Each night I send a daily watch list to clients seen below. You’ll also see my swing trade stalker list below the daily and a nightly video. The swing trade stalker is a targeted list I put out on Sunday and then stalk across the week funneling the best looking trades to the daily watch list nightly. Between my master watch list, nightly scans, the swing trade stalker and the daily watch list there’s plenty of ideas for my clients floating around.

I recommend busy professionals work off my daily watch list while those with more time study the swing trade stalker too, it’s a great learning tool. The video is my way to connect to audio and visual learners. The combination is a lot of work but it’s what’s helped me make over $61,000 profit swing trading part time already this year.

Since I don’t have free trials I like to share my work so you can gauge whether or not my service will help you become a better trader like thousands before you.

Friday morning I’ll send a link and password to the free list to join us in chat so you can check that out too. Make sure you’re on my free list if you’d like to swing through the chat Friday.

So here’s what I sent my premium clients tonight… enjoy!

Thursday night’s premium content…

Rock & roll! These broccoli tomato NutriBullets have me jacked up tonight! That and I’ve gone back to caffeinated coffee after a few months of decaf. Almost 500 in chat today for the live lessons, we’re going to schedule a lot more of those and I’ll get them on the calendar so you can stop in while at work. Love you guys and gals, 2013 has been like shooting fish in barrel, let’s keep firing away.

I didn’t close any trades Thursday so no realized profit though GEVO looks great and I’m still feeling out ZNGA trying to establish entry swing long, read my open trade analysis here and review the portfolio here. I did a video lesson detailing how I made just under 10% on NUGT buying Tuesday when it looked weak and selling Wednesday into the Beige book for $6,400 profit, be sure to watch this lesson when you have time.

Market was strong today on better than expected jobless claims, which dipped to a six-week low, casting a positive spin on the labor front a day before the monthly employment report. Friday’s economic calendar shows nonfarm payrolls and unemployment rate at 8:30 a.m. EST. Heading into Friday I’m bullish on the market and think we’ll see upside action into the weekend but the market is toppy so I’m on my toes. As always I’ll monitor the S&P 500 Friday for higher lows throughout the day to support my trading decisions.

Top reads from this week…

Money, Riches, Wealth, Ballin I.E. CHEDDAR

Congratulations To This Client, She Deserves It

It Is Not An Issue Losing On A Trade, What Matters Is HOW YOU GET BACK!

Soon To Retire Grandma Sets A Goal And Is Up $27,000 In 2-Months

——————————————————–

THE DAILY WATCH LIST

——————————————————–

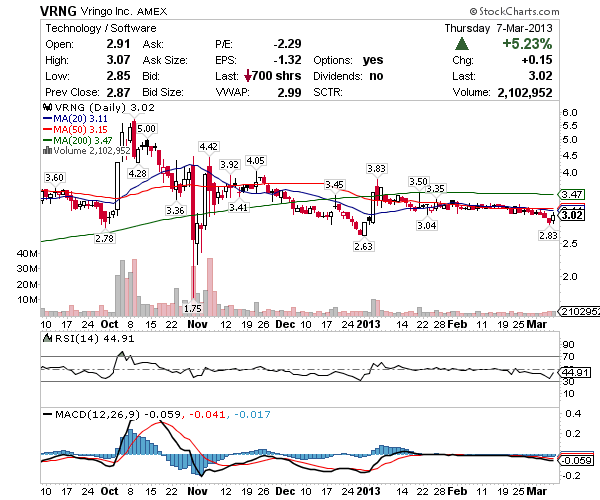

VRNG – First time we’ve seen a volume increase and buyers step up in quite some time, watch the volume close here because if the Moving Averages fall this could run to $3.60 Friday. This story has been quiet for long enough, I think it’s ready to run again in anticipation of their earnings call coming up later this month. Might be a combo Bond Blow Up and Bond Swing Trade for the first time ever because I’m feeling a solid $.50 per share here soon.

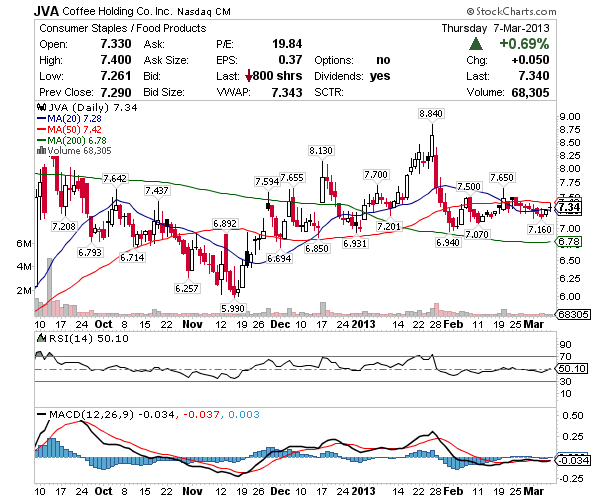

JVA – On the curl I like this trade above $7.20 swing for $9. It’s light volume so bidding support is the way to go here. There’s resistance at $7.65 followed by $9 which is where I think it’s heading. I was in this trade recently and what I can tell you is that it’s not a quick mover, patience will be required so pass on it if that’s not for you. Another trade I’d consider swing long.

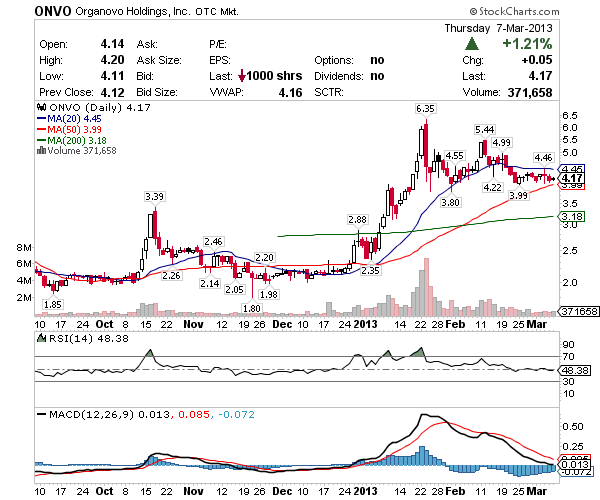

ONVO – DDD and SSYS are on the turn and if they head higher on Friday watch for a sympathy trade in ONVO. Sideways for 2-weeks now a curl in the $4.20’s would attract buyers and a break of the 20 Moving Average opens the door to $5 without any resistance on the way up. The ATR is $.35 here so if this moves it could easily provide $.50 / share in a day or two.

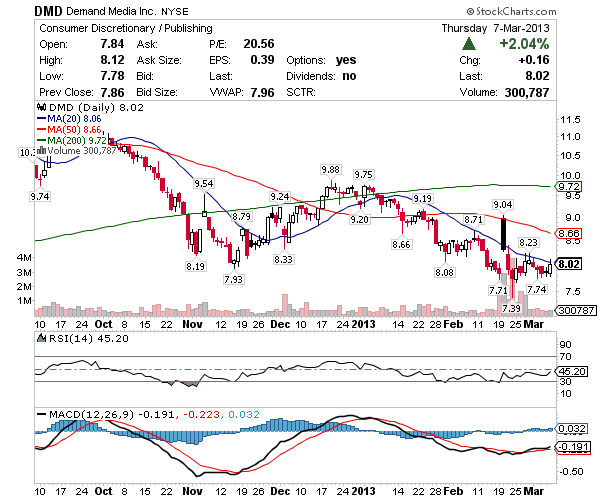

DMD – Above the 20 Moving Average on Friday and I’m considering a swing long on this trade with a stop at either $8 tight or $7.70 aggressive. If I go with the $7.70 stop I’ll scale with maybe 2,500 shares around $8, another 2,500 just above $7.70 and stop if that breaks. Earnings winner that I believe will trade above $10 this quarter with buyout potential in addition to their plans to split the company should bring in some institutional bidders down here.

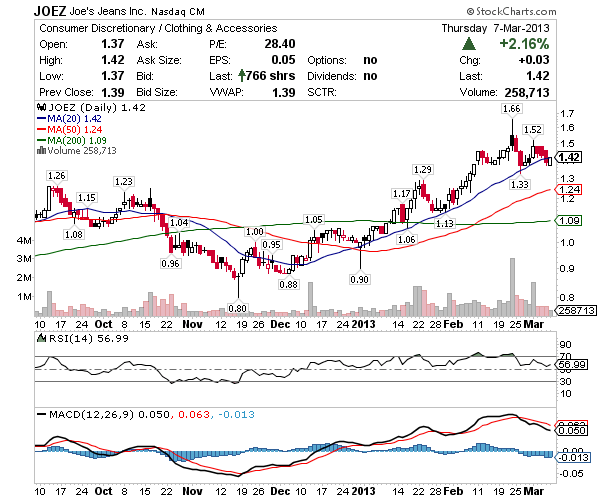

JOEZ – Earnings winner I think this trades above $2 this quarter. Wednesday’s dip was met with buyers Thursday and if $1.42 holds I’m probably going to pick up 20,000 shares and swing this for the $1.60’s and lock profit. Stop on this trade would be the $1.37 low from Thursday.

——————————————————–

THE SWING TRADE STALKER

——————————————————–

Oversold – XIDE, JE, KWK (Charts)

Friday – XIDE is a watch winner moving from $2.61 – $2.82 or 8%, lots to learn just by reviewing this one trade, notice the chop on Wednesday and the pop Thursday, sometimes they take time to develop and patience pays off… into Friday if it opens above $2.76 and takes out $2.80 I think it’ll hit $3. JE closed even on the day and is still in play but not until it curls up again from the sideways accumulation basing pattern it’s been in for a few weeks, open above and hold $7.62 Friday would indicate a test of $7.80’s is coming again. KWK is another watch winner this week up 11% today doing exactly what was indicated on the chat, UNG took off around 10 a.m. EST Thursday and KWK came off the bottom closing up 11%, resistance is at $2.05 or the 20 Moving Average.

Thursday – XIDE is still in play above $2.60 and I like this pattern though it’s sloppy, Wednesday it rejected $2.70 so that’s key today if this trade is going to have a push before the weekend, I’m thinking $3.05 which is the 200 Moving Average if this curl sticks. JE rejected the strong open Wednesday which was unfortunate but the pattern is still in play, look for it to hold Wednesday’s $7.57 low and if the $7.80’s break it’s off and running to $8.50’s. KWK holding above $1.65 but not by much so the pattern looks like it’s going to let go, but watch UNG and $1.65 support on KWK, if natural gas heads higher and KWK holds support buyers might show up before the weekend, $2 would be resistance here.

Wednesday – XIDE setup Tuesday so it’s on the daily watch list for Wednesday so reference my notes above. JE confirmed Tuesday so I bought, check the open trade analysis for my thoughts from here. KWK showed weakness as natural gas UNG didn’t advance, watch $1.65 for a candle over candle entry, though I suspect new lows are coming so probably no trade for me.

Tuesday – XIDE debt to cash isn’t my favorite but this is a known bouncer out of oversold so watching daily, back in May gives you a good example of what I’m looking for here, patience is key, right now $2.60 is what I’m watching for c/c entry. JE into Tuesday made my daily watch list i.e. I think it’s ready so see my notes above. KWK shorts are trying to push these guys out of business but with 29% of the float short and 11 days to cover, UNG rising could trigger a squeeze so watch for the reversal closely, watching $1.65 for c/c entry.

Continuation – ONVO, ZAGG, DMD (Charts)

Friday – ONVO has been moved to the daily watch list so see my notes above for why I think it might be in play Friday. ZAGG hello!!! Monster 7% move Thursday right from the daily watch list, another winner opening at $7.14 with a hod close at $7.65 over $.50 / share in 1-day… into Friday I think it’ll squeeze and test $8 but no trade for me, I missed entry early so it’s on watch for the next technical setup – be sure to review the 1-minute daily from Thursday, you’ll see the bid accumulation I talked about on the daily watch list. DMD looks solid on the curl and had a small bidder Thursday so I’ve funneled it up to the daily watch list, please see my notes above.

Thursday – ONVO still sideways so no interest to me, I like to see the curl heading up to place a bet, but above the 50 Moving Average of $3.95 it’s still on watch, DDD and SSYS have weakened so soft sector will make it hard for this OTCBB to run. ZAGG I’ve filtered to the daily watch list above, so please see my notes there on why I think it’s a possible buy for me today. DMD put in a Doji Wednesday and like ZAGG, despite the sloppy chart I’d like to take this trade because I think some institutional money might accumulate down here… the weakness is concerning given the overall market but if the recent $7.74 low holds and a curl develops I’ll consider a buy, swing to upper $8’s.

Wednesday – ONVO was up down and all around Tuesday only to close just off the open and SSYS and DDD didn’t help so no trade for now and probably not this week, though it is on watch above the 50 Moving Average of $3.91. ZAGG clearly I’m missing something here because it’s loaded with sellers so I’ll steer clear for now and watch for a good technical setup before consideration again, maybe something closer to $6.50, though the triple bottom would concern me. DMD no buyers either right now and light volume so until the pattern improves or volume starts to build I’m just watching the $7.70’s for what it does next.

Tuesday – ONVO is a 3-D printing stock I think touches the $5′s again soon especially with DDD and SSYS gearing up, read my notes on the daily watch list because I think it’s ready Tuesday. ZAGG really wanted $7.20 Monday but the market turned and so did the stock, this made the daily watch list so check my notes above. DMD I’m stalking to see if it makes a higher low above Monday’s $7.74 pullback, if the market is strong I’ll jump back in for a test of $8.23, I think we might see an upgrade soon.

Breakout – ZNGA, USAT, NEON (Charts)

Friday – ZNGA I bought Thursday so please check the open trade analysis for my detailed breakdown of the swing. USAT is just sitting there just below $2.60 with the price heading slightly higher on low volume meaning I think divergence like that could trigger a squeeze Friday testing $2.75 again, no trade for me, the pattern just isn’t predictable enough but it does look favorable, next week I’ll try and get it on a pullback to the 20 Moving Average or after it breaks $2.75 and accumulates above i.e. previous resistance becomes support. NEON snapped back nicely early Thursday but head fake it did (Yoda) which tells me there’s some sellers from the last breakout still, having said that I like how it established above the 20 Moving Average Thursday so it’s definitely in play Friday so long as it opens and holds above $5.42.

Thursday – ZNGA is on the daily watch list again today, it’s just been hard for me to buy because of the pattern not fitting video lesson 1 or 2 but I continue to scout daily because I feel strongly it’s heading higher, I just don’t want to get in and then have to stop out because the pattern falls to support, tight stop if I take the trade or I’ll scale at several support areas. USAT indecision at the top which is normal for charts approaching overbought, with just a few trading days left in the week I will not take this trade but instead scout for an entrance closer to the 20 Moving Average $2.33 and possibly move a bid higher if it curls around $2.50 for the pending breakout. NEON fell 2% Wednesday which isn’t a big deal but it is a step back because it’ll need to find support, probably the 40 Moving Average of $5.08 and curl, from there it’ll be on the continuation pattern watch list but no play as of right now for me.

Wednesday – ZNGA made the daily watch list for Tuesday so reference my notes above. USAT continued to climb after some early weakness so watch $2.50 support, if that holds it could be gearing up for a breakout at $2.74 before the weekend, not my favorite chart but love the company. NEON had light volume riding the 20 Moving Average but slightly lower, not what I look for but above $5.20 it’s in play so I’m watching close to see if $5.40 resistance breaks, that might be the trigger for the next wave up.

Tuesday – ZNGA above the 200 Moving Average in a bull market up 6% Monday looks like a missile heading for gap recovery at $4.47 and I’m looking to take some if I suspect it’s going there soon, stop at the 200 Moving Average though I’d be inclined to ride any dip out, just don’t see this going much lower this quarter. USAT tested $2.74 Monday and couldn’t close at the highs, the candle suggests exhaustion but if it drifts above $2.50 I wouldn’t be shocked if it made another run so that’s what I’m watching for now. NEON is working a rising channel finding buyers in the middle on each pullback, this was on my watch a few weeks back when it made the $5.87 run and I think it’s ready to test $6 again, key the 20 Moving Average for a stop or scale above the 50 Moving Average.

——————————————————–

VIDEO – Friday March 8, 2013

——————————————————–

Sweet!