Most traders are getting spun around from all the market volatility…Welcome to October!

Some traders are shook from the heavy price action… they’re reacting like like a deer staring at beaming headlights… just waiting to get smacked down.

You’d think trading would be easier… after all, there are thousands of stocks in the market and dozens of strategies out there.

However, when we’re faced with so many options… it consumes our brain’s processing power… leaving us exhausted and potentially frustrated.

Managing risk when the stakes are high can be extremely stressful too.

I’ve been there before… and there’s one simple solution to prevent decision fatigue and pull you out of mental exhaustion.

Simplify Your Trading With Stock Screeners

Before we get started, I want to introduce you to a tool that I think is very helpful: Finviz.

If you go to their “Screener” tab, you’ll notice there are 7,850 to choose from!

I don’t know about you, but I don’t have time to look through a mountain of charts every single day.

So what do I do?

Well, there are various items to filter for with this “Screener”.

For the most part, with the specific strategy I’m showing you — my small-cap momentum stock trading system — there are really just 4 things to filter for.

- Market capitalization (Market Cap.) This is basically the market value of the companies I want to trade. I like to look for stocks with a market cap between $300M and $2B. These are considered small-cap stocks… and they could move a heck of a lot more than blue-chip stocks.

- Average Volume. This tells us how active the stock has been trading recently. For the purposes of this lesson, let’s stick with more than 1M shares because that means the stock is fairly liquid and you can get in and out easily. As you gain more experience, you can look for stocks that may not be as liquid.

- Price. This all depends on your preference, but I’m going to look for stocks under $15. If you like trading penny stocks, then you can look for stocks under $5.

Other technical indicators. You could use the Relative Strength Index (RSI) — how I found a $13K winner in Overstock (OSTK) — or patterns, performance. Whatever you think is your edge.

What I’m looking for is the fish hook pattern. I spotted one in Overstock (OSTK)…

… and I had already locked in profits.

However, I knew I wanted to trade it again because it’s my bread-and-butter setup… and I figured the stock wasn’t done moving just yet.

The very next day… I didn’t have to decide what I was going to trade, OSTK was on my radar already.

In addition to the $13K I pulled from it… I added another $3,000 the next day…

… and the fish hook is still in play in OSTK.

If buying oversold stocks isn’t your thing… you can also filter for momentum stocks.

For example, you can change the RSI filter to a moving average price break. Typically, with small-cap momentum stocks, if the price crosses above the 20-day simple moving average (SMA)… it’s bullish.

Pretty straight forward right?

When you use this filter, you can find breakout trades.

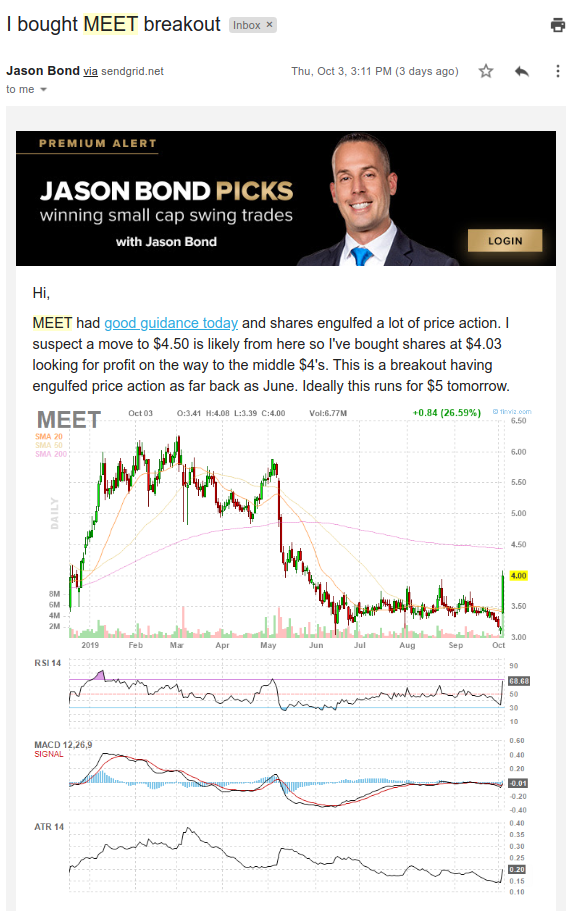

This is what I mean by breakout trades:

Basically, the stock rocketing above a key resistance level.

With The Meet Group (MEET), there was a positive catalyst, and it broke above some key levels.

Once I saw that… I bought shares.

The very next morning… I was taking profits for a nice base hit.

When you use stock screeners… you cut down on the number of stocks you have to look through, saving you plenty of hours… and preventing decision fatigue.

For the most part, with the filters I just showed you… you can look for the fish hook or rocket patterns — two of my best setups for pulling in consistent profits from small-cap momentums stocks.

0 Comments