How to Play James River Coal (JRCC)

Following the lemming ‘group think’ almost never has been good for investors’ trading accounts. With the overwhelming notion that JRCC heads for bankruptcy, and a price chart assuredly repelling the pack, the stock moves ever closer to a potential monster ‘swing’ trade that should shock the shorts.

I firmly believe that the bankruptcy talk surrounding JRCC will change to the new mantra of JRCC miraculous ‘recovery’ or ‘comeback’ stock.

To familiarize yourself with the bears’ case and JRCC’s most recent 10-Q of Nov. 7, a good synopsis can be found here and here.

First, let’s move to the JRCC turnaround thesis, then, to the stock price at which the risk/reward makes smart sense for a long position.

James River’s Turnaround, a Macro-Driven Event

What do the incessant harping bears of JRCC not see? If only a handful of bulls care able to make a killing in JRCC, then the shorts, therefore, must be caught dumbfounded and collectively made poorer, blindsided by a catalyst the lemming traders didn’t see coming.

Cost-cutting measures, layoffs, mine closings, EPA restrictions, soft coal prices, levered balance sheet and the resulting negative sentiment have all conspired for a capitulation in coal, especially JRCC due to its tight liquidity reserves, which, now, stands at approximately $48 million.

Forty-eight million bucks (maybe more in the future from further debt restructuring talks) leaves JRCC barely enough time to survive the bear market in coal, with a rally in the energy complex restarting no later than the beginning of first quarter of 2014, according to many commodities analysts, just in time to save the company from total bust.

Management Competent, Victim of Soft Coal Prices and a Broken Monetary Policy

It’s my thesis that the makings of a real potential of a 2014 turnaround in JRCC cannot be found in its operations. There’s nothing wrong with management. The case for the bulls can be found, however, in the implications for JRCC’s bottom line from the five-year-long monetary policy drama played between central banks of the US and Europe.

The Fed’s next policy move won’t be telegraphed to include a winding down of its balance sheet; it will, instead, hinted to expand its balance sheet. Therefore, real things will most likely outperform paper things as it happened prior to the 2008 crash, and JRCC could provide a derivative-like move higher to catch up with the preliminary rise in energy (ex-oil) as was the case leading in to 2008.

As the Fed ignites the resumption of the so-called commodities super-cycle (coal prices included), I see a relative rotation out of oil and into natgas, lifting coal prices in the reflexive and ongoing arbitrage between the three energy commodities, to levels where JRCC can again make a profit from its idle CAPP mines.

That’s when the excitement in JRCC will begin, IMO. With a whopping 23.5 percent of JRCC’s float short, the rebound in the stock could set traders sights on $2.5, then $5, as the bloated shorts scream for the narrow exits.

And, if you notice from the minutes of JRCC’s earning conference call, Chairman and CEO of JRCC, Peter T. Socha, is ‘hip’ to the real potential for higher coal prices in the near future, a material improvement to JRCC’s liquidity and prospects of survival.

In his opening comment to the conference call, Socha stated:

Just on the market review, just in summary, things are better. Things were terrible, and I think they’re better now. It doesn’t mean they’re good, it just means they’re better. Certainly, we’ve watched what’s going on with European thermal prices in the last month or so. It has felt much better. It actually reminds me of the same time period back in 2007, so we’ll see how it plays out for the rest of the year. [emphasis added]

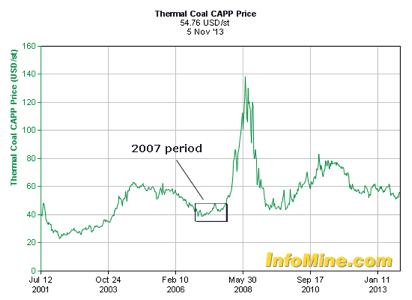

What Socha refers to, is the graph, below, of thermal CAPP prices. As the dollar took a nosedive against all major currencies in 2007-8, commodities soared. Coal followed natgas prices on the way up, and the levered effect of JRCC bottom line to commodities prices took investors up at a much, much faster rate. Complaints that JRCC lacks contracts will benefit the company when coal prices move up again.

Though I don’t expect $14 natgas and $135 thermal coal anytime during 2014, a more modest $5 – $7 natgas range and thermal coal prices closer to $80 (ditto for higher met coal prices) isn’t a far-fetched proposition for next year.

With a move back to the $5 to $7 range in natgas, JRCC becomes profitable. And the reward for betting correctly could be very handsome, indeed. As natgas and coal surged 2.5 times between the summer of 2007 and summer of 2008, JRCC eclipsed coal’s elevation, rising approximately 11 times during the same time period, or a 4.5-to-1 return from the leveraged trade. See graph, below.

At 7 cents to the dollar Price-to-Sales abomination and a Price-to-Book at only 21 cents, JRCC is dirt cheap. But, could JRCC get still dirt cheaper. Sure it can.

Timing the Trade

Watch JRCC closely as $1.15 (the all-time low) is tested, now below today’s stock price. A break below $1.15 could see the stock drifting lower to a buck. At $1, valuations will approach the $25 million mark. That’s enough! IMO. The first quarter of 2014 is expected to attract bids from the algo black boxes, prompted by a Fed whose monetary policy won’t change.

0 Comments