could conceivably be the result of a meaningful change in the outlook of the two enterprises, therefore rendering our analysis faulty.

However, in short, the research award of $6.6 million granted by the Germans to FuelCell Energy does not in our opinion constitute a meaningful change in the outlook for the company.

Ditto for Plug Power.

Recent favorable comments made by analysts who cover PLUG disclose no materially new information regarding the company’s outlook. Plug’s work orders, marquee customer base, and backlog are already public information. Based on our experience with the stock and company management, the pop in PLUG could very well be attributable to retail traders knee-jerking the stock higher due to the speculative response to nearly any news about the company.

The notoriety of PLUG’s erratic trade throughout the years has also become well-known to traders of the stock. Traders affecting short squeezes typically result in a subsequent retracement of prices back to lower levels.

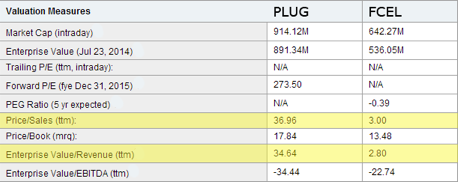

A look at the Price-to-Sales ratios and Enterprise Value-to-Revenue of PLUG and FCEL demonstrate the wide disparity between the two stocks’ performances when compared with the backdrop of the underlying fundamentals of both companies.

Source: Yahoo Finance

From the chart, above, PLUG’s Price-to-Sales and Enterprise Value-to-Revenue ratios are clearly disparate, even when taking into account the vast differences between the companies’ markets within the alternative energy space. Plug’s commercial and multiple-unit business doesn’t match-up well with FuelCell’s industrial and limited-units business.

Jason’s Takeaway

In reference to our article of Jul. 16, titled, Bullish Prediction Sparks Rally In Plug Power Shares, Jason stated that analysts and traders “are probably too bullish even though the company has signed some major deals with the likes of FedEx and Wal-Mart Stores.” The stock may again be trading much ahead of the company’s potential – on a fundamentals basis as measured by the Plug’s Price-to-Sales and Enterprise Value-to-Revenue ratios.

Therefore, considering the developments and price action of both stocks since our Jul. 16 article, traders may want to consider monitoring and possibly arbitraging FCEL and PLUG relative price discrepancy that has resulted from this week’s announcements.

The technical anomaly (correlation analysis, above) may suggest that PLUG’s stock performance has run too far and too fast when compared with FCEL’s relative performance during the week.

0 Comments