What a start to the second half of 2020…

It seems as if the bulls are winning this battle right now, but there’s always a chance we pull back from these levels.

Who really knows what will happen.

Whatever the case may be, I’ll be ready.

Right now, I’ll look to use more risk-defined strategies to trade… more specifically in large-caps.

Why?

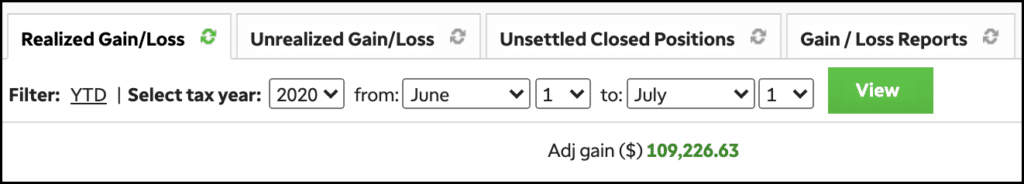

Well, I generated $109K in realized gains last month and about $40K of that came from my Weekly Windfalls strategy.*

I think it comes in handy, and it is an alternative to trading momentum stocks…

I believe it’s important to have different trading strategies at work…And that’s why I want to show you how I utilize the “bookie” advantage to trade options.

How I Utilize The “Bookie” Advantage

Don’t get me wrong… I love trading momentum stocks, and I believe there is plenty of opportunities each and every day.

However, there can be periods where there aren’t as many trades I want to take… and I believe it’s useful to have different ways to make money in the market.

For me, that’s using the “bookie” advantage.

You see, I’ve added a wrinkle to my game and actually also look at large-caps.

I know what you’re probably thinking…

Large-caps are expensive and the options on them can be too.

Well, I’m actually using a risk-defined options strategy that can put the odds in my favor.

Why?

Well, think about it like this…

There are bets being placed by “suckers”. In other words, they’re buying out of the money options, thinking the stock will get to that level.

With those bets, the probability of it occurring is pretty low, in my opinion.

You see, traders who buy puts or calls outright have time working against them, and would need implied volatility and the stock to move to their favor.

To me, that’s stacking the odds against them.

For me personally, I want to take the other side of those trades by selling premium. This is what I call the “bookie” edge.

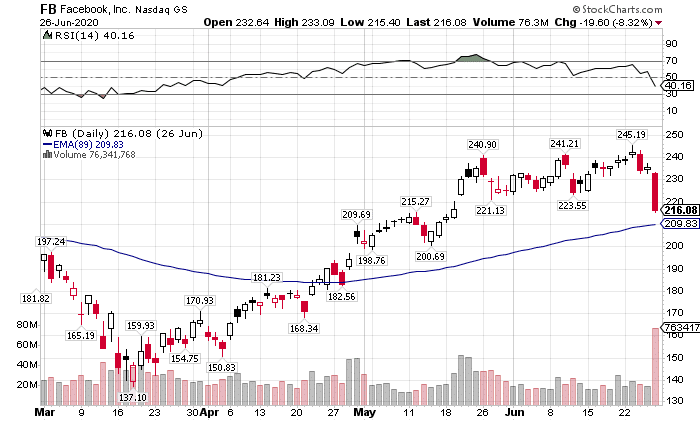

For example, last week, Facebook (FB) took a hit.

Source: StockCharts

I noticed a key support level around the 89-day exponential moving average (EMA), which was at the $209 level.

I figured even if it breaks below that, buyers would step in and buy shares on the cheap.

You see, Facebook has thousands of advertisers, and just a handful pulled out. It was only a matter of time traders figure that out.

Rather than buying shares, which can be expensive… or buying calls, which actually can stack to odds against me depending on which strike and expiration date I select…

I placed a bullish bet by selling puts.

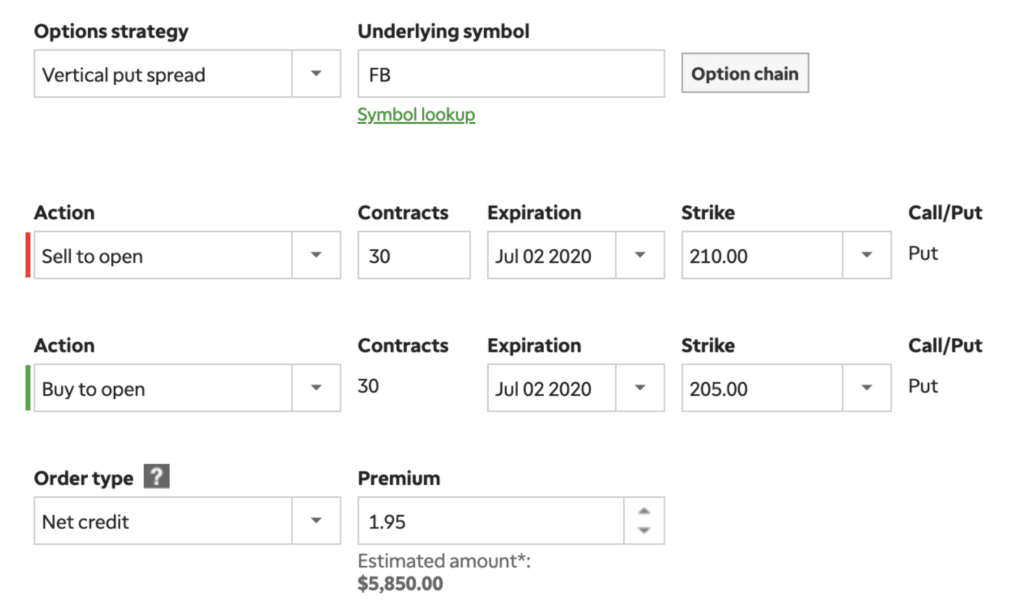

Here’s a look at how I placed the trade.

Now, to understand this, let me explain.

- I sold the $210 puts. This basically means that I expect FB to close above that price by July 2nd.

- I simultaneously bought the $205 puts as insurance if, for some reason, the stock went against me. That way, I hedged my bet and defined my risk.

All in all, this trade risks about $9,000 to make about $6,000.

I know what you’re thinking…

The risk-reward there doesn’t make sense.

However, it does when you factor in the odds.

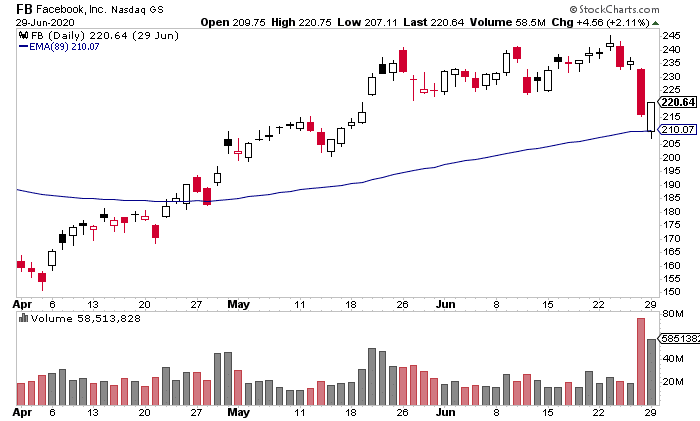

Check out what happened with FB.

Source: StockCharts

It broke below the 89-day EMA and rebounded, closing at $220.64 on Monday…

With this specific trade, I actually closed it out the same day I placed it… and was able to lock in a $3,800 profit (I placed the trade on June 29).

Now, if you want to learn more about how I use my Weekly Windfalls strategy to stack the odds to my favor…

I created a special training guide detailing why I believe this strategy is so powerful.

0 Comments