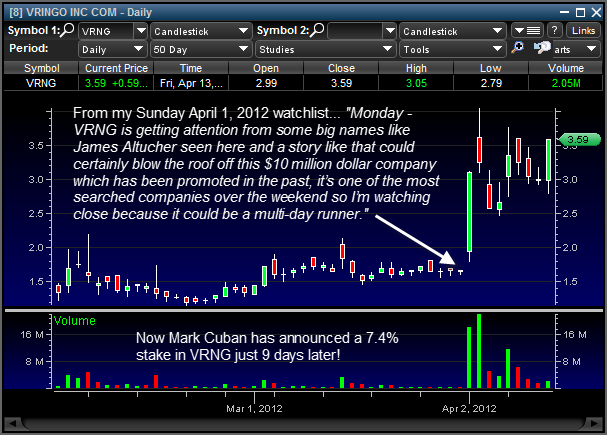

Vringo Inc. (AMEX:VRNG) went out to my subscribers Sunday April 1, 2012 after I found this article on the Business Insider. By Tuesday April 3rd, just two days later, Vringo shares saw a 146% price increase form $1.65 to a high of $4.05. Then I recommended VRNG again as a textbook Fibonacci Retracement play on April 5, 2012 and you can see the amazing results here. And now this morning we’ve come to find out Mark Cuban, the owner of the Dallas Mavericks has placed a huge bet on the mobile software maker.

Once again I’ve successfully presented a trading opportunity to my subscribers well before major players and media jumps on board and pumps the stock to millions of readers. That’s right, Vringo is now making HUGE headlines at CNBC, MarketWatch and the Wall Street Journal this weekend which is sure to drive shares higher than $4 this week, well over 150% from where I first alerted my subscribers just 9 days ago. You can bet some serious institutional buying is probably coming soon.

Here’s an excerpt from MarketWatch…

Cuban takes 7.4% stake in app maker Vringo

By Nathalie Tadena

Mark Cuban has taken a 7.4% stake in video ringtone maker Vringo Inc. VRNG, a disclosure that comes a day after the billionaire made an investment in another applications maker.

Vringo develops mobile video, personalization and social-application platforms. In February, the company said its Facetones app, a Facebook Inc.-integrated visual ringtone based on pictures from a user’s friends, reached 1 million downloads.

The stake of about 1.03 million shares makes Cuban Vringo’s largest holder, according to data from FactSet Research. Hedge fund Iroquois Capital LP has the second-biggest stake in Vringo at 6.4%.

Shares jumped 16% to $3.53 after hours. Through the close, stock had more than tripled since the start of the year.

This isn’t the first time I positioned my subscribers way ahead of Wall Street’s finest. On January 9, 2012 I bought 2,000 shares of Lions Gate Entertainment Corp. (NYSE:LGF) stock at $8.47 and alerted subscribers because I was convinced “The Hunger Games” release in March would drive the stock price significantly higher. The following day I added 2,000 shares to my position at $8.85.

- 1/9/12 – Bought 2,000 LGF at $8.47 on high of day break here. This one is from the watch list and I plan to add 2,000 shares higher or lower.

- 1/10/12 – Added 2,000 LGF at $8.85. Now long 4,000 LGF at $8.66

- 1/11/12 – My goal is a breakout above $9 which should shoot it up into the $10 – $11 range. I feel confident LGF will breakout.

- 1/13/12 – I’m planning on holding LGF long and I mean long…probably a month or two. LGF has a lot and I mean a lot going for it right now and I think it trades well above $10 soon.

- 1/20/12 – I probably won’t look to sell until we get closer to “The Hunger Games” release date of March 23, 2012. There are plenty of good catalysts here to make this a $12 stock or better. I plan to double up at some point.

Read more on how my subscribers and I were in LGF way ahead of Jim Cramer and the rest of Wall Steet

Dear Mr Jason Bond,beleive Me when I say that I could afford u premium service,about a month ago or so I bought shares of mstg,from 1 of those free sites and it was you’re late evening emails that helped me sale my shares,before I took a big loss,but if I would have put the sale in that night,u warned me I would have 9800 dollars than I have now.But I have not been able too work in over 3+ years and we now live on 2340 dollars a month on SSD 100 % disibilty,I have close to 7000 dollars in stock with scottrade, Most of my stock is in nsrs @ a much lower price. And xnez-sefe-lstg-mstg-neom,is there any break for people like me or can I get a pay out deal.Iwould love to Join you’re service,also if I make money off 1 of you’re picks I will pay a little extra.I do beleive u r 1 of the best ever

Thanks James and good luck.

I wish I had known about your services in January….

Glad to have you on board now.