The coming week is going to be filled with action…

- The FDA approved Gilead Sciences’ antiviral treatment for the deadly virus, the first and only approved treatment in the U.S. right now. That’s one catalyst I’ll keep on my radar.

- Rising rates of cases and some are wondering if this will spill over into the winter, and how fast the treatment will hit the market

- Potential stimulus talks. There’s been a lot of back and forth about another round of stimulus, and it’s one catalyst many traders are focused on.

- The upcoming election will also be in focus, as it’s the last full week of campaigns.

Not only that but more than 400 companies are expected to report earnings (more than 180 companies in the S&P).

Apple Inc. (AAPL), Amazon (AMZN), Alphabet (GOOGL), Facebook (FB) and Twitter (TWTR) are all slated to report on Thursday.

There’s uncertainty in the market for sure, but I see that as opportunities. That said, let me show you what key levels I’m watching in some of these names.

Key Levels To Watch In 4 Major FAANG Stocks

Remember, when it comes to earnings, it’s a volatile event… and if you do plan on trading them, make sure you risk manage properly.

That said, let’s take a look at where I’m looking to potentially trade these names.

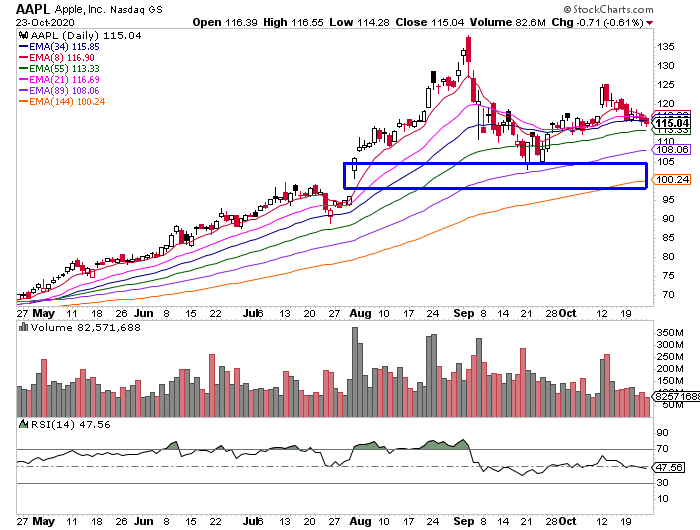

First up, let’s take a look at Apple Inc. (AAPL).

With the company set to report earnings on Thursday, I’m going to wait to see how things shake out. However, it’s good to get a jump on identifying key demand levels. For me, I want to keep an eye on the 21-, 55-, 89-, and 144-day exponential moving averages (EMAs).

I’ve noticed the EMAs have been holding up, and if AAPL dumps, I’ll look to play the dip. On the other hand, if it gaps up after earnings, I want to play the gap and go pattern.

Now, there is a way I trade around earnings that can help me improve my odds of winning. You see, after the earnings announcement and earnings call… there’s less uncertainty. In turn, the volatility gets sucked out of the options.

So I want to take advantage of that vol crush, and I’ll be looking for bull put spreads (I’m going to sell a put spread to collect premium if the price action and options signal it’s favorable).

So the levels I’m watching are: $100, $108, $113.

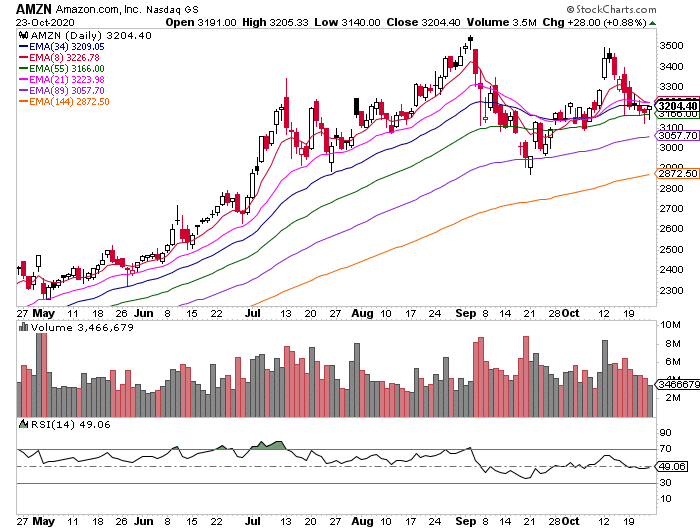

Next up, AMZN is set to report earnings as well.

If AMZN smashes earnings and traders like what they hear, I wouldn’t be surprised if AMZN breaks out. On the flip side, if it disappoints, I think the buy the dippers might step in and support the stock. Whatever the case may be, I’ll be ready.

Again, I want to focus on the same EMAs as AAPL, the 21-, 55-, 89-, and 144-day EMAs will be in play if AMZN pulls back.

Regardless, I want to take advantage of the vol crush, and bull puts will put me in a position to do that, regardless of whether AMZN drops a little or breaks out.

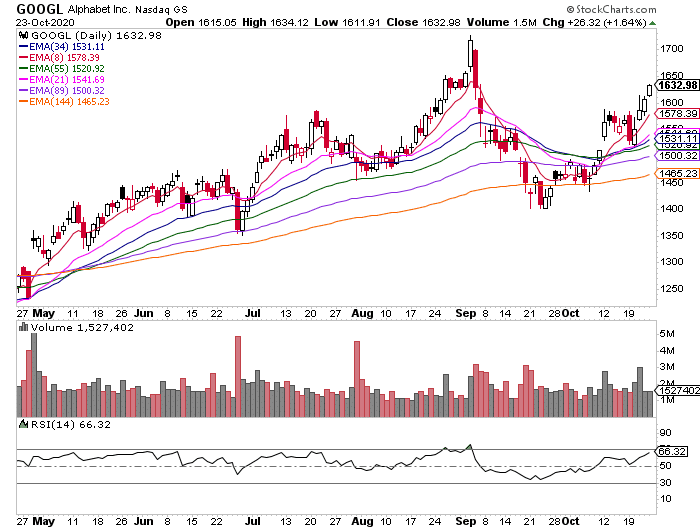

Next up, there’s GOOGL.

With GOOGL, it’s making a move higher already, and if GOOGL does crush expectations, I think it can break out from that $1700 level. On the flip side, if it drops, I’ll look for the $1500 area (89-day EMA), and the $1400 area (a previous support level) to potentially play the dip.

Tomorrow, I’m going to let you know which bull puts look interesting, and why I think they’re great when it comes to trading around earnings.

0 Comments