Well, Tesla Inc (TSLA) is set to host its annual shareholder meeting on Sep. 22 to showcase unveil “mind blowing” battery technology.

It’s one stock everyone and their brother want to get in on.

However, a $400+ price tag is a little bit too steep for many. With the insane volatility in TSLA, the options can get a bit expensive as well.

When I notice bullish momentum patterns in TSLA, I don’t say to myself… The stock is too expensive and the options premiums are so juiced, I’m gonna move on to another trade.

Instead, I scout out the “sucker bets” in TSLA.

I try to establish a bullish position by taking advantage of the low-odds bets in the options market.

That’s how I locked in a ~$17,200 winner in TSLA, without buying calls or shares.*

Allow me to show you the steps I took to uncover this winner…

How I Locked In $17,200 Without Buying Calls Or Shares Of TSLA

I’m a firm believer in using chart patterns to hunt down stocks…

When I combine that with options, I can stack the odds to my favor.

You see, rather than buying options, I’m using a bull put spread (as the name suggests) to express a bullish opinion on a specific stock.

That just means I’m selling puts with a strike price I believe a stock will have a tough time breaking below, and simultaneously purchasing deeper OTM puts to hedge my position.

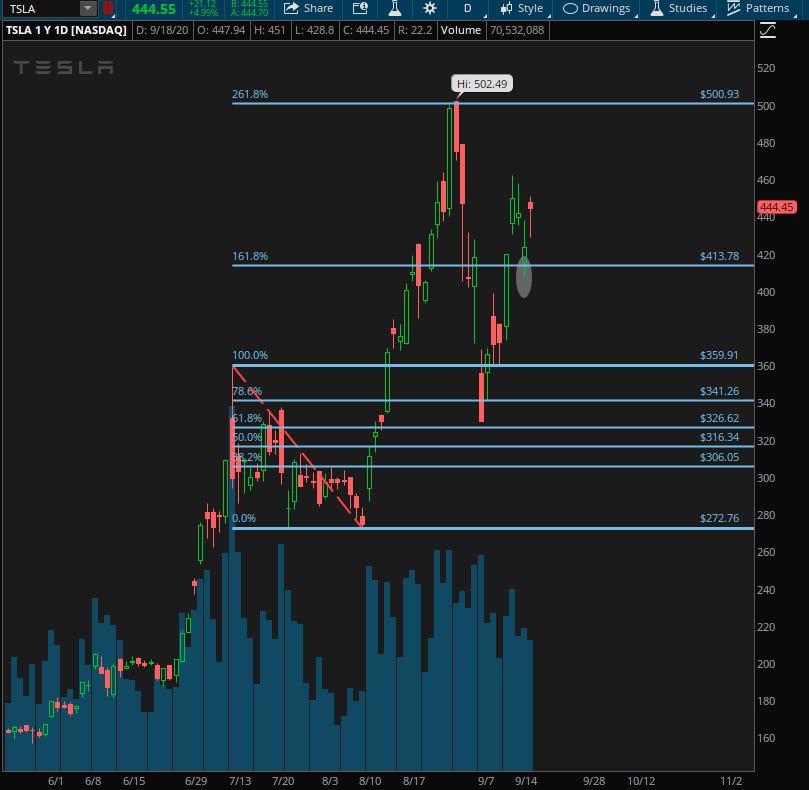

So with TSLA, I realized how there was demand right around the 161.8% Fibonacci extension.

So here’s what I sent out on Thursday.

WWF: TSLA bull puts. sold sep 18 (tomorrow) 425 / 415 put spread for 4.30. risky trade, no room for error.

The following morning (spoiler alert if you saw the chart), TSLA exploded and those options were deep OTM.

Here’s what I sent out on Friday morning.

TSLA is trading in the $440’s and I think it’ll stay strong today so I’ll look to go for max profit here, taking the position off when it’s under $.50, hopefully close to $0. TSLA battery day is next Tuesday and it’s very likely to have a bid headed into that, which is what we’re seeing this morning.

Here was my exit.

WWF: booked TSLA bull puts at $.90 +$17,200 or about 80% of the premium.

Don’t want to babysit this all day for the $4,000 remaining premium. If AAPL doesn’t come around, this will offset most of that loss, allowing me to have a really big week afterall. If AAPL comes around, it’ll be a monster week. It’s early so we’ll see.

Gearing up for new ideas for next Friday expiration.

Uncovering “sucker bets” in high-flying stocks and taking advantage of them is one of my favorite ways to attack the options market.

Let me show you my techniques to help me stack the odds to my favor… and put myself in a position to win in three different scenarios.

*Results presented are not typical and may vary from person to person. Please see our Testimonials Disclaimer here: https://ragingbull.com/disclaimer

0 Comments