Can you feel the volatility in the air? I sure can. Last night, Iran retaliated and attacked U.S. military bases in Iraq — my heart goes out to all the soldiers and families. The markets experienced a harsh sell-off last night after those headlines…

However, the S&P 500 futures actually reversed early this morning… and were trading higher. Talk about whipsawy price action. As traders, we can’t always focus on the minutiae, we just march forward and place trades on our best ideas.

Right now, one of the biggest themes in the market is the “January effect”. Basically, stocks that were beaten down last year may be primed to bounce, because traders and investors want to buy them back on the cheap—after selling them for tax purposes.

In other words, it’s a seasonality play… and a lot of the time, if you’re able to spot these plays, you could find some monster winners. The thing is, small-cap momentum stocks tend to be where it’s at for the January effect.

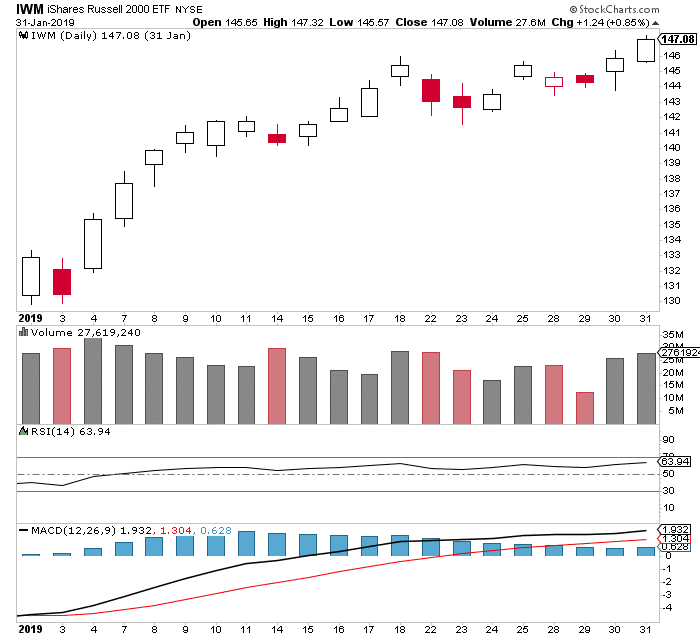

Heck, just take a look at what small-caps did last January…

The iShares Russell 2000 ETF (IWM) had a monster rally and finished January 2019 more than 12% higher. Now, I’m not calling for the same time of price action this January, especially with all the political tensions.

In fact, I am highly selective with my plays, strictly looking for my fish hook and rocket patterns.

It’s still the first full week of January, and I think we could see more seasonality plays. So today, I want to walk you through my $12K winner in a January effect play.

How I Spotted A $12K Winner In OSTK

The other day, I alerted my clients about a potential January effect play in Overstock.com Inc (OSTK).

Here’s what I sent out to my Jason Bond Picks clients, letting them know OSTK was on my watchlist.

Stocks I’m looking to buy soon for January effect are OSTK and I, hopefully in the middle $6’s on both. No rush for new positions since the market is likely to see some selling early this week. Swing trades with hold times ranging from a few days to a few weeks is what you should expect here.

Why did I like this play so much?

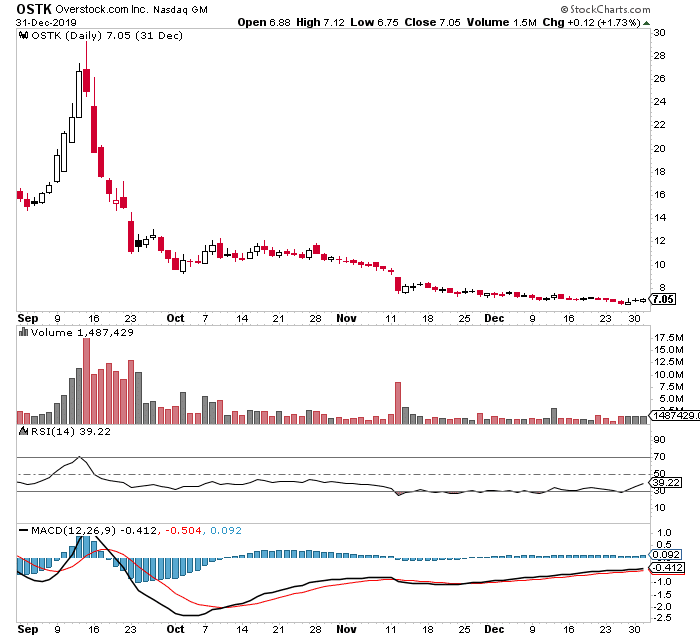

Well, OSTK got destroyed and lost more than 50% of its value in just a few months to cap off 2019.

Remember how the January effect play works. We’re looking for beaten-down names in 2019.

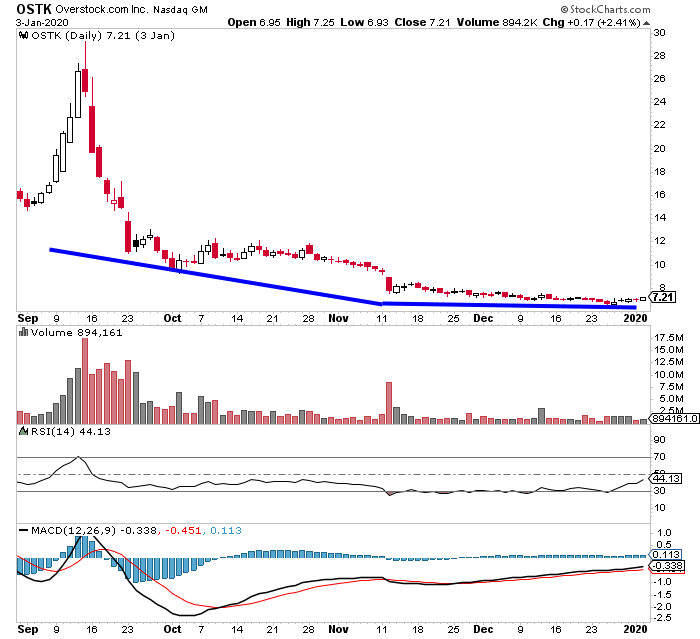

However, I’m not just randomly buying weak stocks because that’s the quickest to get your shirt handed to you. So what did I see in OSTK?

Basically, I look for three things with this setup:

- The stock experiences a massive drop (OSTK plummeted and got sold hard into the end of 2019).

- The stock finds support and holds (OSTK held around $7).

- The stock to catch a small bounce.

When you look at the daily chart above, OSTK satisfied all three conditions, and that was a signal the stock could catch a bounce.

I got in OSTK after it caught a massive bounce to kick off the first full week of January 2020.

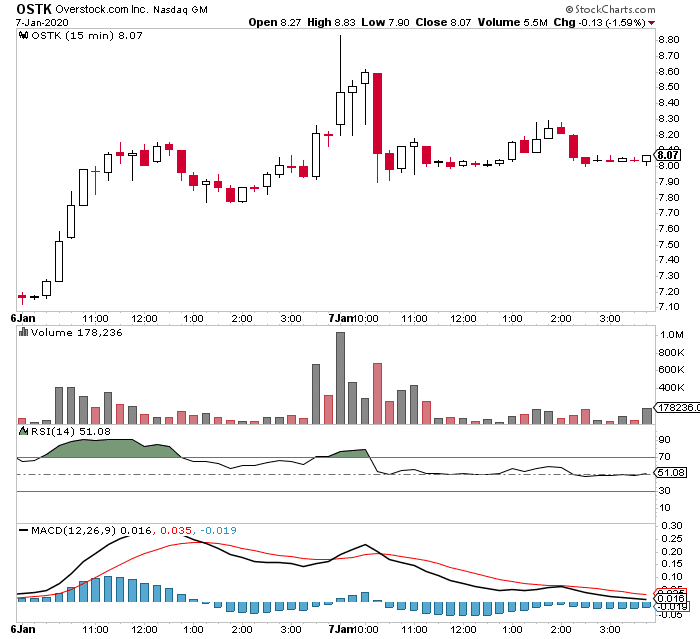

I was chasing a little because I was stubborn the other day, and waited for the right price. However, I couldn’t ignore the price action, so I decided to get in. I wasn’t looking for a massive winner, just 5-10%. The thing is, OSTK had massive upside potential, and it could’ve been good for a 20%+ winner.

Here’s a look at what happened with OSTK.

The stock hit a high of $8.83 that day… and I sold when the stock gained some momentum. I locked in about 10% overnight, a $9,000 profit overnight! I didn’t want to get greedy, so I sold ¾ of my position, and let the rest ride.

Now, for the rest of my position, I actually put a stop-market order. That way, I was able to protect my profits, just in case OSTK turned.

Well, my order got hit at $8.50 on the remaining shares, so I still came out on top with about a 10% winner overall.

That was good for approximately $12,000 overnight!

In this market environment, small-caps is where it’s at… especially when you can lock down 10%+ winners overnight. Not only that, but you don’t really have to worry about all the political headlines because these stocks move to the beat of their own drum.

If you want to learn how I use 2 simple wealth patterns to consistently find winners in any market environment, click here to below to watch this training session.

0 Comments