Trick or treat?! Or how about a winning small cap swing trade? Honestly I love Halloween just about as much as I love Wall Street! VRNG, CLWR, RFMD, LSCC, VG, GRPN and XCO stock are all solid consolidation patterns I’m interested in watching for swing trades Wednesday, provided the market doesn’t fall apart. Many of the charts below are supported by solid catalysts and if the market heads up into the end of the week I’d expect many of them to have a bid.

Vringo (AMEX:VRNG) develops and provides software products for mobile video entertainment, personalization, and mobile social applications. VRNG’s stock market cap is just over $303 million and their currently in the middle of a legal battle with Google that could make it an easy double or dud overnight, depending on the outcome. That aside the price action is gearing up for a move to $5 again after a 41% pullback off the recent high $5.73. Key $4.14 on Wednesday, if that falls is smooth sailing until the upper $4’s. This trade isn’t for the faint of heart, there should be big news coming soon, so buyer beware!

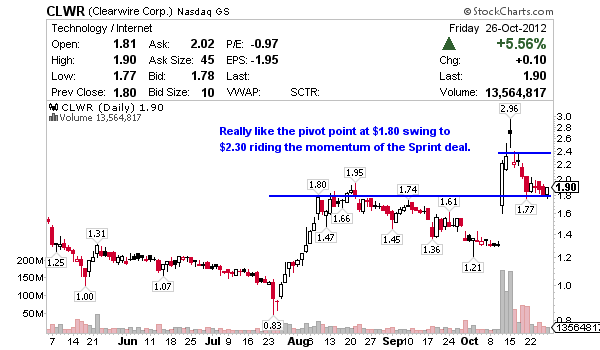

Clearwire (NASDAQ:CLWR) provides fourth generation wireless broadband services in the United States. CLWR’s stock market cap is $1.3 billion and it’s currently riding the coattails of the Sprint deal. After a large squeeze to $2.96 recently shares retraced 40% but held the 20 Moving Average at $1.78 nicely Friday leading me to believe a move to $2.20’s is right around the corner.

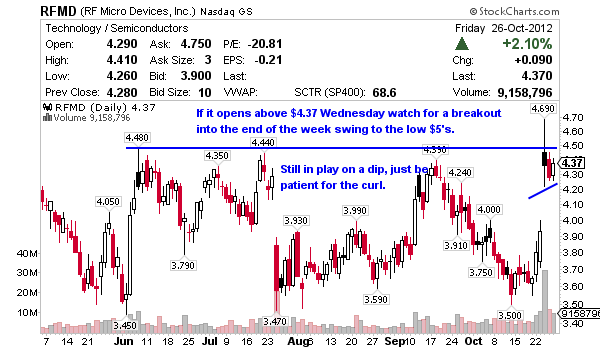

Rf Micro Devices (NASDAQ:RFMD) designs, develops, manufactures, and markets radio frequency (RF) components and compound semiconductor technologies primarily in the United States and Asia. RFMD’s stock market cap is $1.22 billion and they’re fresh off an earnings win on both the top and bottom line. Add in a recently awarded defense contract and a move off the 200 Moving Average trend to the low $5’s is no unreasonable in a bull market.

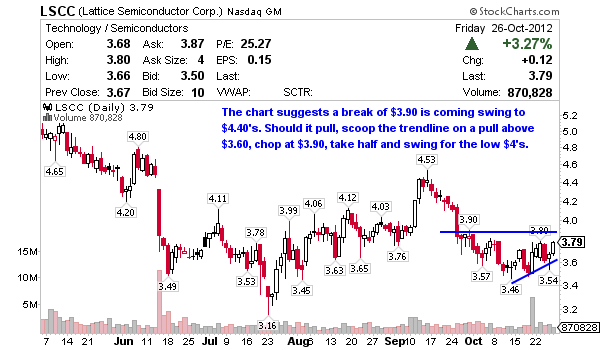

Lattice Semiconductor (NASDAQ:LSCC) designs, develops, manufactures, and markets programmable logic products and related software. LSCC’s stock market cap is $443 million and they have $0 debt on the books with $186 million in cash or $1.60 per share. Friday’s price action working the 20 Moving Average at $3.66 as support suggests a break of $3.82 resistance into the end of the week swing to the low $4’s.

Vonage Holdings (NYSE:VG) provides broadband communication services in the United States, Canada, and the United Kingdom. VG’s stock market cap is $508 million and it’s sure to provide shareholders with a real trick (miss) or treat (beat) on Halloween since it’s earnings call is scheduled before the open Wednesday. This one is not heavily shorted but if they beat I’d be looking for some solid premarket action with a breakout at $2.55.

Groupon (NASDAQ:GRPN) operates as a local commerce marketplace that connects merchants to consumers by offering goods and services at a discount in North America and internationally. GRPN’s stock market cap is outside of my wheelhouse at $2.92 billion but I like this one into their 11/8/12 call. As a matter of fact, I started in accumulating a position Friday just before the close when it held Thursday’s low and headed higher. The key here is a hold of $4.33 swing to $4.75, possibly higher before the call depending on the broader market.

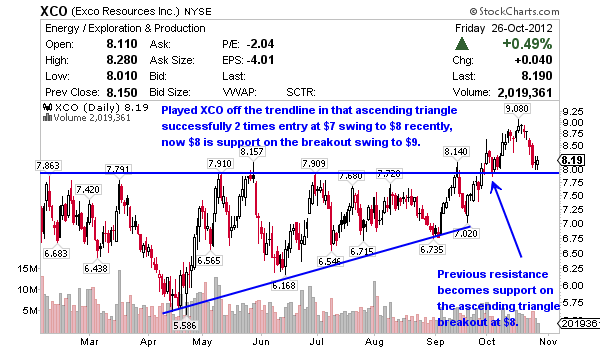

Exco Resources (NYSE:XCO) is an independent oil and natural gas company, engages in the exploration, exploitation, development, and production of onshore U.S. oil and natural gas properties with a focus on shale resource plays. XCO’s stock market cap is $1.75 billion so the upper part of my range but this is one I love to swing, especially when it was working that ascending triangle recently. When it broke out at $8 a few weeks ago that becomes support and given Friday’s reversal off the 50 Moving Average if $8 continues to hold this is a solid swing to $9.

Disclaimer: I am long GRPN

0 Comments