My scan criteria searches for bullish setups between $1 and $2 with an average of 200,000 in volume or more. Preferably I’m looking for a Beta of 1 or higher, market cap between $50 million to $100 million, high short interest and high percent short of the float. Oversold is my favorite chart pattern because there are little to no profit takers but I’ll play many of these in a continuation pattern as well. Market conditions do make a difference so reference the iShares Russell Microcap Index Fund (NYSE:IWB).

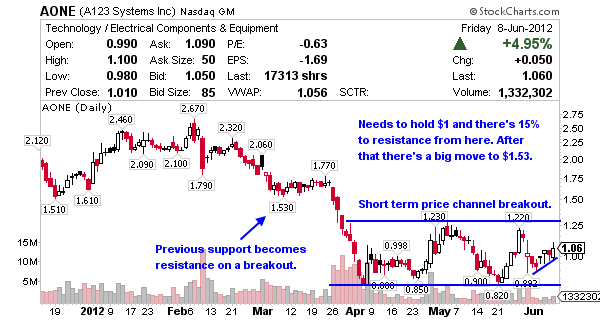

A123 Systems (NASDAQ:AONE) designs, develops, manufactures, and sells rechargeable lithium-ion batteries and energy storage systems worldwide. AONE’s market cap is $156 million and the short interest is 13 days to cover with 25% of the 106 million float short. They have $113 million in cash and $163 million in debt.

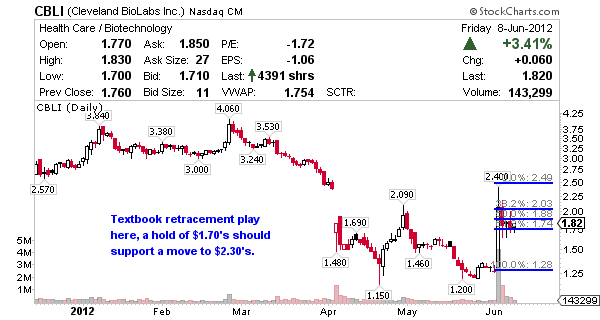

Cleveland Biolabs (NASDAQ:CBLI) is a biotechnology company, engages in the discovery, development, and commercialization of products for cancer treatment, and protection of normal tissues from radiation and other acute stresses. CBLI’s market cap is $65 million and the shot interest is 26 days to cover with 9% of the 32 million float short. They have $24 million in cash and $217 thousand in debt.

Opnext (NASDAQ:OPXT) designs and manufactures optical components, modules, and subsystems for communications uses primarily in the Americas, Europe, Japan, and the rest of the Asia Pacific region. OPXT’s market cap is $97 million and the short interest is 5 days to cover with 4% of the 52 million share float short. They have $76 million in cash and $49 million in debt.

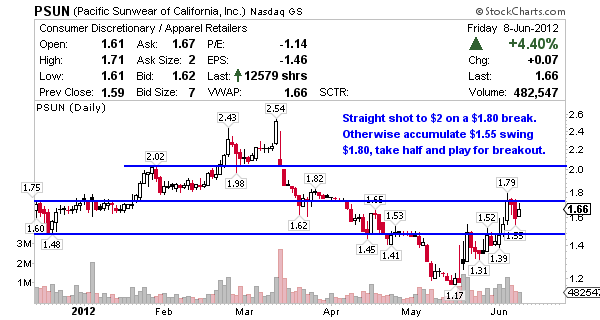

Pacific Sunwear Of California (NASDAQ:PSUN) operates as a specialty retailer in the action sports, fashion, and music influences of the California lifestyle. It sells a combination of branded and proprietary casual apparel, accessories, and footwear designed for teens and young adults. Currently I’m long a small position in PSUN and will look to add more shares on a break of $1.80. PSUN’s market cap is $112 million and the short interest is 20 days to cover with 42% of the 16 million share float short. They have $25 million in cash and $74 million in debt.

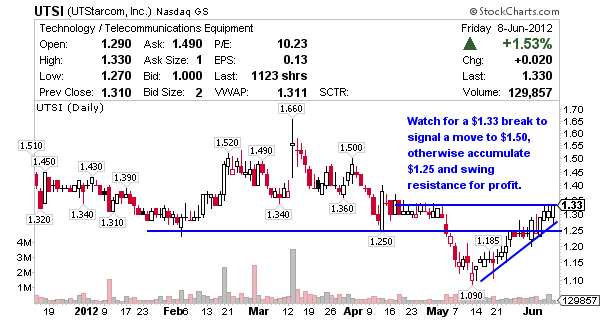

Utstarcom (NASDAQ:UTSI) designs and sells Internet protocol (IP)-based telecommunications infrastructure products to telecommunications service providers and operators worldwide. UTSI’s market cap is a little big for an account builder at $201 million and the short interest isn’t anything to cheer about either at 2 days to cover with less than 1% of the 93 million share float short but the chart sure does look nice. They have $285 million in cash and $0 debt.

Jason do you recommend options I like them, lot less cash to put up,

Thanks Gerald

I will be doing options trades soon.

Hi Jason,

I am very much interested in joining your service (swing trades).

I was wondering when do you send your alert to buy and sell, b’coz i have a fulltime job and limited access to my broker’s webpage at work.(Workplace policy) So I am trying to figure out some way around it. Also what broker do u recommend (I live in Canada).

I would appreciate your help.

thanks

Alerts by chat, text and email in real time. iTrade for Canadian residents works well or Interactive Brokers.

GBGM should i hold or dump.

Looks pretty weak to me, BestDamnPenny never seems to hold their picks up well.

what did you do with UTSI? I noticed it swung to resistance at 1.30 and now is down to 1.20?

thanks in advance

UTSI was a watch list stock, I didn’t buy / alert it.