Up +$100,000 this year swing trading I’m looking to add to those gains with the following picks. For real time alerts by email and text plus access to Wall Street’s hottest stock chat with over 400 traders daily – join Jason Bond Picks premium newsletter here.

For these swing trade ideas at Jason Bond Picks I’m looking at 1-4 day hold times with +5-10% profit goals. I almost always take half my position off the table once I get up +5% to make sure I get a win – then I try to lock the other half at +10%.

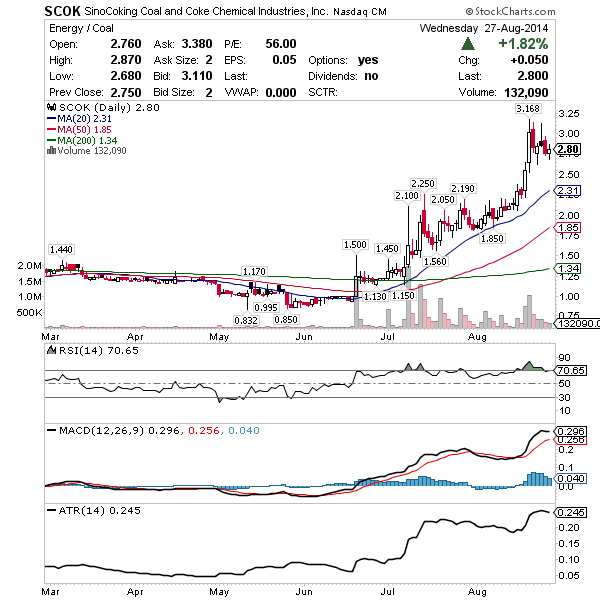

SCOK – Support developing at $2.70 this is a strong uptrend with a lot of short interest that could squeeze above the recent $3.17 high. News out this morning should drive shares higher, look for a test of $3.50’s. The top trendline is in the low $3’s so watch how it handles that chop.

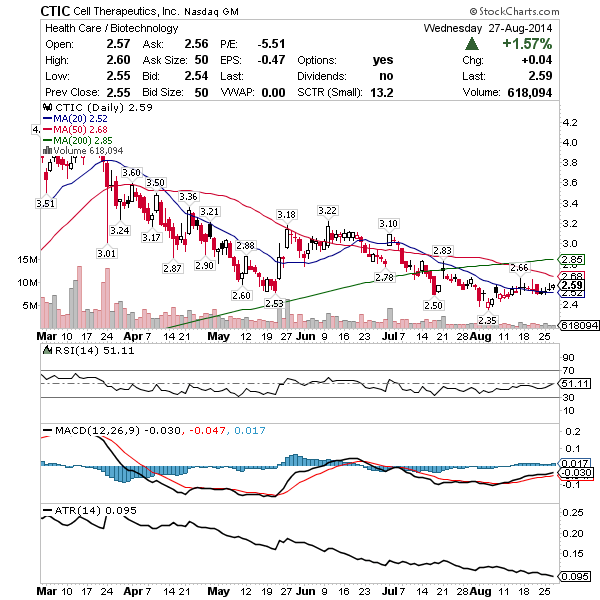

CTIC – Working nicely off the 20 Moving Average now I’m looking for entry close to $2.50 with a goal of the 200 Moving Average around $2.85. Short interest at 15 days to cover provides a nice backstop in this pattern. I wouldn’t be shocked to see this run to $3 soon given this pattern.

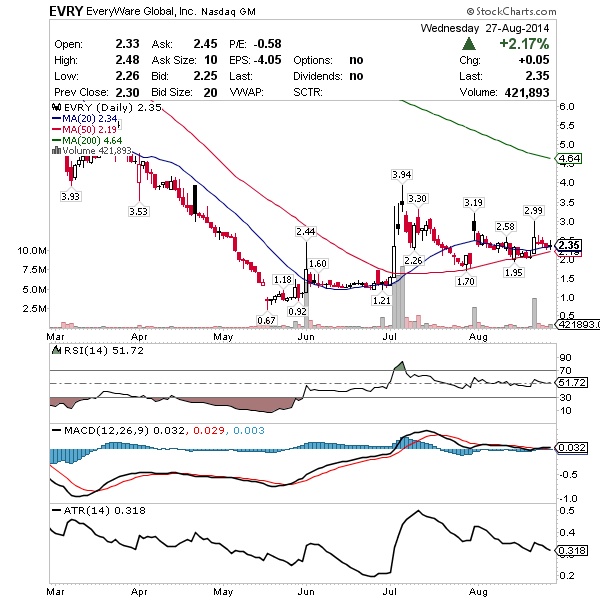

EVRY – The company sold its U.K. business which drove shares higher in the middle of August. A symmetrical triangle has formed here and it’s coiled tight so watch for an explosive move to the upside with decent range to $3 and potential for more if it can hold the trend.

>>> CLICK HERE for real time trade alerts <<<

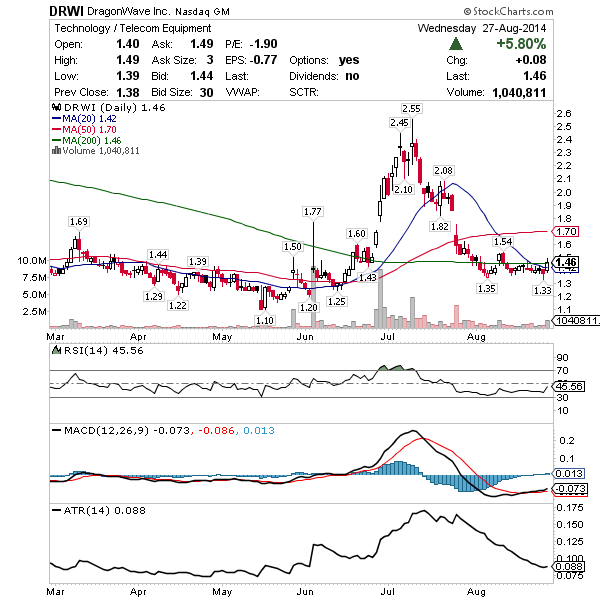

DRWI – Extremely hot back in June DragonWave killed momentum with an offering. time has passed and short interest has grown. Now that shares are back down to excellent support at $1.40 I like the risk / reward here. Major Moving Average support and trendline support makes this rise in volume Wednesday top my list.

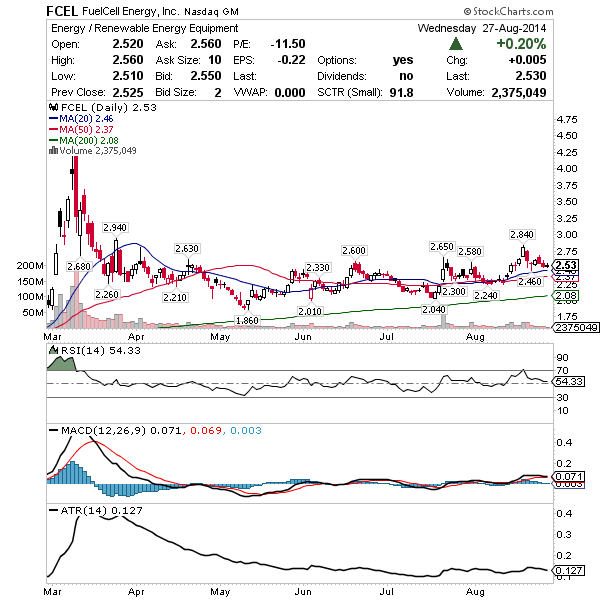

FCEL – Good news drove shares to overbought at $2.84 back in the middle of August. Now shares have settled just above the 20 Moving Average in a hot sector that also works nicely as a sympathy play on PLUG news. Entry here above $2.50 with a goal of the upper $2’s is what I’d look for on this swing.

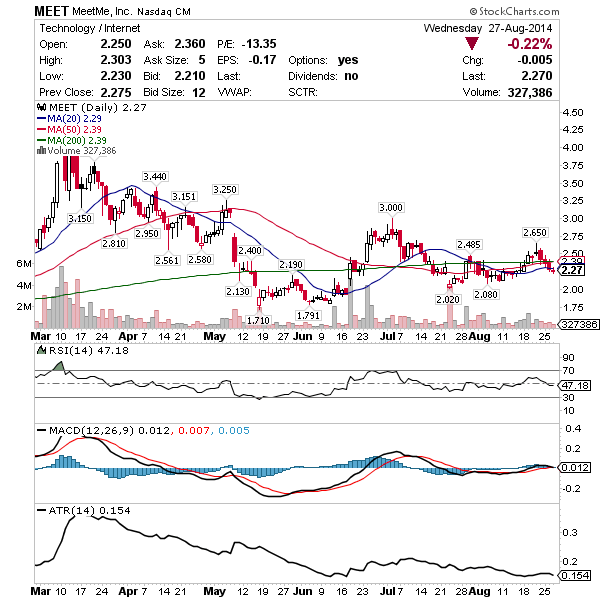

MEET – Not my favorite pick on this list but I do believe it’s going to turn back up soon. The issue is the range to $2.65 resistance doesn’t leave much room for error on the entry and exit. So the game plan here is to get entry closer to $2.10 if shares continue to come in, then swing for the $2.50’s which would make a great trade. The company is good at putting out hot news on mobile growth which is why it’s in play on pullbacks.

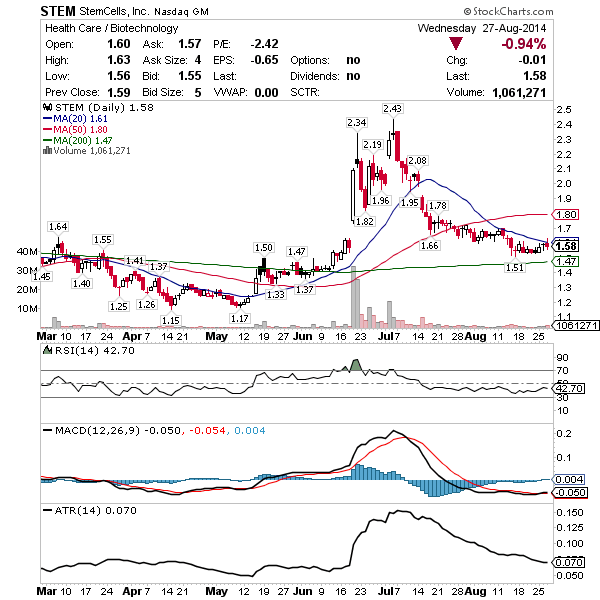

STEM – Huge mover back in June that’s cooled off considerably. Short interest no doubt has grown as big hitters faded the $2.43 high and now it’s back down to good support above the 200 Moving Average. There’s also solid support around $1.50 from price action back in the spring. Working the 200 Moving Average as a stop, look for this to trade back into the upper $1’s provided $1.80 resistance consolidates and comes out on top.

>>> Real time trade alerts <<<

I am going to try some trades with a few of these 7 picks. 8-29-2014

Ok good luck.

How many stocks do we get per alert? Sometimes having too many in one alert is confusing…

Each week I do 3 – 5 swing trade alerts by email, text in real time.

When will the stock SIMH get back with the green stripe.

?or when will SIMH go back up to over $2 per share again?

Are you in that stock?

Hi Jason , do you have a minimum volume criteria for your stock picks ?

Ya I try to focus on $1m in daily dollar volume.