We have something in common, right?!

I love penny stocks too because of the potential to turn a little money into a lot.

For example, in 2015 I’ve made 169% +$158,608 profit in trading penny stocks part time. That’s good money.

Most of the penny stocks on today’s watch list are in breakout mode, which means they require disciplined trading, a strategy detailed in my video lessons.

If you want to win consistently like me, you need to take this seriously and watch the video lessons.

There are 4 open swing trades in the portfolio, refer to previous watch lists and the actual email alerts for my game plan on those as nothing has changed.

As always, real-time trade alerts by email and text.

Additionally, you can join me in the chat room for the breakdown of these 7 hot penny stocks and many more trade ideas.

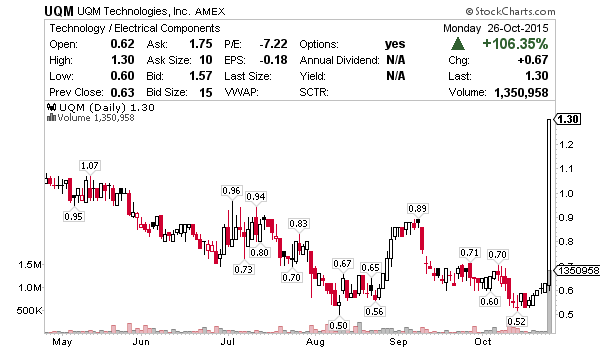

UQM – Tiny $53m company with big contract news, potentially exceeding $400m. Key statistics show $6m cash and $0 debt but that doesn’t mean I’d rule out an offering soon. Pure momentum stock today with 52-week breakout potential above $1.32. There isn’t any intraday support to point out from Monday, given the news was late in the session.

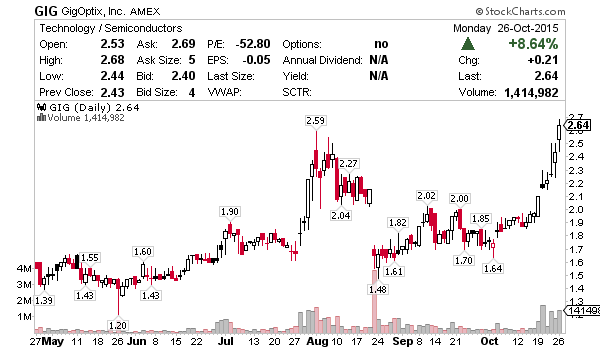

GIG – Strong balance sheet with $35m cash and $0 debt, the company reported all-time record revenue and profitability in Q3 about a week ago. Monday’s breakout triggered new 52’s which could easily squeeze to $3 before slowing. Using $2.60 as the pivot (conservative) or $2.50 (aggressive) I like the breakout continuation potential here given it was +9% when the IWM was red Monday.

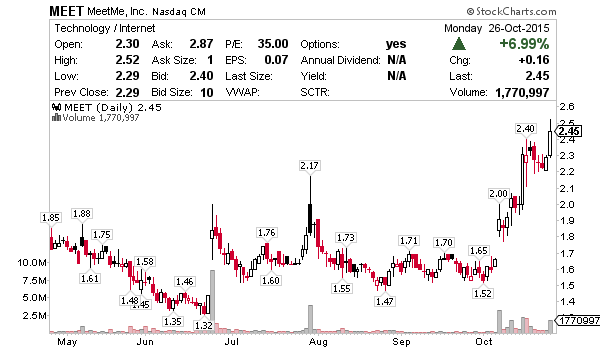

MEET – Earnings winner a few weeks back, then it was hit with a short and distort report into the $2.40 breakout, but the company quickly followed the earnings win with more good news Monday, triggering a short squeeze and 52-week breakout. $16m cash and $3m debt, can’t rule out an offering soon despite the book of $2.12. That said, if the IWM is trending higher, momentum is on its side for now with upside range to $3. Moves a bit slow for me but that can be good for those with a busy schedule.

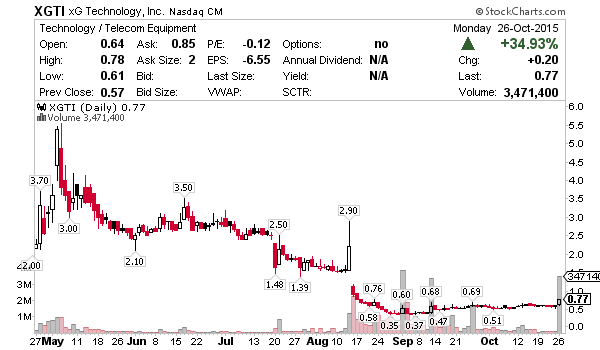

XGTI – Popped 35% Monday on good volume after contract news with the U.S. military. I actually took a small chunk of shares (20,000) in the afternoon at $.69 and sold half of them (10,000) +12% +$800 profit. The company desperately needs to get their stock above $1 to avoid delisting, so I’ll consider adding to my small position today looking for continuation of Monday’s 35% move to $.80’s – $.90’s for profit.

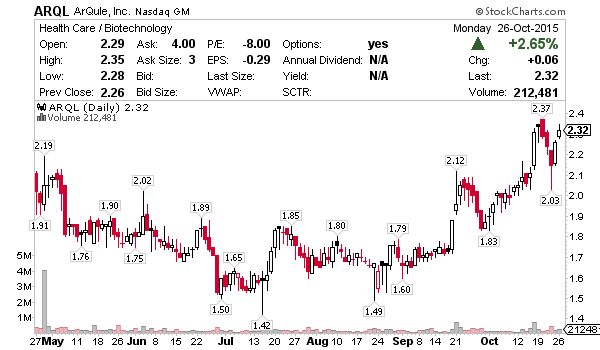

ARQL – $48m cash and $0 debt for this clinical-stage biotech company that researches and develops therapeutics for the treatment of cancer and rare diseases. Key results for its lead product candidate tivantinib are due in Q4 2015, which explains the runup here, just shy of a 52-week breakout above $2.50. Watch for a move above $2.37 to signal the 52-week test.

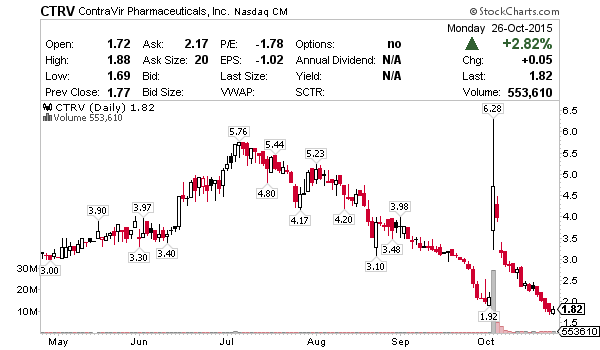

CTRV – Good news to start October, which sent shares screaming from $1.92 to $6.28, was immediately met with an offering to shore up the balance sheet, destroying momentum for traders. Having completely retraced the move, Monday’s 3% gain is the first sign of bottom rejection in a week. Using $1.69 as a pivot, I’m watching to see if this once high flier bounces for a juicy 20%+ profit. Outside chance of more good news following the recent press release could trigger a big short squeeze too.

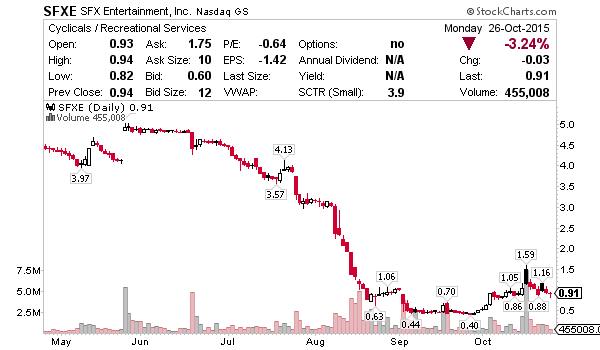

SFXE – Train wreck / scam warning! Okay, so now that the warning has been issued, here’s a lottery pick. Sparing you the extensive details, I suspect the sale of the company goes through this time to stave bankruptcy. Sillerman, or any billionaire for that matter, doesn’t get to be a billionaire without being slippery, which is why I assume he’s probably going to be more aggressive with the lower takeover bid at up to $3.25 a share, down from his previous $5.25 a share bid months back. With some support in the upper $.80’s, now’s probably a good time to watch for buyers and entry. Given the potential for bad news i.e. no deal, I’ll go really small here to protect against a quick drop back to the $.40’s, hence the lotto ticket.

How can I get the IPO for these companies

I’m not sure what you’re asking?

Still collecting money to join you. Looking forward to be with you soon.

Gerzan, the initial public offerings (IPO’s) have already taken place for these companies. They are issued through the primary market. Once they are sold on the primary market they are made available to the general public through the secondary market. The secondary market is where retail investors, you and I, purchase securities.

t

Thanks

lately i have been watching the tutorial and i find it very interesting and i am building up the confidences to make my trade soon! next week