It’s been a wild market out there… and traders are still trying to figure out where stocks can head.

Since I’m an educator at heart, I want to try my best to help as many people out as possible. I’ve seen an overwhelming response from readers regarding the overall market environment.

More specifically, they’re wondering how I’m able to trade in this environment. For me personally, I’ve remained nimble and stuck to my bread-and-butter: momentum plays.

Today, I want to show you how I adapt to this environment and look for momentum stocks to move, as well as some stocks on my long-term watchlist.

How I Navigate In This Market Environment

As a momentum trader, I know things can change on a dime… so I’m not necessarily only looking to buy momentum stocks. I’ve actually been looking at potential bearish plays.

Why?

Well, there are some divergences in momentum stocks with the overall market… and I think it would be foolish if I see a bearish setup that can lead to profits and don’t take it. So in this environment, I’m remaining nimble and adapt accordingly.

Let me show you what I mean by that.

Divergences In The Market

I believe it’s important to watch momentum stocks with the overall market, and I want to show you a position I’m in currently, and what I’m looking for.

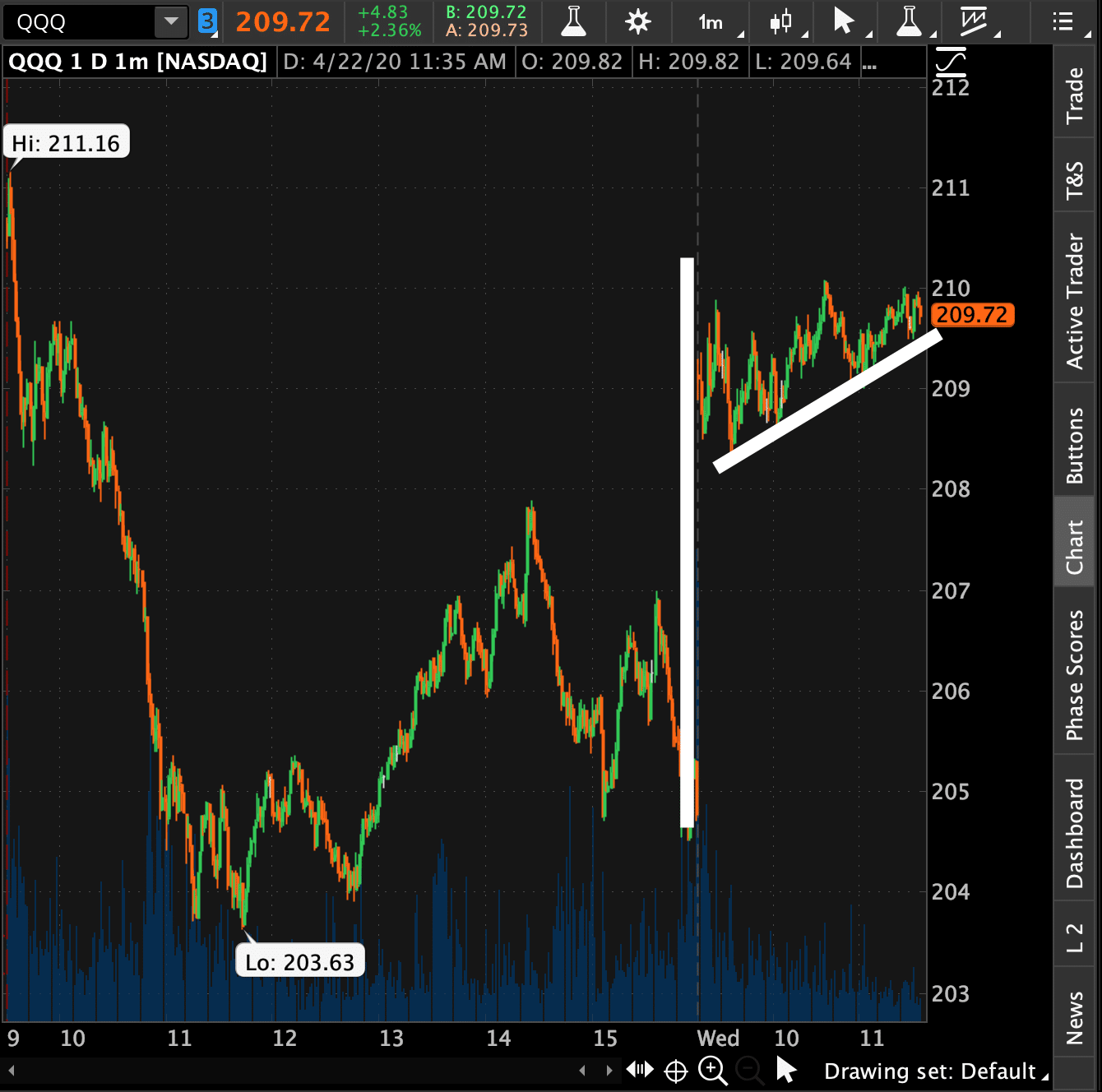

Yesterday, the market edged higher and it’s in a trend with higher lows…

Source: thinkorswim

Now, PENN started higher with the market but notice the lower highs …

Source: thinkorswim

I speculate the upcoming earnings on May 7 is triggering some selling…

Source: FINVIZ.com

With PENN, I think $12.50 needs to crack for the stock to roll lower and be a nice winner. Currently, I own 40 contracts of the May 15 $15 Puts at $2.77 I’m basically even here and considering adding size if I see any weakness in the broader indices as that’d likely help drive this to a test of the key supports.

The key takeaway here is anytime I see a stock diverging from the market I see that as a sign and trade accordingly. So far this is a good sign for the bearish PENN trade. I’ll send an advance notice if I decide to take more puts.

By looking at divergences, I actually uncover more trading opportunities because I can have both bullish and bearish trades… playing the potential momentum on both sides.

Of course, with so much going in the market, how do I find potential trades?

It’s simple for me, I just use a scanner and filter for stocks, then I’ll place them on a watchlist.

For Me, Having A Watchlist Is Key

When I develop a watchlist, it allows me to quickly look for my favorite patterns and plan accordingly. Basically, I save time here and don’t have to sift through dozens of stocks. For example, I have a master watchlist that includes stocks like CHEF, TLRY and PLAY, which I believe are all setting up for a move higher I think.

Assuming the markets are green Thursday I may look for some swing exposure on these names into Friday.

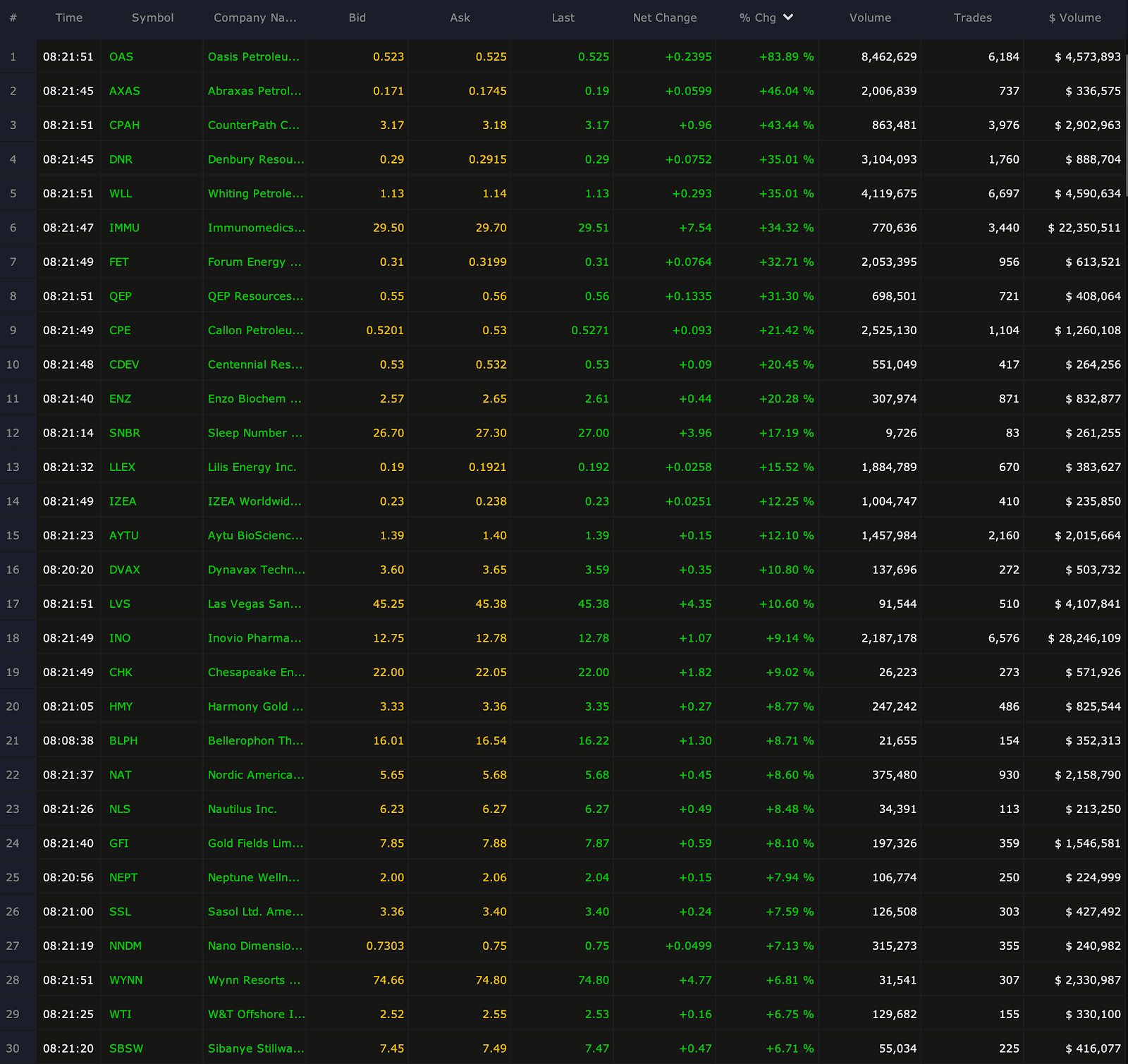

For a daily watchlist, I look for stocks gapping up… and today, I noticed plenty of momentum stocks this morning.

Source: Scanz Technologies

After I filter down my list of stocks to potentially trade in the morning, I monitor them and wait for a clear pattern to develop. Right now, I’ve noticed a lot of oil names on my filter, but since the oil market has been so volatile, I’m going to remain patient.

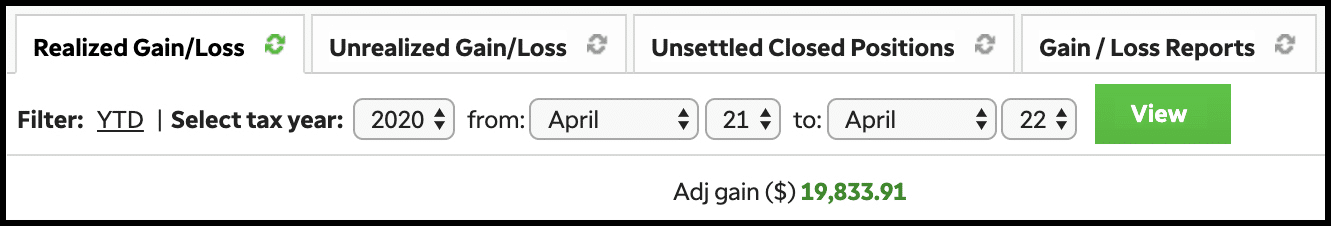

In this environment, I think it’s important for me to be quick on my feet and be able to adapt as the scheme changes. For me personally, momentum trades have been working, and my PnL sat at nearly $20K on Tuesday…

If you want to learn how I developed an edge in the market using my momentum plays, then I think you should check out my brand new eBook, Momentum Hunter. In it, I reveal the patterns I use to uncover momentum stocks to trade, and so much more.

0 Comments