Given the choppy price action of tech stocks, I’ve remained highly-selective and have been focused on playing extreme moves.

I’m really focused on waiting for sharp pullbacks to sell puts into or strong breakouts to sell call spreads into.

Of course, I’m still working to improve my skills — but for the most part, I don’t want to jump the gun here when it comes to options on tech stocks…

So I’ve primarily been trading small-cap stocks.

Now, there was one question my team pointed out one question they got via text message to my community number +1 (410) 210-4522…

They asked, “Can I trade options on small-cap stocks?”

Sure you can, but you’ll need to find which ones are optionable and liquid enough for you to trade.

Let me show you how to uncover options on small-caps, and teach you why they can offer large returns.

If You Want To Trade Options On Small-Cap Stocks, Pay Attention

When it comes to options, not all stocks will have them available to trade. There are specific requirements that a stock needs to meet before they can have options listed on them.

Now, when it comes to small-cap stocks, there’s a filter you can use to find ones that are optionable. Best of all, it’s free of charge and you can head on over to Finviz.

![]()

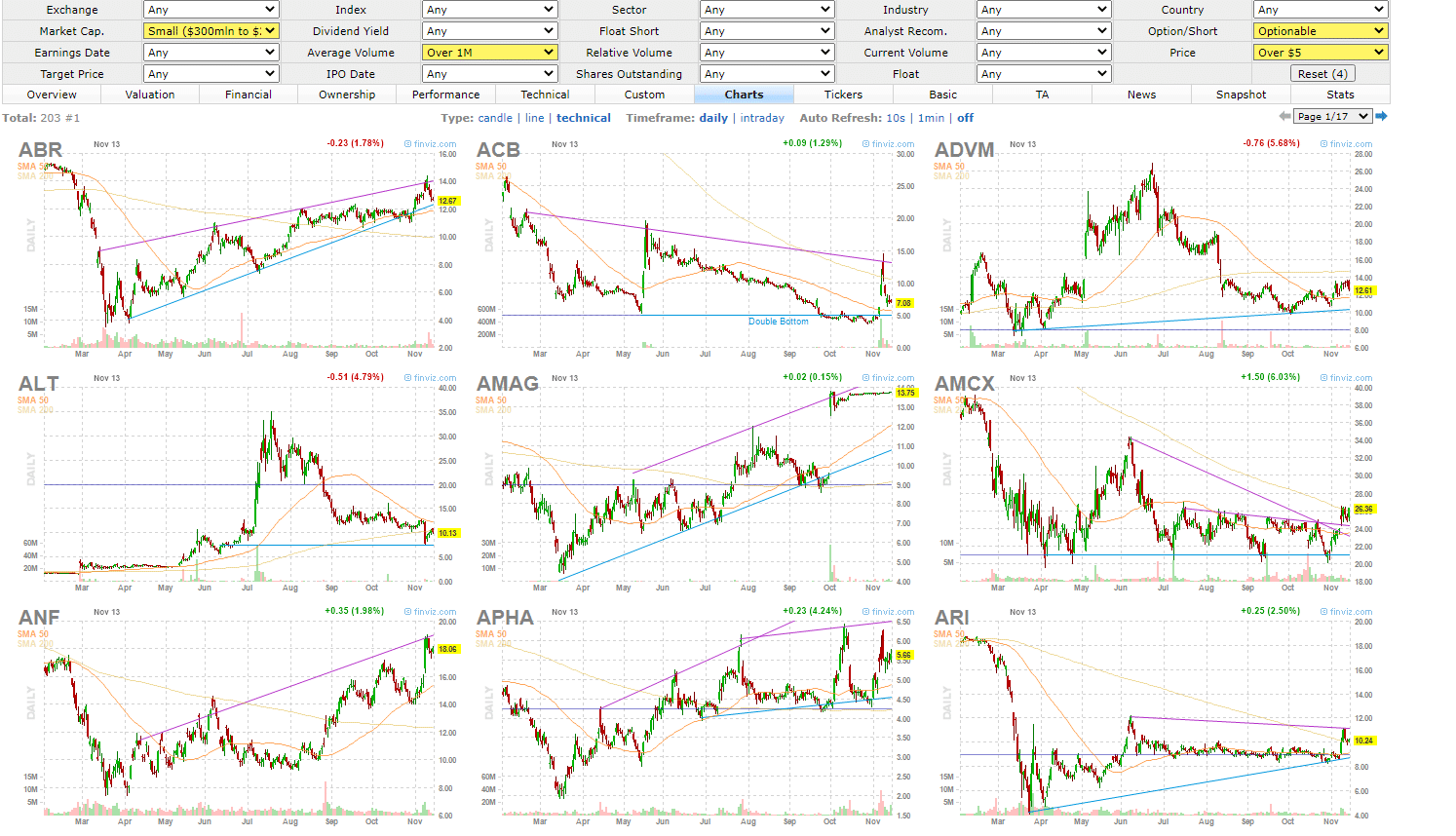

If you go under the “Screener,” you can follow along.

I filtered for:

- Market Cap: Small ($300mln to $2bln)

- Average Volume: Over 1M

- Option / Short: Optionable

- Price: Over $5

This helps narrow down which small-cap stocks have options, and the average daily stock volume lets me know how liquid those options can be.

Typically, the lower the average daily stock volume, the less liquid the options will be.

That said, I don’t think it’s wise to just randomly purchase options on stocks off this list. It’s important to have an edge.

For example, when I get into an options trade on tech stocks, I typically look for a chart pattern and key level.

With small-cap options plays, I think it’s important to do the same.

So on Finviz, you can go under the “Charts” view and you should see something like this…

Now, I’ve developed the ability to recognize my favorite patterns in a relatively fast, and if you want to learn how I do that, click here to attend this chart patterns training workshop.

So let’s see one setup that looks interesting…

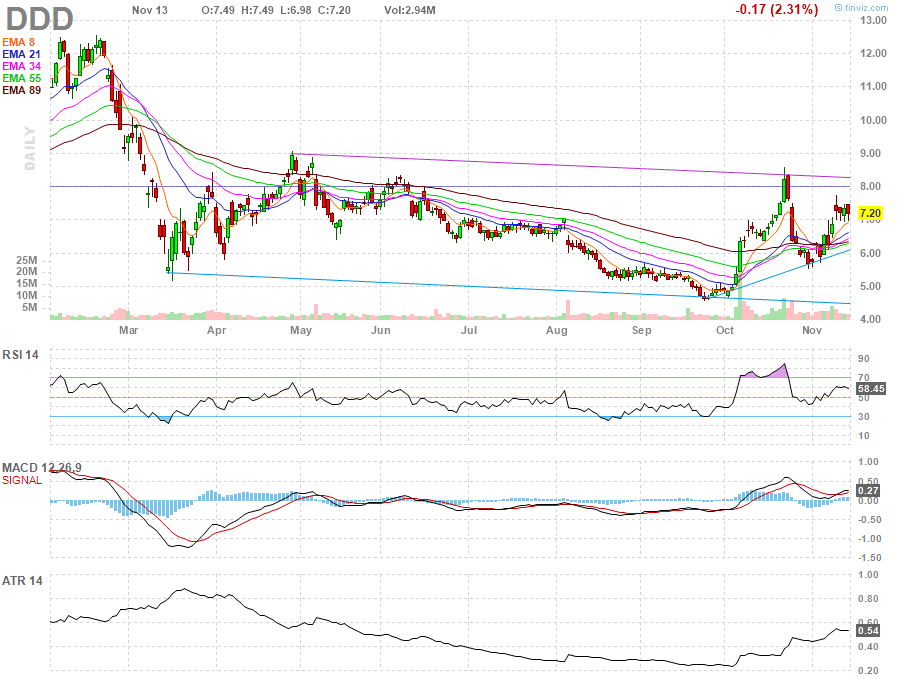

3D Systems Corporation (DDD) is one name that’s interesting. It’s got 111.10M shares floating and 35.88% of those shares are short.

The stock also has a bull flag / pennant forming. That signals this stock can break out.

So when it comes to the options, how can one play this?

Well, it all depends on the outlook first.

If a trader thinks the stock can break out and reach $10 within four weeks, then they can potentially purchase options with an expiration date in say six weeks to buy themselves more time.

With these plays, I think it’s more important to find liquid options rather than finding the cheapest ones. So for this specific play, one can look for the at-the-money (ATM) or even slightly in-the-money (ITM).

Now, there’s a bit that goes into learning how to trade options on small-caps, but what I believe is more important right now is to understand price action.

That way, even if the options are not available on a stock or if they’re illiquid, you can potentially trade the stock and play for potential runs higher.

If you want to learn how chart patterns can help you develop an edge in the market, then you should attend my important chart patterns workshop here.

0 Comments