LRAD (LRAD) is on the move – again! This time the trend up in the stock price may be more sustained and for a much longer time period as the global economy shows signs of entering another sluggish period after five years of the worst central-bankers-induced recovery since the Great Depression.

The maker of Long-Range Acoustical Devices (LRADs) – also known as Acoustical Hailing Devices (AHDs) or “sound cannons”– is well-positioned to supply military and law enforcement personnel with specialized sound-hailing devices used to manage checkpoints, provide early warning systems and disperse large and angry crowds with loud and irritating acoustics. Without these types of devices, a much greater risk of physical violence between citizens and law enforcement is introduced during demonstrations.

Source: Getty Images

LRAD got an initial jolt up of $1.40 (56%) in eight trading days following the company’s Aug. 7 earnings release for the period ending Jun. 30, where LRAD reported a $5.8 million, or a 271%, hike to revenue of $8.0 million for the second quarter. A delivery of a $4.0 million order “for border security” to a customer in the Middle East accounted for the bulk of the revenue surge, according to the the company’s news release.

On Aug. 19, LRAD announced two more meaningful orders for the company’s ‘sound cannons’, this time from two SE Asia customers. Details of the orders include a purchase order for LRAD(R) 500 and 1000X systems, amounting to $1.0 million and $0.7 million, respectively, from the two entities.

Following the announcement, the stock sold off, rallied, sold off, and rallied again, as $3.00 has proved to be strong resistance since 2008. However, at the close Monday, LRAD has held $3.00 as support for the past eight trading days. LRAD has broken out of it’s five-year trading range of $0.80 and $3.00.

Source: StockCharts.com

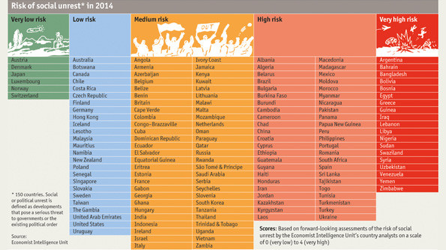

Traders who follow the stock know that LRAD has a history of surprising Wall Street with new contracts and bumper revenue. We strongly believe that LRAD is well-positioned to rapidly increase revenue due to the growing global trend toward mass civil unrest, and that the positive surprises will become more frequent in coming years.

Fundamental Outlook

Incidents of mass civil unrest in Argentina, Bahrain, Brazil, Bulgaria, Egypt, Israel, Japan, Mexico, Singapore, Spain, Thailand, Tunisia, Turkey, Ukraine and the US (Ferguson) are among the most noteworthy examples of the growing trend of mass civil unrest happening, globally.

Source: Economist Intelligence Unit

When jobs and household income hit the skids, mass civil unrest invariably results as a last-ditch response by the citizenry to their insouciant politicians who won’t hold accountable those responsible to the commonwealth for failed economic and monetary policies.

On Dec. 23, 2013, The Economist quotes Laza Kekic from the Economist Intelligence Unit (EIU),

Declines in income and high unemployment are not always followed by unrest. Only when economic trouble is accompanied by other elements of vulnerability is there a high risk of instability. Such factors include wide income-inequality, poor government, low levels of social provision, ethnic tensions and a history of unrest. Of particular importance in sparking unrest in recent times appears to have been an erosion of trust in governments and institutions: a crisis of democracy.

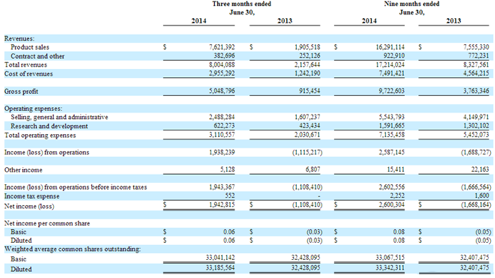

Fantastic Second-Quarter Results

Traders should note LRAD’s most-recent P/L statement for clues to LRAD’s acceleration of revenue and gross margin. As mentioned, above, revenue is up 271% for the second quarter from the equivalent quarter last year. As of the nine months ended Jun. 30, revenue has soared 106%, indicating that revenue had greatly accelerated in the second quarter from the previous two quarters (sequentially).

Source: SEC.gov

Gross margin surged to 63.1% for the second quarter, from 42.3% for the second quarter of 2013. For the nine months ending Jun. 30, gross margin has reached 56.5%, up 1130 basis points (from 45.2%) for the nine months ending Jun. 30, 2013.

Net income per share for the none months ending Jun. 30 rose to 8 cents, from a loss of 5 cents for the equivalent nine-month period last year.

About LRAD Corporation

LRAD Corporation is using long range communication to peacefully resolve uncertain situations and save lives on both sides of its proprietary Long Range Acoustic Device(R). LRAD(R) systems are being sold into 70 countries around the world in diverse applications including fixed and mobile military deployments, maritime security, critical infrastructure and perimeter security, commercial security, border and port security, law enforcement and emergency responder communications, emergency warning and mass notification, asset protection and wildlife preservation and control. For more information about the Company and its LRAD systems, please visit www.lradx.com.

Looking for another big stock play like LRAD?

To get insightful analysis on stocks in-the-news BEFORE the big move, start by joining our mailing list (top of the page). Or, take the next bold step now by joining Jason’s community of dynamic and active traders with your subscription to Jason Bond Picks.

Click here for 2013 Performance Record +77%

0 Comments