My penny stock watch is designed to build smaller accounts or simply for those who love penny stocks. Wednesday my newsletter dedicated to penny stocks, Penny Stock PRO, goes on sale.

These are not my typical bread and butter 5-10% trades i.e. perfect for those looking to swing for the fences, these trades could explode! If there’s liquidity and it’s between $.01 and $3 with a good technical setup or catalyst you can bet I’m watching for a profit opportunity.

Tired of not knowing when to enter and exit swing trades? Let me do all the heavy lifting for you. My March profit is +$28,664, Q1 profit is +$84,087 +46.72% compared to the IMW +2.59%.

Sign up for Jason Bond Picks today and I’ll toss in a discount to Penny Stock PRO, which goes on sale Wednesday, but has limited seats. Penny Stock PRO will sell out fast, so be sure to check back Wednesday.

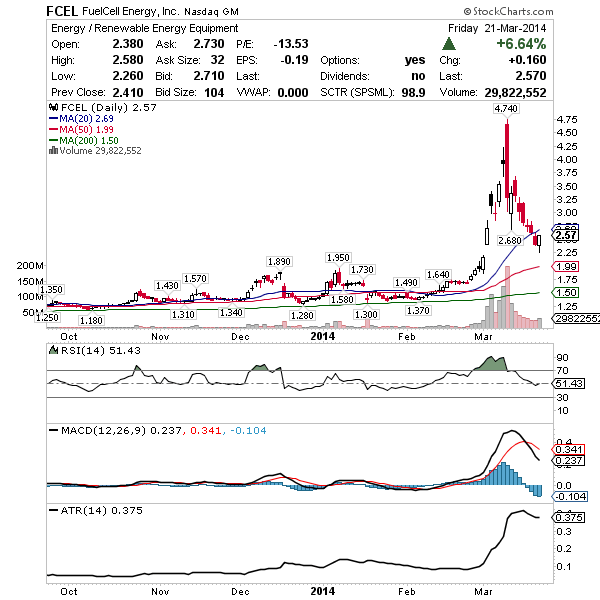

FCEL – The huge sector rally cooled off last week but this reversal around the 20 Moving Average is very attractive for a move back into the low $3’s this week. Will look to use $2.40 as a stop here.

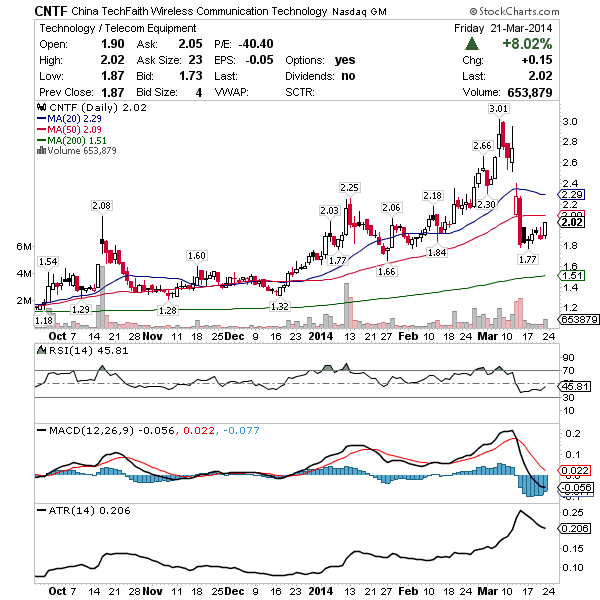

CNTF – Good base developed last week above $1.77. There’s range here into the $2.40’s with upside potential to $3 if it retests recent highs.

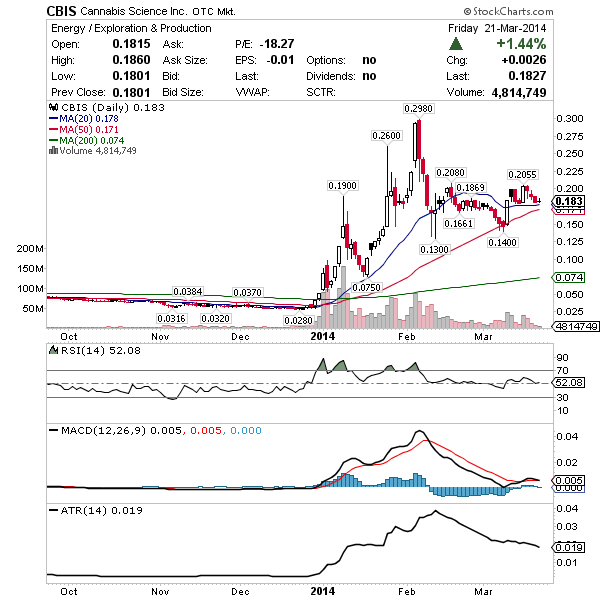

CBIS – Hot sector and bound to make more headlines this is a decent play in the marijuana space. Above the 20 Moving Average I’m interest for a move to $.21 with potential to breakout and double on a new high.

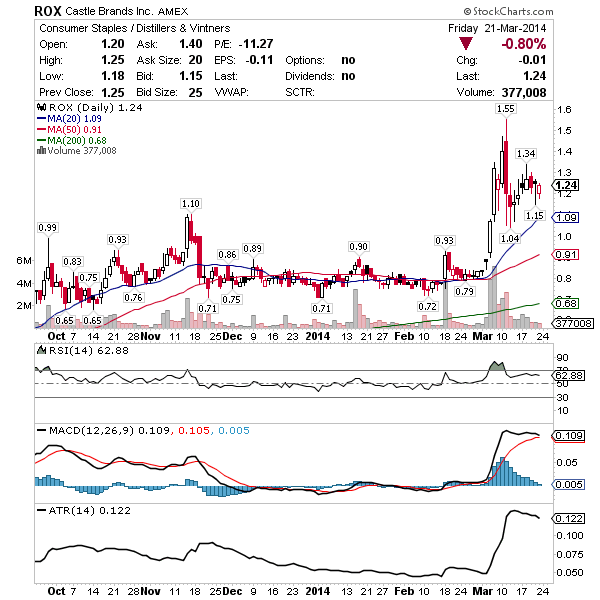

ROX – Big insider buying once again has Castle Brands shares rallying. Looking for the 20 Moving average to act as support and rally to the $1.50’s again soon. Really like this one on pullbacks looking to sell the rips.

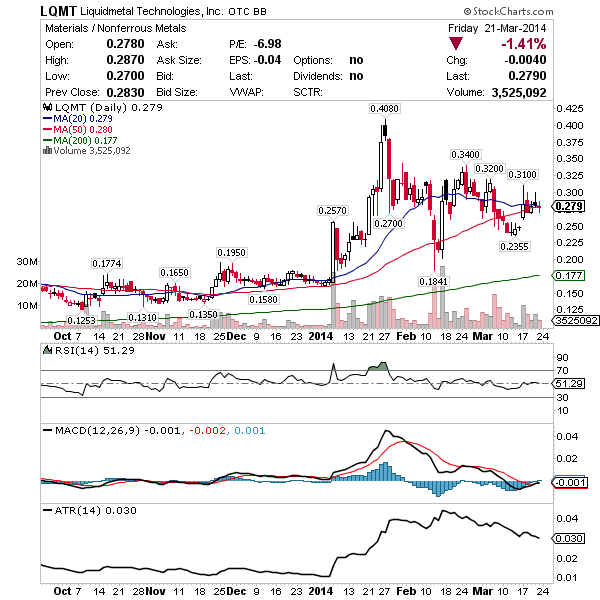

LQMT – With lots of hype starting about Apple’s latest products, look for Liquidmetal headlines to appear in major media again. When they do, I expect shares to rally and test the $.40’s again.

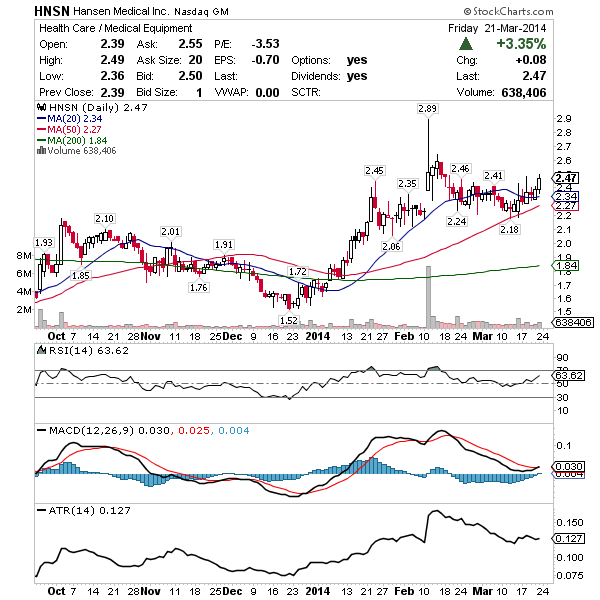

HNSN – Excellent chart working the 20 Moving Average with breakout potential above $2.60. The Relative Strength is building and the MACD crossed the signal line Friday which could trigger an explosive move this week.

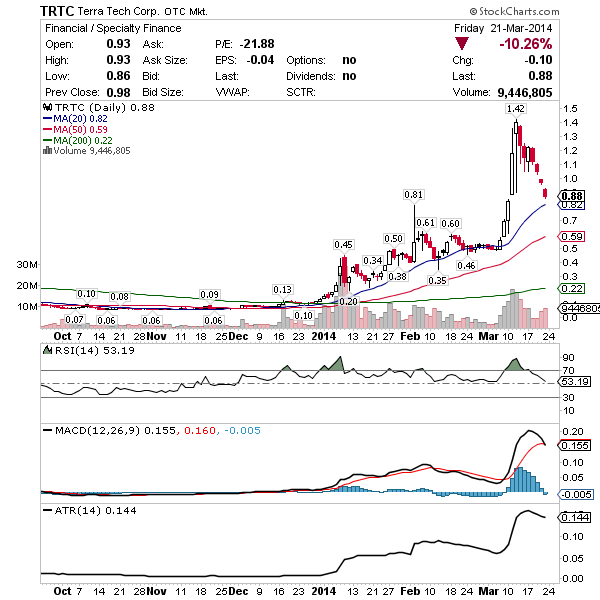

TRTC – Legal weed is sweeping the nation and it’s not going away. Nice technical pullback here to the 20 Moving Average I’m looking to gobble up when it shows signs of a reversal. Actually working up a report on this one, like I did PHOT, as I believe this is one of the better pot plays out there. I’m not in a rush to get in, but think it reverses soon.

Would like to know where to go for teaching as mentioned in news letter?

Good afternoon. My video lessons are all available after you sign up / login http://www.jasonbondpicks.com/lp/sales

I have signed up with Jason Bond, now what do I do? Thanks

Did you get the welcome email?

Do not remember any instructional email. Have gone back in archives as far as I can but do not find. Any help would be appreciated! Again, Thanks

Ok, check your spam. Let me know, email jason@jasonbondpicks.com and I can send it manually.

Awesome Alert on FCEL!!! Thanks!

Did you buy some Jeff?

yes at $2.38!!!

Excellent, very strong showing and PLUG is running after hours so probably FCEL, BLDP gaps tomorrow too. Cheers!

Wish I would have stayed in, but gotta take your money. LOL. Cheers!

Ya, I was in BLDP yesterday, sold for a small loss sadly, just missed the big move, very glad to hear you got some profit.

You are awesome! I lose some money before I knew your site. I bought PLUS and make $1200 within 3 days.

Should I buy FEEL now?

FCEL

Please send the instructional video – would like to be able to take advantage of your advise.

Hey Jason… Im going to re-sign up with you on Tuesday… What are you more enthused about these days? Penny Stock Pro or you’re Swing Trades? I play both, but want to choose the one your really excited about. Thanks

Swing trading will always be the foundation of my service and includes the chat. Welcome back.