The only certainties in life are death and taxes… in the markets, there’s something known as the volatility tax. The mathematical finance geniuses came up with this term… and it shows how crashes affect your returns.

It’s not like the tax you pay to Uncle Sam, instead, it resembles a tax because when you hold assets in your portfolio… and they suffer from shocks… over the long run, you’re actually leaving money on the table.

It’s a hidden fee that applies to investors when markets crash.

Let me show you how it all works.

Let’s say you buy a bunch of stocks, thinking the market rally will continue higher. However, political tensions rise and the market plummets and your account takes a hit by 25%… then you need to make 50% just to get back to even.

That’s the volatility tax… and the traders most susceptible to that are the ones who don’t plan for market downturns.

The key to success in the markets is to avoid paying volatility taxes… and plays into Warren Buffett’s cardinal rule — “Don’t lose money”.

So how exactly do you do that?

Have a strategy in place that benefits from crashes and look for smoke signals.

Stop Paying The Volatility Tax And Start Raking In Profits

The traders who are successful in the markets have plans in place when stocks start to correct… or worse, enter bear market territory. You see, rather than trying to hedge their positions, they look for ways to profit during downturns.

You see, when the market takes a dive, you don’t want to scramble and pay the volatility tax. Instead, you should have a strategy in place that profits in bear markets, as well as sideways and bull markets. Remember, stocks can still sell off even if we’re not in correction or bear market territory.

But how do you know when to place your bets?

Well, for the most part, I look for smoke signals, whether it be in a specific sector or the overall market.

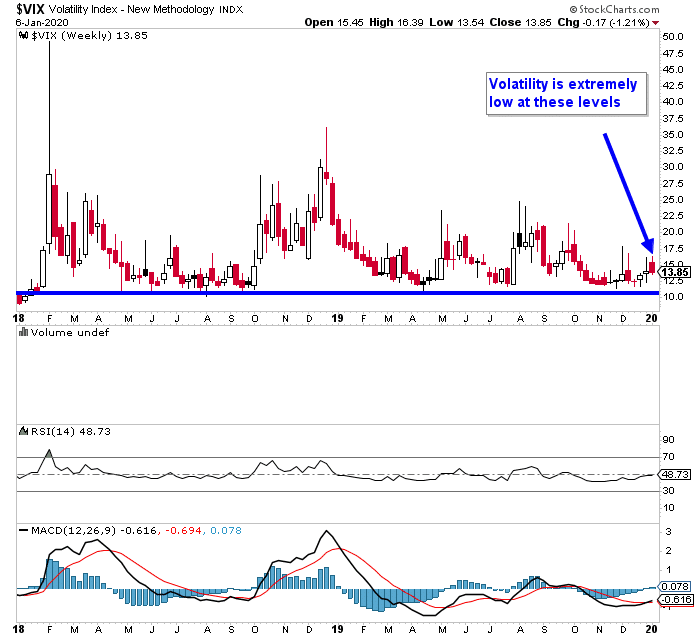

The one smoke signal pointing to a potential market-wide sell off is the CBOE Volatility ($VIX).

Check out the weekly chart in $VIX over the last two years. Volatility has been extremely low, and that makes a lot of sense with the market still near all-time highs. However, when traders brush off any bad news and turn back to the “buy the dip” mentality… it’s a massive smoke signal that tells me they’re not prepared for the worse.

If things do shake up, the markets would sell off and the $VIX would rise significantly.

Low volatility is actually a good thing for those who want to generate massive profits in the event of a downturn.

Why?

Well, that means you can buy puts on the SPDR S&P 500 ETF (SPY), or even get creative… and buy calls in a volatility product (such as VXX). That way, you’re positioned to generate massive profits, and won’t really have to panic and figure out how you could get out unscathed.

Sure, everything is all rosy in the markets right now… but the markets are like boxing. It’s the punch that catches you off guard that’ll put you on your butt.

Despite the markets’ attempts to signal a potential recession in the cards, traders have just brushed them off.

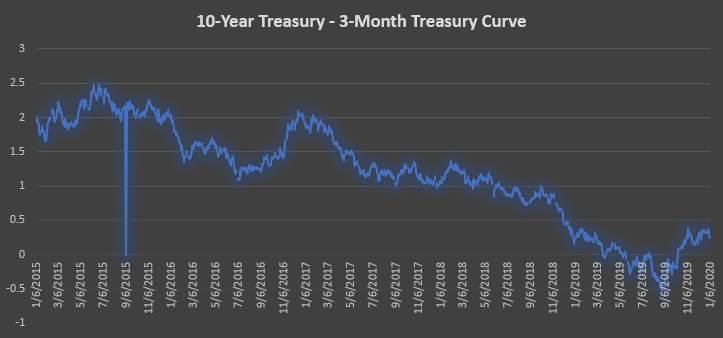

Take the 3-Month and 10-Year Treasury Yield Curve.

Typically, when the yield curve between these two rates turn negative… it’s a signal the market could turn lower. Right now, the yield curve is flattening, and it could reach negative territory, yet again.

If that in does in fact happen, it’s another smoke signal that the markets could start to turn.

With low volatility, a flattening yield curve, political tensions rising, and earnings coming up, it’s the makings of the perfect storm. With that being said, I think it’s time to adapt and look for ways to benefit in the event of a crash.

If you’re ready to profit when there’s blood on the street, as well as avoid the volatility tax, then you’ll want to check out my latest service — Smoke Signals — it’s designed to profit off of crashing stocks, while others lose their shirt in the market.

0 Comments