What a blood bath it’s been today… traders are starting to realize there could be a second wave of the coronavirus.

If we do see more cases of COVID-19, then the market could reverse its course and have potentially enter into correction territory…

Or we could see the “buy the dippers” ignore this news and just pile in.

Who really knows what’s going to happen at these levels.

With stocks gapping down and up randomly, there is one setup I turn to…

And one that I used just the other day to help me uncover a large winner in IWM.

So what’s this setup and how did I use it to my advantage?

[Revealed] The Patterns I Used To Lock In $15.3K In IWM

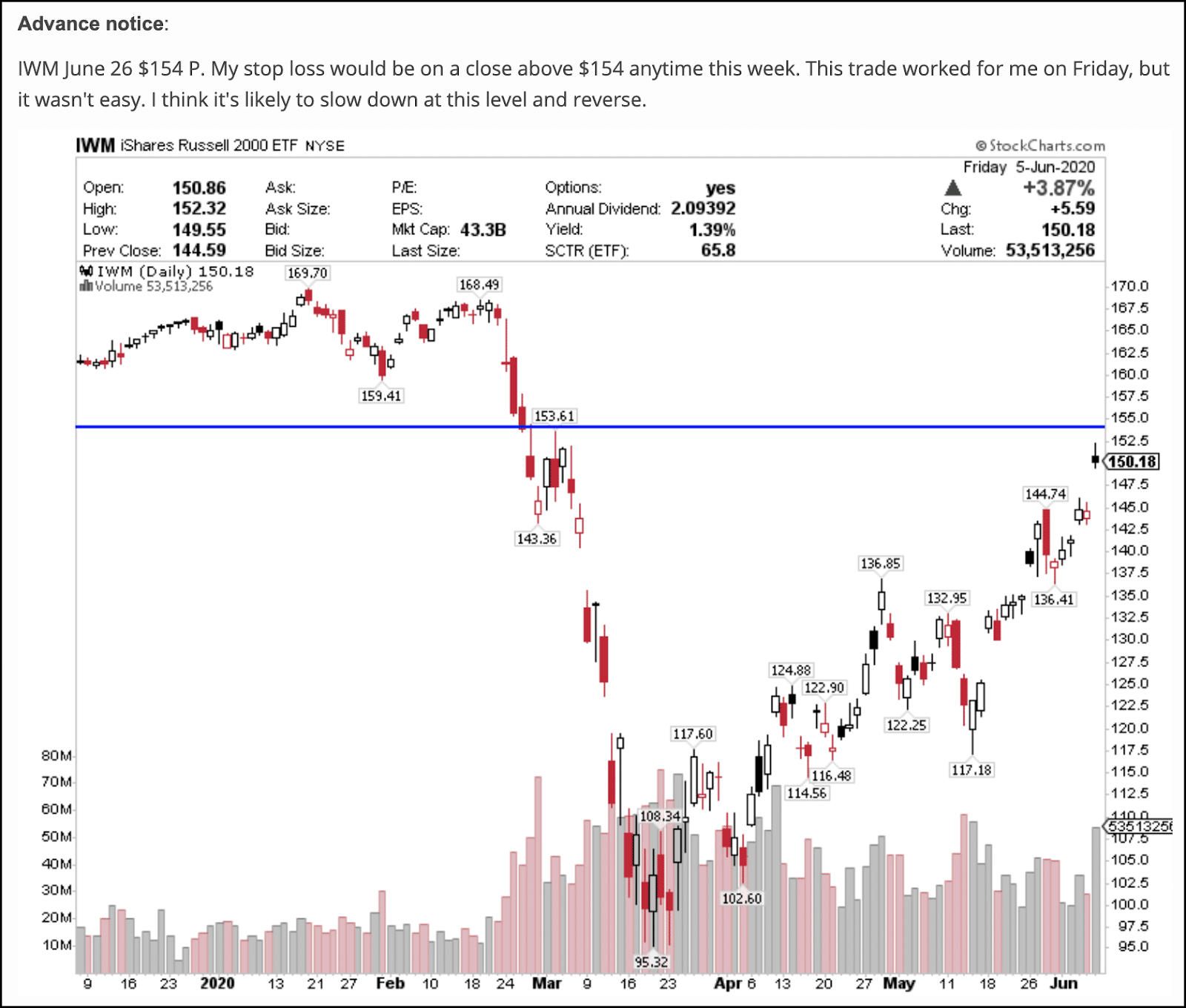

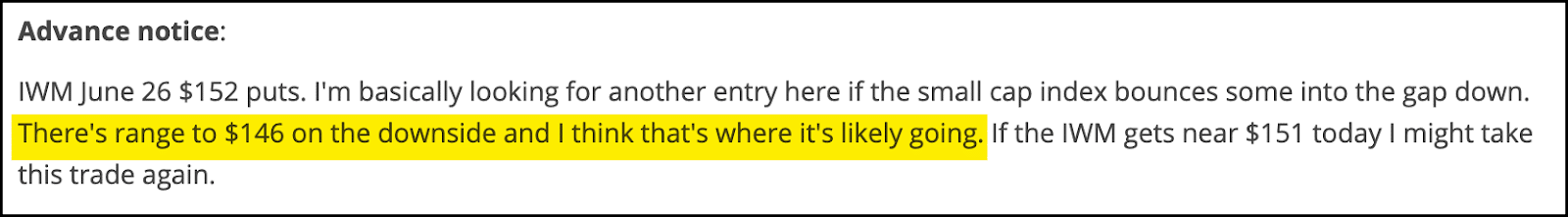

On Monday morning, I sent out an advance notice alert to my subscribers… because I was starting to get a little bit bearish on the iShares Russell 2000 ETF (IWM).

Of course, the exchange-traded fund (ETF) is pretty expensive if I wanted to bet against it by shorting shares outright…

And the risk is not defined when it comes to shorting shares.

So what do I do instead when I’m bearish?

Use put options.

Chart Courtesy of StockCharts

For example, in the advance notice alert above, I mentioned I was looking to purchase the IWM June 26 $154 puts. In other words, I was betting for IWM to drop… and it was unlikely it would go straight up and break above the resistance line — in my opinion.

So the puts would allow me to profit off a drop, with defined risk.

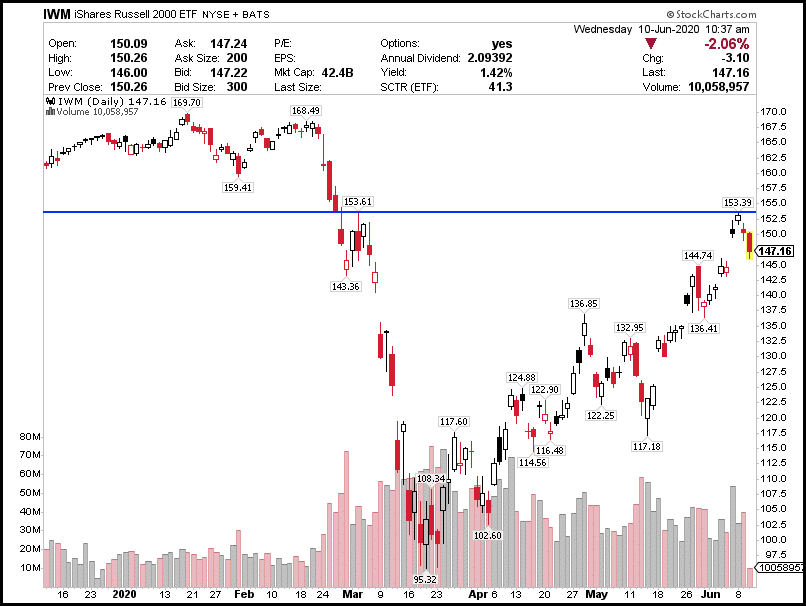

Here’s what happened with IWM the other day…

Source: StockCharts

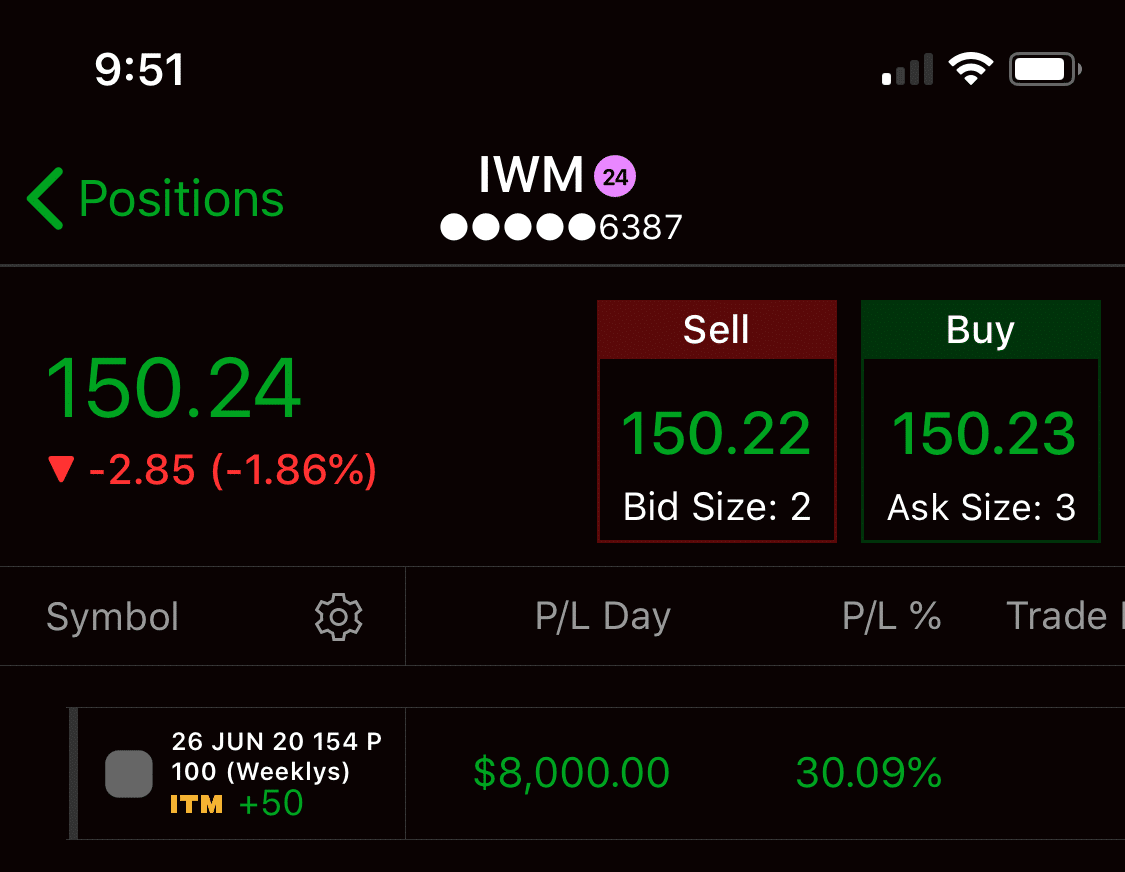

With what I believed to be a simple bet… I was able to lock in $8K overnight (from Monday heading into Tuesday).

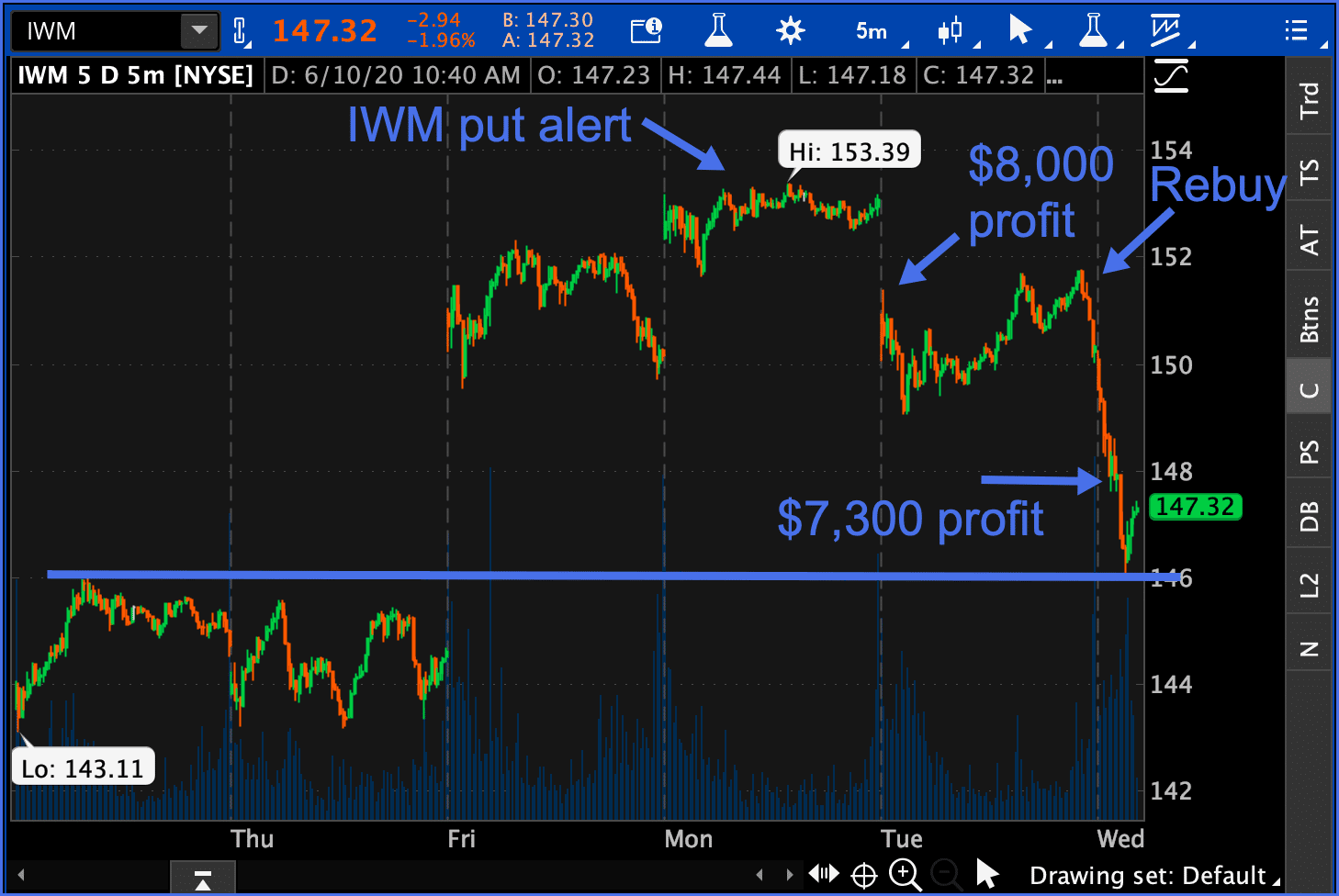

Now, the pattern I was referring to earlier was the gap recovery… which actually presented another opportunity to me.

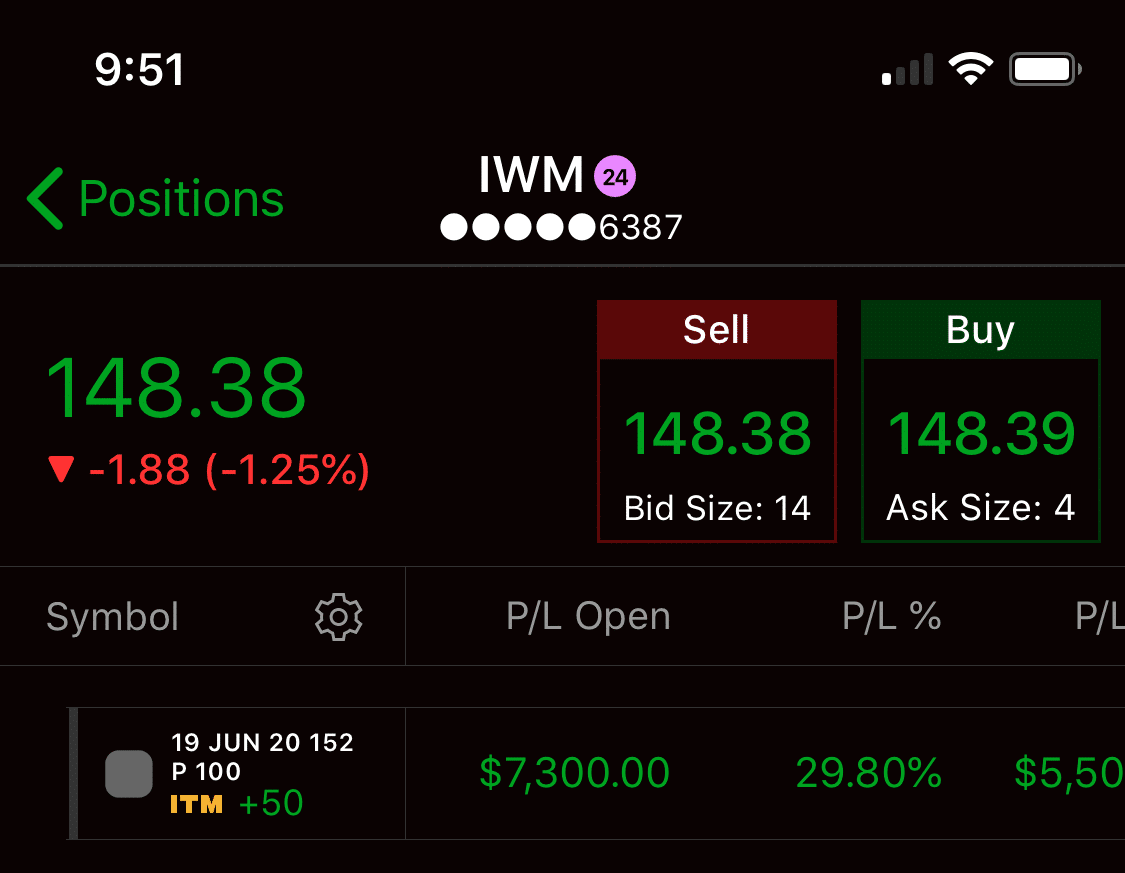

Source: thinkorswim

I actually rebought puts when IWM rebounded but failed to get into the gap.

In my opinion, that’s a good short strategy I use when I miss the initial move down.

However, it just so happens on this one I didn’t miss the initial move down, but instead timed the first drop pretty good and then rebought.

To me, the gap recovery is a pretty predictable trade setup whether it’s on a bearish trade, like this, headed up into the gap resistance or a bullish trade, headed down into gap support.

Here’s what I mentioned to subscribers BEFORE I re-entered those puts.

By playing the gap recovery setup, I was able to lock in an additional $7,300 in IWM…

Putting my total to nearly $15.3K.

You see, sometimes… I like to play the downside momentum as well. If you want to learn how I’m able to trade momentum stocks when the market is popping off… or pulling back…

0 Comments