Stocks posted a losing week as fears of the coronavirus resurfaced. However, that may not be the only reason the S&P 500 and Nasdaq plummeted by 1.05% and 1.79%, respectively. You see, the coronavirus is actually damaging economic growth and corporate earnings.

However, I’m not going to call a market top at these levels… I’ll just stick to my guns — patterns, value, and catalysts. Instead, I want to walk you through one of my favorite setups, and how you could still buy stocks and make money… even if the market is selling off.

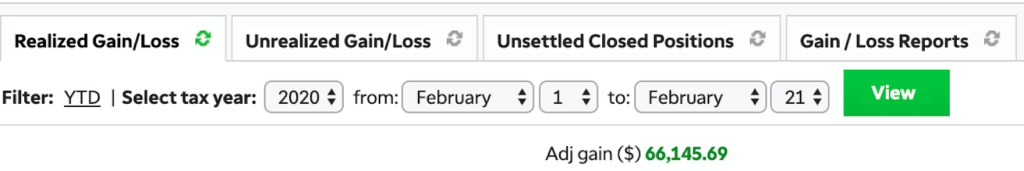

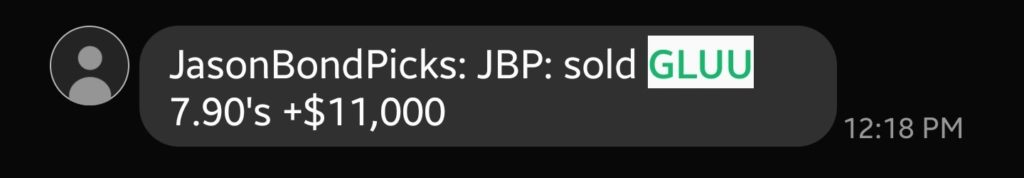

I was able to lock in $11,000 on one single trade, all while the stocks were getting destroyed — bringing my February profits to $66,145.69… and the month isn’t even over yet.

When I show you the technique I used to spot this juicy winner… you’re probably going to wish you knew about it earlier.

How I Locked In $11K On This Small-Cap Momentum Stock

When the market tanks and you’re looking to find stocks to trade… you may notice a sea of red across the board and panic. Heck, you may even follow the herd and dump your long positions, and look to flip short and buy puts.

However, following the herd only leads to trouble because that means you’re actually one step behind. Instead of staying on the sidelines and missing out on money-making opportunities… I turn to stocks move in the opposite direction of the overall market — traders call this divergence.

It’s really that simple. If a stock is strong when the overall market is tanking… what do you think would happen when the market turns?

The stock would gain momentum and most likely continue higher, and thereby, increasing your odds of success.

Sounds pretty easy right?

All you really need to do is look when the market is down, and use a simple scanner to find stocks trading higher that day.

Once you’ve found a stock diverging with the overall market, the next step is to look for the pattern.

Uncover Stocks Set To Explode

I know you’re probably wondering, “Okay, Jason… tell me how you uncovered an $11K winner while the market was showing signs of weakness?”

With this specific trade, I used my trusty rest and retest pattern — one of the highest probability setups I’ve seen throughout my career.

So what exactly is the rest and retest pattern?

Well, if you’ve ever seen a stock shoot up and think to yourself, “I can’t believe I missed the trade! I should’ve bought the stock” … this is where the pattern comes into play and could help you uncover another money-making opportunity.

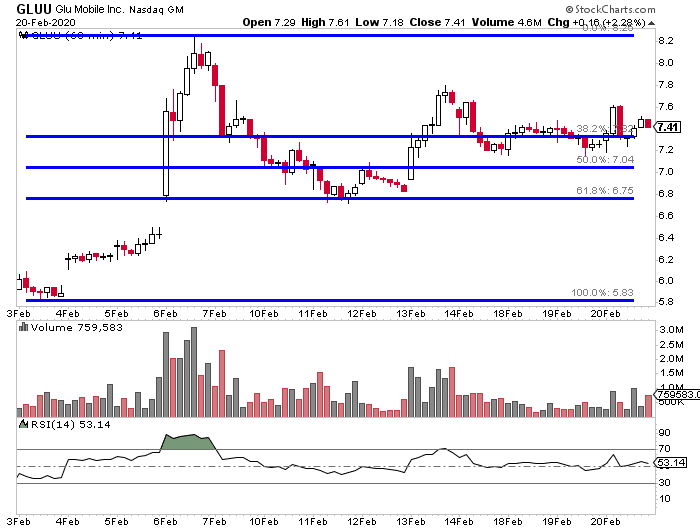

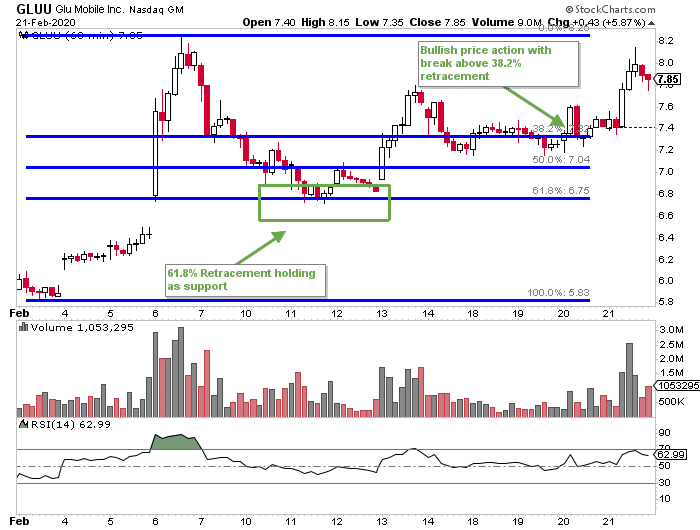

Check out this hourly chart in Glu Mobile Inc. (GLUU).

If you look to the left-hand side of the chart, you’ll notice GLUU made a massive move… and if you missed out on it, that’s okay. All you need to do is identify the high and low points of the move and the Fibonacci retracement tool does the rest.

Let me show you how it works in action.

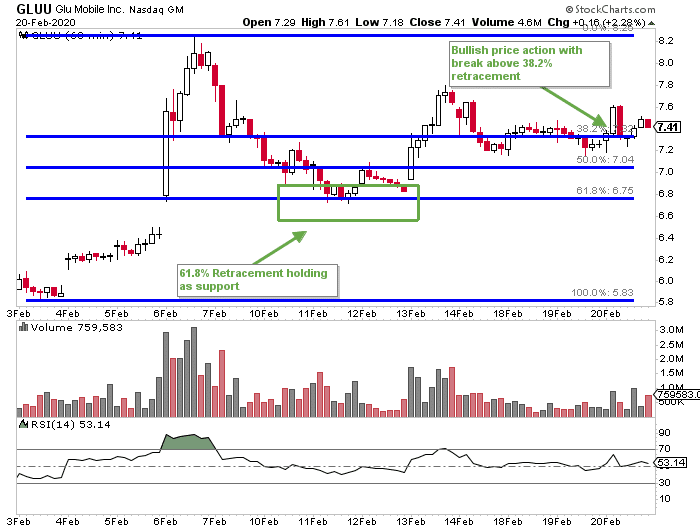

If you look at the chart above, you can clearly see the 61.8% retracement line held as support and continued higher… thereafter, the 38.2% retracement level became an area of value. So what did I do?

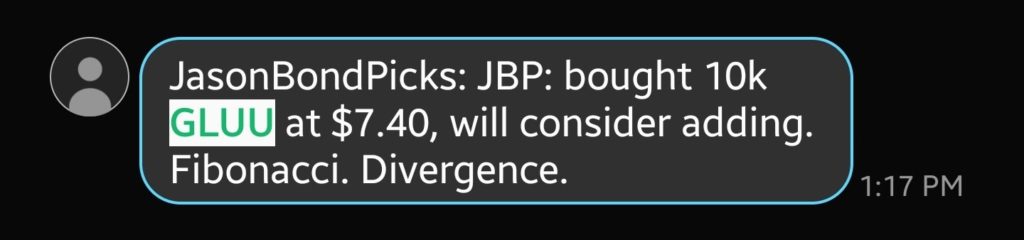

I bought shares as GLUU broke above that level…

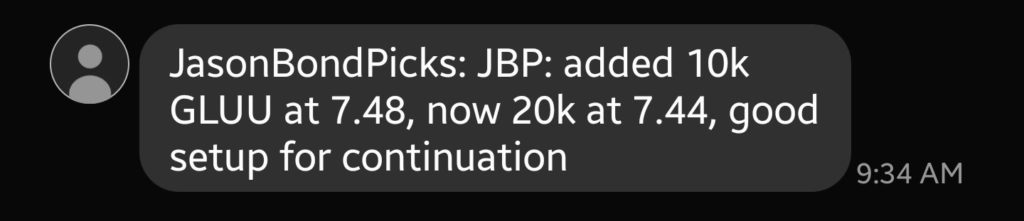

When the market was selling off, GLUU was actually strong and I decided to buy more shares the following day…

Just a few hours after I added to the position, GLUU exploded and retested its recent high.

Of course, once the stock retested highs, I locked in my profits and ended the week on a high note… that was good for $11,000 on one single trade.

If you struggle to find money-making opportunities in the market, consider looking for stocks that don’t move with the overall market with a high-probability pattern. Now, if you want to learn how I’m able to consistently find monster winners in the market, then click here to watch this exclusive training session about my wealth patterns.

0 Comments